3 Buy Rated Finance Stocks Flashing Relative Strength: HRTG, ERIE, EZPW

Image Source: Pixabay

Relative strength focuses on stocks that have performed well compared to a relevant benchmark. For our purposes, the S&P 500 will be the benchmark.

By targeting those displaying this favorable price action, investors can participate in positive market trends where buyers are in control. Recently, several top-ranked finance stocks have shown precisely that.

Heritage Insurance (HRTG - Free Report), EZCORP (EZPW - Free Report), and Erie Indemnity (ERIE - Free Report) have all enjoyed positive price action over the last month, as illustrated below. But what’s driving the outperformance? Let’s take a closer look.

Image Source: Zacks Investment Research

Heritage Insurance Reports Robust Growth

Heritage Insurance is a property and casualty insurance holding company that provides personal residential insurance for single-family homeowners and condominium owners through its subsidiary.

It recently posted quarterly results that easily exceeded expectations, penciling in a 60% EPS beat. Big growth was delivered, with EPS improving 90% year-over-year alongside a 10% sales increase. The stock now sports a favorable Zacks Rank #1 (Strong Buy), with earnings expectations melting higher following the release.

Image Source: Zacks Investment Research

The company enjoyed a favorable quarter, with gross premiums earned climbing 6% year-over-year alongside a notable improvement (55.7% compared to 60.3% prior) in its net loss ratio. Simply put, the company has continued to build its top line while also reducing the amount lost from claims.

Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

Ernie Garateix, CEO, said, ‘This is an opportune time to accelerate growth given the disruption in many of our markets that is opening up significant market share, combined with the positive impact of Florida legislative changes and a stabilized reinsurance market where we continue to receive support from our partners.’

Current valuation multiples reflect the future growth acceleration expected, with the company’s current 1.3X price-to-book ratio above the 0.7X five-year median.

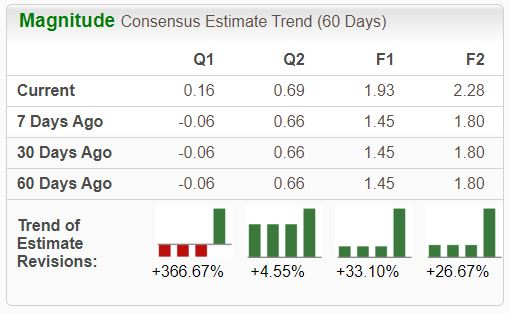

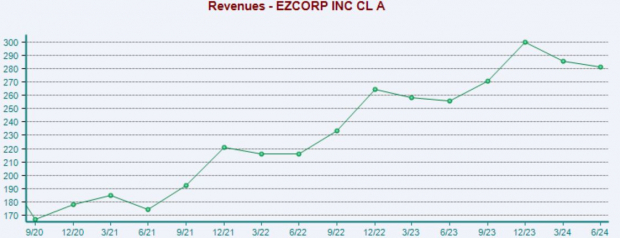

EZCORP Enjoys Consumer Tailwinds

EZCORP establishes, acquires, and operates pawnshops that function as convenient consumer credit sources and value-oriented specialty retailers of previously owned merchandise. The stock is a current Zacks Rank #1 (Strong Buy), with the revisions trend for its current fiscal year highly bullish.

Image Source: Zacks Investment Research

Like HRTG, the company recently enjoyed a strong quarter, posting record Q3 sales and its highest level of pawn loans outstanding (PLO) in its history. A challenging environment for consumers has provided tailwinds, such as a higher interest in short-term cash solutions and an increased focus on high-quality pre-owned goods.

Image Source: Zacks Investment Research

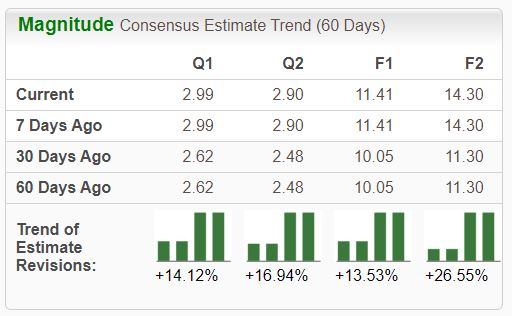

Erie Indemnity Pays Investors Nicely

Erie Indemnity, a current Zacks Rank #1 (Strong Buy), issues, renews, and underwrites insurance products for personal liability, property, boat, recreational vehicles, home, flood, and auto. The company’s earnings outlook is notably bullish across all timeframes.

Image Source: Zacks Investment Research

Income-focused investors could find ERIE shares attractive, with the company currently sporting a shareholder-friendly 7.4% five-year annualized dividend growth rate paired with a sustainable payout ratio sitting at 50% of its earnings.

While the current 1.1% annual yield is on the lower end relative to the Zacks Finance sector, the dividend growth helps bridge the gap nicely.

Image Source: Zacks Investment Research

Shares got a nice boost following its latest set of quarterly results, with the company posting 40% earnings growth on 18% higher sales. Earnings results have regularly exceeded our expectations, with the company beating the Zacks Consensus EPS estimate by an average of 12% across its last four releases.

Bottom Line

Several stocks have enjoyed market-beating price action over the last month, including Heritage Insurance, EZCORP, and Erie Indemnity.

All three sport a favorable Zacks Rank and are coming off recent positive quarterly results, undoubtedly a strong pairing.

For those seeking to ride relative strength, all three deserve serious consideration.

More By This Author:

2 Companies Actually Benefiting From AI: Palantir, Meta Platforms3 Companies Unlocking Higher Profits: DECK, KMB, SKX

3 Stocks To Watch Following Guidance Upgrades: LMT, NOC, CRH