2 Former Pandemic Darlings Poised To Lead Again

Image: Bigstock

COVID-19 Accelerated Certain Industries by Years

The COVID-19 pandemic significantly impacted online business, healthcare, and software.

In terms of online business, the pandemic sped up the migration towards e-commerce and digital marketplaces. Because traditional brick-and-mortar stores were closed or operating at a limited capacity, many consumers were forced to turn to online mediums to shop. Companies such as Amazon (AMZN - Free Report) and Etsy Inc (ETSY - Free Report) were the main beneficiaries.

From a healthcare perspective, the pandemic underscored the significance of telemedicine and virtual consultations. Electronic health records and other forms of digital healthcare have become more popular. The unusual circumstances sent telehealth stock Teledoc (TDOC - Free Report) into the stratosphere.

Remote work has ushered in the era of video conferencing, project management, and other software. In software, the onset of a widespread work-from-home culture brought about soaring demand for remote work collaboration tools.

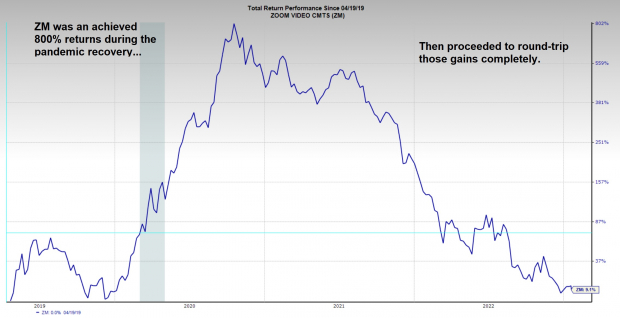

Furthermore, the pandemic drove more companies to adopt cloud computing technologies. As a result, stocks like video conferencing leader Zoom Video (ZM - Free Report) and Twilio Inc (TWLO - Free Report) went on meteoric runs.

Easy Money, Stimulus, and a New Generation of Investors

Immediately after the pandemic news broke, stocks cratered but soon reversed strongly with the help of the Federal Reserve and stimulus packages like the Paycheck Protection Program (PPP). As investors realized that technology would potentially be pushed ahead by years, the S&P 500 Index doubled over the next few years. With nearly the entire domestic workforce sitting at home with little to do, a new class of investors was born.

Unfortunately, valuations got crazy, inflation reared its ugly head, and darlings like Zoom would go on to get crushed.

Image Source: Zacks Investment Research

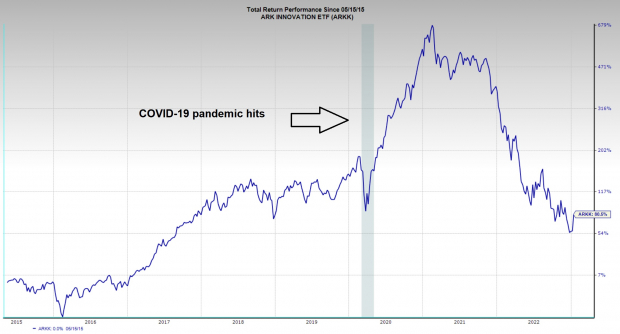

The actively managed Ark Innovation ETF (ARKK - Free Report), which came to prominence during the pandemic, would suffer a similar fate as Zoom.

Image Source: Zacks Investment Research

As time passes, some of the pandemic darlings will go the way of CMGI and Pets.com after the dot com bubble, while others will rise again to lead the market.

Turnaround Time?

Shopify (SHOP - Free Report) is the dominant cloud-based, multi-channel e-commerce platform for small and medium-sized businesses. Merchants use the company’s software to run businesses across various sales channels, including web and mobile storefronts, physical retail locations, and social media storefronts.

Since cratering with most tech stocks over the past year, Shopify is beginning to shape up from a technical perspective. While stocks like Teledoc and Zoom remain well below their 200-day moving averages, Shopify shares have regained it. The stock is also testing its pre-pandemic breakout zone – an area of price support.

Image Source: Zacks Investment Research

The e-commerce growth rate is anticipated to return to normal levels – but not higher than the super performance achieved during the pandemic itself when shoppers were forced to shop online.

Nonetheless, shares have corrected more than 70% over the past year. Meanwhile, Shopify’s revenue growth remains healthy (+22% last quarter), and analysts anticipate that EPS growth will pick back up in the coming quarters.

Image Source: Zacks Investment Research

Zillow Group (ZG - Free Report) provides real estate information to prospective buyers and sellers via mobile and its website Zillow.com. Shares of the stock have had a rough go of it recently – falling from a high of more than $220 to a low of $26 before rebounding.

Image Source: Zacks Investment Research

While nothing materially had changed with Zillow’s existing business, in 2018, the company decided to begin purchasing homes to become a market maker. The idea was a disaster and led to management selling the entire inventory of 7,000 homes for a loss equating to upwards of $400 million and massive company-wide layoffs.

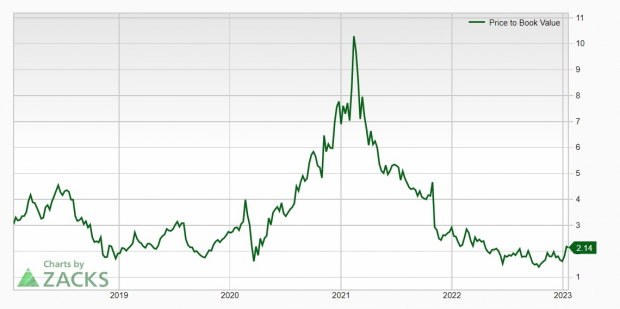

Even with the flipping debacle, the company has retained profitability annually since 2019. Furthermore, its valuation is very attractive after shares have dropped. ZG’s price to book has cratered from more than 10 to 2.14 currently – matching levels its saw during the pandemic.

Image Source: Zacks Investment Research

Conclusion

Zillow and Shopify offer investors interesting investments due to their contrarian nature, attractive valuations, and strong underlying businesses. Investors interested in owning these stocks can use the 200-day moving average level as a risk guide to start.

More By This Author:

D.R. Horton To Report Q1 Earnings: Here's What To ExpectLooking Beyond Profit: Bet On These 4 Stocks With Increasing Cash Flows

The Charles Schwab Corporation Misses Q4 Earnings And Revenue Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more