3 Highly-Ranked Stocks Perfect For Income Investors

Image: Shutterstock

Investing for a stream of income is a widely-popular strategy deployed by investors, and for understandable reasons – we all love getting paid. A reliable income stream from your investments is undoubtedly a significant boost, and it’s even better when those investments perform well.

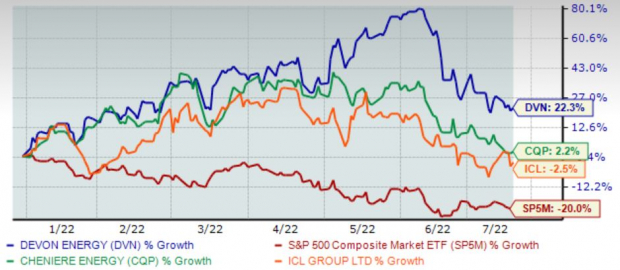

Investors are well aware of how brutal the market has been in 2022, but there are still stocks out there performing relatively well, such as Devon Energy (DVN - Free Report), ICL Group (ICL - Free Report), and Cheniere Energy Partners (CQP - Free Report). In addition, all three pay a hefty dividend and have strong Zacks Ranks, making them even more appealing.

The chart below illustrates the year-to-date performance of all three companies while blending in the S&P 500.

Image Source: Zacks Investment Research

As we can see, all three companies’ shares have been notably more robust than the S&P 500, undoubtedly a major positive. Let’s look at each company’s dividend and free cash flow metrics a little closer to understand why they’d be solid bets for income investors.

ICL Group

ICL Group (ICL - Free Report) is engaged in the fertilizer and specialty chemical sectors. The company’s operating segments include Fertilizers, Industrial Products, and Performance Products.

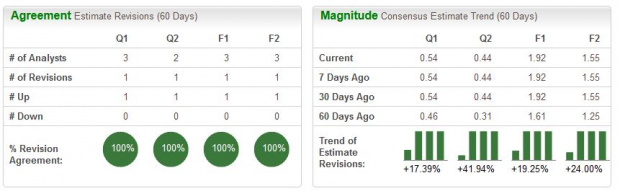

ICL is a Zacks Rank #1 (Strong Buy) with an overall VGM Score of a B. Analysts have substantially raised their earnings outlook across all timeframes over the last 60 days.

Image Source: Zacks Investment Research

ICL has stellar dividend metrics. The company rewards its shareholders via its annual dividend that yields a massive 10.6%, with a payout ratio sitting sustainably at 39% of earnings.

In addition, the company has increased its dividend payout seven times over the last five years, with a five-year annualized dividend growth rate of a double-digit 17.5%. The company’s annual yield is much higher than its Zacks Sector’s average.

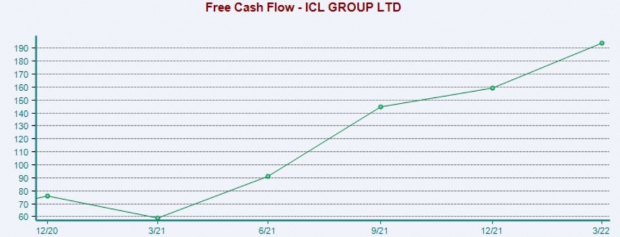

Image Source: Zacks Investment Research

Additionally, free cash flow of the company has recently been on an uptrend, as illustrated in the chart below.

Image Source: Zacks Investment Research

Cheniere Energy Partners

Cheniere Energy Partners (CQP - Free Report) owns and operates regasification units at the Sabine Pass LNG terminal. It provides clean, secure, and affordable LNG to several entities.

CQP is a Zacks Rank #1 (Strong Buy) with an overall VGM Score of a B. Within the last 60 days, analysts have raised their earnings outlook marginally higher.

