3 Buy Rated Stocks To Consider As Earnings Approach

Image Source: Unsplash

With the Q1 earnings season underway, there will be a microscope on companies that can continue to show improvements in their outlook amid an uptick in inflation.

That said, several top-rated Zacks stocks are standing out before their quarterly report next week, and here are three to consider.

Interactive Brokers (IBKR - Free Report)

First quarter results from Interactive Brokers on Tuesday, April 16 are expected to reflect considerable growth in the global electronic security exchange providers' top and bottom lines. Quarterly sales are projected to rise 12% to $1.19 billion with Q1 EPS forecasted to pop 20% to $1.62 versus $1.35 a share in the comparative quarter.

Overall, Interactive Brokers' annual earnings are now expected to rise 8% in fiscal 2024 with total sales forecasted to be up 6% to $4.6 billion.

Image Source: Zacks Investment Research

Abbott Laboratories (ABT - Free Report)

Reporting Q1 results next Wednesday, April 17, Abbott Laboratories' expansion as a diversified healthcare products company has remained compelling. This is despite Q1 EPS forecasted to dip -7% to $0.96 a share although first quarter sales are expected to rise 1% to $9.85 billion.

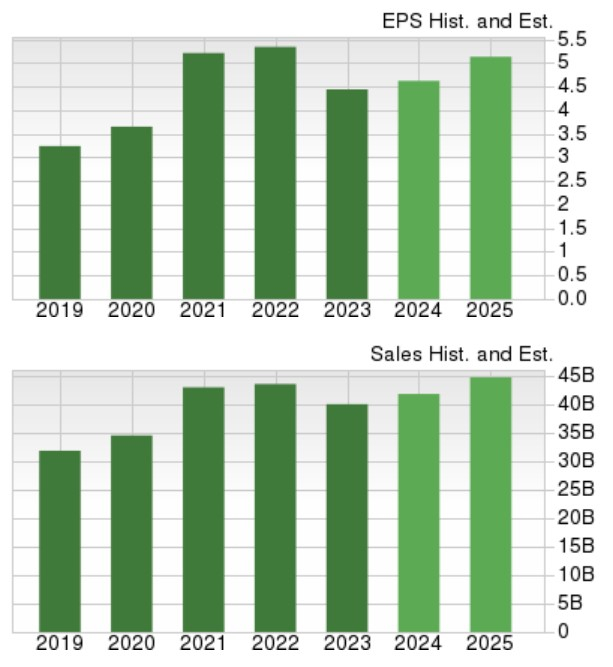

Plus, annual earnings are still projected to edge up 4% this year and are expected to jump another 11% in FY25 to $5.13 per share. Estimates of 4% total sales growth in FY24 and another 7% leap in FY25 to $44.85 billion is more reassuring. Abbott’s stock also has a 1.97% annual dividend yield that tops the S&P 500’s 1.3% average and the broader Zacks Medical-Products Market’s 1.59%.

Image Source: Zacks Investment Research

ASML Holding (ASML - Free Report)

ASML Holding’s Q1 report on Wednesday will be much anticipated as the world leader in advanced technology systems for the semiconductor industry. An intergraded portfolio for manufacturing complex integrated circuits has led to robust growth in recent years.

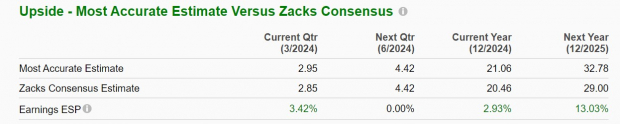

Following a very tough to-compete-against prior-year quarter, ASML Holding’s Q1 EPS is expected to drop to $2.85 compared to $5.31 per share a year ago. However, the tech giant has exceeded EPS estimates for five consecutive quarters posting an average earnings surprise of 9.38% in its last four quarterly reports. Furthermore, annual earnings are expected to dip -5% in FY24 but are anticipated to rebound and soar 42% in FY25 to a whopping $29.00 per share.

Image Source: Zacks Investment Research

Better still, the Zacks ESP (Expected Surprise Prediction) indicates ASML could continue its streak of beating EPS estimates with the Most Accurate Estimate having Q1 earnings pegged at $2.95 per share and 3% above the Zacks Consensus.

Image Source: Zacks Investment Research

Takeaway

Interactive Brokers, Abbott Laboratories, and ASML Holding will certainly be three stocks to watch next week. At the moment they each sport a Zacks Rank #2 (Buy) and strong Q1 results could move these top-rated stocks higher.

More By This Author:

Low Beta Tech Stocks To Consider For A Rebound Amid Heightened Market VolatilityCitigroup Q1 Earnings And Revenues Beat Estimates

4 Sector ETFs & Stocks To Benefit From Hot Inflation

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more