2 Names To Consider In A Heating Up Small-Cap Biotech Sector

TM Editors' Note: This article discusses one or more stocks that are, or have recently been, penny stocks. Such stocks are easily manipulated; do your own careful due diligence.

Karuna Therapeutics (KRTX), NextCure (NXTC), and Constellation Pharmaceuticals (CNST) are but the latest examples of how the biotech sector has been heating up. All 3 of these names have seen very strong stock appreciation on early impressive data.

KRTX just reported that its developmental drug "KarXT, designed for the treatment of acute psychosis in schizophrenia patients, demonstrated "statistically significant and clinically meaningful reduction" in total positive and negative syndrome scale (PANSS) score compared with a placebo."

Subsequently, the stock price exploded from around $20 a share all the ways to a pre-market high of $140 in a few days.

NXTC reported what at first seemed like positive early data, but after further data release, it was determined that their data was not as good as their Society for Immunotherapy of Cancer (SITC) abstract first appeared. The abstract was based upon seven patients. However, when the data was expanded to N = 49, there were no further responses observed beyond the initial two. Nevertheless, the stock made a huge move from around $20 a share to as high as $109, before crashing back down to around $35 a share.

CNST had the most impressive data of the latest biotech big runners, with strong early data from an N = 4 Phase 2 clinical trial for myelofibrosis in combination with Incyte's (INCY) Jakafi. In this study, all four patients showed a strong response to combination therapy.

CNST's stock price before positive data announcement was around $15 a share and went on a run to as high as $45.42. Unlike the first 2 companies mentioned here, CNST has held its value rather well, currently trading around $40 a share.

In this write-up, we offer 2 under-the-radar developmental biotech companies we think have the potential to see some strong bids come in rather soon.

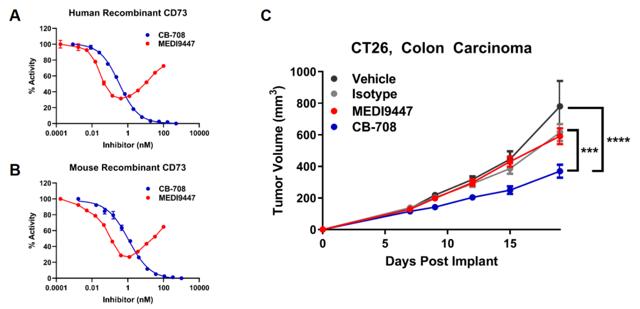

Calithera Biosciences (CALA) is a company we have extensive knowledge of and have been following since 2015. The company is nearing an important inflection point with the upcoming results of the randomized Cabozantinib + Telaglenastat combination study in 2nd line Renal Cell Carcinoma (RCC) due in the 2nd half of 2020. Notably, the company revealed that it is seeking a partnership deal in order to advance its 3rd pipeline asset CB-708, an ecto-5'-nucleotidase (CD73) inhibitor into the clinic. Pre-clinically, the small molecule has shown some promise when compared to the more common approach of antibody inhibition of this target. AstraZeneca's (AZN) antibody, MEDI9447, is the most clinically advanced of the bunch. However, it appears that an antibody approach here is a sub-optimal means to inhibit this extracellular enzyme.

Of course, there is also a significant advantage of small molecules over antibodies in terms of manufacturing and patient compliance. Small molecules can be administered orally, which makes CB-708 a more marketable product, should this candidate achieve approval one day. CD73 is broadly expressed across a number of tumor types, including, but not limited to: colon, pancreatic, lung, and head and neck.

Patients with mutations in the RAS and EGFR pathways tend to carry a high expression of CD73 per studies performed by Arcus Biosciences (RCUS). It is known that patients harboring EGFR mutations are unresponsive to standard checkpoint inhibitors (see here), making CD73 an especially attractive IO target in these patients. In all, we feel that CB-708 should garner some strong interest from potential partners, given the appeal of the target and strength of the preclinical model.

