2 Stocks Of Relative Strength In Slowing Semiconductor Industry

Image: Bigstock

Companies in the Semiconductor – General industry are at the forefront of the ongoing technological revolution based on HPC, AI, automated driving, IoT, and so forth. These semiconductors also enable the cloud to function and help analyze the data into actionable insights that can be used by companies to operate more efficiently.

The pandemic led companies to ramp up technology investments in order to stay operational when it was unsafe to go to work or meet in person. But since this meant that a lot of infrastructure was built out in advance, analysts currently expect demand to slow down in the near future. Longer-term trends continue to favor digitization, cloud, AI, etc., which will drive strong demand for semiconductors.

This is not a great place to invest in right now, but STMicroelectronics and Texas Instruments look relatively attractive.

About The Industry

The companies grouped under the Semiconductor – General category produce a broad range of semiconductor devices, both integrated and discrete, like microprocessors, graphics processors, embedded processors, chipsets, motherboards, wireless and wired connectivity products, DLPs, and analog, serving multiple end markets. The industry includes companies like Nvidia, Texas Instruments, Intel, and STMicroelectronics.

According to recent data from the Semiconductor Industry Association (SIA), global semiconductor sales in the first quarter of 2022 grew 23.0% to $151.7 billion. 2021 sales were up 26.2% to the highest-ever annual total. All regions grew, with the Americas up 40.1%, Europe 25.7%, Japan 20.4%, China 17.3%, and Asia Pacific/All Other 17.9%. The 2022 projection of 8.8% growth was not revised.

Main Themes

Being on the building-block side of technology, the industry stands to benefit from the proliferation of the Internet and the growing digitization of our lives, irrespective of the direction we move in the future. And since the pandemic has accelerated this move toward digitization, we are seeing a profound impact on the semiconductor industry.

Demand for smartphones (a primary application of semiconductors) declined for the third straight quarter according to IDC, and the outlook isn’t great because of inflation and supply chain concerns. The China lockdowns and Ukraine war are other negatives. So, IDC expects smartphone shipments to grow 1.6% in 2022 (previous 3.0%), with the ASP continuing to expand until next year, when 5G handsets become cheaper.

The other major chip consumer is the PC market, where the consumer and education segments are temporarily slowing down following two years of very strong growth. But the commercial segment will continue to grow strongly, according to IDC. Yet other segments are gaining in importance. AI, for instance, should grow strongly (MarketsandMarkets expects a 39.7% CAGR between 2021 and 2026, from $58.3 billion to $309.6 billion).

In IoT, which is still evolving, Mordor Intelligence expects a 10.53% CAGR between 2021 and 2026 from $761.4 billion to $1,386.1 billion. Automotive electronics is another area of evolving needs and strong growth potential (Grand View Research estimates a 7.9% CAGR in 2021-2028, driven mainly by various safety systems.

Moreover, the cost of electronic components in automobiles is expected to jump from 35% of total vehicle cost to 50% by 2030. Automation and robotics, with increasing adoption across industrial operations, are other areas of growth. The strong end markets will drive continued demand for semiconductor components for years to come.

Because of the growth potential in emerging markets, regulatory (and/or political) issues in China and the U.S., may play an increasingly important role. The government’s strong stance against China has cast a shadow over the space. Semiconductor companies in particular stand to benefit from a truce between the U.S. and China as the Chinese government’s drive to build its own industry requires collaborations with leading semiconductor players.

Moreover, commercial sales to China would help fund R&D in the U.S. The government is more concerned about IP protection. Be that as it may, the $52 billion infusion from the CHIPS Act (when adopted) will be a big boost to the domestic semiconductor market.

Because end devices have to be priced lower to reach more people, the pressure on companies to bring down costs remains. But although companies still find it advantageous to move operations to places where labor may be cheaper or where the proximity to manufacturing facilities can lower transportation and other costs, governments across the world are waking up to the strategic value of producing chips onshore.

