2 Top-Ranked Chip Stocks To Buy For Income

Image Source: Unsplash

Semiconductors, commonly referred to as microchips, are a bright highlight of technology, existing in nearly every aspect of our lives.

Over the last several years, chip stocks have exploded in popularity, and for an easy-to-understand reason – they have been stellar investments.

And for those seeking exposure, several chip stocks – Micron Technology (MU) and ASML (ASML) – have all seen their near-term earnings outlooks shift favorably, reflecting optimism among analysts.

Let’s take a closer look at each.

Micron Technology

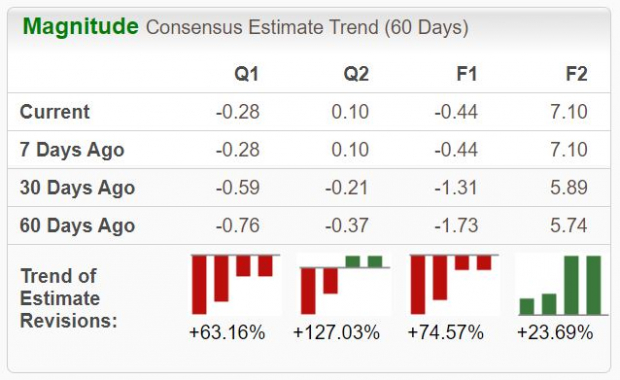

Micron manufactures and markets high-performance memory and storage technologies. The stock is a Zacks Rank #1 (Strong Buy), with expectations moving higher across the board in a big way.

Image Source: Zacks Investment Research

On top of semiconductor exposure, investors stand to reap a passive income stream, with MU shares currently yielding 0.5% annually. While the yield isn’t that steep, it provides a nice buffer against potential drawdowns.

And Micron’s forecasted growth is impossible to ignore, with consensus expectations for its current fiscal year suggesting 90% earnings growth on 43% higher sales. Peeking ahead, expectations for FY25 allude to an additional jump in earnings paired with a 45% sales bump.

ASML

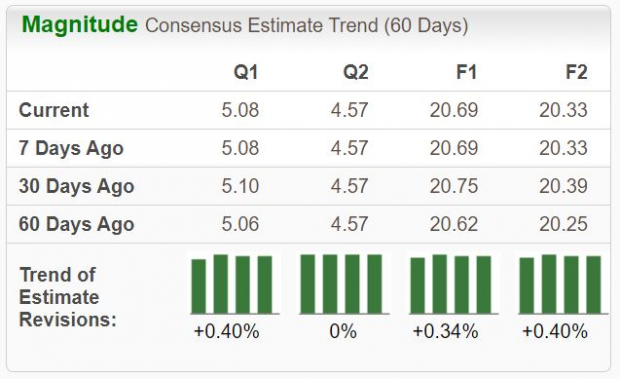

ASML is a world leader in manufacturing advanced technology systems for the semiconductor industry. The company has seen its earnings outlook inch higher across nearly all timeframes, helping land it into a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Like MU, ASML shares come with the perk of passive income, with ASML’s annual dividend currently yielding 0.7%. And the company has been committed to increasingly rewarding shareholders, with ASML carrying a sizable 33.4% five-year annualized dividend growth rate.

Shares are expensive but less so on a historical basis, with the current 35.5X sitting beneath the 36.1X five-year median and highs of 55.4X in 2021. The stock sports a Value Style Score of ‘D.’

Image Source: Zacks Investment Research

Bottom Line

Semiconductor stocks have enjoyed great runs over the last several years, quickly becoming cherished among investors.

And for those interested in exposure, both stocks above – Micron Technology and ASML – precisely fit the criteria. In addition to favorable Zacks Ranks, both stocks pay out dividends, undoubtedly another great perk.

More By This Author:

High-Volume Trading Suggests It's Time To Buy These Top-Rated Stocks3 Hartfort Mutual Funds To Buy Now For The Long Run

Bull Of The Day - MercadoLibre

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more