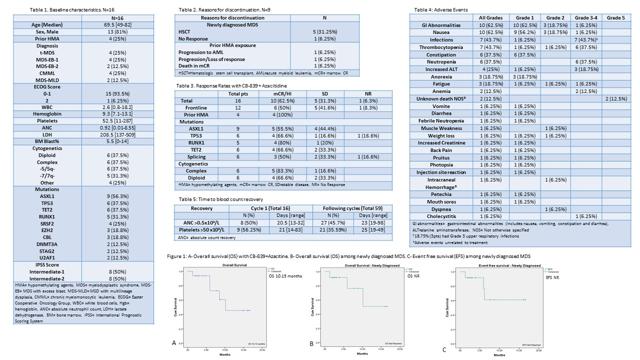

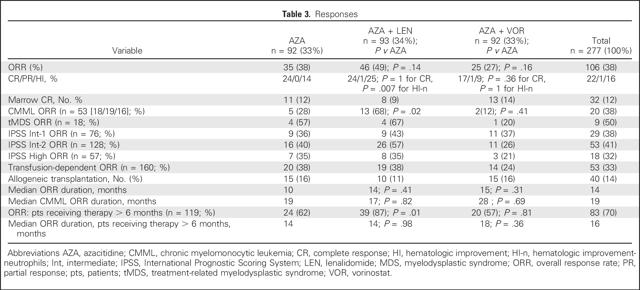

On the company's last earning's call, another catalyst to watch with this name is the rather under covered investigator-sponsored trial of Telaglenastat in combination with Azacitidine (Vidaza) performed by The MD Anderson Cancer Center. We are anticipating an update to the promising abstract posted on the American Society for Hematology (ASH) website. The abstract, which is shown below, demonstrates a high complete response rate of 62.5% achieved in a median of just one cycle along with a transplantation rate of 31.25%. These numbers compare favorably to the CALGB 9221 study.

The second company on our radar is probably the highest risk and highest reward proposition of the two we are covering here in this write-up.

Curis (CRIS) has a somewhat checkered history, but has recently made some significant changes to turn the company around. Notably, the company has installed new management, restructured financing, and has refocused efforts on two key programs, Fimepinostat, and CA-4948.

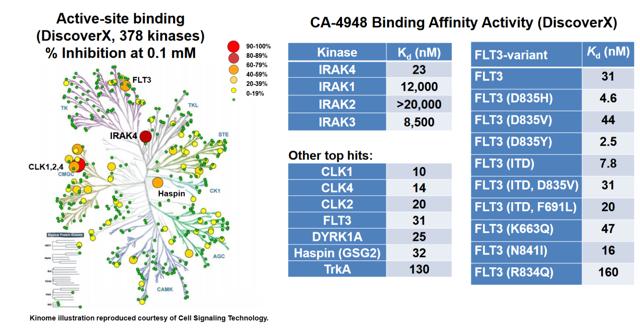

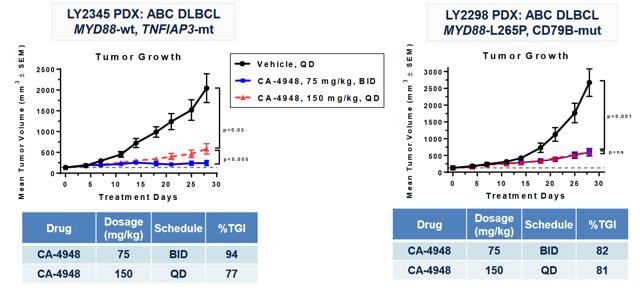

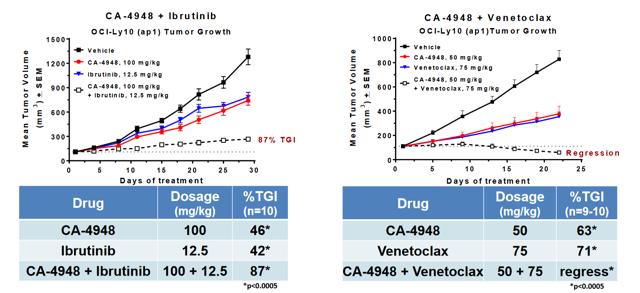

Of particular interest to us is CA-4948, an interleukin-1 receptor-associated kinase 4 (IRAK4) inhibitor. IRAK4 has long been considered one of the 'holy grail' targets in oncology, with multiple companies attempting to generate therapeutics against it. The first generation of IRAK4 approaches mostly have failed in preclinical toxicology studies. More recently, some progress has been made in generating tolerable inhibitors against this target, including Pfizer's (NYSE: PFE) program, PF-06650833 in Rheumatoid Arthritis. As well, CRIS has posted data at SOHO.

In an abstract published in the Blood Journal, the company has indicated that at least 2 patients at the 200 mg BID dose level as well as 3 patients at lower dose levels have demonstrated anti-tumor activity (≥20% tumor reduction from baseline). According to recent calls, efficacy is tracking ahead of the mouse model, which would be rather promising for the 400 mg BID dose level. This is an approximate equivalent to the 75 mg/kg BID dose tested in mice. If this model holds and the company is correct in its assessment, we would expect deep single-agent responses at the 400 mg BID dose level. Promisingly, on the latest earnings call, CRIS indicated that The Maximum Tolerated Dose (MTD) has so far not been reached even at the 400 mg dose level.

CRIS has also stated an intention to explore mutations such as SF3B1 and U2AF1 which drive oncogenic IRAK4-L in AML. This could be a compelling niche for the company to explore on its own accord. Given the company's financial position of $28 M in the bank now (they need a few million more to be comfortable engaging new trials), we anticipate an update on CA-4948 during ASH to be followed by financing, if the data provides support to do so. After this, CRIS would be in a better position to negotiate a potential partnership for combinations as well as expanding clinical experience with CA-4948.

