2020 Value Stocks List: Lowest P/E Stocks (+The Top 3 Value Stocks Now)

Value investing is a broad term, and can mean different things to different investors. Value investors typically look for cheap stocks, although there is no single definition of what constitutes a cheap stock. Generally, value investors look for stocks that are trading below intrinsic value. This is the basic philosophy adhered to by Warren Buffett, arguably the greatest value investor of all time.

Value stocks are often classified by low valuation ratios. While there are many ways to value stocks, the most common valuation metric is the price-to-earnings ratio, otherwise referred to as the P/E ratio. Broadly speaking, value investors typically look for stocks with low P/E ratios.

For this article, value stocks are defined as the 100 stocks in the Russell 2000 with the lowest forward price-to-earnings ratios. With this in mind, we compiled a list of these 100 value stocks.

Breaking Down The P/E Ratio

The price-to-earnings ratio, or P/E ratio, is perhaps the most frequently-utilized valuation metric for stock investors. The P/E ratio essentially values stocks based on a multiple of the company’s earnings-per-share. It is calculated by dividing the stock price by the company’s earnings-per-share. The earnings-per-share of a company represents its net income on a per-share basis. This can be found on a company’s income statement.

P/E ratios can either be calculated on a trailing basis (by using the company’s trailing 12-month EPS) or on a forward basis (by using the company’s expected EPS over the next 12 months). The advantage of the trailing multiple is that it uses verifiable EPS results instead of a projection which may or may not materialize, while the forward P/E ratio allows investors to look ahead, which many investors believe is more predictive.

Consider a stock that has a current share price of $100, and earnings-per-share of $5.00. In this case, the stock has a P/E ratio of 20 on a trailing basis. There are only two reasons why the stock price would rise above $100. Either the company grows its earnings-per-share, or the P/E ratio expands above 20.

For example, if EPS increases to $6.00 in the following year, the same P/E ratio of 20 would result in a share price of $120, for a 20% gain. The stock price could still rise to $120 (or higher) without the underlying EPS growth, but the P/E ratio would rise as a result. To that end, if EPS remain flat at $5.00 and the share price rises to $120, the P/E ratio would expand to 24.

Consequently, when it comes to movement in share prices, returns are generated for investors either through earnings-per-share growth, or a rising P/E ratio. In our view, the best investments are stocks that deliver a combination of growing EPS, an expanding P/E ratio, and dividends to boot.

A Real-Life Example

To illustrate, consider the case of Dividend Aristocrat AbbVie Inc. (ABBV), which we believe to be an undervalued stock. In 2019, AbbVie reported adjusted earnings-per-share of $8.94, an increase of 13% from 2018. For 2020, AbbVie expects adjusted earnings-per-share in a range of $9.61 to $9.71. At the midpoint of guidance, AbbVie’s EPS is expected to increase 8% in 2020, to $9.66.

Using $9.66 as the forward EPS estimate, and a recent share price of $86.50, AbbVie stock is trading for a forward price-to-earnings ratio of approximately 9.0. We see this as too low for a company of AbbVie’s quality. AbbVie is a highly profitable pharmaceutical giant that continues to grow adjusted EPS at a high rate. In our view, a P/E ratio of 11.5 is a reasonable estimate of fair value for AbbVie stock.

This matters a great deal, because investors can earn sizable returns by buying undervalued stocks. In the AbbVie example, shareholder returns could be boosted by approximately 5% each year over the next five years if the P/E multiple expands from 9 to 11.5 by 2025.

Returns would be further boosted by AbbVie’s future earnings growth (estimated at 5.5% per year), as well as its high dividend yield of 5.5%. Adding it all up, and we believe AbbVie stock is capable of generating total returns of 16% per year over the next five years.

You can find additional information regarding our assessment of AbbVie stock in this recent article.

Therefore, it is clear that investors can benefit greatly if a stock price increases, due to a rising P/E multiple. After all, a stock price at any given moment is a function of its earnings-per-share, and the valuation multiple that is applied to those earnings.

The Top 3 Value Stocks Today

The following list represents our top 3 stock picks from the Value Stocks spreadsheet. The stocks on the list represent the 100 lowest forward P/E stocks in the Russell 2000.

We believe these 3 stocks offer the highest total return potential over the next five years, due to a combination of a rising valuation multiple, future earnings growth, and dividends. Stock picks are ranked by 5-year expected annual return, in order of lowest to highest.

