$2 Billion Hedge Fund Loses Nearly Half After Carvana Plummets 75% In 2022

Image Source: Pexels

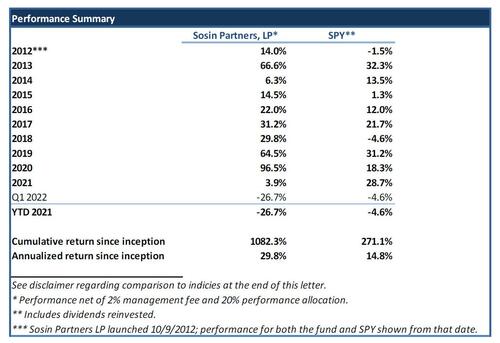

For a vivid example of a hedge fund that has previously prospered but is now imploding, look no further than CAS Investment Partners, a Westport-based hedge fund which had "grown" more than 1000% since its inception in October of 2012. Yet, this hedge fund has lost nearly half of its assets in just the past four months, thanks to a heavily concentrated portfolio of stocks. However, this is mostly due to the novelty used car dealer Carvana.

CAS -- which is based on the initials of its 40-year-old founder, Clifford Sosin -- had built up a huge (for a small hedge fund) 3.3 million share stake in Carvana in 2019 and early 2020. This stake grew to over $1 billion in August 2021 when CVNA stock topped $350, and it accounted for a quarter of the fund's AUM as of March 31.

However, since then, things have gone from bad to worse. After dropping to $250/share by year-end, Carvana has plunged another 75% in 2022. The stock tumbled another 10% on Friday as traders grew concerned that the company equity may be worthless, and it appears a debt-for-equity swap is inevitable (and there is a lot of debt to be swapped), especially if the used car market is just now starting to crack.

The crash in CVNA shares, and the resulting collapse in the CAS hedge fund, must have prompted a barrage of angry investors, which culminated on Friday in a 25-page letter written by Sosin, in which he writes that Carvana's troubles are transitory and that all will be well soon.

“Carvana’s challenges, especially when coupled with the precipitous decline in its stock price, clearly seem terrifying,” Sosin wrote in the letter. However, he stated, “I believe that in due time we will look back at them as bumps in the road on the company’s path to success.”

Sosin, who started his career in the Houlihan Lokey restructuring group in 2004, declined to comment to Bloomberg.

Carvana, which was once a 'pandemic darling,' has since fallen out of favor. Its first-quarter results revealed a deepening cash burn, stemming from surges in used-vehicle prices and capital spending. Meanwhile, after peaking a few months ago, used car prices appear set to plunge in the coming months now that the US consumer is fully tapped out.

Used car prices. pic.twitter.com/O6R6iLHRH8

— zerohedge (@zerohedge) April 12, 2022

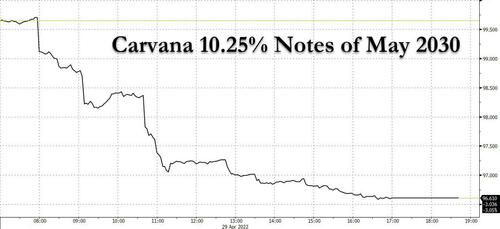

Adding insult to injury, earlier this week, Carvana struggled to raise $3.3 billion in the junk bond market. The company had to revamp a junk-bond offering.

Not looking good for CVNA https://t.co/itWOMmB6as

— zerohedge (@zerohedge) April 27, 2022

Those new bonds tumbled to 96 cents on the dollar in their first day of secondary trading, even after Apollo Global swooped in to buy roughly half of the sale -- or rather because Apollo swooped in. This was a move many speculate is a signal that Apollo will control the fulcrum security, and thus the post-record equity, in the coming Chapter 11 filing.

And while we wait for the wheels to come off the Carvana bullish narrative, we will go back to what we said earlier. Namely, how this story may be indicative of the reversal of fortune for hedge funds who never actually had to hedge. Indeed, as Bloomberg notes, "for CAS, 2022 is a stark contrast to its previous performance. Its fund hasn’t had a down year since launching in October 2012, and in 2020 it returned a record 96.5%."

Desperate to avoid a flood of redemptions, Sosin focused entirely on Carvana in his 25-page letter. He acknowledged its weak unit volume, but he also said it should accelerate when the industry normalizes (which may take a while since the US economy is only just now entering a recession).

He added that the company should generate profits of $100 million annually from its acquisition of Adesa Inc.’s U.S. car-auction business, which was financed with this week’s debt offering.

Then again, there is the $600 million in interest expense: "While the company’s $600 million of annual interest expense is largely fixed, and a certain level of fixed/ overhead costs are necessary to run the company, the company’s growth investments are under the management’s control."

Still, Sosin refuses to cut and run, writing that “Carvana has a great deal of latent margin potential.” He added that “this potential should allow the company to pursue its growth ambitions, albeit at a slower pace of expansion, without meaningfully accessing the capital markets or counting on a significant used-vehicle industry recovery.”

For now, the market clearly disagrees.

But if Sosin's reversal of fortune is bad, it's nowhere near as bad as the billionaire father-son duo behind the Phoenix-based Carvana. Ernie Garcia II and Ernie Garcia III have lost almost $14 billion combined so far this year, according to the Bloomberg Billionaires Index. The younger Garcia, the company’s chief executive officer, has lost about 73% of his net worth since the start of 2022.

The senior Garcia began selling Carvana shares in late October 2020, as they climbed to around $200 from their pre-pandemic level of about $90. The stock closed Friday at $57.96.

“If Carvana works out as well as it could, they might be among the richest people on the planet,” Sosin told Bloomberg in a 2019 interview. Three years since that remark, he said the company still has a bright future. “I am not immune to mistakes, and I promise that when I eventually make a doozy I will put it here at the top of this letter,” Sosin wrote. “In this case, however, I do not believe I have.”

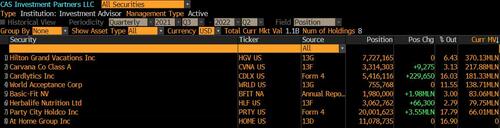

For those who disagree, here is a list of CAS's holdings. If and when the margin calls and forced selling comes, these are the names that Sosin will rush to liquidate to avoid a collapse of his hedge fund. This is why others may decide to sell them first.

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

Good read.