3 Financial Transaction Services Stocks To Buy Now

Image Source: Unsplash

Referring to an agreement, communication, or movement of assets between two or more parties, there is always an obvious need for financial transactions. Some of the most common financial transactions include the buying and selling of goods or services, along with financial instruments, funds transfers, and debt settlements.

Of course, financial transaction services are crucial to the economy, from real estate and insurance to banking and consumer finance, including investment funding for securities.

This leads to the point that the Zacks Financial Transaction Services Industry is currently in the top 19% of almost 250 Zacks industries. Furthermore, several stocks in the space have made their way onto the coveted Zacks Rank #1 (Strong Buy) list.

Standing out in terms of value, growth, and momentum, here are three of these highly ranked financial transaction services stocks to consider.

MoneyLion (ML - Free Report)

We’ll start with the digital financial platform MoneyLion, which offers a mobile banking and financial membership to help consumers take control of their finances. After going public in 2021, MoneyLion’s expansion has helped its stock shoot up +37% year-to-date, with the company expected to post a profit of $1.45 per share in fiscal 2024 compared to an adjusted loss of -$4.63 a share last year.

While MoneyLion’s 60.6X forward earnings multiple may appear to be a stretched premium, FY25 EPS is projected to soar another 280% to $5.51, which should lead to a more attractive P/E valuation. Plus, MoneyLion’s price-to-sales ratio of 2X is edging closer to the optimum level of less than 1X, with its top line expected to expand 24% this year and forecasted to grow another 21% in FY25 to $636.7 million.

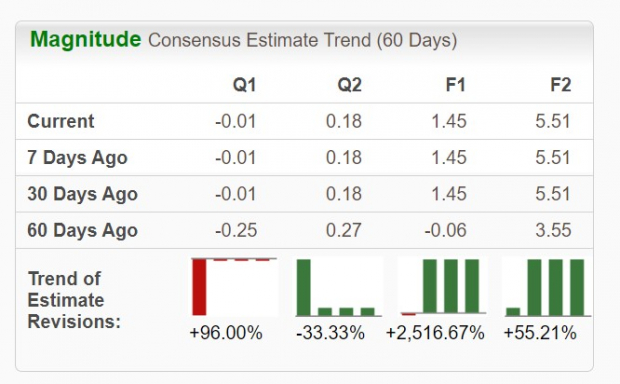

Additionally alluding to more upside in MoneyLion’s stock is the fact that earnings estimate revisions have skyrocketed over the last 60 days for both FY24 and FY25.

Image Source: Zacks Investment Research

RB Global (RBA - Free Report)

Operating an omnichannel marketplace, RB Global’s stock is attractive as a provider of value-added insight services and transaction solutions for buyers and sellers of commercial assets and vehicles. The stock has spiked +18% this year, with RB Global’s increased probability starting to make its 24.2X forward earnings multiple look more reasonable.

In this regard, RB Global’s annual earnings are currently slated to increase 10% in FY24 and are expected to jump another 9% in FY25 to $3.59 per share. Plus, total sales are projected to climb 17% in FY24 and are expected to increase another 4% next year, with projections over $4 billion.

Image Source: Zacks Investment Research

Western Union (WU - Free Report)

With a price tag of $12, Western Union’s stock may certainly catch value investors' attention, as its dividend is currently at a whopping 7.42%. Notably, many companies in the Zacks Financial Transaction Services Industry prioritize their internal growth and don’t offer a payout to shareholders, which separates the leading money transfer company from its peers.

Furthermore, Western Union’s improving operational performance in various global regions including Latin America and Asia is compelling, with annual earnings expected to increase 1% in FY24 and projected to rise another 5% in FY25 to $1.85 per share.

While Western Union’s stock is only up +1% year-to-date, it trades at just 7.2X forward earnings, which is a steep discount to the industry average of 14.3X and further suggests investors are getting a good deal at current levels when considering its high dividend yield.

Image Source: Zacks Investment Research

Bottom Line

Like MoneyLion, the stocks for RB Global and Western Union have seen a positive trend of earnings estimate revisions. This attributes to their strong buy ratings, and may suggest they could outperform the broader market as beneficiaries of a strong business industry. More importantly, as promising financial transaction services companies, they should be viable investments for 2024 and beyond.

More By This Author:

3 Transportation Dividend Growth Stocks To Keep An Eye On3 Solid Tech Funds To Buy As Nasdaq Hits New Milestone

Bear Of The Day: Xerox Holdings

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more