Tensions with China have also made regulators eager to develop alternative supply chains. Industry consolidation should continue, however, as larger players add expertise and capacity through acquisitions. There’s also likely to be close collaboration with device makers, facilitating quicker consumption and better inventory management.

Zacks Industry Rank Indicates Deteriorating Prospects

The Zacks Semiconductor-General Industry is a stock group within the broader Zacks Computer and Technology Sector. It carries a Zacks Industry Rank #197, which places it in the bottom 22% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates that near-term prospects aren’t too bright. Our research shows that the bottom 50% of the Zacks-ranked industries underperforms the top 50% by a factor of 1:2.

An industry’s positioning in the top 50% of Zacks-ranked industries is normally because the earnings outlook for the constituent companies in aggregate is encouraging. The opposite is true for stocks in the bottom 50% of industries.

In this case, the aggregate earnings estimate for 2022, while displaying an improving trend in the last few months, is up a mere 2.3% from the year-ago level. The aggregate earnings estimate for 2023 is down 17.9% from last year.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Leads on Stock Market Performance

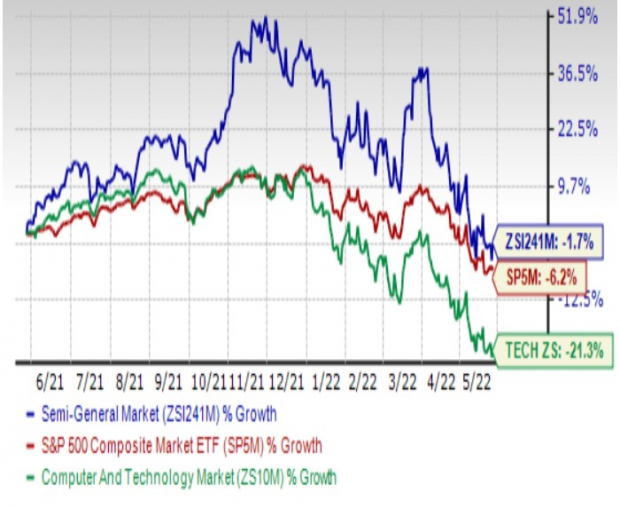

Tracking the performance of the Zacks Semiconductor – General Industry over the past year shows that the industry has traded higher than both the broader Zacks Computer and Technology Sector and the S&P 500 index.

The industry lost 1% over the past year compared to the 21.3% loss of the broader sector and the 6.2% loss of the S&P 500 index.

One-Year Price Performance

Image Source: Zacks Investment Research

The Industry's Current Valuation

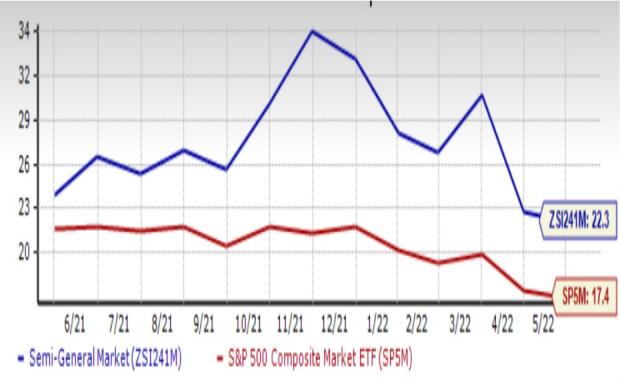

On the basis of forward 12-month price-to-earnings (P/E) ratio, which is a commonly used multiple for valuing semiconductor companies, we see that the industry is currently trading at 22.3X, which is its lowest multiple over the past year. However, the S&P 500 trades at 17.4X while the sector trades at 20.3X, so the industry appears overvalued in both these comparisons.

Over the last five years, the industry has traded as high as 34.34X, as low as 12.86X, and at the median of 18.94X.

Forward 12-Month Price-to-Earnings (P/E) Ratio

Image Source: Zacks Investment Research

2 Stocks Worth Considering

STMicroelectronics N.V. (STM - Free Report) is a company that designs, develops, manufactures, and markets a broad range of semiconductor integrated circuits and discrete devices used in a wide variety of microelectronic applications, including telecommunications systems, computer systems, consumer products, automotive products, and industrial automation and control systems.

