3 Blue-Chip Stocks With Rock-Solid Dividends

Image: Bigstock

Investing in blue-chip stocks is a stellar strategy. Blue-chip stocks are companies that have consistently provided quality, reliability, and the ability to operate profitably in both good and bad times. Additionally, they generally carry robust dividend metrics – another major perk for investors.

Three companies that fit the parameters – Pfizer (PFE - Free Report), Caterpillar (CAT - Free Report), and Johnson & Johnson (JNJ - Free Report) – would all be excellent selections for investors seeking a stream of income paired with solid growth prospects.

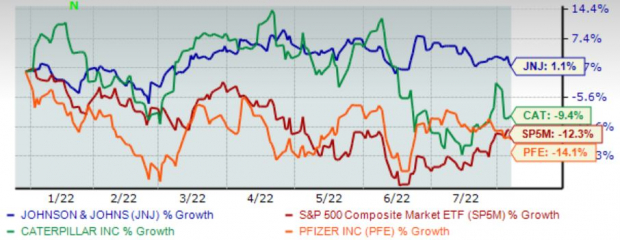

The chart below illustrates the year-to-date performance of all three companies while blending in the S&P 500 as a benchmark.

Image Source: Zacks Investment Research

Let’s take a look at each company a little closer.

Caterpillar (CAT - Free Report)

Caterpillar is the world’s largest construction-equipment manufacturer. The company designs, develops, engineers, manufactures, markets, and sells machinery, engines, financial products, and insurance to customers. The company is a Zacks Rank #3 (Hold) with an overall VGM Score of an A.

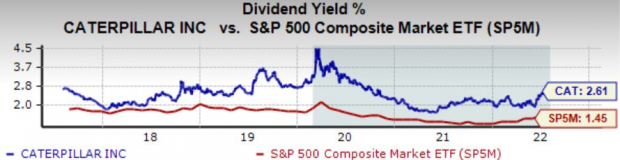

CAT has increased its dividend in 28 consecutive years, meeting the demanding requirements to join the elite Dividend Aristocrat group. The company’s annual dividend yields 2.6%, with a payout ratio sitting sustainably at 41% of earnings. Additionally, the company has a notable 8.9% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

As it stands, CAT is projected to register substantial growth. For the current fiscal year (FY22), the Zacks Consensus EPS Estimate resides at $12.70, reflecting a stellar 18% year-over-year uptick.

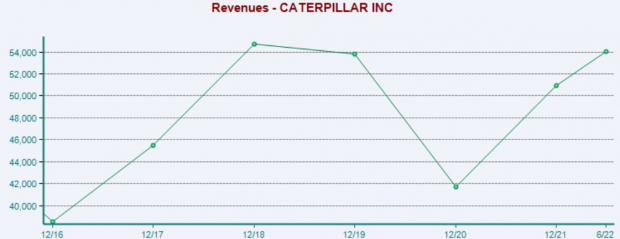

Image Source: Zacks Investment Research

The growth doesn’t stop there – CAT is forecasted to generate a mighty $57.5 billion in revenue in FY22, good enough for a double-digit 13% uptick from FY21 annual sales of $50.9 billion.

Image Source: Zacks Investment Research

Johnson & Johnson (JNJ - Free Report)

Johnson & Johnson is an American multinational corporation that develops medical devices, pharmaceuticals, and consumer packaged goods. The company is a Zacks Rank #4 (Sell) with an overall VGM Score of an A.

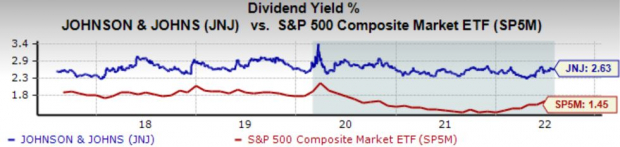

JNJ has increased its dividend for 60 consecutive years, making it not just a Dividend Aristocrat but a Dividend King as well – Dividend Kings have raised dividends for at least 50 straight years.

The company’s annual dividend yields 2.6%, with a payout ratio sitting sustainably at 45% of earnings. Additionally, the company has a five-year annualized dividend growth rate of a notable 6%. Johnson & Johnson’s yield is much higher than the S&P 500’s.

