3 Defensive Stocks To Watch As Trade Tensions Resurface: GILD, JNJ, KR

Image Source: Pexels

Resurfaced tensions between the U.S. and China caught the market off guard in Friday’s trading session, with the S&P 500 and Nasdaq falling over 2% on news that President Trump plans to impose an additional 100% tariff on Chinese goods starting November 1st.

Notably, President Trump stated the move was prompted by China taking an “extraordinarily aggressive” position in what had been ongoing trade talks by announcing new export controls on the U.S. that will take effect next month.

With investors being on edge as the world’s two largest economies go head-to-head again, seeking out stocks that can offer defensive safety in the portfolio may be necessary.

Top Performing Medical Stocks

The medical sector had been at the forefront of defensive positions earlier in the year when President Trump’s Liberation Day Tariffs rocked the broader market, with Gilead Sciences (GILD - Free Report) and Johnson & Johnson (JNJ - Free Report) being able to hold onto some of these exhilarating gains.

GILD and JNJ shares are hovering near their 52-week highs and are still up more than +25% year to date, respectively. Enthusiasm for their drug pipelines has been magnified by increased probability, as Gilead Sciences has a stronghold in developing treatments for HIV and liver diseases, while Johnson & Johnson has a robust portfolio across immunology, oncology, neuroscience, and other therapeutic areas.

Image Source: Zacks Investment Research

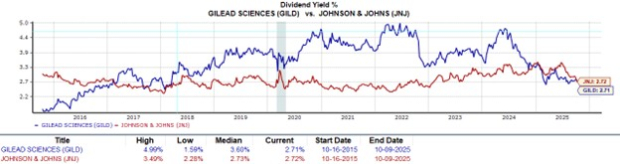

Also attracting investors have been Gilead Sciences and Johnson & Johnson’s respectable dividends, which are both around 2.7%, topping the Zacks Medical sector’s average of 1.47% and the S&P 500’s average of 1.1%.

Image Source: Zacks Investment Research

Kroger’s Value as a Retail Grocery Leader

As one of the largest grocery chains in the U.S., investors have shown a tendency to flock to Kroger's (KR - Free Report) stock for defensive safety as well. While Kroger stock lost some of its YTD gains when tariff concerns subsided, KR is still up a respectable +13% in 2025.

Amid a resurgence in market volatility, Kroger’s value may take center stage with KR trading at a reasonable 14X forward earnings multiple and well under the preferred level of less than 2X sales.

Image Source: Zacks Investment Research

Seeing steady top and bottom line expansion, Kroger stock stands out with an overall “A” VGM Zacks Style Scores grade for Value, Growth, and Momentum. Plus, Kroger also offers an annual dividend yield of over 2%.

Even better, Kroger’s 28% payout ratio suggests there is plenty of room to raise its dividend in the future, with KR having an impressive annualized dividend growth rate of 15.24% in the last five years.

Image Source: Zacks Investment Research

Bottom Line

Building their reputations as viable defensive investments, Gilead Sciences, Johnson & Johnson, and Kroger stock all land a Zacks Rank #3 (Hold) at the moment. That said, these stocks will likely attract investors if markets continue to pull back, as their operations are deemed essential regardless of economic uncertainty.

More By This Author:

3 Broadcast Radio & TV Stocks To Buy From A Prospering Industry3 Electronics Stocks To Watch From A Challenging Industry

Buy The Spike In Pepsi Stock After Exceeding Q3 Expectations?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more