Value Stock #3: Cleveland Cliffs (CLF)

Founded in 1847, Cleveland Cliffs Inc. is the largest and oldest iron ore mining company in the United States. It supplies iron ore pellets to the North American steel industry, from its mines and pellet plants in Michigan and Minnesota.

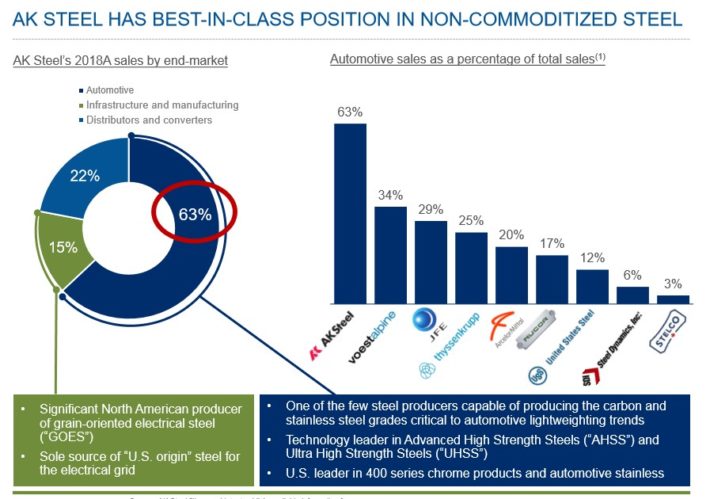

In December 2019, Cleveland Cliffs announced it will acquire AK Steel in a $3 billion all-stock transaction. The deal boosts Cleveland Cliffs’ steel production exposure, and integrates downstream activities such as carbon automotive, stainless and electrical. Cleveland Cliffs expects to have a pro-forma debt to adjusted EBITDA ratio of 3.5x. The company also expects annual cost synergies of approximately $120 million, with the acquisition being accretive in 2020.

The combination will create a company with total revenue above $8 billion. Strategically, Cleveland Cliffs management was attracted to AK Steel’s non-commoditized steel business.

Source: Investor Presentation

Cleveland Cliffs could use the boost. Revenue declined 23% in the most recent quarter, and 13% for 2019, mostly due to lower sales volumes. Therefore, the AK Steel acquisition is the company’s attempt to rejuvenate growth in 2020 and beyond.

In the meantime, the stock looks cheap, with a forward P/E ratio of 5.3; while it is not unusual for commodity businesses to have lower valuation multiples, due to the cyclical business model, Cleveland Cliffs could deserve a higher valuation. The company remains profitable, and pays a hefty dividend yield of 4.3%.

Of course, dividends are never guaranteed when it comes to cyclical commodity producers. The company generated diluted earnings-per-share from continuing operations of $1.04 in 2019, a steep drop from $3.42 per share in 2018. As a result, the annual dividend payout of $1.05 per share is not fully covered, although a recovery in EPS could be in store for 2020.

Given the volatile nature of the company’s operating results, a P/E ratio of 6x seems prudent. Still, the stock appears undervalued. Total returns could reach 8%-9% per year over the next five years, from valuation expansion, expected EPS growth of 1%-2% per year, and the 4.3% dividend yield.

Value Stock #2: Hawaiian Holdings (HA)

Hawaiian Holdings began as a modest three-aircraft operation back in 1929. Since then it has grown to become Hawaii’s largest air carrier, flying about 12 million passengers annually. The company’s annual revenue now approaches $3 billion and trades with a $1 billion market capitalization.

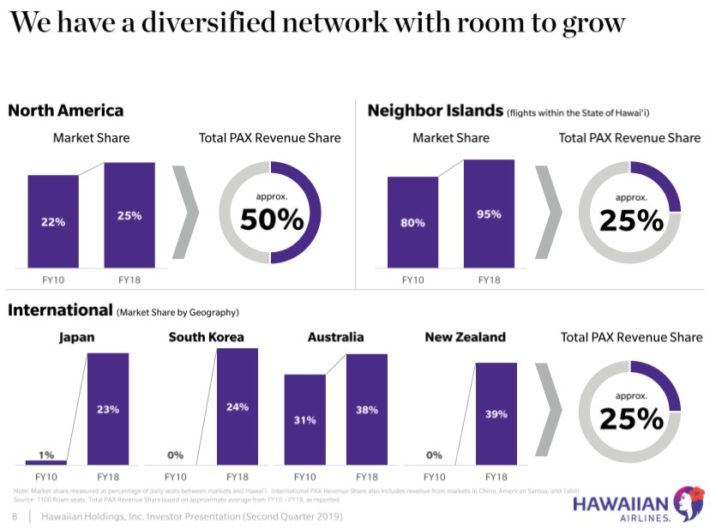

Over the past decade, the company has greatly expanded its market share, across multiple geographies.