STMicroelectronics continues to see strong demand across all segments, except the imaging product line, and all markets, except China (because of pandemic-induced shutdowns). Its favorable pricing remains positive for profitability.

Given its exposure to the automotive market, the replenishment of inventories across the automotive supply chain, and the ongoing electrification and digitalization are positives, despite the lower-than-expected number of cars produced.

Industrial, the other significant end market for STMicroelectronics, is currently being driven by factory automation, power, and energy applications, as well as building and home control. Industrial electrification and digitalization are the main trends accelerating the increase in semiconductor content.

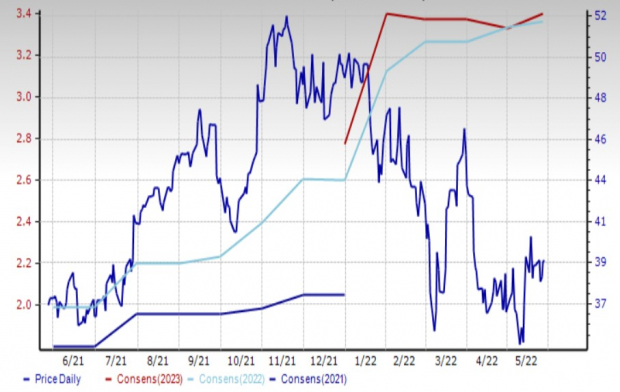

STM beat the Zacks Consensus Estimate for the fourth quarter by 11.3%. In the last 30 days, the current year EPS estimate of this Zacks Rank #3 (Hold) stock increased 13 cents (4.1%).

The shares of the company are up just 0.2% over the past year, mainly because of the pressure they have been under since the beginning of this year and particularly since March.

Price & Consensus: STM

Image Source: Zacks Investment Research

Texas Instruments, Inc (TXN - Free Report) is an original equipment manufacturer of analog, mixed signal, and digital signal processing (DSP) integrated circuits.

Texas Instruments has significant exposure to the industrial and automotive markets, where the semiconductor shortage is driving strong demand and pricing strength. But like STM, the company also sees some impact from China’s pandemic-related shutdowns.

The company is known for operating a flexible manufacturing model (including its 300mm facilities) that includes both internal capabilities and external sources, thus making it a bit of a defensive play in downcycles. But the secular growth prospects in its served markets, coupled with the current chip shortage, have been driving the company to increase capacity.

Those extra costs notwithstanding, Texas Instruments continues to generate solid cash flows. It also returns cash to investors through regular share repurchases and dividends. This is one of the steadiest performing companies and it continues to deliver, quarter upon quarter.

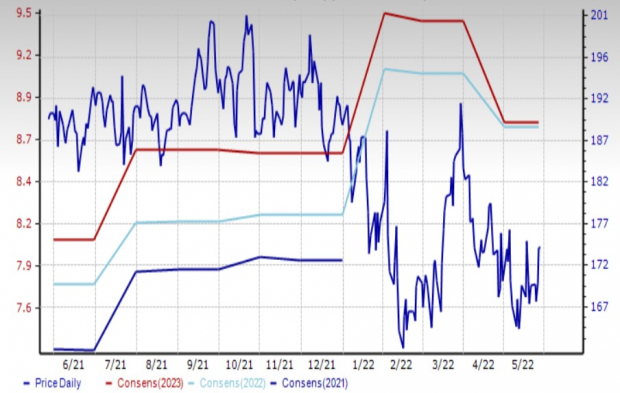

In the last quarter, Texas Instruments generated earnings that topped the Zacks Consensus Estimate by 8.3% on revenues that beat by 4.1%. The Zacks Consensus Estimate for 2022 is up 18 cents (2.0%) in the last 30 days.

Shares of this Zacks Rank #3 company are down 7.9% over the past year, mainly due to the broad market weakness.

Price & Consensus: TXN

Image Source: Zacks Investment Research

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more