2 Top Rated Stocks To Consider Buying Before Earnings

Image: Bigstock

After several Big Tech and Big Oil stocks reported earnings this week, next week’s lineup will continue to feature a few well-known names among their respective sectors. Let’s take a look at two well-known companies that are currently top-rated Zacks stocks and set to give quarterly releases next week.

Aflac Incorporated

Aflac Incorporated (AFL - Free Report) is a stock investors may want to consider. The insurance provider is in the Finance sector and is set to report its fourth-quarter earnings on Wednesday, Feb. 1.

Aflac is a viable investment out of the top-rated Insurance-Accident and Health Industry, which is currently in the top 12% of over 250 Zacks Industries. Sporting a Zacks Rank #2 (Buy), this company's earnings estimate revisions are trending higher for fiscal year 2023 despite a slight dip in FY22 estimates.

Image Source: Zacks Investment Research

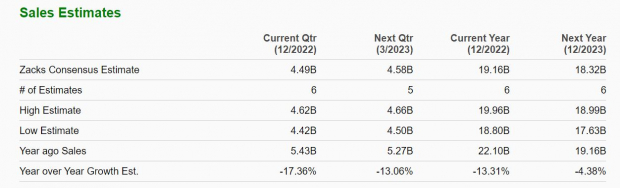

Q4 Preview

Aflac’s Q4 earnings are expected at $1.21 per share, which would be -5% dip from Q4 2021. This would round out fiscal year 2022 EPS at $5.25, an -11% drop from FY21, but FY23 earnings are projected to continue the company’s solid bottom line growth and rise 3% to $5.43 a share.

Q4 sales are projected to be $4.49 billion, down -17% from the prior year quarter. Total sales are expected to decline -13% in FY22 and fall another -4% in FY23 to $18.32 billion. Still, the expected rise in earnings in FY23 with estimates also going up is a great sign that Aflac is managing operating costs effectively during the broader economic slowdown.

Image Source: Zacks Investment Research

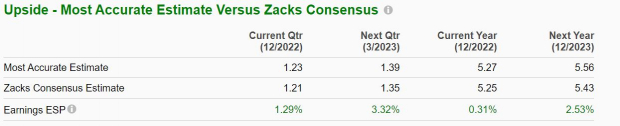

Earnings ESP

The Zacks Expected Surprise Prediction indicates that Aflac could top bottom-line estimates for Q4, with the Most Accurate Estimate at $1.23 per share and the Zacks Consensus having EPS at $1.21.

Image Source: Zacks Investment Research

Takeaway

Topping Q4 bottom line expectations could help Aflac's stock rally, and it looks quite possible that the company may be able to provide positive guidance with fiscal 2023 earnings estimate revisions trending higher.

Plus, the market has appeared to accept the slight dip in Aflac’s top line due to the stability in earnings despite the challenging operating environment, as Aflac's stock is up +17% over the last year to largely outperform the S&P 500’s -9%.

McDonald’s Corporation

Another household name that investors may want to consider buying before its Q4 earnings report on Tuesday, Jan. 31 is McDonald’s (MCD - Free Report) out of the Retail and Wholesale sector.

McDonald’s stock has been able to outperform the broader market over the last year, with the company being a more affordable fast food option for consumers amid higher inflation. This looks set to continue, with the famous burger chain also sporting a Zacks Rank #2 (Buy) as earnings estimates are slightly up for the current quarter, fiscal 2022, and FY23.

Image Source: Zacks Investment Research

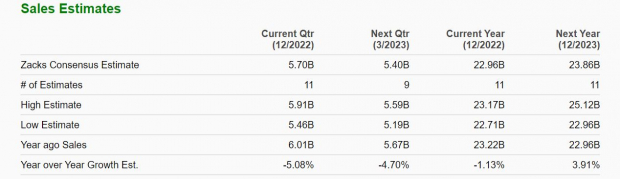

Q4 Preview

McDonald’s Q4 EPS is expected at $2.45, up 10% from Q4 2021. Even better, this would round FY22 earnings at $9.93, a 7% year-over-year increase, with FY23 EPS projected to rise another 6%. Fourth quarter sales are forecasted to be $5.70 billion, down -5% from the prior year quarter. Total sales would be down -1% for FY22, but they are projected to rise 4% in FY23 to $23.86 billion.

Image Source: Zacks Investment Research

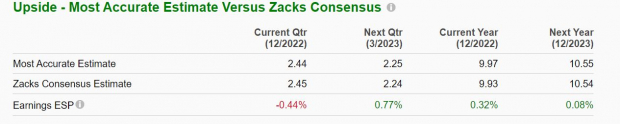

Earnings ESP

McDonald’s is expected to slightly miss bottom-line expectations, with the Zacks Consensus for Q4 earnings at $2.45 a share and the Most Accurate Estimate having EPS at $2.44.

Image Source: Zacks Investment Research

Takeaway

Despite the possibility of missing Q4 bottom-line expectations, the rising earnings estimate revisions for fiscal 2023 are a good sign that McDonald’s could offer stronger guidance in their outlook for the year. This could continue to intrigue investors, with MCD stock up +6% over the last year to largely outperform the benchmark.

Bottom Line

Both McDonald’s and Aflac stock could continue to outperform the broader market this year, and the guidance in their Q4 reports will be a larger indicator of such. Despite the slowing top-line growth in these well-known companies, investors may want to consider buying their stocks as management has shown the ability to make the best of the tougher operating environment and challenging economy, as indicated by the bottom line stability.

More By This Author:

What's in Store for Waste Management (WM) in Q4 Earnings?

Earnings Preview: Qualcomm Q1 Earnings Expected To Decline

Electronic Arts To Report Q3 Earnings: What's In Store?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more