3 Highly Ranked Energy Stocks To Buy For Sound Growth & Value

Image Source: Unsplash

Although crude oil prices have dropped over the last week several energy stocks are starting to stand out in terms of growth and valuation. To that point, many energy companies are reaping nice profits with crude prices still over $70 a barrel despite the recent dip.

Coinciding with their increased profitability, several Zacks Oils and Energy sector stocks have made their way onto the Zacks Rank #1 (Strong Buy) list this week.

Mostly attributed to their strong buy ratings is the very positive trend of upward earnings estimate revisions. Adding support to their very reasonable P/E valuations, this largely suggests there could be more upside for these highly ranked energy stocks.

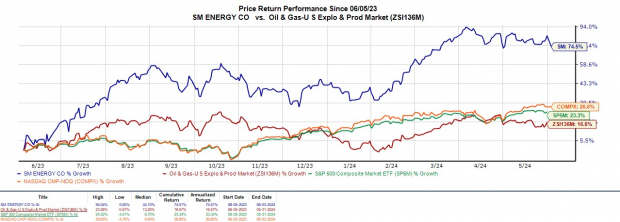

Image Source: Yahoo Finance

SM Energy (SM - Free Report)

We’ll start with Colorado-based SM Energy, an independent oil and gas exploration and production company with operations in the coveted Permian basin.

Despite soaring +25% year to date, SM still trades under $50 and at a 7.6X forward earnings multiple. Trading well below the S&P 500’s 22.1X, SM also trades at a pleasant discount to the Zacks Oil and Gas-Exploration and Production-United States Industry P/E average of 11.9X.

More compelling is SM Energy’s steady expansion as total sales are expected to rise 9% in fiscal 2024 and FY25 with projections climbing north of $2 billion. Better still, annual earnings are projected to be up 12% this year and are forecasted to jump another 12% in FY25 to $7.46 per share. Suggesting the rally in SM has legs, earnings estimate revisions have continued to trend higher over the last quarter with FY24 and FY25 EPS estimates rising 5% and 7% in the last 30 days respectively.

Image Source: Zacks Investment Research

Vitesse Energy (VTS - Free Report)

After going public in 2023, Vitesse Energy is another independent energy company that investors may want to consider with its stock up a very respectable +12% YTD. Headquartered in New York, Vitesse is engaged in the acquisition, development, and production of non-operated oil and natural gas properties.

Trading under $25, VTS trades near the industry P/E average at 13.1X forward earnings with EPS expected to spike 7% in FY24 and projected to expand another 13% in FY25 to $2.21 per share. Plus, earnings estimates are slightly up over the last month and total sales are now anticipated to climb 17% in FY24 and are projected to rise another 9% next year to $297.1 million.

What may also peak investors' interest is that VTS has a 7.84% annual dividend yield that towers over the S&P 500’s 1.28% average and its industry average of 2.07%.

Image Source: Zacks Investment Research

Geopark (GPRK - Free Report)

With a price tag of $10, Geopark’s stock is starting to look like a bargain at just 3X forward earnings. Furthermore, this comes as GPRK has rallied 24% in 2024 with Geopark being a Bermuda-based oil and gas exploration company that operates primarily in South America including Chile, Columbia, Brazil, and Argentina.

Image Source: Zacks Investment Research

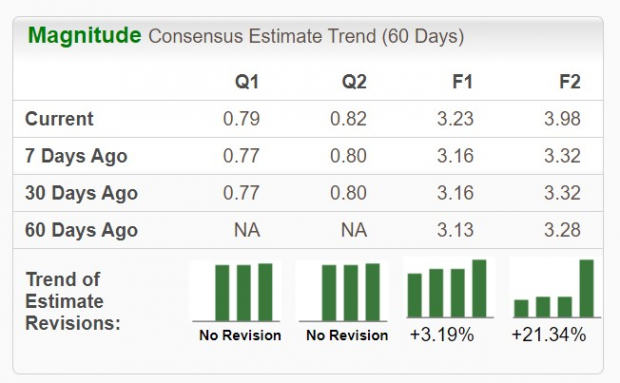

Seeing as the offshores of Brazil have become a hot spot for further oil exploration, Geopark’s total sales are slated to increase 6% this year and are projected to rise another 13% in FY25 to $917.37 million. More impressive, Geopark’s annual earnings are expected to soar 51% in FY24 to $3.23 per share versus $2.14 a share in 2023. Even better, FY25 EPS is forecasted to expand another 23%.

Reassuringly, over the last 60 days, FY24 earnings estimates are up 3% with FY25 EPS estimates climbing 21%. It’s also noteworthy that GPRK has a 5.63% annual dividend yield that is nicely above the industry average and the benchmark.

Image Source: Zacks Investment Research

Bottom Line

When it comes to growth and value, SM Energy, Vitesse Energy, and Geopark are three of the most appealing stocks to consider. More importantly, now looks like an ideal time to invest considering the positive trend of rising earnings estimate revisions.

More By This Author:

Top Stock Picks For Week Of June 3, 2024Bear Of The Day: Diodes

5 Food Stocks For A Healthy Portfolio Amid Fluctuations

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more