2 Top-Ranked "Defensive" Stocks To Buy After Earnings

Image: Bigstock

There have been quite a few stocks out of the Zacks Industrial Products and Oil & Energy sectors that have outperformed the broader market over the last few years amid inflationary concerns. Many of these equities can benefit from higher commodity prices in correlation with rising inflation and act as a defensive hedge for investors.

Let’s take a closer look at two of these top-ranked stocks that are starting to stand out after their strong quarterly reports.

Arch Resources (ARCH - Free Report)

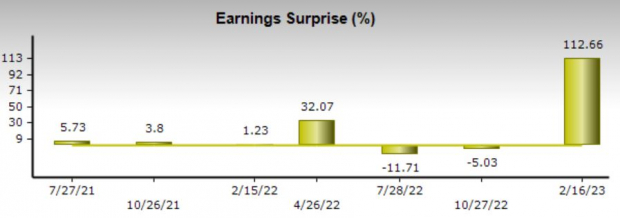

Sporting a Zacks Rank #1 (Strong Buy), Arch Resources stock continues to stand out after blasting its Q4 top- and bottom-line expectations.

Arch Resources impressively beat bottom-line expectations by 113% with EPS at $23.18, up 75% from $13.19 per share a year ago. On the top-line, the coal producer topped estimates by 19% with sales at $859.46 million, up 6% year-over-year.

Image Source: Zacks Investment Research

As one of the largest coal producers in the world, operating nine mines across the major coal basins in the U.S., Arch Resources’ earnings estimates revisions for fiscal 2023 and fiscal 2024 have continued to rise. To that note, this could continue after Arch Resources more than doubled its Q4 profit expectations. The company attributed improved sales volume, unit costs, and cash margins to its stellar performance.

Fiscal 2023 earnings are expected to decline -28% to $46.10 per share after a very exceptional 2022 that saw EPS at $63.88. However, FY23 earnings estimates have continued to go up, climbing 12% over the last quarter. Furthermore, FY24 earnings estimates have gone up 11% over the last 90 days despite ARCH’s EPS expected to drop another -29% to $32.46 as higher coal prices start to settle.

Image Source: Zacks Investment Research

Plus, Arch Resources’ bottom-line would still be well above historical levels. On the top-line, sales would also remain above historic levels despite being forecasted to drop -15% in FY23 and fall another -14% in FY22 to $2.69 billion, based on Zacks estimates.

Shares of ARCH spiked 9% following its stellar quarterly results. Arch Resources stock is now up +11% year-to-date, topping the S&P 500’s +6% and the Coal Markets’ -1% performance. Even better, over the last two years and amid higher inflation, ARCH is up an outstanding +223% to crush the benchmark’s +3% and roughly match its Zacks Subindustry’s +226%.

Image Source: Zacks Investment Research

Reliance Steel & Aluminum Co. (RS - Free Report)

Also standing out following its Q4 report is Reliance Steel & Aluminum, with its stock sporting a Zacks Rank #1 (Strong Buy) as well. The metals service center operator continued to profit from higher commodity prices, beating bottom-line expectations by 31% with Q4 EPS of $5.87, despite this being down -14% year-over-year following an exceptional prior-year quarter.

Image Source: Zacks Investment Research

Fourth quarter sales slightly missed expectations by -1% at $3.61 billion, down -9% year-over-year. Still, fiscal 2022 was a record year in annual net sales, recording $17.03 billion. Reliance also saw a record year for annual EPS at $30.03, along with record quarterly and annual cash flow following the fourth quarter at $808.7 million and $2.12 billion, respectively.

According to Zacks estimates, Reliance’s fiscal 2023 earnings are projected to decline -39% at $18.26 per share following its record year. With that being said, earnings estimates have gone up 11% throughout the quarter. Sales are forecasted to drop -17% in FY23 to $14 billion, but Reliance’s’ top- and bottom-lines remain well above historical levels.

Image Source: Zacks Investment Research

More impressive, Reliance stock is up 22% year-to-date to top the Metal Producer Markets +15% and outperform the rallies among the broader indexes. Furthermore, shares of RS are up +95% over the last two years to also top its Zacks Subindustry’s +68% and the benchmark.

Image Source: Zacks Investment Research

Bottom Line

Both Arch Resources (ARCH - Free Report) and Reliance Steel & Aluminum (RS - Free Report) have been leaders in their respective industries, and their stocks continue to look attractive following their Q4 results. These are two names investors will want to keep an eye on in 2023, as their strong performances looked poised to continue with earnings estimates revisions trending higher.

More By This Author:

Nvidia To Report Q4 Earnings: What's In The Cards?Previewing Etsy And Overstock Before Q4 Earnings

Against All Odds: The Coal Industry Is Back From The Dead

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more