As exemplified by the current runs of a few early-stage biotech companies, these stocks can appreciate rather quickly, generating a massive return in a short period of time. However, these stocks are also very risky, and one can lose everything they put up in these types of companies if making an investment over a trade.

We see CALA as the more stable of the 2, while we see CRIS as the more risky play, but with a higher short-term reward. CALA has several shots on goal with approx. $133.6 M in cash/cash equivalents. CRIS, as mentioned prior, has about $28 M in cash/cash equivalents with two shots on goal. But, if CRIS hits on one of their shots, we think the valuation could 5 to 10 bag from the $1.50 range. CALA may 3 to 5 bag from here, but would not expect to see that until at least mid-year next year.

Valuation Measures - Calithera

| Current | |

|---|---|

| Market Cap (intraday) | 226.39M |

| Enterprise Value | 82.56M |

| Trailing P/E | N/A |

| Forward P/E | -2.77 |

| PEG Ratio (5 yr expected) | -0.03 |

| Price/Sales (TTM) | ∞ |

| Price/Book (mrq) | 1.88 |

| Enterprise Value/Revenue | N/A |

| Enterprise Value/EBITDA | -0.92 |

Balance Sheet - Calithera

| Total Cash (mrq) | 133.59M |

| Total Cash Per Share (mrq) | 2.48 |

| Total Debt (mrq) | 8.58M |

| Total Debt/Equity (mrq) | 7.11 |

| Current Ratio (mrq) | 7.39 |

| Book Value Per Share (mrq) | 2.24 |

Share Statistics - Calithera

| Avg Vol (3 month) | 391.01k |

| Avg Vol (10 day) | 460.85k |

| Shares Outstanding | 53.78M |

| Float | 44.19M |

| % Held by Insiders | 1.31% |

| % Held by Institutions | 67.90% |

| Shares Short (Oct 30, 2019) | 1.78M |

| Short Ratio (Oct 30, 2019) | 3.92 |

| Short % of Float (Oct 30, 2019) | 5.24% |

| Short % of Shares Outstanding (Oct 30, 2019) | 3.32% |

| Shares Short (prior month Sep 29, 2019) | 1.49M |

Valuation Measures - Curis

| Market Cap (intraday) | 54.78M |

| Enterprise Value | 23.2M |

| Trailing P/E | N/A |

| Forward P/E | N/A |

| PEG Ratio (5 yr expected) | N/A |

| Price/Sales (TTM) | 5.78 |

| Price/Book (mrq) | N/A |

| Enterprise Value/Revenue | 2.45 |

| Enterprise Value/EBITDA | -1.05 |

Share Statistics - Curis

| Avg Vol (3 month) | 167.28k |

| Avg Vol (10 day) | 299.3k |

| Shares Outstanding | 33.2M |

| Float | 24.54M |

| % Held by Insiders | 17.28% |

| % Held by Institutions | 24.15% |

| Shares Short (Oct 30, 2019) | 189.04k |

| Short Ratio (Oct 30, 2019) | 2.12 |

| Short % of Float (Oct 30, 2019) | 0.69% |

| Short % of Shares Outstanding (Oct 30, 2019) | 0.57% |

| Shares Short (prior month Sep 29, 2019) | 287.49k |

Balance Sheet - Curis

| Total Cash (mrq) | 28.01M |

| Total Cash Per Share (mrq) | 0.84 |

| Total Debt (mrq) | 409k |

| Total Debt/Equity (mrq) | N/A |

| Current Ratio (mrq) | 6.93 |

| Book Value Per Share (mrq) | -0.78 |

CALA's market cap is currently around $226 M, while CRIS is nearly $55 M - this is quite a large difference in early valuation.

CRIS is basically going to be a big hit or a total bust because, without IRAK 4 success, the company will not be able to raise the money needed to advance its pipeline. In other words, with early successful data here in which we are predicting, the company will almost certainly engage a stock raise. CALA, on the other hand, has a good amount of cash and cash equivalents on hand to get them through the next 12 to 16 months quite comfortably in addition to multiple Investigator sponsored trials, which incur a little cost to the company. However, CALA's main risk is its CANTATA trial, which has 445 patients enrolled and will read out data 2nd half of next year. If this data hits as we think, CALA will be in a great position, but a failure in this data will leave the company short on cash forcing it to raise cash at less than optimal levels. Cash raises are part of developmental biotech. We want to see companies engage in them properly in order so they can be financed correctly. But raising cash after failed data normally results in years of misery for their holders and potentially could mean ultimate failure.

Developmental biotech can certainly reward investors with drastic and sudden riches, but can as equally bring drastic and sudden depreciation, which goes the old story, "rags to riches, riches to rags."

Disclosure: I am/we are long CRIS, CALA.

This article/video is intended for informational and entertainment use only, and should not be construed as professional investment advice. They are ...

more

Nice find.