3 Highly Ranked Stocks To Buy For Momentum This Spring

Image: Bigstock

Several highly ranked stocks have been standing out in terms of momentum this spring, and many have been witnessing a very positive trend of upward earnings estimate revisions. Belonging to the Zacks Rank #1 (Strong Buy) list, here are three top-rated stocks to consider at the moment.

Applied Industrial Technologies (AIT - Free Report)

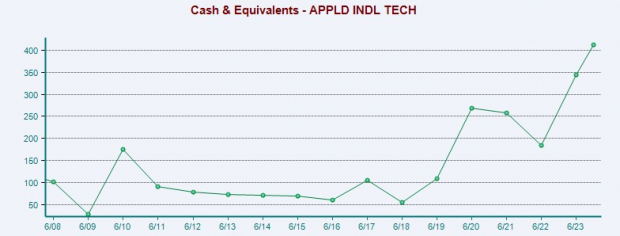

As a distributor of value-added industrial products including engineered fluid power components, bearings, specialty flow control solutions, and power transmission supplies, Applied Industrial Technologies’ rising EPS estimates and improved cash flow look rather intriguing

Cash & equivalents soared 84% to multi-year peaks of $344 million going into 2024 compared to $184 million at the beginning of 2023. Bolstering Applied Industrial’s balance sheet is the fact that total assets now come out to $2.74 billion, which is nicely above the company’s total liabilities of $1.28 billion.

Image Source: Zacks Investment Research

Notably, Applied Industrial’s stock has soared +14% year-to-date. Plus, FY24 and FY25 EPS estimates are nicely up over the last week and have now risen 2% and 7% over the last 60 days, respectively. Furthermore, Applied Industrial's annual earnings are now expected to rise 8% this year, and are projected to edge up another 2% in FY25 to $9.71 per share.

Image Source: Zacks Investment Research

Home Builders

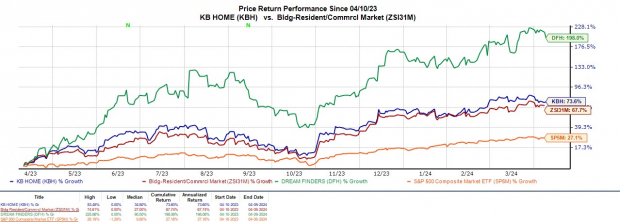

Entering the busy home-shopping season, earnings estimate revisions have continued to rise for many homebuilders, with KB Home (KBH - Free Report) and Dream Finders Homes (DFH - Free Report) standing out in particular. Continuing their stellar price performances over the last year, KB Home's stock is up a very respectable +7% year-to-date, with Dream Finders’ shares soaring +13%.

Image Source: Zacks Investment Research

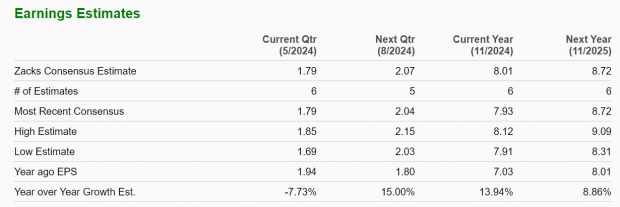

Notably, KB Home's FY24 earnings estimates are up 5% in the last 60 days, while FY25 EPS estimates have risen 4%. Furthermore, KB Home’s growth is very attractive, with annual earnings now projected to jump 14% in FY24 and expected to rise another 9% in FY25 to $8.72 per share.

Image Source: Zacks Investment Research

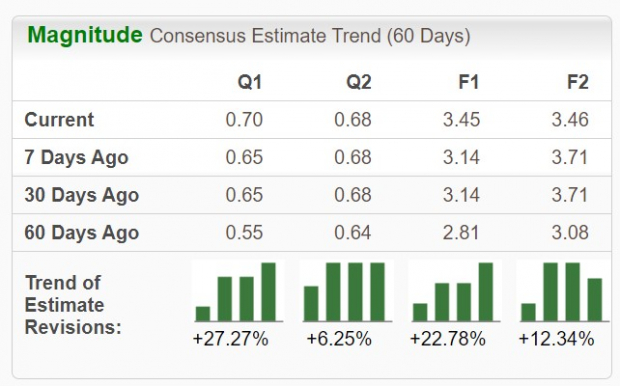

As for Dream Finders, its increased probability has caught Wall Street’s attention as well, with EPS forecasted to spike 23% this year to $3.45 compared to $2.79 a share in 2023. While Dream Finders’ EPS growth is expected to be virtually flat next year, it's noteworthy that earnings estimate revisions have soared over the last two months for both FY24 and FY25.

Image Source: Zacks Investment Research

Bottom Line

Rising earnings estimates are a great sign that there could be more upside for these highly ranked stocks. Bolstering their Zacks Rank #1 (Strong Buy) ratings is the fact that they share an “A” Zacks Style Scores grade for Momentum.

More By This Author:

Bear Of The Day: IPG Photonics3 Top Rated Retail Restaurant Stocks To Consider In April

3 Oil & Gas Stocks Poised To Continue Their Winning Streaks In 2024

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more