3 Dividend Kings Crushing The S&P 500 In 2022

Income investors love to target Dividend Aristocrats, companies that have increased their dividend payouts for a minimum of 25 consecutive years.

However, a step above is the elite Dividend Kings group, companies with at least 50 consecutive years of increased dividend payouts.

Clearly, companies in the Dividend King club carry well-established and successful business operations, displayed by their commendable commitment to shareholders over decades of increased payouts.

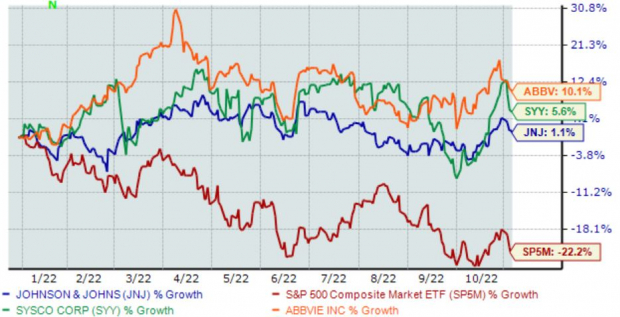

And several of them have outperformed the S&P 500 by a fair margin in 2022, including AbbVie (ABBV) , Sysco Corp. (SYY) , and Johnson & Johnson (JNJ) . This is shown in the chart below.

Image Source: Zacks Investment Research

Let’s take a deeper dive into each one for those interested in building up a cash pile.

Johnson & Johnson

Headquartered in New Jersey, Johnson & Johnson is an American multinational corporation that develops medical devices, pharmaceuticals, and consumer packaged goods.

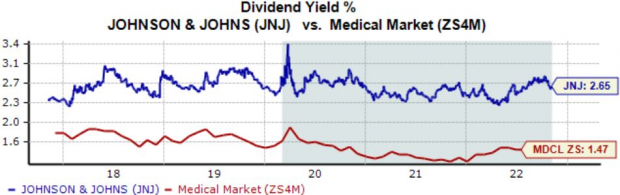

JNJ’s annual dividend yield comes in at a solid 2.7%, notably higher than its Zacks Medical sector average.

Further, the company carries a sustainable 45% payout ratio paired with a 6% five-year annualized dividend growth rate.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Johnson & Johnson’s earnings streak is more than impressive; the company has exceeded the Zacks Consensus EPS Estimate in each quarter dating back to 2012.

Just in its latest print, JNJ registered a 2.4% EPS beat paired with a 2.2% sales surprise. Below is a chart illustrating the company’s revenue on a quarterly basis.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Sysco Corp.

Sysco markets and distributes a range of food and related products primarily to the food service or food-away-from-home industry.

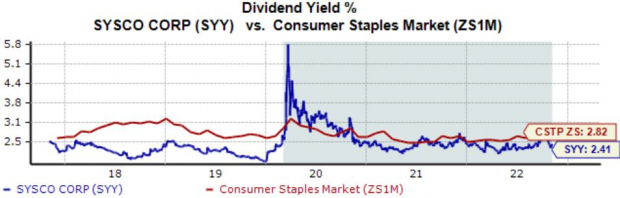

SYY’s 2.4% annual dividend yield is a few ticks below its Zacks Consumer Staples sector average of 2.8%. Still, the company’s 8.3% five-year annualized dividend growth rate helps to pick up the slack by a fair margin.

(Click on image to enlarge)

Image Source: Zacks Investment Research

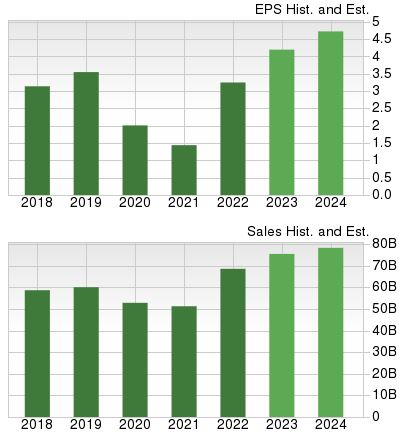

It’s hard to ignore SYY’s growth profile; earnings are forecasted to climb more than 25% in its current fiscal year (FY23) and a further 12.5% in FY24.

The projected earnings growth comes on top of forecasted Y/Y revenue upticks of 11.3% and 4.3% for FY22 and FY23, respectively.

(Click on image to enlarge)

Image Source: Zacks Investment Research

SYY shares trade at a 19.4X forward earnings multiple, nicely beneath its 21.7X five-year median and a fraction of 2021 highs of 65.4X.

The company sports a Style Score of an A for Value.

(Click on image to enlarge)

Image Source: Zacks Investment Research

AbbVie

AbbVie, a global research-based biopharmaceutical company that delivers innovative medicines, became a top pharma company following its acquisition of Botox maker Allergan in a cash-and-stock deal for $63 billion in May 2020.

ABBV’s annual dividend yield comes in at a steep 3.9%, paired with an impressive 14% five-year annualized dividend growth rate. The company pays out 41% of its earnings.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Shares trade at a 10.4X forward earnings multiple, above the 9.5X five-year median but representing a 53% discount relative to its Zacks Medical sector.

The company carries a Value Style Score of a B.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Targeting dividend-paying stocks is an excellent strategy that investors can deploy.

Dividends soften the blow from drawdowns in other positions, provide more than one way to reap a return from an investment, and allow maximum returns through dividend reinvestment.

And all three stocks above – AbbVie (ABBV Quick QuoteABBV - Free Report) , Sysco Corp. (SYY Quick QuoteSYY - Free Report) , and Johnson & Johnson (JNJ Quick QuoteJNJ - Free Report) – are Dividend Kings, upping their dividend payouts for a minimum of 50 consecutive years.

For those seeking a reliable income stream, all three deserve serious consideration.

More By This Author:

2 Utility Stocks to Consider BuyingActivision Blizzard Q3 Preview: What's in Store?

Walt Disney To Report Q4 Earnings: What's In The Cards?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more