3 Cheap Stocks To Buy Now For June And Beyond

Image: Bigstock

The Nasdaq dropped around 1% during regular trading Thursday, while the S&P 500 dipped 0.36%. The moves came a day after many growth stocks jumped and shares of so-called meme stocks such as AMC Entertainment (AMC Quick Quote AMC - Free Report) and Bed Bath & Beyond (BBBY Quick Quote BBBY - Free Report) soared.

Amid the return of meme stock mania, investors might want to consider buying highly-ranked “cheap” stocks that boast solid fundamentals. Adding to a portfolio even amid lower summer trading volume and inflation worries might prove beneficial given the broader bullish backdrop that includes the improving earnings picture and the U.S. economic boom, boosted by the reopening.

And let’s remember that the bulls have pushed the S&P 500 back within touching distance of its highs as interest rates are likely to remain historically low even if the Fed is forced to raise rates to tamp down rising prices.

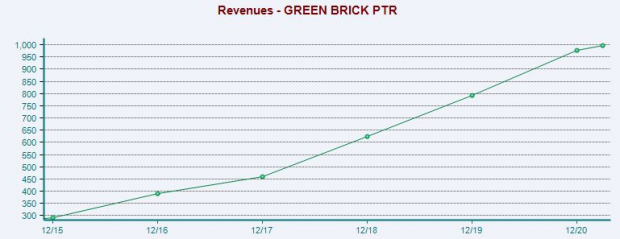

Green Brick Partners, Inc. (GRBK Quick Quote GRBK - Free Report)

Prior Close: $22.92 USD (close of regular trading Thursday, June 3)

Green Brick is a diversified homebuilding and land development firm that operates in growth markets such as Texas, Georgia, Florida, and Colorado. The firm is on an impressive run and the continued momentum in the housing market could help GRBK extend its growth streak. Home sales soared last year to their highest level since 2006 as people clamored for more space and took advantage of low mortgage rates, all driven by the coronavirus. The rampant demand has cooled down a bit amid tight supply that will likely benefit homebuilders.

The Texas-based company topped our first quarter FY21 estimates in early May, with revenue up 10% against 27% top-line growth in the year-ago quarter. GRBK posted its best first quarter in company history and saw its net new home orders soar 71%.

More importantly, it ended the quarter with its highest backlog in history, up 133%. “To meet the unprecedented demand, Green Brick started a record 2,043 homes in the last six months and ended the quarter with 2,303 units under construction, a 62% increase from a year ago,” CEO Jim Brickman said in prepared remarks.

Image Source: Zacks Investment Research

Green Brick’s earnings revisions have climbed since its report, with consensus analysts estimates for FY21 up 9% and FY22 19% higher. Zacks estimates call for GRBK’s revenue to surge 39% this year to reach $1.36 billion and then jump 20% higher in FY22.

These projections would extend its streak of nearly 20% or stronger sales growth to eight straight years. Meanwhile, GRBK’s adjusted earnings are expected to soar 48% this year and 19% next year.

Green Brick’s positive earnings revisions activity helps it grab a Zacks Rank #2 (Buy) right now, alongside its “B” grades for Value and Momentum in our Style Scores system. And three of the four brokerage recommendations Zacks has are “Strong Buys.”

Given some of these fundamentals and the market momentum off the virus lows, it might not be a surprise that Green Brick shares are up 100% in the last year to easily beat its highly-ranked Real Estate–Development industry’s 70% average.

Luckily for investors who missed out the stock is flat in 2021 to lag its industry’s 33% run. GRBK is currently hovering between its 50-day and 200-day moving average, with a below-neutral RSI of 45. The stock is also trading at a 45% discount to its industry at 6.5X forward earnings and 15% below its own year-long median.

Plus, Green Brick shares are trading nearly 20% below its early May highs at roughly $23 a share. All of this might create an enticing buying opportunity to buy GRBK on the dip after Wall Street took profits on the big pandemic winner.

Everi Holdings Inc. (EVRI Quick Quote EVRI - Free Report)

Prior Close: $22.07 USD (close of regular trading Thursday, June 3)

Everi is a Las Vegas-based casino tech firm that sells a variety of gaming machines and services. The company also provides financial services-focused products that “power the casino floor,” player loyalty offerings, as well as intelligence and regulatory compliance solutions.

EVRI is coming off a tough covid-hit year that disrupted the broader hospitality world and casinos. As one might assume, Everi’s business started to improve in the second half of last year and it’s poised for a big comeback amid the U.S. economy’s grand reopening.

