2 Portfolio Worthy Value Stocks To Consider After Q4 Results: GM, IVZ

Image Source: Pixabay

A pair of intriguing value stocks are standing out after exceeding Q4 earnings expectations on Tuesday morning with respect to auto giant General Motors (GM - Free Report) and investment management leader Invesco (IVZ - Free Report) .

Spiking over +50% in the last year respectivley, GM and Invesco stock have impressively outperformed the broader market. That said, both stocks are still trading at noticeable discounts to the benchmark S&P 500 and many of their respective industry peers in terms of various valuation metrics.

Following their Q4 reports, GM appears to be in store for higher highs, with IVZ presenting an intriguing buy-the-dip opportunity. GM stock spiked nearly +9% in today’s trading session, hitting a new all-time high of $87 a share, while IVZ dipped 5% on a pullback from a recent 52-week high of $29.

Image Source: Zacks Investment Research

Shareholder-Friendly Returns Highlight GM’s Q4 Report

GM’s strong underlying operating performance was able to overshadow a net loss of $3.21 billion, primarily due to $7.2 billion in special charges tied to unused EV manufacturing equipment.

Highlighting GM’s operational performance was the announcement of a new $6 billion share repurchase plan and a 20% dividend increase, signaling confidence in the company’s long-term cash flow.

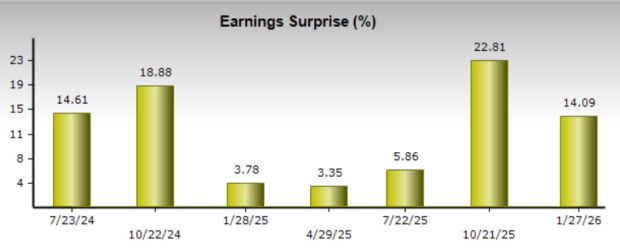

Plus, GM’s Q4 adjusted EPS of $2.51 still beat expectations of $2.20 by 14% and climbed over 30% from $1.92 per share a year ago. This was despite Q4 sales of $45.28 billion missing estimates of $46.13 billion and falling from $47.71 billion in the prior year quarter due to the end of the $7,500 federal tax credit for new EV purchases.

Image Source: Zacks Investment Research

Record AUM Boosts Invesco’s Q4 Results

Long-term inflows and higher operating revenues supported Invesco’s favorable Q4 results despite a $1.8 billion non-cash impairment charge, which was attributed to writing down the value of certain intangible assets.

Still, net inflows of $19.1 billion pushed Invesco’s assets under management (AUM) to a record $2.2 trillion. This was primarily driven by index and fixed income services, as well as ETFs such as the popular Invesco QQQ (QQQ - Free Report), which gives access to the performance of the largest and most innovative tech companies with regard to the Nasdaq-100 Index.

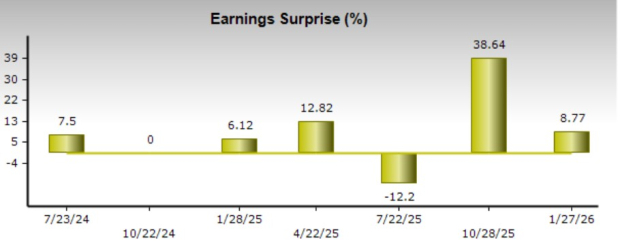

Invesco’s Q4 adjusted EPS of $0.62 beat expectations of $0.57 by nearly 9% and spiked 19% from $0.52 per share in the comparative quarter. Quarterly sales increased 8% to $1.25 billion and edged estimates of $1.24 billion.

Image Source: Zacks Investment Research

GM’s Positive Guidance & Invesco’s Strategic Priorities

Expecting “another year of strong financial performance”, GM expects full-year fiscal 2026 EPS to increase to a range of $11-$13 from $10.60 per share in FY25. Additionally, GM forecasts FY26 adjusted EBIT at $13 billion-$15 billion compared to $12.7 billion last year and projects adjusted automotive free cash flow at $9 billion-$11 billion versus $10.6 billion in FY25.

Holding the #2 spot in the domest EV market behind Tesla (TSLA - Free Report), GM does anticipate significantly lower EV volume in 2026, but also expects EV losses to improve by $1-$1.5 billion due to right-sizing production and reduced one-time charges.

Although Invesco didn’t issue formal guidance, the investment management firm shared its strategic priorities for FY26. This includes private markets expansion through partnerships with Barings and LGT Group, continued portfolio simplification, and an emphasis on ETF growth, including structural improvements for the QQQ. Notably, Invesco’s FY25 adjusted EPS increased 19% to $2.03, with annual sales rising 6% to $4.66 billion.

Attractive Valuations & Dividends

Regarding value, IVZ has traded near the preferred level of less than 2X forward sales, with GM at 0.4X. Furthermore, GM trades at just 6X forward earnings with IVZ at an attractive 10X.

More intriguing is that relative to their expected earnings growth, GM and IVZ are making a clear argument for being undervalued with PEG ratios under the admirable level of 1X.

Image Source: Zacks Investment Research

The cherry on top is that GM’s annual dividend yield is edging toward a respectable 1%, with Invesco’s at an enticing 2.93%.

Image Source: Zacks Investment Research

Bottom Line

As two portfolio-worthy value stocks to consider, the idea of buying GM stock for higher highs and picking up IVZ shares on the dip is very tempting following their Q4 reports. At the moment, GM and IVZ sport a Zacks Rank #2 (Buy) with both checking an overall “A” Zacks Style Scores grade for the combination of Value, Growth, and Momentum.

More By This Author:

Apple Vs Microsoft: Which Is The Best Tech Investment As Quarterly Results Approach?Thinking Of Buying Visa Before Q1 Earnings? You Might Want To Wait

Japan ETFs To Shine As BOJ Upgrades Economic Growth Forecast

Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific securities ...

more