3 Energy Stocks Suited Nicely For Income Investors

The Zacks Oils and Energy sector has displayed relative strength, gaining more than 4% over the last month compared to the S&P 500’s -0.9% decline. Rising oil prices have investors interested in the sector again, particularly following Saudi Arabia and Russia announcing an extension to their crude production cuts.

For those with a preference for income, there are several stocks within the sector currently paying investors handsomely, including Magellan Midstream Partners (MMP) , CVR Energy (CVI) , and Granite Ridge Resources (GRNT).

For those that like payday, let’s take a closer look at each.

Magellan Midstream Partners

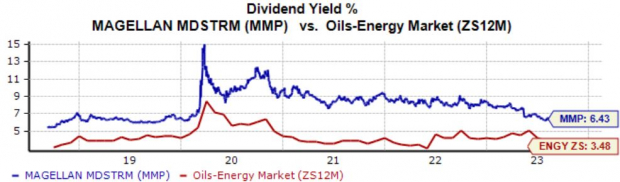

Magellan Midstream Partners owns and operates a diversified portfolio of energy infrastructure assets. The stock is a current Zacks Rank #2 (Buy), with earnings expectations creeping higher across several timeframes.

MMP shares currently yield a sizable 6.4% annually, nicely above the Zacks Oils and Energy sector average. Dividend growth is apparent, with the payout growing by 1.4% annualized over the last five years.

(Click on image to enlarge)

Image Source: Zacks Investment Research

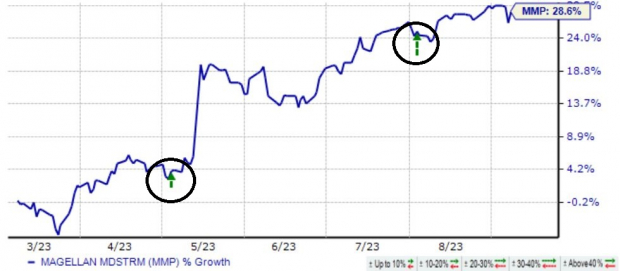

Better-than-expected quarterly results have helped keep MMP shares on an upward trajectory, as we can see illustrated in the chart below. Just in its latest release, the company penciled in a 12% EPS beat and reported revenue nearly 10% ahead of expectations.

(Click on image to enlarge)

Image Source: Zacks Investment Research

In addition, Magellan is forecasted to witness solid growth in its current year, with the $5.10 Zacks Consensus EPS Estimate suggesting an improvement of 12% year-over-year on 7% higher revenues.

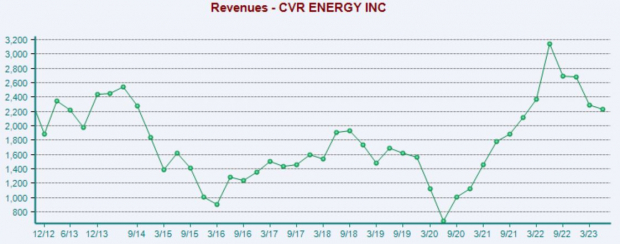

CVR Energy

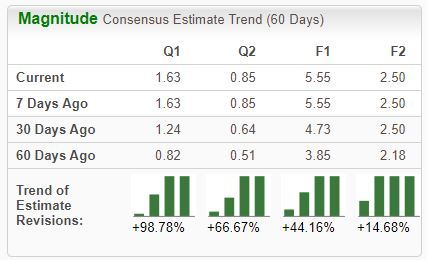

CVR Energy’s near-term earnings outlook has jumped higher across all timeframes over the last several months, landing the stock into the highly-coveted Zacks Rank #1 (Strong Buy).

(Click on image to enlarge)

Image Source: Zacks Investment Research

CVR Energy shares currently yield a solid 5.3% annually paired with a payout ratio sitting sustainably at 30% of the company’s earnings.

And like MMP, CVR Energy has consistently beat bottom line expectations, exceeding the Zacks Consensus EPS Estimate by an average of nearly 30% across its last four quarters. In its latest release, the company beat EPS expectations by 36% but fell short of revenue expectations.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Granite Ridge Resources

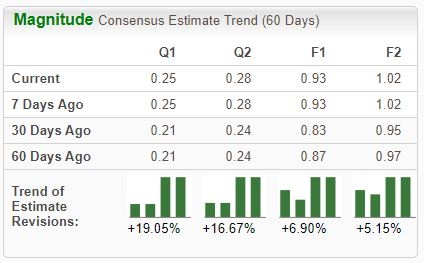

Granite Ridge, a current Zacks Rank #2 (Buy), is a scaled, non-operated oil and gas exploration and production company. The company’s earnings outlook has improved across the board, with shares currently yielding a solid 5.9% annually.

(Click on image to enlarge)

Image Source: Zacks Investment Research

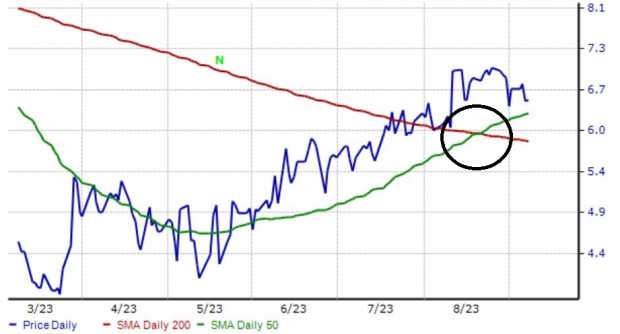

GRNT shares have recently witnessed the ‘Golden Cross,’ as we can see illustrated below. The Golden Cross occurs when the shorter 50-day moving average rises above the 200-day moving average, indicating near-term momentum.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Energy stocks have displayed notable momentum over the last month, with rising oil prices providing a tailwind.

And for those interested in tapping into the momentum and reaping a passive income stream, all three stocks above – Magellan Midstream Partners (MMP Quick QuoteMMP - Free Report) , CVR Energy (CVI Quick QuoteCVI - Free Report) , and Granite Ridge Resources (GRNT Quick QuoteGRNT - Free Report) – could be considered.

All three pay their investors handsomely and sport favorable Zacks Ranks, with the latter indicating optimism among analysts.

More By This Author:

DocuSign Beats Q2 Earnings And Revenue Estimates3 Top Ranked Mutual Funds For Your Retirement

Gamestop Q2 Loss Narrower Than Expected, Revenues Up Y/Y

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more