2017 Will Be Like 2016

The optimism about earnings and the economy heading into this year is higher than last year even though the Fed is more cautious. The Fed expected 2.4% growth in 2016. This likely won’t be met looking at the numbers which have come in so far. For 2017 the expectation is for 2.1% growth. There isn’t much variability in the Fed’s forecasts as it has unemployment staying low and inflation only increasing moderately. The Fed forecasts what it wants to happen, not what it thinks will happen. It’s impossible for recessions to have been eliminated. It’s the same for most financial professionals because being bearish isn’t good for sales. This exact setup is what causes crashes as everyone liquidates at the same time because they were all too bullish.

I can’t be too critical of the bulls because they were correct this year, for the most part. Bulls were correct on stocks. Stocks outperformed gold even though it didn’t look like they would after the big rally in gold in the beginning of the year. I’d say the economy was a wash between the bears and the bulls because GDP growth missed expectations, but it didn’t nose dive into a recession. The bears were correct on Fed policy because the Fed only raised rates once compared to the mainstream consensus estimate for 4 rate hikes. This didn’t translate into an investible thesis, however, unless you directly bet on them. The bears were also correct on the political landscape as populism won across the globe because voters were disaffected by the weak economy. This didn’t translate into the volatility the bears hoped for.

The reason I am reviewing 2016 is because I see 2017 shaping up as a similar year. GDP growth looks like it will choppy yet again. I expect the Fed to go through the same motions it did last year as it will take any excuse it can find to not raise rates as much as its guidance implies. The big difference between 2017 and 2016 is that the negative catalyst that was the rate hike last December won’t cause another selloff this winter. This is because the market is pinning its hopes on Trump. George W. Bush attempted similar economic policies and it didn’t lead to a roaring stock market, but the market is ignoring history and living on hype.

I feel expectations have gotten out of hand. Since when has the government come through with capitalistic economic growth measures in the past few decades? I have learned not to trust politicians to deliver on their promises. It’s tough to say when the hype will fade because there’s not one specific piece of legislation that will determine whether growth will occur. Personally, I’m focused on healthcare legislation with regards to how Obamacare is replaced and the infrastructure plan.

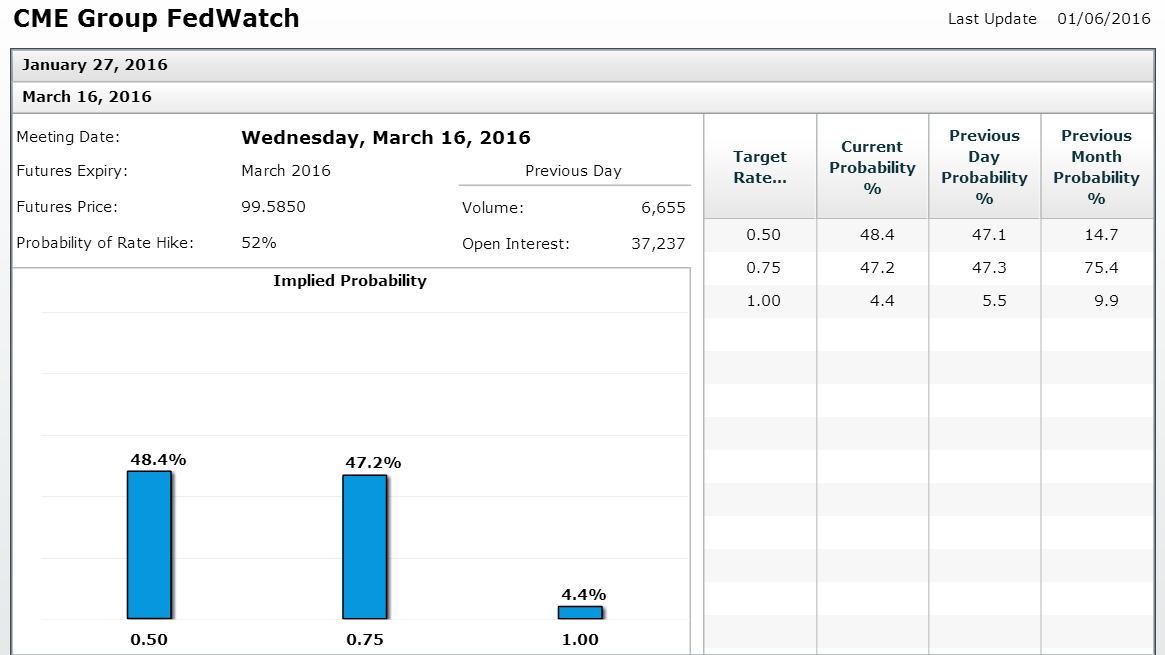

The screenshot below was taken on January 6th, 2016. It shows you why I’m having a case of déjà vu. The March meeting was expected to see rates increase to 75 basis points. This rate hike is the one we ended up getting in December. The big reason for the delay was the market crash that happened in January and February.

As we look at the expectations for the March 2017 meeting, you can see that there aren’t expectations for a hike. It’s funny how the Fed is supposed to be so hawkish, yet the market isn’t expecting a hike in the first two meetings. The market crash last winter seems to have reverberated into the expectations for this year’s meetings. The point I am making is the Fed is less hawkish at the beginning of this year than it was last year which is quite something because we only ended up with one hike this year.

The déjà vu also applies to the rates because the expectations for last year and this year are almost the same as both are expecting rates to be 75 basis points. As I have mentioned several times in past articles, I am not on the band wagon for the 3 hikes in 2017. At this time last year, I was expecting the Fed to cut once in 2016. This dovish expectation ended up bearing fruit although I was clearly not 100% accurate.

Because the I think market volatility will stem from fiscal policy disappointments, this will be the catalyst to push back the expected three rate hikes. As I said, the reason for not raising rates in the beginning of year is the Fed is afraid of spooking the market like it did last year. At this point we will be in the spring with no rate hikes. That means the three rate hikes would have to come in short order. If the Fed is waiting for fiscal policy to lead it before it hikes rates, it will be waiting awhile because the government generally works slow when there’s no emergency. Trump also differs with the Republicans on many policies which means debates will take place before policy is decided. There are questions if the Fed should act before any policies are enacted. This argument will only be strengthened enough to be a factor if inflation increases in the beginning of the year.

Instead of being a catalyst to raise rates, fiscal policy will be a catalyst for rate hikes to be delayed. You would think any policy which promotes economic growth would be a positive, but that’s not the case when the market is pricing in big announcements. If the Fed was data dependent, it would determine how effective these policies will be based on historical data and act in coordination with those expectations. However, the Fed is dependent on the market, so even if the policies lead to growth beating its 2.1% forecast, if the market is disappointed with the policies, the Fed will back off from rate hikes to calm the volatility.

Conclusion

In terms of Fed policy and economic growth in 2017, I expect the same situation as last year. The Fed will push off hiking rates and growth will be lumpy. The catalyst for my thesis playing out is the fiscal disappointment the market will get when Trump fails to deliver the level of growth this current recovery has yet to see.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more