3 Great Value Stocks To Buy Now For Steady Long-Term Growth

Today’s episode of Full Court Finance at Zacks dives into the recent market dip as Wall Street is forced to once again recalibrate its inflation outlook amid a string of hot economic data. The episode then explores three highly-ranked value stocks with resilient businesses—CAH, GPK and BJ—that investors might want to consider buying amid lingering inflation and for stable long-term expansion.

The Nasdaq fell 1.8% on Thursday and closed around 0.6% lower to end the week, while the S&P 500 posted slightly smaller back-to-back drops. The market saw some buyers step in during late afternoon trading on Friday to help make things feel slightly better heading into the long Presidents Day holiday weekend.

Wall Street finally decided to back off a bit amid a wave of hot economic data that includes the January CPI release, unemployment data, retail sales, producer prices, and more. Inflation is still cooling, but Wall Street might have to pump the brakes on the breakneck pace of the rally until January’s data is proven to be a blip on the radar on the road toward the Fed’s 2% target range.

Investors have also sent the 2-year U.S. Treasury yield back up to 4.63% as of Friday afternoon vs. its recent lows of 4.10% on February 1. The short-term yield is now approaching the recent high-water mark of 4.75% from November.

The bears shouldn’t do any premature celebrating. Still, investors looking to buy stocks might want to avoid chasing the red-hot tech stocks in favor of stable value-focused stocks that should perform well in the near term and possibly for years to come. The three stocks we dive into today also proved their strength during the brutal 2022.

Image Source: Zacks Investment Research

Cardinal Health (CAH) is a healthcare products distributor that benefits from the growth of pharmaceuticals, biotech, medical products, and much more. CAH topped our Q2 FY23 EPS estimates in early February and raised its outlook.

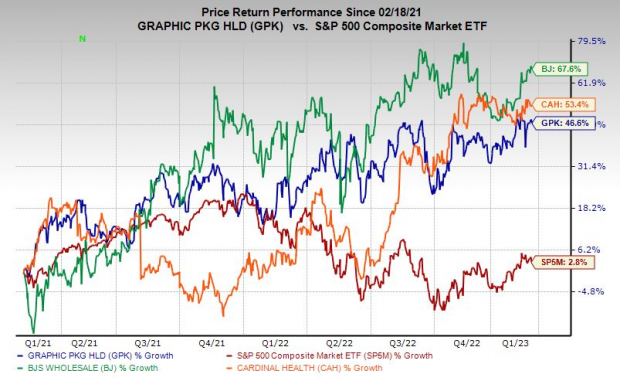

Cardinal Health lands a Zacks Rank #2 (Buy) right now and its stock is up 53% in the last two years. Despite the run, CAH is far from overheated and it pays a dividend. Plus, Cardinal Health’s valuation levels are rather enticing.

Graphic Packaging Holding Company (GPK) is a sustainable paper and fiber-based packaging firm with a portfolio that services companies in beverages, foodservice, personal care, household products, pets, and beyond. Graphic Packaging made a big strategic acquisition in 2021 to help expand its reach to Europe. Wall Street loves the stock for its straightforward, essential business and other fundamentals.

GPK posted great FY22 results on February 7 and boosted its outlook to help it grab a Zacks Rank #1 (Strong Buy). Graphic Packaging stock has crushed the market over the last 15 years and it is up 46% in the last two. Plus, its under $25 a share price and valuation levels make it a potentially very attractive buy and hold.

BJ's Wholesale Club Holdings, Inc. (BJ) is one of the leaders in the warehouse retail club space. BJ’s Wholesale is the definition of a one-stop shopping destination and its memberships help it keep prices low and customers loyal.

BJ stock is up 240% in the last three years and 67% during the trailing 24 months to crush its larger rival Costco. This includes a roughly 12% YTD climb. Yet, its valuation remains solid. BJ's Wholesale’s outlook also appears strong and its upward earnings revisions have it a Zacks Rank #1 (Strong Buy).

More By This Author:

3 Highly-Ranked Stocks That Beat The Market In 2022 To Buy NowBear Of The Day: 3M Company

Meta And Amazon Earnings: Time To Buy These Beaten-Down Tech Stocks?

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more