2 Stocks To Watch After Blasting Q3 Earnings Expectations: AA, TCBI

Image Source: Unsplash

Aluminum producer Alcoa (AA - Free Report) and financial holding company Texas Capital Bancshares (TCBI - Free Report) are two stocks to watch after crushing their third quarter earnings expectations on Thursday.

Further suggesting they are worthy of investors' consideration is that Alcoa and Texas Capital were able to post significant growth on their bottom lines from the comparative quarter.

Alcoa’s Q3 Results

Zacks Rank #3 (Hold)

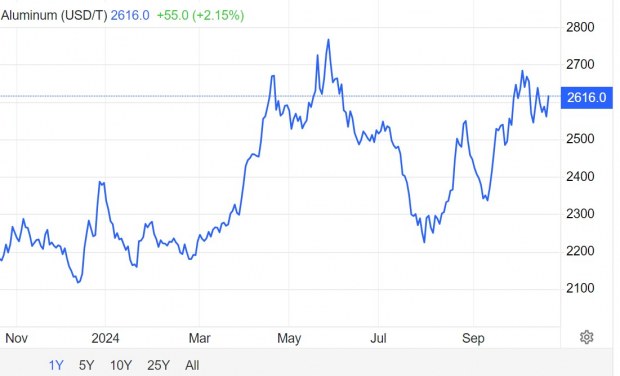

With Aluminum prices up +20% this year to current levels of over $2,600 per "tonne", Alcoa’s ability to lower raw material costs was another major catalyst in boosting its profit margins. Alcoa’s Q3 adjusted net income of $135 million or $0.57 per share soared from an adjusted loss of -$1.14 a share in the prior year quarter and crushed EPS estimates of $0.23 by 148%.

Image Source: Trading Economics

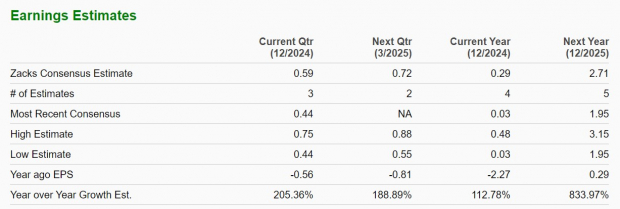

The impressive earnings beat came as Q3 sales of $2.9 billion missed estimates of $2.99 billion by -3% but increased 11% from $2.6 billion a year ago. Furthermore, Alcoa has surpassed earnings expectations in three of its last four quarterly reports posting a very impressive average EPS surprise of 51.52%. This has continued to confirm projections of a sharp rebound on Alcoa’s bottom line in fiscal 2024 and FY25.

Image Source: Zacks Investment Research

Texas Capital’s Q3 Results

Zacks Rank #1 (Strong Buy)

Notably, a trend of positive earnings estimate revisions had been very compelling for Texas Capital prior to its Q3 report which correlates with its strong buy rating. As the parent company of Texas Capital Bank, the company’s focus on middle-market business customers and high-net-worth individuals has continued to pay off with an emphasis on the cities of Dallas, Houston, Fort Worth, Austin, and San Antonio.

Image Source: Zacks Investment Research

Texas Capital reported a quarterly record for net fee income growth which increased 38% year over year to $64.8 million. Total net income was $74.3 million or $1.62 per share which spiked 37% from EPS of $1.18 in Q3 2023 and comfortably exceeded estimates of $0.97 a share by 67%. Plus, Q3 sales of $304.91 million came in 9% better than estimates of $279.64 million and rose over 9% from $278.94 million in the comparative period.

Exceeding earnings expectations in two of its last four quarterly reports and posting an average EPS surprise of 12.39%, Texas Capital’s bottom line is currently projected to dip -9% in FY24 after a tougher to-compete against year but is forecasted to rebound and soar 39% in FY25 to $4.91 per share.

Image Source: Zacks Investment Research

Bottom Line

Following their favorable Q3 results, Alcoa and Texas Capital are two of the more intriguing stocks to watch and could be in store for more upside as earnings estimate revisions are likely to trend higher in the coming weeks.

More By This Author:

Bull Of The Day: Vertex2 Finance Stocks To Buy After Q3 Earnings: PGR & PNC

Top Value Stocks Nearing 52-Week Highs With Stellar Dividends

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more