2 Intriguing Medical Stocks To Buy For Steady Growth As Earnings Approach

Image Source: Unsplash

Among the medical sector, Alcon (ALC - Free Report) and Prestige Consumer Healthcare (PBH - Free Report) are two intriguing stocks to buy for growth as their quarterly results approach on Tuesday, May 14.

Alcon stands out as a provider of a full suite of eye care products while Prestige distributes over-the-counter (OTC) healthcare and household cleaning products. Let’s take a look at their expansion and get a better gauge as to why now is a good time to buy Alcon and Prestige’s stock.

Alcon Preview

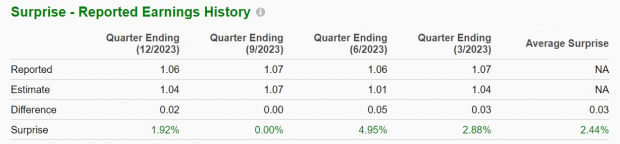

Alcon primarily provides ophthalmic products for various eye surgeries and along with its contact lenses has a comprehensive portfolio of ocular health products for dry eye, allergies, and redness. First-quarter sales are projected to rise 5% to $2.46 billion with Q1 earnings expected to be up 3% to $0.72 a share. Notably, Alcon has surpassed the Zacks EPS Consensus in three of its last four quarterly reports with Q4 earnings of $0.70 a share most recently beating bottom-line expectations by 3% in February.

Image Source: Zacks Investment Research

Prestige Preview

Through its subsidiaries, Prestige has a wide range of OTC products with some of its major brands including BC/Goody’s analgesic powders, Boudreaux’s baby ointments, Chloroacetic sore throat treatments and mouth pain products, and Clear Eyes eye care products among others.

Reporting its fiscal fourth quarter results on Tuesday, Prestige’s Q4 sales are expected to slightly increase to $286.91 million compared to $285.87 million in the comparative quarter. Even better, Q4 EPS is projected to expand 6% to $1.14. Prestige has also surpassed its bottom line expectations in three of its last four quarterly reports with Q3 EPS of $1.06 most recently exceeding estimates by 2% in February.

Image Source: Zacks Investment Research

Growth Trajectories

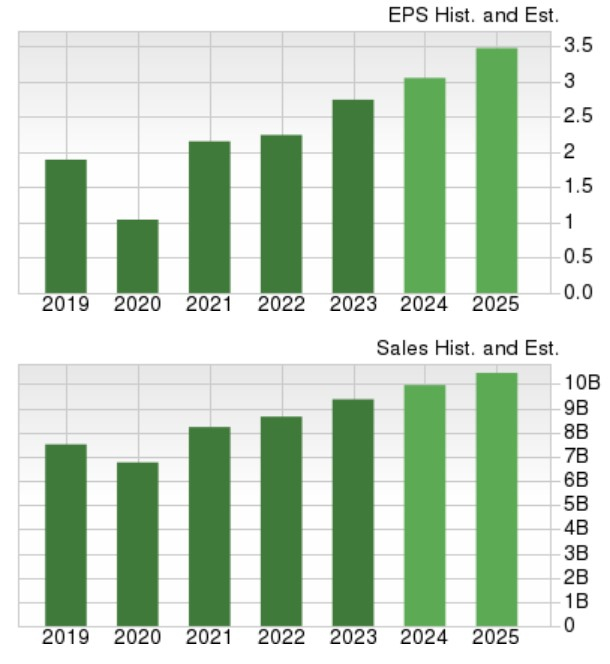

Further illustrating their steady growth is that Alcon’s total sales are projected to increase 6% in fiscal 2024 with the company’s top line expected to expand another 6% in FY25 to $10.56 billion. More impressive, annual earnings are forecasted to jump 11% this year to $3.05 per share with another 14% EPS growth projected in FY25.

Image Source: Zacks Investment Research

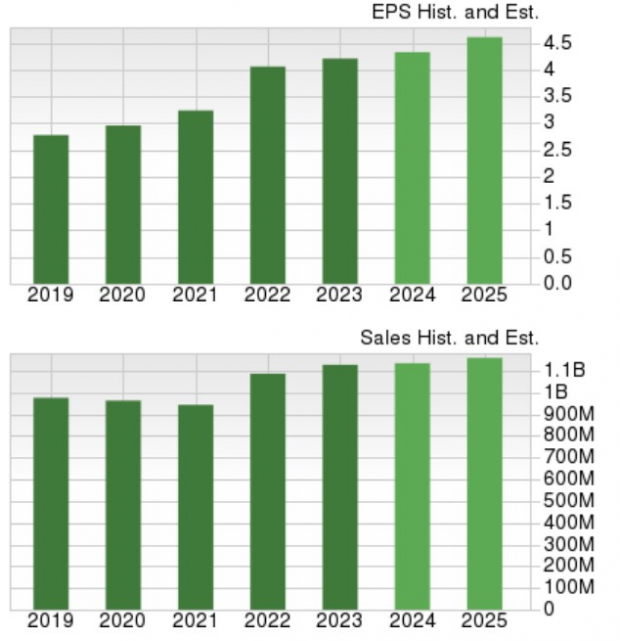

As for Prestige, total sales are expected to be virtually flat in FY24 but are projected to rise 2% in FY25 to $1.16 billion. Prestige’s annual earnings are now forecasted to increase by 3% this year and are expected to rise another 6% in FY25 to $4.61 per share.

Image Source: Zacks Investment Research

Takeaway

Experiencing lofty expansion in recent years, investors shouldn’t overlook the steady growth of Alcon and Prestige Consumer Healthcare. To that point, both stocks sport a Zacks Rank #2 (Buy) ahead of their quarterly reports on Tuesday.

More By This Author:

3 IT Services Stocks To Buy From A Challenging Industry4 Paper & Related Products Stocks To Watch In The Promising Industry

Tsakos Energy Laps the Stock Market: Here's Why

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more