3 Buy-Rated Construction Stocks With Bright Outlooks

Image: Bigstock

Targeting areas of the market that are seeing favorable earnings estimate revisions is an excellent way for investors to insert themselves in favorable trends. That’s precisely what construction stocks have witnessed, helping push the Zacks Construction sector into the #1 spot out of all 16 Zacks sectors. In fact, it’s widely outperformed the S&P 500’s 9% gain over the last three months, gaining 17%.

Three stocks from the Zacks Construction Sector – KB Home (KBH - Free Report), Sherwin-Williams (SHW - Free Report), and Comfort Systems USA (FIX - Free Report) – could all be considerations for those looking to tap into the relative strength. Let’s take a closer look at each.

KB Home

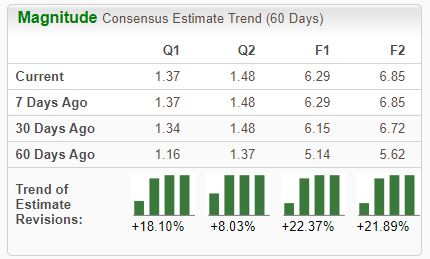

KB Home, a Zacks Rank #1 (Strong Buy), is one of the largest homebuilders in the United States, operating in 47 markets from coast to coast. The company’s outlook has shifted favorably across all timeframes.

Image Source: Zacks Investment Research

The company’s growth is forecasted to cool in its current year, with our estimates suggesting a 30% pullback in earnings on 11% lower revenues. Still, growth looks set to resume in FY24, as expectations allude to a 9% recovery in earnings paired with an 8% revenue bump.

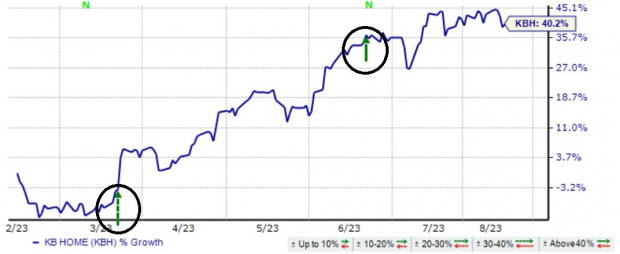

Robust quarterly results have helped boost shares post-earnings in back-to-back releases, as shown in the chart below. In fact, the company has exceeded the Zacks Consensus EPS Estimate by an average of 20% across its last four quarters.

Image Source: Zacks Investment Research

Sherwin-Williams

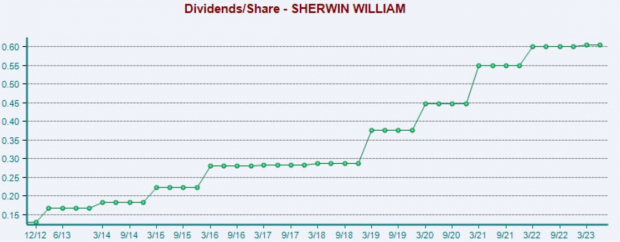

Sherwin-Williams, a Zacks Rank #1 (Strong Buy), manufactures paints, coatings, and other related products. The company’s earnings outlook has shifted higher across the board, reflecting the near-term optimism among analysts.

The company has consistently displayed a shareholder-friendly nature, boasting a sizable 17% five-year annualized dividend growth rate. Shares currently yield 0.89% annually, a few ticks below the Zacks Construction sector average.

Image Source: Zacks Investment Research

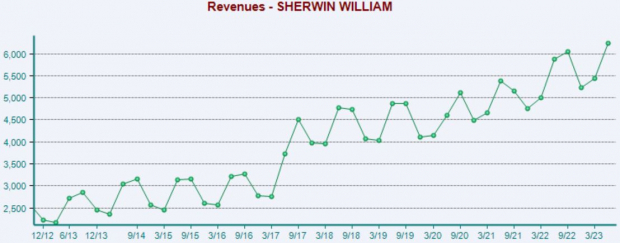

In addition, SHW continues to fire on all cylinders; quarterly revenue of $6.2 billion in 2023 Q2 reflected a quarterly record, improving 6% from the year-ago period. Adjusted earnings of $3.29 grew 36% year-over-year, with the company topping off the robust results with a FY23 guidance upgrade.

Image Source: Zacks Investment Research

Comfort Systems USA

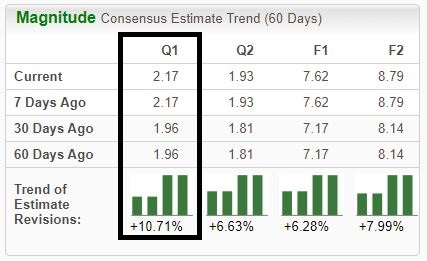

Comfort Systems USA, a current Zacks Rank #1 (Strong Buy), is a national provider of comprehensive heating, ventilation, and air conditioning installation, maintenance, repair, and replacement services. Like the stocks above, analysts have become bullish on the company’s outlook, with the trend particularly notable for its next quarterly release.

Image Source: Zacks Investment Research

It’s hard to ignore the company’s growth trajectory, with Zacks estimates suggesting 44% earnings growth in its current year on 21% higher revenues. The growth is slated to continue, as expectations for FY24 allude to year-over-year earnings and revenue growth rates of 15% and 6%, respectively.

Shares trade at a 23.2X forward earnings multiple (F1), above the 18.8X five-year median by a fair margin but below highs of 25.5X in 2022. Investors have had little issue forking up the modest premium for shares given the company’s favorable outlook, with FIX shares up more than 50% on a year-to-date basis.

Image Source: Zacks Investment Research

Something To Watch

While Home Depot (HD - Free Report) isn’t a part of the Zacks Construction sector, it’s worth mentioning that the home improvement retailer is scheduled to report quarterly results next week on Aug. 15. HD shares haven’t fared great in 2023, lagging behind the general market and likely reflecting the deceleration in home improvement projects post-pandemic.

Analysts have kept their expectations muted for Home Depot’s release, with the $4.46 Zacks Consensus EPS Estimate remaining unchanged over the last 60 days, reflecting a 12% pullback in earnings year-over-year.

In addition, Home Depot is forecasted to bring in $42.2 billion per the Zacks Consensus Estimate, reflecting a modest pullback of 3.5% from the year-ago quarter. The company posted somewhat mixed results in its latest release. Still, the market reacted highly positively to the print, causing HD shares to embark on a fresh uptrend post-earnings.

More By This Author:

3 Glenmede Funds To Buy For Impressive ReturnsBear of the Day: Pool Corp

Bull of the Day: Shift4 Payments

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more