3 Companies Enjoying Meaningful Margin Expansion

We continue to navigate the Q4 earnings cycle, seeing many companies report quarterly results daily. There have been many positive surprises, with several companies enjoying meaningful margin expansion throughout the period.

More specifically, three companies – Netflix (NFLX), Procter & Gamble (PG), and Meta Platforms (META) – all saw their profitability pictures improve nicely, posting results that pleased investors. For those looking to tap into the earnings momentum, let’s take a closer look at each.

Netflix

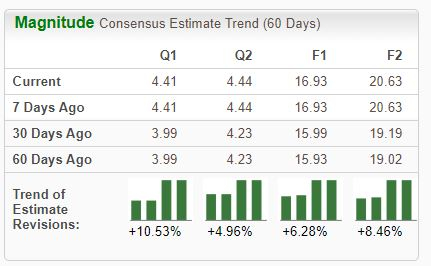

Streaming giant Netflix has enjoyed positive earnings estimate revisions across the board, landing it into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

The profitability picture improved in a big way throughout its latest period, as operating income of $1.5 billion crushed $0.5 billion previously, with operating margin also improving to 17% from 7% in the same period last year.

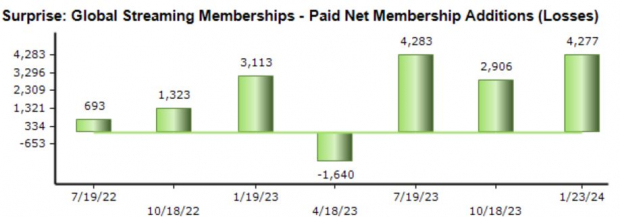

Subscriber additions throughout the period totaled 13.1 million, crushing our consensus estimate of 8.8 million. The company has consistently posted big beats regarding subscribers, as shown below.

Image Source: Zacks Investment Research

Meta Platforms

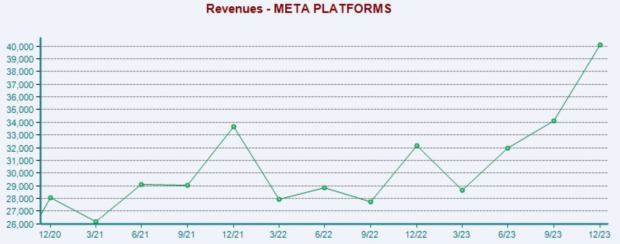

Meta has consistently posted robust earnings results lately, exceeding our consensus EPS expectations by an average of 20% across its last four releases. Impressively, the company’s operating margin came in at 41%, crushing the year-ago quarterly figure of 20%.

Concerning the latest report, the technology titan posted 25% year-over-year revenue growth paired with a 77% EPS jump. The 25% revenue jump penciled in the highest year-over-year growth rate in eight quarters.

Image Source: Zacks Investment Research

To top off the robust results, the company unveiled its first-ever dividend, which is payable on March 26th to stockholders of record as of the close of business on February 22nd.

Procter & Gamble

Procter & Gamble delivered an 8% beat relative to the Zacks Consensus EPS estimate and posted revenue a hair below expectations, with both items higher than year-ago figures. The company’s gross margin came in at 52.7%, nicely above the year-ago figure of 47.5%.

Following the results, the company upped its FY24 core net EPS growth into a band of 8% - 9% vs. the previously expected 6% - 9%. Shares have seen bullish activity following the release, injecting positive sentiment.

Image Source: Zacks Investment Research

Bottom Line

A favorable operating environment has led to increased profitability for many companies, causing many to see shares jump post-earnings throughout the 2023 Q4 cycle so far.

More By This Author:

Shopify Reports Next Week: Wall Street Expects Earnings GrowthBull Of The Day: Booz Allen Hamilton

Highly Ranked Stocks To Watch As Earnings Approach