3 Cheap Stocks To Buy For Growth & Value

Image Source: Unsplash

Often times there are some absolute bargains in regard to stocks to invest in among the coveted Zacks Rank #1 (Strong Buy) list.

This appears to be the case with several new additions to the strong buy list this week as the growth and valuations of these companies support the notion that their stocks are cheap.

Geopark (GPRK - Free Report)

Checking an “A” Zacks Style Scores grade for Growth and a “B” grade for Value, we’ll start with Geopark which is an explorer, operator, and consolidator of oil and gas primarily in South America including Chile, Columbia, Brazil, and Argentina.

At $11, Geopark’s stock has soared +25% year to date but still trades at just 3.3X forward earnings. To that point, FY24 EPS is projected to expand 51% to $3.23 versus $2.14 a share last year. Even better, FY25 EPS is projected to increase another 23%. Geopark’s increased profitability is also accompanied by steady top line expansion with total sales expected to rise 5% this year and projected to jump another 17% in FY25 to $925.51 million.

Image Source: Zacks Investment Research

More reassuring and indicative that the rally in Geopark’s stock could continue is that earnings estimate revisions for FY24 have risen 3% over the last 60 days with FY25 EPS estimates spiking 20%.

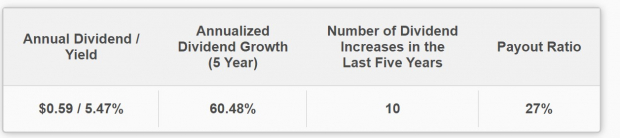

What also adds to the premise that Geopark’s stock is a bargain is that its 5.47% annual dividend yield towers over its Zacks industry average of 2.17% and the S&P 500’s 1.28% average. Better still, Geopark has increased its dividend 10 times in the last five years for an annualized growth rate of 60.48% during this period and its 27% payout ratio suggests more hikes could be in store.

Image Source: Zacks Investment Research

Steelcase (SCS - Free Report)

Daunting an “A” Style Scores grade for both Growth and Value is Steelcase, a designer and manufacturer of products used to create high-performance work environments. Steelcase’s product portfolio includes furniture systems, seating, storage, desks, case goods, and interior architectural and technology-related products and services.

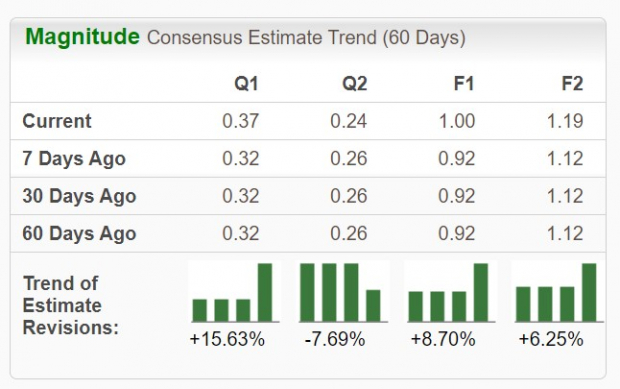

With its stock trading at $13, Steelcase’s 13.2X forward earnings multiple is attractive considering annual earnings are expected to increase 7% this year and are forecasted to jump another 19% in FY25 to $1.19 per share. Plus, total sales are expected to expand by 3% in FY24 and FY25 with projections over $3 billion. The cherry on top is that Steelcase’s annual dividend yield is currently at 3.01% with FY24 and FY25 EPS estimates rising 9% and 6% over the last 60 days respectively.

Image Source: Zacks Investment Research

MINISO Group (MNSO - Free Report)

Another stock that is hovering near perceived bargain territory is MINISO Group Holding Limited, a retailer offering design-led lifestyle products in China. MINISO’s stock trades at $20 and has a “B” Style Scores grade for both Growth and Value.

While Chinese equities have been submerged in volatility due to concerns of slower economic growth in China and geopolitical tensions, a sharp rebound should still be expected at some point and MINISO Group’s stock could be poised for lift-off. Notably, MINISO Group was founded in 2013 and is already profitable after going public in 2022 with a Hong Kong public listing as well.

Annual earnings are expected to soar 59% in FY24 to $1.24 per share and are projected to soar another 25% next year to $1.56 a share. However, it is MINISO Group’s top line expansion that further alludes to its future earnings potential with total sales projected to pop 25% in FY24 and forecasted to climb another 21% in FY25 to $2.94 billion. More importantly, FY24 and FY25 EPS estimates have soared 11% and 14% in the last two months respectively making MINISO’s forward P/E of 16.6X look reasonable.

Image Source: Zacks Investment Research

Bottom Line

Rising earnings estimates are helping to make the case that these highly ranked stocks are indeed cheap with now looking like an ideal time to buy considering their attractive growth trajectories and reasonable valuations.

More By This Author:

Top Stock Picks For Week Of June 24, 2024Will General Mills Top Estimates In Q4 Earnings Release?

Bank Of Hawaii Eyes Capital Raise Amid Bond Losses

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more