EVRI topped our Q1 earnings and revenues estimates on May 5 and it announced on May 20 an agreement with Caesars Entertainment (CZR Quick Quote CZR - Free Report) to begin a Nevada field trial for its Jackpot Xpress. The firm’s first-quarter revenue jumped 23% from Q1 2020 and 12% against Q1 FY19.

Plus, its adjusted earnings soared and it topped our estimate by 425%. “A key driver of the growth in our Games and FinTech business segments is our high-margin, recurring revenue streams, which we expect will help sustain our near- and long-term growth as the casino industry continues to recover,” CEO Michael Rumbolz said in Q1 remarks.

The provider of land-based and digital casino gaming content is also prepared to expand into more markets and its consensus EPS estimates have skyrocketed since its report, with its FY21 figure 168% higher to $0.67 a share and FY22 up 54%. This bottom-line positivity helps Everi grab a Zacks Rank #2 (Buy) right now next to its “A” grade for Momentum in our Style Scores system.

Image Source: Zacks Investment Research

EVRI’s 2021 revenue is projected to soar over 46% to $561.9 million to come in above its pre-pandemic levels and then climb 9% higher in FY22. On the bottom line, Everi is expected to swing from an adjusted loss of -$0.96 a share in the covid-shutdown year up to +$0.67 in 2021 and $0.77 next year.

Along with its strong Zacks Rank, all six of the brokerage recommendations Zacks has for the stock are “Strong Buys.” EVRI shares have surged nearly 25% since its early May report as part of a 60% run in 2021 and a 230% climb in the past 12 months. Unlike, GRBK, Everi shares might be a bit overheated right now and it could face a near-term pullback.

But despite trading right near its records, its valuation picture has improved significantly in the last six months, trading 44% below its six-month highs in terms of forward earnings. And Everi could continue to benefit from the reopening boom and the growth of digital casinos.

Mattel, Inc. (MAT Quick Quote MAT - Free Report)

Prior Close: $20.86 USD (close of regular trading Thursday, June 3)

Mattel is a historic toys and games maker with a portfolio that includes Barbie, Hot Wheels, Fisher-Price, and much more. The company is coming off a strong second-half of 2020 that saw it post back-to-back quarters of 10% sales growth. This expansion marked its strongest in years, as traditional toy and game companies struggle to adapt to the tech-heavy world of video games and smartphones.

Mattel executives said they are seeing higher-than-expected demand because people are trying to find different ways to entertain their kids and families amid growing concerns about screen time that was elevated during remote learning. Most recently, its first-quarter FY21 revenue skyrocketed 47% to blow by estimates, while it beat bottom-line projections by 70%. The growth came against an easier to compare period but it still represented a record Q1.

MAT’s fiscal 2020 revenue climbed 2%, for its first top-line growth in six years. Zacks estimates currently call for its FY21 sales to jump 9% to reach $4.98 billion, with FY22 projected to come in 4.6% higher. Better yet, Mattel’s adjusted earnings are projected to climb by 68% and 27%, respectively during this stretch. The company has also crushed our bottom-line estimates by an average of 80% in the trailing four-quarter.

Image Source: Zacks Investment Research

Analysts have raised their earnings estimates since its Q1 release to help Mattel land a Zacks Rank #1 (Strong Buy) at the moment. On top of that, eight of the 11 brokerage ratings Zacks has for the stock are “Strong Buys,” with the other three at a “Hold.”

MAT has jumped 20% in 2021 and 105% in the past 12 months to nearly triple its highly-ranked Toys-Games-Hobbies industry that includes TakeTwo Interactive (TTWO Quick Quote TTWO - Free Report) and Hasbro (HAS Quick Quote HAS - Free Report). Despite its outperformance, MAT trades at a solid discount to its industry at 21.4X forward 12-month earnings vs. 26.3X.

The stock did slip around 3% during regular trading Thursday, as the Nasdaq fell, to put it about 9% below its 52-week highs. And MAT still has plenty of potential runway before it nears the $33 a share it traded at in 2016 and the $45 it touched back in 2013.

The recent pullback has Mattel shares below neutral RSI levels. And MAT’s growth outlook suggests that there could be an active push from some parents for their kids to spend less time on screens in a world where more people are addicted to devices. MAT is also ready to roll out movies and TV Shows. “We gained global market share and continued to transform Mattel into an IP-driven, high performing toy company,” Ynon Kreiz said in prepared remarks last year.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more