3 Highly Ranked Stocks To Buy After Crushing Q1 Earnings Expectations

Image Source: Unsplash

Belonging to the coveted Zacks Rank #1 (Strong Buy) list, several stocks are standing out after these companies were able to impressively exceed their first quarter top and bottom-line expectations on Wednesday.

Here’s a look at three of these highly-ranked stocks that investors will certainly want to pay attention to following their strong Q1 results.

Abercrombie & Fitch (ANF - Free Report)

The turnaround for the premium apparel retailer Abercrombie & Fitch has been well documented considering its stock has been one of the market's top performers soaring over +100% year to date and up a mind-boggling +772% in the last two years.

Abercrombie & Fitch’s revamped popularity continued during the first quarter with its women’s and men’s divisions growing across its brand families which includes Hollister, Gilly Hicks, and Social Tourist outside of its namesake brand.

This led to Q1 records in net sales of $1.02 billion and operating income of $130 million or $2.14 per share. Furthermore, Q1 sales grew 22% year over year while beating estimates of $952.25 million by 7%. More impressive was that Q1 earnings skyrocketed 448% from $0.39 a share in the comparative quarter and beat EPS expectations of $1.66 by 29%. Notably, Abercrombie & Fitch has exceeded earnings expectations for five straight quarters posting a very impressive average earnings surprise of 210.32% in its last four quarterly reports.

Image Source: Zacks Investment Research

Chewy (CHWY - Free Report)

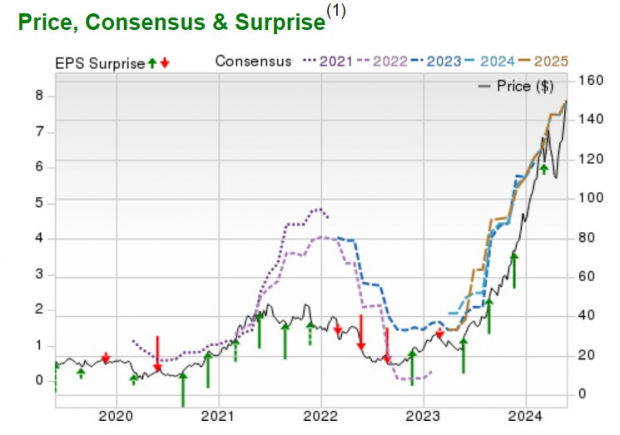

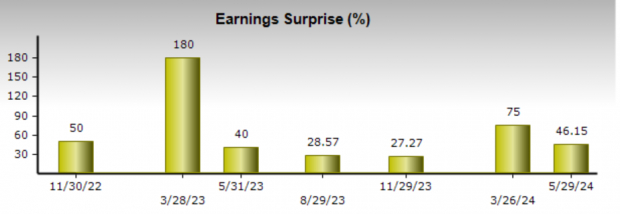

Online pet products retailer Chewy stood out yesterday with Q1 EPS of $0.31 comfortably surpassing estimates of $0.21 per share while rising 55% from $0.20 a share in the comparative quarter. Quarterly sales of $2.87 billion came in 1% above estimates and rose 3% from $2.78 billion a year ago.

Chewy has beaten earnings expectations for nine consecutive quarters posting an average earnings surprise of 57.66% in its last four quarterly reports.

Image Source: Zacks Investment Research

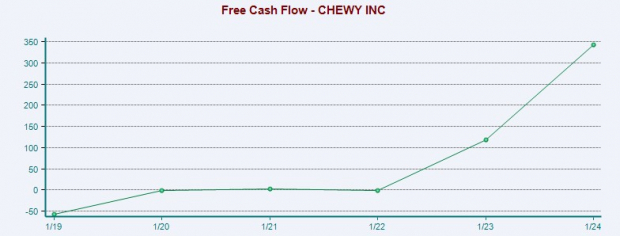

It’s also noteworthy that Chewy achieved record-breaking adjusted EBITDA during Q1 of $162.9 million which increased by $52.1 million YoY.

Plus, Chewy generated $50 million in free cash flow during Q1 with CEO Sumit Singh stating the company is at an inflection point driven by its strong balance sheet which led to the board of directors authorizing a first-ever share repurchase plan of up to $500 million.

Image Source: Zacks Investment Research

nCino (NCNO - Free Report)

As a provider of cloud-based banking solutions, nCino’s growth is starting to stand out with Q1 EPS of $0.19 beating estimates of $0.13 per share by 46% and soaring 171% from $0.09 a share in the prior-year quarter. Sales of $128.09 million expanded 12% from $113.67 million a year ago and was able to edge estimates of $126.59 million.

nCino’s strong results were driven by the continued adoption of its platform by existing customers in the United States with the North Carolina-based company now exceeding earnings expectations for nine consecutive quarters and posting an average earnings surprise of 44.25% in its last four quarterly reports.

Image Source: Zacks Investment Research

Bottom Line

The expansion and consistency of Abercrombie & Fitch, Chewy, and nCino should be catching investors' attention. To that point, earnings estimate revisions are likely to trend higher for these highly ranked stocks in the coming weeks which could certainly coincide with more upside.

More By This Author:

What Awaits Hewlett Packard Enterprise In Q2 Earnings?

Big Oil Consolidation: Chevron Acquiring Hess - ConocoPhillips Acquiring Marathon Oil

3 Vanguard Mutual Funds For Remarkable Returns

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more