3 Buy-Rated Stocks Suited Nicely For Value Investors

Despite the market’s incredible run so far year-to-date, not all stocks have become expensive, with plenty of deals out there.

Value-focused investors target mispriced stocks with the idea that others will eventually ‘catch on’ and recognize their actual value, which can lead to serious gains. After all, we all enjoy a nice deal.

And for those seeking stocks without stretched valuations, Oshkosh (OSK) , Post Holdings (POST) , and Urban Outfitters (URBN) – could all be considerations.

In addition to sound valuation levels, all three sport a favorable Zacks Rank and carry solid growth profiles, with the former indicating optimism among analysts. Let’s take a closer look at each.

Oshkosh

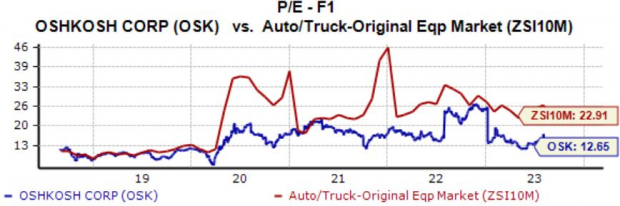

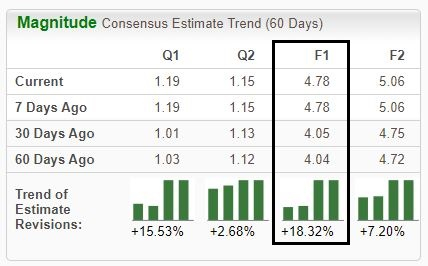

Oshkosh is a designer, manufacturer, and provider of various vehicle bodies and specialty vehicles. Analysts have taken their earnings expectations higher across the board, pushing the stock into the highly-coveted Zacks Rank #1 (Strong Buy).

(Click on image to enlarge)

Image Source: Zacks Investment Research

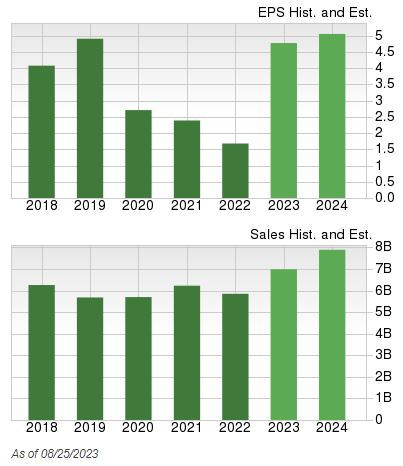

The company’s shares aren’t expensive given its growth trajectory, with earnings forecasted to climb 130% in its current year on 15% higher revenues. Shares trade at a 12.7X forward earnings multiple (F1), beneath the 15.1X five-year median and the respective Zacks industry average by fair margins.

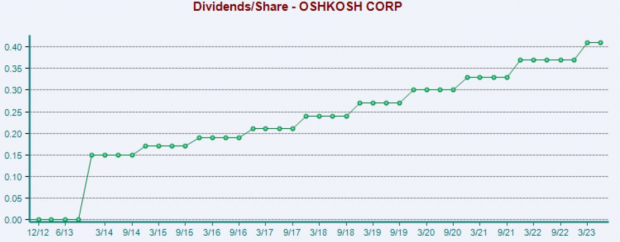

Image Source: Zacks Investment Research

Income-focused investors could also find OSK attractive, with shares currently yielding 1.6% annually. Impressively, the company has grown its payout by 10% annualized over the last five years.

Image Source: Zacks Investment Research

Post Holdings

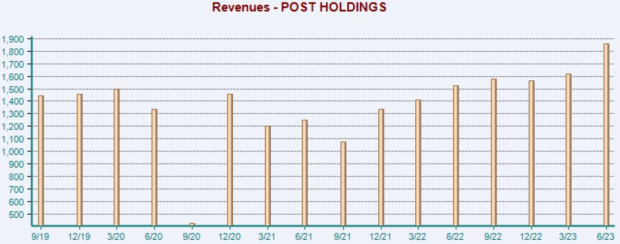

Post Holdings, a current Zacks Rank #1 (Strong Buy), is a consumer-packaged goods holding company involved in many food categories. The company has enjoyed positive earnings estimate revisions across all time periods, with the trend particularly notable for its current fiscal year.

(Click on image to enlarge)

Image Source: Zacks Investment Research

POST shares trade at an 18.9X forward earnings multiple (F1), below the 24.9X five-year median and a fraction of the 65.8X high in 2022. And the company is forecasted to witness a notable growth recovery, with Zacks Consensus Estimates alluding to 180% earnings growth on 14% higher sales in its current year.

(Click on image to enlarge)

Image Source: Zacks Investment Research

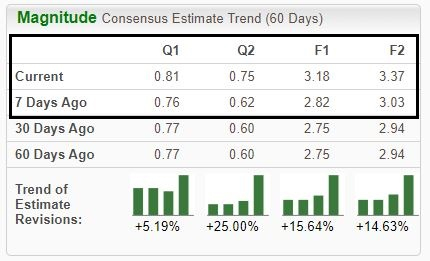

The company has consistently blown away quarterly expectations, exceeding the Zacks Consensus EPS Estimate by an average of 60% across its last four releases. As shown below, the company’s revenue has recovered from the initial pandemic shock and has seen a slight acceleration as of late.

(Click on image to enlarge)

Image Source: Zacks Investment Research

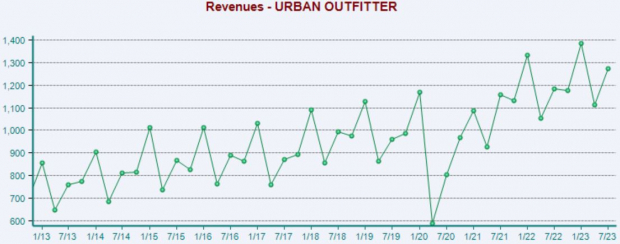

Urban Outfitters

Urban Outfitters, a current Zacks Rank #1 (Strong Buy), is a lifestyle specialty retailer offering fashion apparel and accessories, footwear, home décor, and gift products. The company’s earnings outlook has shifted positively following its latest better-than-expected quarterly release on August 22nd.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Regarding the mentioned release, URBN posted a positive 24% EPS surprise and reported revenue 2% ahead of expectations. Earnings improved 70% year-over-year, whereas revenue climbed 7% from the year-ago period.

(Click on image to enlarge)

Image Source: Zacks Investment Research

URBN shares currently trade at a 10.5X forward earnings multiple (F1), below its respective Zacks industry average and the 11.5X five-year median. And like POST, Urban Outfitters is forecasted to see a sizable growth recovery in its current year, with the $3.18 Zacks Consensus EPS Estimate suggesting an 80% jump in earnings year-over-year.

Bottom Line

Value investors always seek out deals, expecting others to eventually catch onto the discounts.

When you pair this strategy with the Zacks Rank, which is focused on earnings estimate revisions, it’s much easier to find mispriced stocks with great near-term potential.

And all three top-ranked stocks above – Oshkosh, Post Holdings, and Urban Outfitters – could be considerations for those with a value-conscious approach.

More By This Author:

Bull of the Day: Palo Alto NetworksLululemon Reports Next Week: Wall Street Expects Earnings Growth

Airline Stock Roundup: American Airlines' Bearish Q3 Cost View, Allegiant's July Traffic Report

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more