2 Highly Ranked Restaurant Stocks That Can Fulfill Investors' Appetites

Image Source: Pixabay

Among the Zacks Rank #1 (Strong Buy) list, Brinker International (EAT - Free Report) and Texas Roadhouse (TXRH - Free Report) are two stocks that stand out in terms of growth.

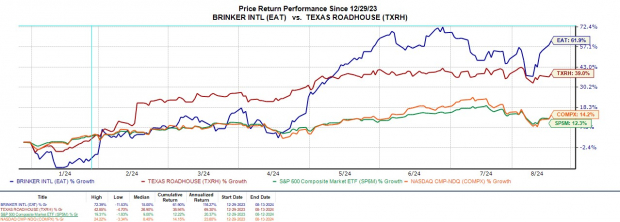

Seeing increased traffic, these retail restaurant stocks should fulfill investors' appetites with their expansion. To that point, Brinker International’s stock has soared +62% this year with Texas Roadhouse shares up nearly +40%.

Image Source: Zacks Investment Research

Higher Traffic at Chile’s is Driving Brinker International’s Growth

Brinker International’s momentum has been attributed to traffic-driving initiatives and improved operational performance at its Chile’s Bar and Grill locations with the company also operating Maggiano’s Little Italy.

Chile’s low-cost meal offerings have been a go-to for consumers with Brinker stating the American-style restaurant beat the industry sales average by 7% during its most recent fiscal third quarter report while topping traffic averages by 4%.

Notably, Brinker will be reporting its Q4 results on Wednesday, August 14 with quarterly sales expected to be up 7% to $1.16 billion. More impressive, Q4 earnings are slated to spike 19% to $1.65 per share compared to EPS of $1.39 in the comparative quarter. Brinker has exceeded earnings expectations for seven consecutive quarters posting an astonishing average EPS surprise of 213.35% in its last four quarterly reports.

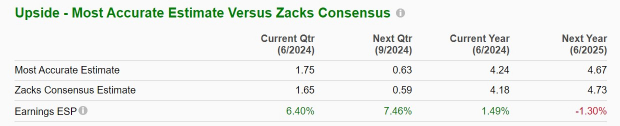

Image Source: Zacks Investment Research

The Zacks ESP (Expected Surprise Prediction) indicates this impressive streak could continue with the Most Accurate Estimate having Q2 EPS pegged at $1.75 and 6% above the Zacks Consensus.

Image Source: Zacks Investment Research

Bubba’s 33 is Fueling Texas Roadhouse’s Growth

Able to exceed its Q2 top and bottom line expectations in late July, Texas Roadhouse’s growth has been lifted by its sports bar brand Bubba’s 33. Complementing its namesake steak restaurants, Bubba’s 33 has been one of the fastest-growing sports bars in the US with Texas Roadhouse stating the chain brought in $123,000 in weekly sales during Q2.

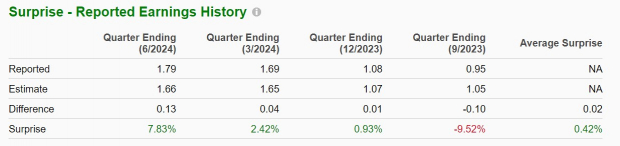

This helped Texas Roadhouse post Q2 sales of $1.34 billion which met estimates and rose 14% year over year. Earnings of $1.79 per share soared 47% from Q2 EPS of $1.22 a year ago and beat estimates by 8%. Texas Roadhouse has exceeded earnings expectations in three of its last four quarterly reports posting an average EPS surprise of 0.42%.

Image Source: Zacks Investment Research

EPS Outlook

Tracking their increased probability, Brinker International’s annual earnings are now expected to soar 48% in fiscal 2024 to $4.18 per share versus EPS of $2.83 last year. Furthermore, FY25 EPS is projected to expand another 13%.

More intriguing is that FY24 earnings estimates are up 4% in the last 60 days with FY25 EPS estimates spiking 6%.

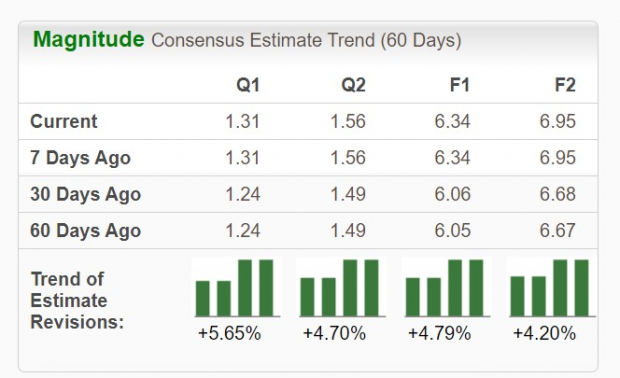

Image Source: Zacks Investment Research

As for Texas Roadhouse, 40% EPS growth is expected this year with projections at $6.34 per share compared to $4.54 a share in 2023. Plus, FY25 EPS is slated to increase another 9%. Better still, FY24 and FY25 EPS estimates have risen over 4% in the last 60 days respectively.

Image Source: Zacks Investment Research

Bottom Line

Rising earnings estimate revisions are a very positive sign that the strong price performances of Brinker International and Texas Roadhouse stock could continue. This attributes to their strong buy ratings and makes now an ideal time to invest in these retail restaurant leaders.

More By This Author:

3 Communication Services Funds To Buy As Rate Cuts Draw Near3 Crypto Stocks To Watch As Bitcoin Stages A Comeback

Bear of the Day: Robert Half Inc.

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more