3 Buy-Rated Stocks Fit For Value Investors

Image: Bigstock

Value investing is centered around jumping on stocks trading at a discount, with the idea that the market will eventually ‘catch up’ and recognize their true value, which can lead to serious gains. After all, we all enjoy a good deal. And this strategy can become even more lucrative when adding in the Zacks Rank, allowing us to find stocks that analysts have recently become optimistic about.

Three top-ranked stocks that have been trading at enticing valuation levels – JD.com (JD - Free Report), KB Home (KBH - Free Report), and AllianceBernstein (AB - Free Report) – may all be considerations for one's portfolio. Here is a closer look at each.

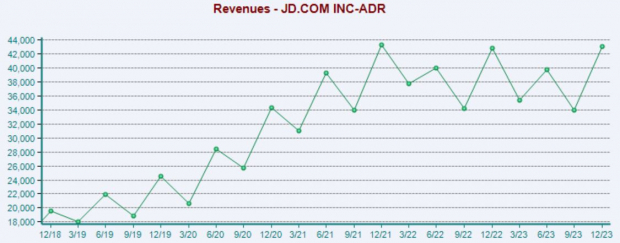

JD.com

JD.com operates as an online direct sales company in China. The stock sports the highly-coveted Zacks Rank #1 (Strong Buy), with earnings expectations drifting higher across multiple timeframes.

Shares have recently been seen trading at a 7.8X forward 12-month earnings multiple, a fraction of the 39.0X five-year median and the five-year high of 84.9X. The forward 12-month price-to-sales ratio resides at 0.3X, which is nicely beneath the 0.5X five-year median.

The company’s quarterly consistency is worthy of highlighting, beating the Zacks Consensus EPS estimate in each of its last ten releases. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

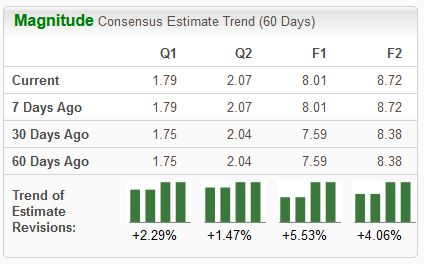

KB Home

KB Home is a well-known homebuilder in the United States. Analysts have become bullish across the board, raising their earnings expectations and pushing the stock into a Zacks Rank #1 (Strong Buy) rating.

Image Source: Zacks Investment Research

Shares have recently traded at a 7.3X forward 12-month earnings multiple, a few ticks beneath the five-year median and the high of 12.5X in 2020. The forward 12-month price-to-sales ratio presently stands at 0.6X, which is beneath the five-year high of 0.8X.

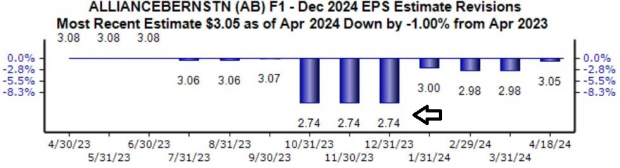

AllianceBernstein

AllianceBernstein, a current Zacks Rank #2 (Buy) stock, provides diversified investment management services, primarily to pension funds, endowments, foreign financial institutions, and individual investors.

The revisions trend for its current fiscal year has shifted notably positive since the beginning of 2024, with the $3.05 Zacks Consensus EPS estimate suggesting 14% year-over-year growth.

Image Source: Zacks Investment Research

Shares have recently traded at a 10.2X forward 12-month earnings multiple, nicely beneath the 11.5X five-year median and the high of 16.3X in 2022. The forward 12-month price-to-sales ratio stands at 1.0X, which is in line with the five-year median and beneath the high of 1.5X in 2021.

Bottom Line

Value investors are always looking for deals, expecting the rest of the crowd to eventually catch onto the discounts, leading to significant gains. And when you pair this strategy with the Zacks Rank, which is focused on earnings estimate revisions, it’s much easier to find mis-priced stocks with great near-term potential.

All three stocks discussed above – JD.com (JD - Free Report), KB Home (KBH - Free Report), and AllianceBernstein (AB - Free Report) – could entice value-focused investors, further underpinned by their Style Scores of ‘A’ and 'B' for Value.

More By This Author:

This Combination Of 3 Stocks Provides Monthly Income3 Quarterly Releases To Watch Next Week

Bear Of The Day: Boeing