2 Great Value Stocks To Buy In April And Hold For Years

The S&P 500 and the Nasdaq surged to end March as Wall Street scoops up tech stocks. The wave of buying and the impressive quarter has some pockets of the market overheated, especially considering the economic unknowns ahead. Therefore, we dig into two highly-ranked Zacks stocks—Humana (HUM - Free Report) and O-I Glass, Inc. (OI - Free Report) —that offer investors great value, alongside the ability to thrive in all types of economic conditions.

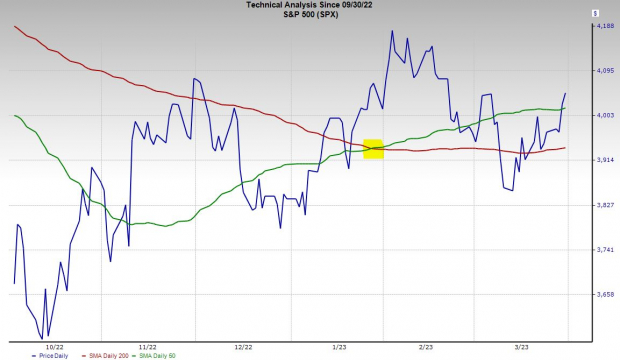

The Nasdaq has soared around 16% YTD, with the benchmark up roughly 6%. Both are once again trading above their 50-day and 200-day moving averages and sit at other technical levels that make it more difficult to be a bear.

Wall Street thinks the Silicon Valley Bank-related issues have been contained and see the increased financial tightening that will come along with it as a net positive. Despite some legitimate disputes on what the Fed will do next, most are sure Jay Powell will be far less hawkish for the remainder of the year.

Wall Street also liked what it saw from the PCE and consumer spending data on Friday morning.

Image Source: Zacks Investment Research

All that said, the market could face near-term selling pressure with some tech stocks trading at rather overheated levels. There are also many other possible headwinds ahead, including how first quarter 2023 earnings results and guidance come in.

With this in mind, investors likely want to stay exposed to the broadly upbeat market, while not chasing some of the overbought names in the short term.

Humana Inc. (HUM) is a health insurance firm that offers a wide range of plans for Medicare, Medicaid, and beyond. In short, healthcare needs won’t stop even if the economy slows. Plus, the U.S. is only going to spend more on healthcare for an aging population, which fits directly into Humana’s core business.

Humana averaged 12% revenue growth in the past five years, including 12% expansion in 2022. Zacks estimates call for HUM’s sales to climb 12% in 2023 and another 9% in 2024 to help boost its adjusted earnings by 11% and 13%, respectively. HUM’s positive earnings revisions help it land a Zacks Rank #2 (Buy) and it has continued to raise its dividend while maintaining a very sustainable payout ratio.

Humana has crushed the market over the last decade and it currently trades 13% below its November peaks. Better yet, HUM trades at 16.8X forward 12-month earnings, which marks 30% value vs. its own 10-year highs and 10% vs. its median.

O-I Glass, Inc. (OI) is one of the top producers of glass bottles and jars on the planet, working with some of the leading food and beverage brands. Glass containers aren’t going anywhere, and O-I Glass is in the midst of a revamp to “unlock” more shareholder value.

OI’s revenue climbed 8% last year and it upped its earnings guidance to help it land a Zacks Rank #1 (Strong Buy) right now. Zacks estimates call for O-I Glass to post 5.5% higher revenue in 2023 and 12% stronger adjusted earnings.

O-I Glass shares have jumped 35% YTD and 70% over the last year, which is part of a 250% run during the past 36 months. At around $22.50 a share, OI sits 15% below its average Zacks price target. OI also trades at a roughly 50% discount to the Zacks industrial products sector and 20% below its own five-year highs at 8.9X forward earnings.

More By This Author:

2 Highly-Ranked, Market-Beating Value Stocks To Buy Amid Bank FearsBull Of The Day: Meta Platforms, Inc.

Market-Beating Stocks To Buy For March And Hold

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more