Source: Investor Presentation

Hawaiian Holdings reported mixed results for 2019. Passenger revenue for the year declined fractionally, as did other revenue, meaning full-year total revenue was essentially even with 2018 at $2.8 billion. Revenue passengers flown, which is a measure of traffic, declined -0.8% to 11.7 million.

Revenue passenger miles increased 3.5%, however, and available seat miles rose only 2%, so the company’s load factor improved to a very impressive 86.6%, up from 85.3% in 2018. Finally, passenger revenue per available seat mile declined -2.2% to 12.63 cents in 2019.

Collectively, Hawaiian continues to fill seats at an industry-leading rate, but its pricing power for those seats is declining. The company continues to see wage pressure, with wages and benefits expense up nearly 6%. One positive note was that 2019 saw a respite from soaring fuel prices, and the company saw that line item decline nearly -10%, offsetting the increase in personnel costs. In total, operating income increased 4.2% year-over-year to $327 million.

Earnings-per-share came in at $4.60 for the year, down significantly from 2018’s $5.44, which contained some noncomparable items. We are forecasting more pain for this year as our initial estimate is $3.80. We see continued traffic concerns from coronavirus, as well as Southwest’s continued penetration into Hawaiian’s home market.

Hawaiian Holdings stock has a forward P/E ratio of 4.9. Market sentiment has deteriorated for stocks in the travel and leisure industries, due to fears of the coronavirus. Our fair value estimate is a P/E ratio of 7.5, meaning valuation expansion could increase annual returns by 8.9% per year over the next five years. We also expect 3.5% annual EPS growth, while the stock has a 2.2% dividend yield.

In all, we expect total annual returns of approximately 14.6% per year over the next five years for Hawaiian Holdings stock.

Value Stock #1: B&G Foods (BGS)

B&G Foods, Inc. is a consumer staples company with operations in the U.S., Canada and Puerto Rico. Some of the company’s well-known brands include Green Giant, Cream of Wheat, Cary’s, Ortega, Don Pepino, Mrs. Dash and Maple Grove Farms. The company has acquired 29 brands since 1997 greatly expanding its portfolio. The company’s product portfolio focuses on shelf-stable, frozen and snack brands. B&G Foods has a market capitalization of $1 billion.

B&G Foods recently reported fourth-quarter and full year 2019 financial results. Net sales increased 2.6% to $470 million for the fourth quarter. The increase was due primarily to the recent acquisition of Clabber Girl baking products, partially offset by the divestiture of Pirate Brands. However, adjusted earnings-per-share declined 18% year-over-year, primarily due to increasing interest expense.

Full-year results told a similar story. Net sales declined 2.4% for the full year, while adjusted earnings-per-share declined 11%. B&G Foods is an attractive value and income stock, as it has a forward P/E ratio of 13.4 and a very high dividend yield of 13.3%. Of course, investors should always take double-digit dividend yields as a sign of caution. In many cases, extremely high yields are a warning that the dividend is unsustainable.

Indeed, B&G has an expected dividend payout ratio above 100% for 2020, meaning the company is set to distribute more in dividends than it will generate in underlying earnings-per-share. This is a red flag, as no company can maintain a dividend payout ratio above 100% forever. Either the company’s earnings-per-share need to grow enough to cover the dividend, or the dividend will be reduced.

Companies can raise external capital to fund dividends, such as selling stock or issuing debt. But B&G already has a high level of debt, due largely to its acquisition spree over the past several years. And, equity raises are unlikely with the stock price down more than 70% from its five-year high.

B&G could generate strong returns if its turnaround efforts are successful, and the company manages to maintain its hefty dividend. But the uncertain outlook for B&G’s future growth and its dividend are reasons for risk-averse investors to avoid B&G stock.

Final Thoughts

Value investing is all about buying stocks when they are undervalued. But just because a stock has a low P/E ratio, does not automatically make it a buy. Investors still need to perform fundamental analysis to determine the company’s business outlook. Sometimes, stocks appear cheap on the surface because they have low P/E ratios, but amount to value traps as the business model is deteriorating.

In addition to low P/E ratios, the 10 stocks on this list also have positive future growth potential, and in many cases pay dividends to shareholders. We expect high total returns from these 10 stocks over the next five years.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more