3 Buy-Rated Technology Stocks Sporting Attractive Valuations

Image: Bigstock

Technology stocks have been standout performers year-to-date, often rewarding investors handsomely. The Zacks Computer & Technology sector is up an impressive 40% in 2023, widely outperforming the S&P 500’s substantial 20% gain.

And with the sector’s strong run, many have begun raising concerns surrounding valuations. However, not all technology stocks are expensive. Look no further than Celestica (CLS - Free Report), Jabil (JBL - Free Report), and NCR (NCR - Free Report).

All three sport sound valuations and have enjoyed positive earnings estimate revisions, undoubtedly a solid pairing. Let’s take a closer look at each.

NCR

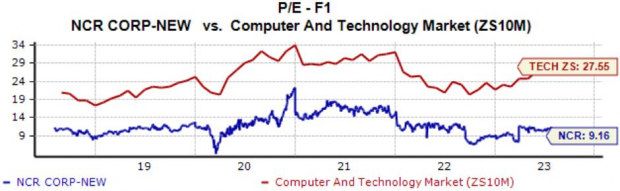

NCR Corporation, a current Zacks Rank #2 (Buy), is the world's leading enterprise provider of software, hardware, and services for banks, retailers, restaurants, and small businesses. Shares presently trade at a 9.2X forward earnings multiple (F1), well off the 11.3X five-year median and 2022 highs of 15.8X. The stock carries a Style Score of ‘A’ for Value.

Image Source: Zacks Investment Research

NCR shares could also attract growth-focused investors; estimates for its current fiscal year suggest 20% EPS growth in its current fiscal year (FY23) and an additional 9% of growth in FY24.

In addition, the company has delivered strong quarterly results as of late, exceeding the Zacks Consensus EPS Estimate by at least 30% in back-to-back releases. The results have impressed the market, with NCR shares seeing bullish activity following both prints.

Image Source: Zacks Investment Research

Celestica

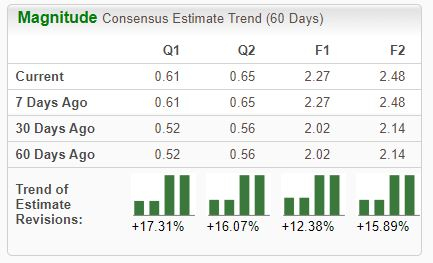

Celestica is one of the world's largest electronics manufacturing services companies serving the computer and communications sectors. The company’s earnings outlook has recently improved across the board, helping land the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

The company’s forward earnings multiple (F1) sits at 10.4X, a few ticks above the five-year median and well below the Zacks Computer & Technology sector average. In addition, the forward price-to-sales (F1) works out to be a small 0.3X.

And like NCR, Celestica is forecasted to witness solid growth, with estimates suggesting a 20% bump in earnings on 8% higher sales in its current year. Looking ahead to FY24, expectations allude to a further 10% improvement in earnings on a 5% sales increase.

Jabil

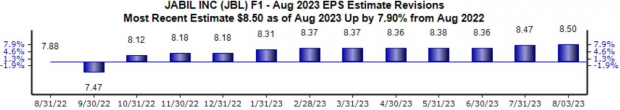

Jabil provides electronic manufacturing services and solutions to its customers, currently boasting a Zacks Rank #2 (Buy). The revisions trend has been particularly notable for its current year, with the $8.50 per share estimate up 8% since August last year.

Image Source: Zacks Investment Research

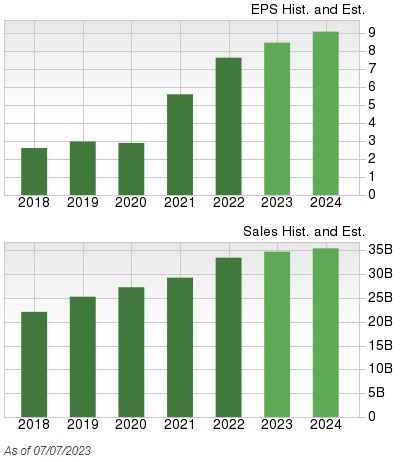

It’s worth highlighting that JBL shares offer exposure to technology paired with a passive income stream; JBL shares currently yield a small 0.3% paired with a sustainable payout ratio sitting at 4% of the company’s earnings.

And shares don’t appear overvalued given the company’s growth profile, with earnings forecasted to climb 11% in its current year and a further 9% in FY24. Shares presently trade at a 12.8X forward earnings multiple (F1) and a 0.4X forward price-to-sales (F1).

Image Source: Zacks Investment Research

Bottom Line

With technology stocks enjoying strong runs in 2023, many have feared valuations have become too expensive. However, that certainly isn’t the case for all in the sector, as demonstrated by Celestica (CLS - Free Report), Jabil (JBL - Free Report), and NCR (NCR - Free Report). All three sport sound valuations, carrying a Style Score of ‘A’ for Value.

In addition, all three have enjoyed positive earnings estimate revisions, helping provide fuel for shares to continue climbing.

More By This Author:

3 Upcoming Quarterly Reports Investors Can't IgnoreEli Lilly To Report Q2 Earnings: What's In The Cards?

Bear Of The Day: Royal Gold (RGLD)

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more