2 Cheap Stocks To Buy And Hold During The Market Rebound

Image: Bigstock

The S&P 500 has surged nearly 9% in roughly two weeks and it closed regular trading on Friday around 6% below its records. The benchmark is now back above its 200-day moving average as the bulls continue to buy beaten-down stocks amid the ongoing Russian invasion of Ukraine.

The tech-heavy Nasdaq has ripped off a nearly 13% climb since March 14 (above its 200-day), driven by big gains from technology titans. Wall Street is apparently pleased enough with the Fed’s updated rate-hike outlook, having accepted the official end of the super easy-money days.

Yields on the 10-year U.S. Treasury are already up near three-year highs at 2.5%, and rising interest rates should make stocks less attractive. Still, real yields are deeply negative when factoring in almost 8% inflation.

Investing in bonds or hoarding cash might not be as prudent as some might assume, with interest rates still historically low and inflation at 40-year highs. This backdrop could leave Wall Street possibly chasing returns in equities for the foreseeable future.

Volatility seems likely to remain elevated given rising prices across the economy, coupled with a new, changing rate environment and the geopolitical chaos.

Investors who want to add stocks to their portfolios as we head into the second quarter might consider dividend-paying stocks with solid valuations that are also poised to grow. Today, we look at two stocks that fit the criteria and are also cheap.

Image Source: Zacks Investment Research

Graphic Packaging Holding Company (GPK - Free Report)

Graphic Packaging is a sustainable paper-based packaging firm with a portfolio of products that services companies in the food, beverage, foodservice, and consumer product spaces. GPK boasts that it’s one of the biggest producers of folding cartons and paper-based foodservice products, with leading market positions in solid bleached sulfate paperboard, coated unbleached kraft paperboard, and coated-recycled paperboard.

The company in 2021 completed its acquisitions of both AR Packaging and Americraft to expand its reach. Graphic Packaging’s revenue climbed 9% in 2021 after it popped 7% in 2020 to extend its streak of year-over-year sales expansion to six years running.

Looking ahead, Zacks estimates call for its FY22 revenue to jump 22% (driven by its acquisitions) to reach $8.8 billion, with FY23 projected to come in 2% higher. Meanwhile, its adjusted earnings are projected to surge 74% and 8%, respectively, and its FY22 and FY23 consensus estimates have climbed since its Q4 release.

Image Source: Zacks Investment Research

Graphic Packaging stock is up 3% in 2022 to outpace its industry and the market’s decline. GPK shares have also climbed 58% in the past five years to top its highly-ranked Paper and Packaging industry’s 5% decline. At roughly $20 a share, GPK trades about 6% below its own records and 17% beneath its current Zacks consensus price target. Plus, nine of the 14 brokerage recommendations Zacks has are “Strong Buys.”

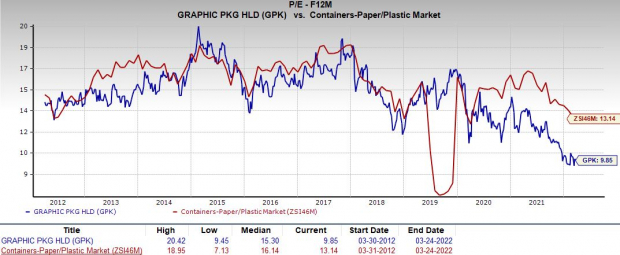

Graphic Packaging, which lands a Zacks Rank #3 (Hold) at the moment, pays a dividend that’s yielding 1.5% to top the S&P 500 average. On top of its $20 price tag, GPK has been trading right at its decade-long lows at 9.9X forward 12-month earnings. This represents a 50% discount to its own highs during this stretch and 25% vs. its industry, despite its outperformance and its own 265% run in the last 10 years.

Runway Growth Finance Corp. (RWAY - Free Report)

Runway Growth Finance is a leading provider of flexible capital solutions to late-stage and growth companies that are looking for an alternative to raising equity. RWAY went public in October and aims to lend capital to companies that are looking for investments to aid in their growth with minimal dilution. The company posted strong fourth quarter and full-year fiscal 2021 financial results in early March.

Runway Growth closed 2021 with an investment portfolio that had an aggregate fair value of roughly $729.5 million, made up of $635.9 million in term loans, 98% senior secured, and $48.6 million in warrants and equity-related investments in 39 portfolio companies. Its annual investment income (or revenue) jumped 24% to $71.4 million vs. 2020, and it provided upbeat guidance.

Runway Growth is set to benefit from rising interest rates going forward. And chief executive David Spreng said in prepared remarks that it will “continue to capitalize on industry tailwinds created from the historically strong momentum in the growth debt landscape.”

Zacks estimates call for Runway Growth’s revenue to climb 36% this year and another 55% in 2023 to hit $151 million. RWAY’s adjusted earnings are expected to jump 15% in 2022 and 37% in 2023 to hit $1.77 a share.

Image Source: Zacks Investment Research

The company’s positive earnings revisions activity helps RWAY land a Zacks Rank #2 (Buy). Runway upped its dividend by 8% to $0.27 a share for its March payout. This is good enough for a forward annual dividend yield of a whopping 7.4% that crushes the 10-year and 30-year U.S. Treasuries. Plus, all seven of the brokerage recommendations Zacks has are “Strong Buys.”

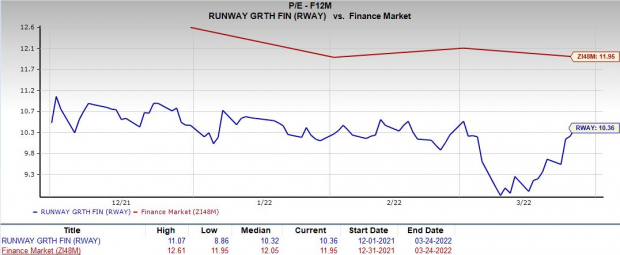

Runway shares are up about 14% since their debut, including a 20% jump since March 8 to trade at roughly $14.65 per share at the end of regular trading Friday. The stock also trades at a slight discount to its industry at 10.4X forward 12-month earnings vs. 11.9X.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more