3 Big Revenue Beats You Might Have Missed

We all know about Amazon’s (Nasdaq:AMZN) rip-roaring earnings success. And if you wish you can see what top analysts have to say about it here but which other stocks deserve a slice of the limelight? Using TipRanks’ nifty Trending Stocks tool we pinpointed three best-rated stocks that are buzzing right now. These three stocks all have one thing in common: big revenue beats and big support from the Street.

TipRanks’ tracks and ranks over 4,700 Wall Street analysts. The result, as you will see below, is that we can dive into analysis of these three stocks from the Street’s top-performing analysts.

So let’s take a closer look now and why they find these 3 trending stocks so compelling:

Trending Stock #1: Merit Medical Systems

Merit (Nasdaq:MMSI), a booming medical device maker specializes in cardiology and radiology, manufacturing everything from therapeutic catheters to diagnostic systems. MMSI has just delivered results revealing significant revenue upside. Overall revenue increased a very strong 18.7% and was up 15.7% on a constant currency basis.

“We are maintaining our OUTPERFORM investment rating on Merit Medical shares given the company’s reaffirmation of its previous financial guidance as well as the high level of operational execution that we believe will continue to be demonstrated for at least the next few years” writes top Barrington Research analyst Michael Petusky on April 26.

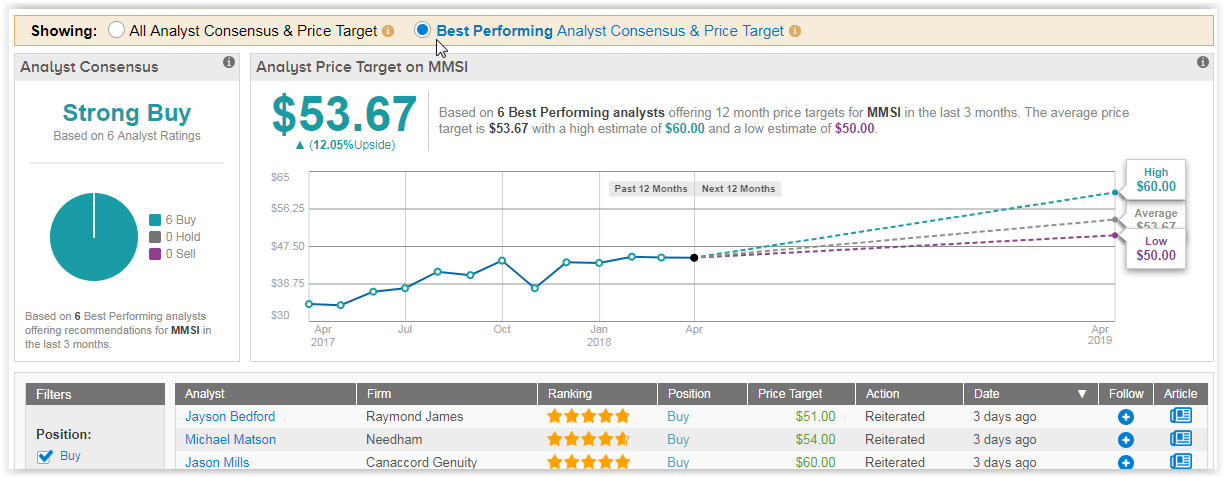

Specifically, the company announced revenue of $203.0M (7.1% Y/Y organic), vs consensus of $192.6M. Meanwhile adjusted EPS came in at $0.31 easily beating consensus of $0.29. And, as we can see from the screenshot below, this stock has 100% buy ratings from the Street. With an average analyst price target of $54, these analysts are modelling for 12% upside from current levels.

Trending Stock 2#: Western Digital

Data giant Western Digital (Nasdaq:WDC) is a key player in the multi-billion-dollar memory industry. Shares in WDC rose 3% on April 26 on better-than-expected profit and revenue. WDC delivered March-quarter revenue/EPS of $5.0B/$3.63 smoothly sailing past the expected $4.93B/$3.31.

Top Susquehanna analyst Mehdi Hosseini sees massive upside potential for WDC of 85%. He points out that consensus keeps moving higher, “but stock still asleep; can’t hit snooze forever.” Shares can reach $150 from the current $81 price says Hosseini and pushes up his full year revenue estimate to $20.6 billion from $20.5 billion previously.

“WDC continues to benefit from insatiable cloud demand for high-cap Nearline drives, but while this may spill over into 2HCY18, the key story to watch will be whether a tighter NAND [flash memory] supply environment unfolds in 2HCY18 – a notion that we have been supporting for the past several months, and that WDC acknowledged could become a reality” opines Hosseini.

Even though he is more bullish than consensus, we can see that the average analyst price target for WDC still indicates 47% upside potential. You can click on the screenshot below for further insights into the individual ratings.

Trending Stock #3: Atricure

Closing our trending stocks list we have “Strong Buy” stock Atricure (Nasdaq:ATRC). This is a company that provides atrial fibrillation solutions to medical centers in the US and internationally. Top 25 Canaccord Genuity analyst Jason Mills can’t stop singing its praises. Even after stellar earnings, he believes there is still time to jump into the ATRC story:

“It is far from too late to accumulate shares of ATRC; indeed, we see a 3-year “golden era” for the company during which revenue growth could accelerate to mid-teens, GM could expand to the 75%+ range and the firm generates positive cash flow.”

He continues: “Coming out of a strong print to begin 2018, we increase our estimates, even more bullish about near-term trends in its core businesses – A-Fib ablation (open & MIS) and appendage management (LAAC) – within which there are few, if any, viable competitors, let alone a long runway to drive adoption of its proprietary technologies in these large, under-penetrated markets.”

As a result, Mills is now looking for prices to spike 21% to hit his $27 price target. This is just above the average analyst price target of $25. Note that this analyst tends to get it right when it comes to his Atricure recommendations:

For the quarter, ATRC revenue came in at $47 million. This is up 13.8% from the same period last year, and smashed the consensus estimate of $45.4 million. Going forward, management reiterated 2018 guidance for total revenue of $190-196M (+9-12%).

Disclaimer: TipRanks is an independent cloud based service that measures and ranks digitally published financial advice. TipRanks' natural language processing (NLP) algorithms aggregate and ...

more