2 Top Cloud Computing Stocks Investors Can't Miss: AMZN, ANET

Image Source: Pixabay

Zacks Thematic Screens lets you dive into 30 dynamic investment themes shaping the future. Whether you're interested in cutting-edge technology, renewable energy, or healthcare innovations, our themes help you invest in ideas that matter to you.

Let’s take a closer look at the ‘Cloud Computing’ theme and analyze a few stocks within.

What is Cloud Computing?

Cloud computing refers to the on-demand seamless access of computing resources such as servers, storage, databases, networking, software, analytics, and intelligence over the Internet (the cloud) on a pay-per-use pricing model.

It marks a paradigm shift from traditional on-premises infrastructure storage to remote cloud-based storage facilities and relies heavily on virtualization and automation technologies. Instead of buying, owning, and maintaining physical data centers and servers, organizations access a virtual pool of shared resources from a cloud service provider on an as-needed basis.

This lowers operating costs, increases productivity with greater agility and flexibility, and improves scalability with higher economies of scale.

Amazon Remains Cloud Leader

Amazon (AMZN - Free Report) shares reflect an excellent opportunity for investors to obtain exposure to cloud computing thanks to Amazon Web Services (AWS). Many are familiar with AWS, whether through the many advertisements across TV or in their own professional work.

AWS is the dominant player in the cloud computing market, flexing a significant market share globally. It provides various services, including computing power, storage, databases, and AI/ML tools.

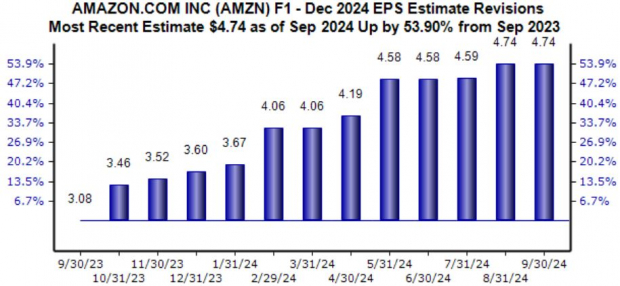

Earnings expectations for its current fiscal year have soared higher for the mega-cap giant, reflecting an optimistic outlook from analysts. The $4.74 Zacks Consensus EPS estimate suggests 63% growth year-over-year.

Image Source: Zacks Investment Research

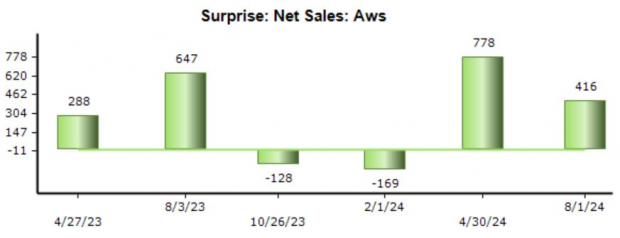

AWS results have recently exceeded our consensus expectations in back-to-back releases, as shown below.

Image Source: Zacks Investment Research

ANET Shares Benefit from Robust Demand

Arista Networks (ANET - Free Report) is an industry leader in data-driven, client-to-cloud networking for large AI, data center, campus, and routing environments. Shares have been red-hot over the last year thanks to robust quarterly results stemming from unrelenting demand, gaining nearly 100% compared to the S&P 500’s 28% gain.

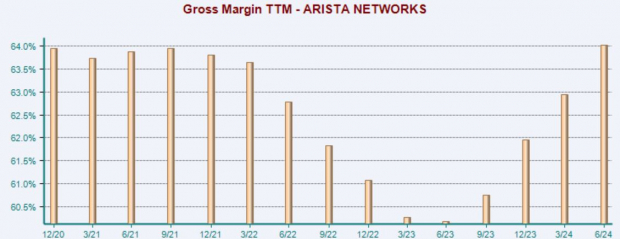

The company again posted strong results in its latest release, enjoying margin expansion alongside a 30% pop in EPS. Please note that the margin chart below is on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Bottom Line

Thematic investing has emerged as a powerful way for investors to sync their portfolios with emerging trends. A mix of long-term and short-term themes is increasingly dictating which companies lead as economies expand and markets shift.

While stocks in each theme aren't direct recommendations, they offer a solid starting point. Leverage the Zacks Rank and other metrics to identify the best stocks for your strategy. Each featured stock comes with a Zacks report, giving you the tools to analyze performance and potential.

The Cloud Computing thematic list, which currently Amazon and Arista Networks are part of, focuses on technology companies that provide the related hardware and software to enable cloud computing services, the communication service providers that offer the network facilities and the various firms that utilize the services across diverse sectors like financial, consumer discretionary and industrials.

More By This Author:

3 Buy Rated Stocks Cruising At 52 Week Highs

Insider Trading: 3 Recent Large-Cap Purchases

3 Unique Investment Angles For Artificial Intelligence: Nvidia, Vertiv, Palantir