3 Fertilizer Stocks Benefiting From Increased Momentum

Image: Shutterstock

Assisted by a late end-of-day rally, the market closed solidly in the green on Thursday and continued its ascent. On Friday, things were a little flat. The strong rally we’ve witnessed kicked off last week and has provided investors with a highly desired week of green and positive momentum.

Momentum traders take advantage of trends in the market, believing that stocks will continue their uptrends and lead to considerable gains. The momentum effect becomes more potent within Zacks Rank #1 (Strong Buy) or #2 (Buy) stocks due to the nearly immediate effects of positive earnings estimate revisions on stock prices.

Fertilizer Momentum

Before this year, the fertilizer industry was in haywire. Increasing costs of natural gas used for production, new export-licensing requirements, and severe storms within the U.S. completely disrupted the industry, cutting deeply into farmers’ margins and sending fertilizer prices soaring.

Things have taken another downwards turn with Russia’s invasion of Ukraine this year. Russia, the world’s largest fertilizer producer, has been shunned by shipping companies refusing to dock and collect goods from the country. According to farmers, alternative sources are very costly, causing the product’s supply to be slashed.

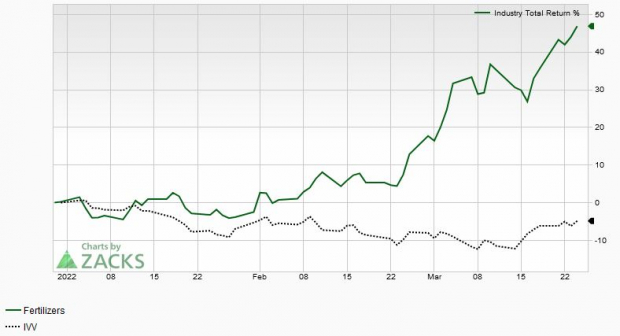

To no surprise, fertilizer stocks have been skyrocketing. The positive momentum within these companies can be expected to continue as long as earnings estimates continue to rise and supply chain-related issues continue to cap supply.

Two critical factors affecting the Momentum Style Score include the stock’s recent performance and the rate at which the consensus estimate trend is increasing. Let’s analyze these metrics in three fertilizer stocks with a Zacks Rank #1 (Strong Buy) rank and see how the companies are benefiting from the momentum.

Image Source: Zacks Investment Research

Sociedad Quimica Y Minera SA

Sociedad Quimica Y Minera SA (SQM - Free Report) is a fertilizer and iodine manufacturer that distributes its products to over 60 countries worldwide. Year-to-date, shares have skyrocketed by nearly 66%, scorching the S&P 500’s 4.5% decline.

SQM shares have displayed incredible strength over the last year as well, ascending 64% compared to the S&P 500’s return of 16%. Lastly, shares have crushed the S&P 500’s return of 4% over the previous month, increasing 27% in value.

Analysts have taken note of the momentum and have been revising their estimates over the last 60 days, boosting current full-year earnings 26% to $4.65 per share and next year’s EPS estimate 22% to $4.16 per share.

The next and following quarters have seen notable increases as well in the consensus estimate trend, increasing 32% to $1.05 per share and 15% to $1.06 per share, respectively. Overall, there have been seven upwards estimate revisions. SQM has a Momentum Style Score of an A.

Sociedad Quimica y Minera S.A. Price, Consensus and EPS Surprise

Sociedad Quimica y Minera S.A. price-consensus-eps-surprise-chart | Sociedad Quimica y Minera S.A. Quote

Nutrien LTD

Nutrien LTD (NTR - Free Report) produces and sells fertilizer and other related industrial feed products. The company is headquartered in Saskatoon, Canada.

Nutrien shares have been a bright spot in a dim market year-to-date, increasing by nearly 45% in value and far outperforming the S&P 500. Over the last year, the return has been even more impressive; shares have ascended almost 100% in value and crushed the general market’s performance. Share performance over the last month has told the same story, increasing 25% in value.

Over the last 60 days, NTR’s current year consensus estimate trend has climbed 37% to $12.86 per share, and next year’s EPS estimate has increased by a whopping 81% to $10.37 per share.

The next and following quarter’s EPS estimates have seen solid increases as well, rising 4% to $2.54 per share and 11% to $4.44 per share for the following quarter. In total, there have been 15 upwards estimate revisions in this time frame. NTR boasts a Momentum Style Score of an A as well.

Nutrien Ltd. Price, Consensus and EPS Surprise

Nutrien Ltd. price-consensus-eps-surprise-chart | Nutrien Ltd. Quote

The Andersons, Inc

The Andersons, Inc (ANDE - Free Report) is a regional grain merchandiser with diversified agriculture businesses that include crop nutrient formulation and distribution.

Like SQM and NTR, ANDE shares have been a hot item in the market year-to-date, increasing 41% in value and easily outperforming the general market. The last year’s performance is rock-solid, with shares seeing an increase of nearly 93%, and over the previous month, shares continued to demonstrate their strength by increasing 20%.

Most notably, the consensus estimate trend for the company has increased by nearly 61% for the next quarter, boosting the quarterly estimate to $0.66 per share from $0.41 per share. One downwards estimate revision has decreased the following quarter’s EPS estimate by 8% to $0.88 per share, and current-year earnings estimates have increased 15% to $2.63 per share.

There have been three upwards estimate revisions over the last 60 days and no revisions for next-year earnings. ANDE currently holds a Momentum Style Score of C.

The Andersons, Inc. Price, Consensus and EPS Surprise

The Andersons, Inc. price-consensus-eps-surprise-chart | The Andersons, Inc. Quote

Bottom Line

SQM, NTR, and ANDE have all received upwards estimate revisions over the last 60 days, pushing them into a #1 (Strong Buy) ranking and giving the companies solid Momentum Style Scores.

It’s crucial to remember that trends are rapidly changing and that what worked for investors a month ago may not work at all a month from now. Simply put, momentum investing relies on being flexible enough to pivot to names at any given time to capture the move at its earliest point.

Fortunately, we can utilize the Zacks Rank and Style Scores to alleviate this problem and provide a clearer picture since estimate revisions are one of the most powerful forces impacting stock prices.

Due to current conditions and trends, I believe that all three companies provide excellent opportunities for momentum investors trying to catch some gains. However, estimate revisions need to keep increasing for these companies to retain their momentum, so investors should heed caution and double-check rankings before purchasing.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more