2 Stocks To Buy After The European Central Bank & Bank Of Canada Cut Rates

Image Source: Unsplash

Optimistically, the European Central Bank (ECB) and Bank of Canada (BOC) cut interest rates this week somewhat ensuring large economies may be on the path to easing inflation and beating the U.S. to the punch.

Canada is particularly receptive to the idea of a soft landing becoming the most recent G7 nation to reduce borrowing costs for consumers with the BOC cutting its benchmark rate by 25 basis points to 4.75%.

Notably, the BOC sees more easing ahead while the ECB has remained cautious despite Euro Zone rates being cut by 25 basis points as well to 3.75%. This comes as the Federal Reserve has kept rates in the United States at 5.25%-5.5% with the Bank of England at 5.25%.

Presumably, investors may be eyeing stocks that can benefit more directly from what will likely be a more favorable operating environment for companies in Canada and Europe. With that being said, here are two Intriguing stocks to consider in this regard.

Agnico Eagle Mines (AEM - Free Report)

Zacks Rank #1 (Strong Buy)

Somewhat of a double-edged sword for investors, gold is often a viable inflationary hedge and Toronto-based mining company Agnico Eagle Mines is a gold producer that is seeing robust growth.

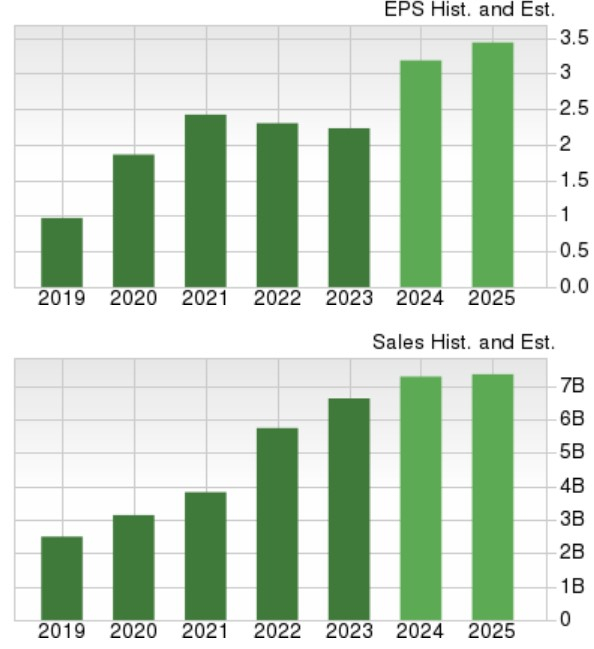

Image Source: Zacks Investment Research

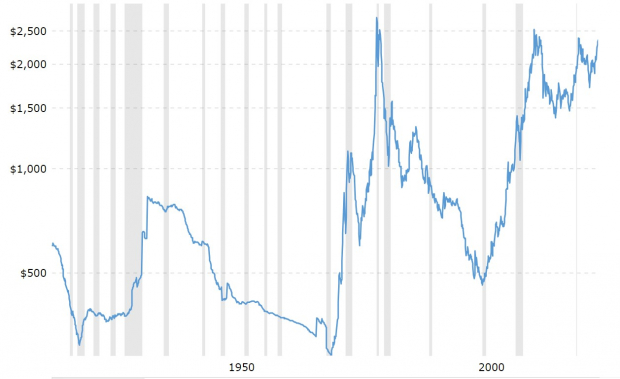

With spot gold prices still near historical and multi-year peaks of over $2,000 per troy ounce, it’s also noteworthy that AEM offers a generous 2.42% annual dividend yield and the Zacks Mining-Gold Industry is currently in the top 6% of over 250 Zacks industries.

Image Source: Macrotrends

Siemens (SIEGY - Free Report) ) – European ADR

Zacks Rank #2 (Buy)

Headquartered in Germany, Siemens’ bottom-line expansion is attractive as the world’s largest supplier of products, systems, solutions, and services for industrial automation and building technology.

Siemens’ valuation and dominance among European capital goods suppliers is very intriguing, especially considering the ECB’s recent rate cuts could help improve the company’s profitability.

To that point, SIEGY trades at an attractive 16.9X forward earnings multiple with EPS projected to increase 9% in fiscal 2024 and forecasted to expand another 13% in FY25 to $6.56 per share. Plus, SIEGY has a very respectable 1.91% annual dividend yield.

Image Source: Zacks Investment Research

Bottom Line

Recent rate cuts by the ECB and BOC could certainly lead to a more favorable operating environment for many companies in Canada and Europe with Agnico Eagle Mines and Siemens being two stocks to keep an eye on respectively.

More By This Author:

What Really Went Wrong In America?

What's Next? War On Money?

Mastering the Art of Finance

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more