2 Stocks To Buy As The S&P 500 Enters A New Bull Market

Image: Bigstock

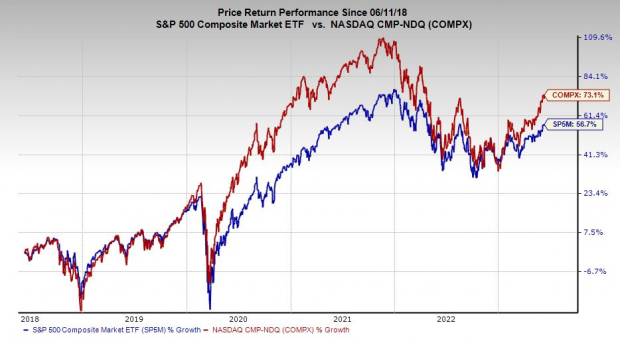

The S&P 500 officially entered a new bull market on Thursday. The tech-heavy Nasdaq began its new bull run back in May. Both indexes surged off their lows as Wall Street looked ahead to cooling inflation, the end of Fed tightening, and a return to earnings growth in 2024.

In the forward-looking world of Wall Street, most of these bullish support factors remain in place. That said, the market will get key updates on interest rates and inflation next week in the form of the Fed’s FOMC meeting and May’s CPI release.

If inflation keeps cooling and the Fed pauses, the market could be ready to push even higher during the historically quiet and low-volume summer months on Wall Street. And with the way the market looks right now, investors don’t seem too concerned about inflation or the possibility of higher rates.

Image Source: Zacks Investment Research

On top of that, there are signs that investors are starting to buy stocks outside of mega-cap tech. Once other sectors start to climb, then Wall Street might be looking even better.

Plus, there is growing sentiment that even if the big tech stocks tumble again, the big fund managers will have to buy the dips because anyone who missed out on buying at the end of 2022 or early 2023 simply cannot afford to get left behind.

Overall, investors with long-term horizons should avoid market timing as it can prevent you from participating in rallies—such as the one we are in at the moment. And remember that both the S&P 500 and the Nasdaq still trade solidly below their peaks.

Today, we explore two highly-ranked Zacks stocks that have crushed the market over the last five years which operate proven businesses that should help them keep growing for years to come.

ServiceNow (NOW - Free Report)

ServiceNow provides cloud-based digital workflow services and solutions to nearly 8,000 enterprise customers. NOW aims to help automate digital workflows, with a product portfolio designed to help boost workflow automation across areas like IT, HR, and beyond. ServiceNow’s customers are scattered throughout nearly every facet of the economy, from health care and technology to financial services and consumer products.

Image Source: Zacks Investment Research

ServiceNow has already and will continue to benefit from the constant wave of technological innovation that forces businesses from all industries to adapt and spend heavily to thrive and keep pace. NOW boasts partnerships with the likes of Microsoft (MSFT - Free Report) and many others.

ServiceNow’s critical offerings and successful subscription model (which accounts for about 95% of revenue) are showcased by a decade-straight of 20% or higher revenue expansion that took it from under $300 million in sales in 2012 to $7.25 billion in 2022.

ServiceNow topped our Q1 estimates in late April and its upbeat EPS revisions help it grab a Zacks Rank #1 (Strong Buy) right now. Zacks estimates call for the company to post roughly 22% sales growth in both 2023 and 2024 to jump up to $10.69 billion in total revenue. Meanwhile, its adjusted earnings are projected to climb by 26% and 25%, respectively, to help extend its run of remarkably consistent and impressive expansion.

Image Source: Zacks Investment Research

NOW stock has skyrocketed roughly 1,300% in the last 10 years vs. the Zacks Tech Sector’s 260%. Like many growth names, ServiceNow got crushed during the 2022 downturn as Wall Street was forced to recalibrate valuations. NOW has been trading in line with Tech over the last three years. And ServiceNow currently trades around 20% below its highs, even though it is up 38% year-to-date.

