2 Highly Ranked Stocks To Buy After Earnings: AROC, MNDY

Image Source: Unsplash

Holding spots on the Zacks Rank #1 (Strong Buy) list, Archrock (AROC - Free Report) and Monday.com (MNDY - Free Report) are two stocks to consider after reporting their Q3 results on Monday.

As intriguing prospects among the energy and tech sectors, respectively, let’s review Archrock and Monday.com’s Q3 results to see why now is a good time to buy.

Archrock’s Natural Gas Services

Archrock’s expansion has become appealing among the Zacks Oil and Gas-Field Services Industry which is in the top 32% out of 250 Zacks industries.

Providing natural gas contract compression services, Archrock reached its Q3 earnings expectations of $0.28 a share. This was a pleasant increase from EPS of $0.20 in the prior-year quarter. On the top line, Q3 sales of $292.16 million rose 15% year over year despite slightly missing estimates of $292.95 million.

AROC has soared over +50% year to date but still trades under $25 and at a reasonable 22.1X forward earnings multiple. Archrock’s impressive YTD performance could continue as fiscal 2024 and FY25 EPS estimates have risen 6% and 9% in the last 30 days respectively.

Annual earnings are now projected to soar 59% this year and are slated to expand another 37% in FY25 to $1.50 per share. Reassuringly, total sales are projected to increase by over 15% in FY24 and FY25 with projections edging north of $1 billion.

Image Source: Zacks Investment Research

Monday.com’s Software Applications

Allowing organizations to build software applications and work management tools, Monday.com has thrust itself into the conversation of up-and-coming tech stocks to consider.

Even better, Monday.com’s Zacks Internet-Software Industry is in the top 18% of all Zacks industries. Indicative of such, Monday.com was able to post Q3 EPS of $0.85 which crushed the Zacks Consensus of $0.61 by 39% and soared from $0.64 a share in the prior period. Q3 sales of $251 million beat estimates of $245.67 million and spiked 32% from $189.19 million a year ago.

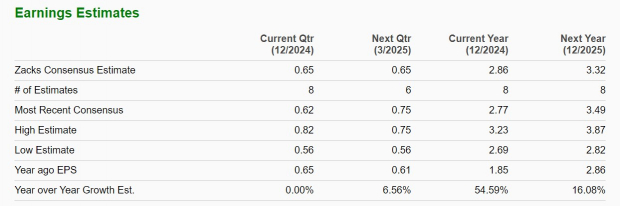

Also benefitting from a positive trend of earnings estimate revisions, Monday.com's increased profability is being fueled by expectations of high double-digit top line growth in FY24 and FY25 .

Image Source: Zacks Investment Research

Like Archrock, Monday.com’s annual sales are edging toward $1 billion with the company’s future earnings potential starting to compel investors.

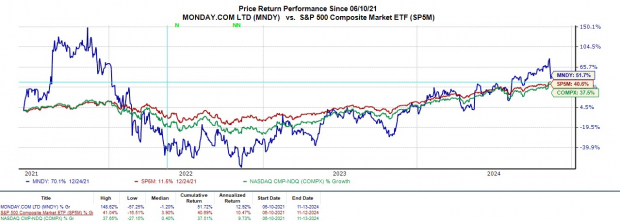

To that point, MNDY is sitting on +40% gains in 2024 and has skyrocketed over +150% in the last two years. Seeing nice momentum, Monday.com has been one the best-performing IPOs in recent years with its stock up +50% since going public in June of 2021.

Image Source: Zacks Investment Research

Bottom Line

As two top-performing stocks this year, Archrock and Monday.com are certainly worthy of consideration after posting impressive quarterly growth. With their earnings estimate revisions remaining higher, the rally in AROC and MNDY may continue.

More By This Author:

Cisco Systems Surpasses Q1 Earnings And Revenue EstimatesHome Depot Tops Q3 Earnings And Revenue Estimates

Internet Services Industry Is Hot: Buy Shopify, Alphabet, Uber

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more