2 Consumer Discretionary Stocks Poised To Cruise Higher

Image Source: Unsplash

Two consumer discretionary stocks that have made their way onto the Zacks Rank #1 (Strong Buy) list in the last month and looked poised to move higher are cruise line operators Norwegian Cruise Line (NCLH - Free Report) and Royal Caribbean Cruises (RCL - Free Report).

To that point, the spring and summer represent peak travel season for leisure and recreation activities with Norwegian and Royal Caribbean’s stock starting to look undervalued at their current levels.

Post-Pandemic Recovery & Growth Trajectories

More than three years removed from the height of the COVID-19 pandemic, the recovery of the broader cruise industry appears to be in full swing.

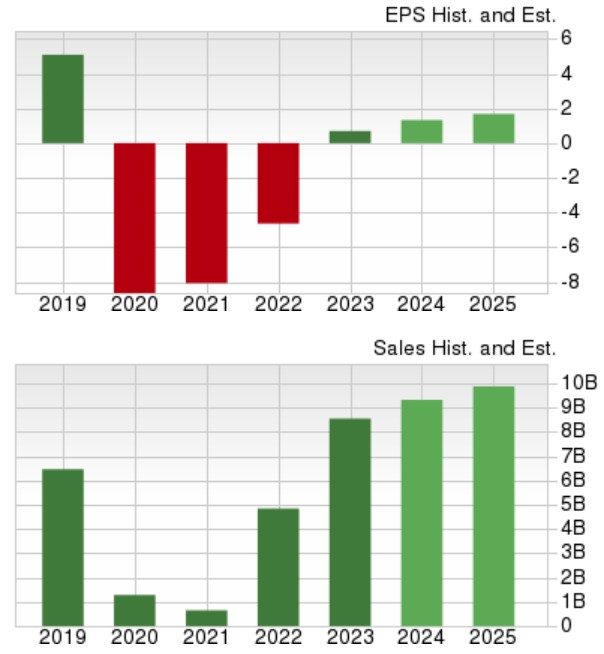

Notably, Norwegian’s total sales are expected to be up 9% in fiscal 2024 and are projected to rise another 6% in FY25 to $9.93 billion. More importantly, Norwegian’s annual earnings are forecasted to soar 94% this year to $1.36 per share versus $0.70 a share in 2023. Plus, FY25 EPS is projected to jump another 27% to $1.73 a share.

While Norwegian’s bottom line is still some distance from pre-pandemic earnings of $5.09 a share in 2019, the company has surpassed pre-COVID sales of $6.46 billion that year.

Image Source: Zacks Investment Research

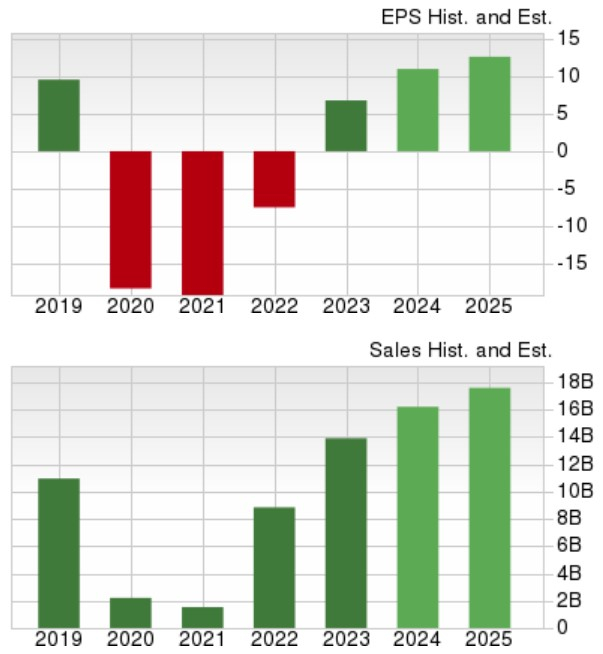

As for Royal Caribbean, its top line is expected to expand 16% in FY24 and is projected to rise another 9% in FY25 to $17.63 billion. Even better, Royal Caribbean’s annual earnings are projected to climb 62% in FY24 to $10.96 per share compared to $6.77 a share last year. Furthermore, another 15% EPS growth is expected in FY25. It’s also noteworthy that Royal Caribbean is set to surpass pre-pandemic earnings of $9.54 a share in 2019 and has also surpassed pre-COVID sales of $10.95 billion.

Image Source: Zacks Investment Research

Attractive P/E Valuations

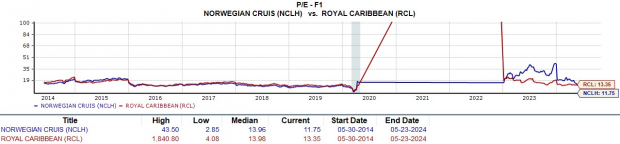

Making the post-pandemic recovery in Norwegian and Royal Caribbean’s stock stand out even more is their reasonable P/E valuations. In this regard, Norwegian’s stock trades at 11.7X forward earnings with Royal Caribbean at 13.3X which is a nice discount to their Zacks Leisure and Recreation Services Industry average of 18.7X and the S&P 500’s 22.1X.

Image Source: Zacks Investment Research

Bottom Line

On top of their recovery and attractive P/E valuations, earnings estimate revisions have continued to trend higher for Norwegian Cruise Line and Royal Caribbean’s FY24 and FY25. This supports the notion that Norwegian and Royal Caribbean’s stock look cheap and should have more upside from current levels.

More By This Author:

Nvidia Stock: Cheaper Than It Was A Year Ago

5 Reasons To Buy Nvidia's Stock After Strong Q1 Results

Time To Buy The Dip In These Top-Rated Retail Stocks

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more