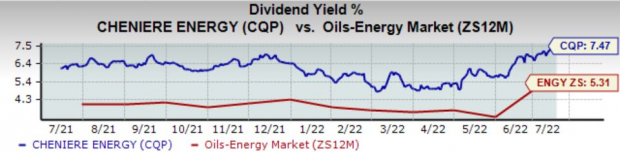

Image Source: Zacks Investment Research

CQP’s annual dividend yield resides at a steep 7.5%, undoubtedly on the high end. However, what sticks out is CQP’s dedication to rewarding its shareholders; over the last five years, the company has increased its dividend a whopping 19 times, with a five-year annualized dividend growth rate of 11.5%.

The yield is much higher than its Zacks Sector’s average.

Image Source: Zacks Investment Research

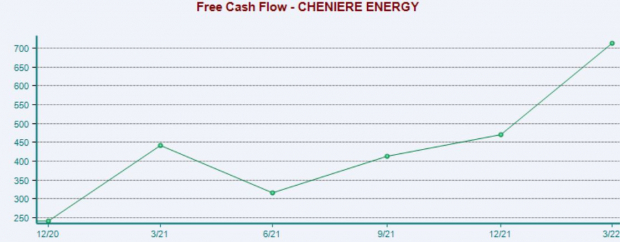

In addition, free cash flow of the company has recently been strong, as depicted in the chart below.

Image Source: Zacks Investment Research

Devon Energy

Devon Energy Corporation (DVN - Free Report) is an independent energy company engaged primarily in the exploration, development, and production of oil and natural gas.

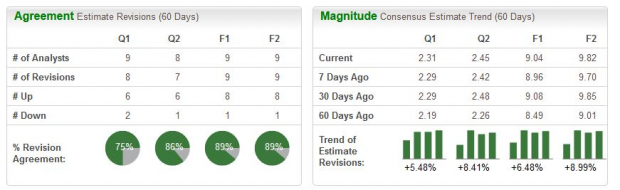

DVN is a Zacks Rank #2 (Buy) with an overall VGM Score of an A. Over the last 60 days, analysts have pushed their earnings estimates notably higher across all timeframes.

Image Source: Zacks Investment Research

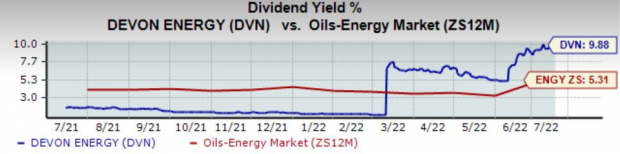

DVN is dedicated to consistently rewarding its shareholders; over the last five years, the company has impressively increased its dividend ten times and has a double-digit five-year annualized dividend growth rate of a sizable 47%. The company’s annual dividend yields a massive 9.9%.

In addition, DVN’s annual dividend yield is much higher than its Zacks Sector’s average.

Image Source: Zacks Investment Research

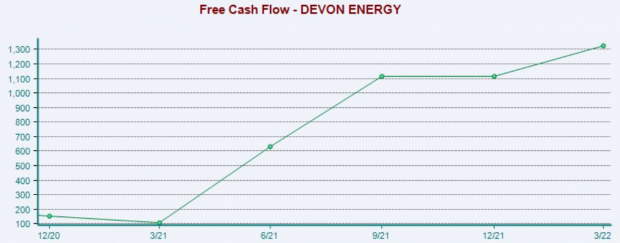

The company’s free cash flow has also consistently increased, as displayed in the chart below.

Image Source: Zacks Investment Research

Bottom Line

Everybody loves getting paid. Income investing is a widely-used strategy in the market, and it won’t be going anywhere anytime soon. All three companies above have high dividend yields paired with robust dividend growth, undoubtedly enough to make any income investor excited.

In addition, all three companies above have strong Zacks Ranks, rising free cash flow, strong year-to-date share performance, and positive estimate revisions across all timeframes. All three companies would be solid bets for investors looking to add an income stream into their portfolios.

More By This Author:

Netflix Q2 Preview: Is the Show Over?Citigroup Surpasses Q2 Earnings And Revenue Estimates

BlackRock Q2 Earnings And Revenues Miss Estimates

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more