Image Source: Zacks Investment Research

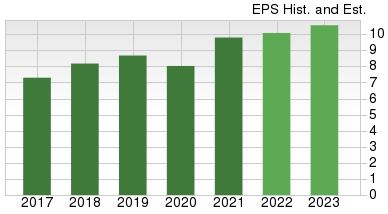

Of course, the titan is forecasted to grow at a solid pace – for the current fiscal year (FY22), earnings are expected to climb a respectable 3%.

Image Source: Zacks Investment Research

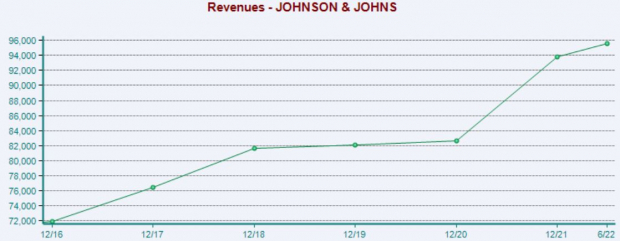

Pivoting to top-line projections, the annual revenue estimate of $95 billion for FY22 pencils in a modest 1.5% year-over-year uptick. The chart below illustrates the company’s revenue on an annual basis.

Image Source: Zacks Investment Research

Pfizer (PFE - Free Report)

Pfizer is a multinational pharmaceutical and biotechnology corporation headquartered in New York City, well-known for its COVID-19 vaccine. The company is a Zacks Rank #3 (Hold) with an overall VGM Score of an A.

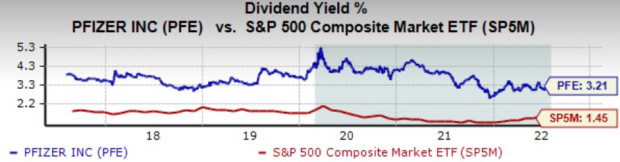

Pfizer’s annual dividend yield sits enticingly at 3.2%, well above that of the S&P 500. In addition, the company’s payout ratio sits very sustainably at 26% of earnings, with an annualized five-year dividend growth rate of 4.7%.

Image Source: Zacks Investment Research

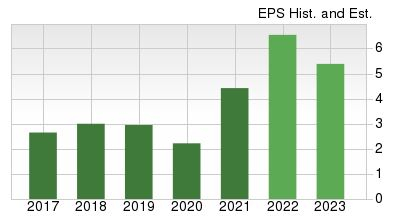

The company has stellar growth projections. For the current fiscal year (FY22), the Zacks Consensus EPS Estimate resides at $6.54, reflecting a sizable 48% double-digit year-over-year uptick.

Image Source: Zacks Investment Research

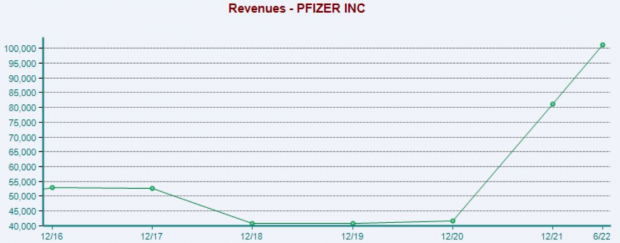

Top-line projections are rock-solid as well – PFE is forecasted to rake in $101.3 billion in revenue in FY22, a 25% year-over-year jump compared to FY21 annual sales of $81.5 billion. The chart below illustrates the company’s revenue on an annual basis.

Image Source: Zacks Investment Research

Bottom Line

In addition to solid dividend payouts and consistent growth, blue-chip stocks are typically less volatile as well, another major perk for investors. All three companies above had solidified themselves as titans in their respective industries. In addition, all three companies have repeatedly reported quarterly results above expectations, and current fiscal year growth is inspiring.

For investors looking to add an additional layer of defense into their portfolio paired with solid growth and handsome dividend payouts, Caterpillar, Johnson & Johnson, and Pfizer would all fit those parameters.

More By This Author:

Alibaba Q1 Earnings Beat Estimates, Revenues Fall Y/YAirline Stock Roundup: Ryanair's Solid July Traffic, Copa's Q2 Earnings Beat & More

Best Growth Stocks to Buy for August 5th, 2022

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more