ServiceNow has been trading above its 50-day moving average, and it hit that bullish golden cross in early March. NOW is far from a value stock. But its PEG ratio has come steadily down over the last five years, with it recently trading at a 50% discount to its own median during that stretch and 90% below its own highs. Wall Street is still willing to pay up for NOW’s growth, and 26 of the 30 brokerage recommendations Zacks has are “Strong Buys.”

Eaton (ETN - Free Report)

Eaton is a power management firm that’s been in business for over 100 years. ETN helps its customers improve and manage their electrical, hydraulic, mechanical power systems, and more. Eaton spent the past several years revamping its operations to benefit from booming megatrends such as renewable energy and EVs, as well as broader electrification and digitalization.

The rapid expansion of wind, solar, and many other non-fossil fuel-based energy sources requires massive amounts of investment in electricity systems and infrastructure. On top of that, large swaths of electrical grids in the U.S and around the world are in dire need of repairs, investment, and in many cases, large-scale overhauls. Eaton’s business segments include Electrical Americas, Electrical Global, Aerospace, Vehicle, and eMobility.

Image Source: Zacks Investment Research

Eaton’s revenue climbed by 10% in 2021 and 6% in 2022, and it raised its fiscal 2023 earnings and sales guidance following a strong first quarter that also saw it post record Q1 segment margins and boost its backlog by 51%.

Current Zacks estimates call for another 9% revenue growth in 2023 and 6% higher in 2024 to reach $24 billion. Meanwhile, its adjusted earnings are projected to climb by 12% in FY23 and another 9% in FY24.

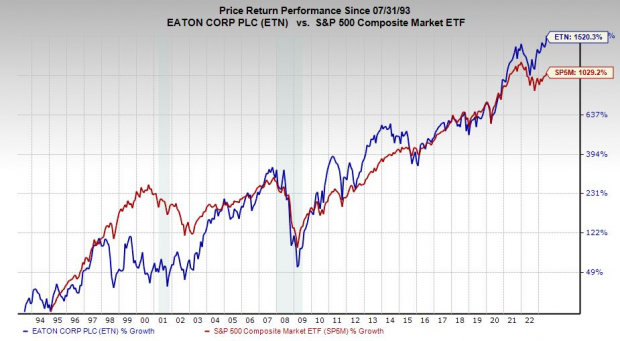

ETN shares have climbed by 130% in the last five years vs. its Zacks Econ sector’s 18% and the S&P 500’s 57%. This is part of an 850% run over the past 20 years to more than double the benchmark (with its outperformance dating back even longer as shown by the chart provided). More recently, ETN has popped 36% in the past 12 months to hit fresh records, including an 18% year-to-date surge.

Image Source: Zacks Investment Research

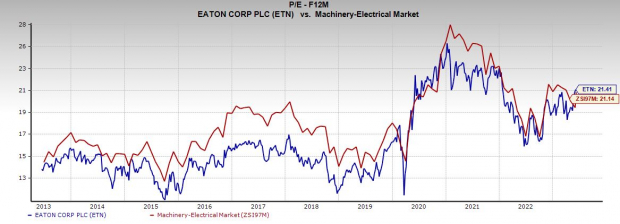

Even though Eaton has crushed its industry, it has recently traded almost directly in line with its peers at 21.4X forward 12-month earnings and at a 17% discount to its own decade-long highs at 21.4X forward 12-month earnings.

ETN’s improved earnings outlook helps it land a Zacks Rank #2 (Buy) at the moment. Plus, Eaton’s dividend yields 1.9% to double its highly-ranked Manufacturing – Electronics industry.

More By This Author:

Bull of the Day: Hubbell IncorporatedBear of the Day: DocuSign, Inc.

Highly-Ranked Growth Tech Stocks To Buy And Hold As The Bulls Fight Back

Disclosure: Ben Rains owns ETN in the Zacks Alternative Energy Innovators service.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the ...

more