2 Bargain Energy Stocks To Buy As We Begin 2025: GPRK, SUN

Image Source: Pexels

Energy stocks have been quite volatile recently, but Geopark (GPRK - Free Report) and Sunoco LP (SUN - Free Report) are two to consider with crude oil prices rebounding to over $70 a barrel.

To that point, both stocks are starting to glamor in terms of value and have landed spots on the coveted Zacks Rank #1 (Strong Buy) list as we begin 2025.

One of the Most Intriguing Stocks Under $10 - GPRK

When considering the risk to reward, Geopark's stock is appealing as an explorer, operator, and consolidator of oil and gas throughout major regions of South America. Echoing Geopark’s cheap stock price of under $10 is that GPRK trades at just 3.6X forward earnings.

Furthermore, Geopark’s annual earnings are now expected to increase 19% in fiscal 2024 and are projected to climb another 70% in FY25 to $4.36 per share. While the volatility of oil prices appears to be putting a dent in the optimism for Geopark’s increased profitability, GPRK has a tight nit 52-week range of $7.24-$11.72.

Motor Fuel Distribution Leader - SUN Stock

As one of the largest distributors of motor fuel in the United States, Sunoco’s stock is hard to overlook at around $50 and 7.4X forward earnings. In comparison, this is a sharp discount to its renowned rival Murphy USA (MUSA - Free Report) at 21.3X and its Zacks Oil and Gas-Refining and Marketing-Master Limited Partnership Industry average of 20X.

Image Source: Zacks Investment Research

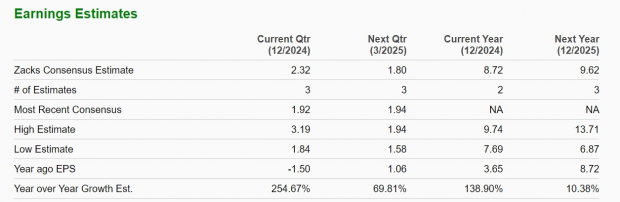

Keeping Sunoco on pace as a very viable investment is the company’s energy infrastructure expansion through the key acquisition of NuStar Energy LP last year. Critical to transporting motor fuels, Sunoco has over 14,000 miles of pipeline with annual earnings now expected to soar 139% in FY24 to $8.72 per share versus EPS of $3.65 in 2023.

Looking ahead, FY25 EPS is projected to increase another 10% with Sunoco’s expansion into Mexico and Europe being viewed as promising catalysts towards future growth.

Image Source: Zacks Investment Research

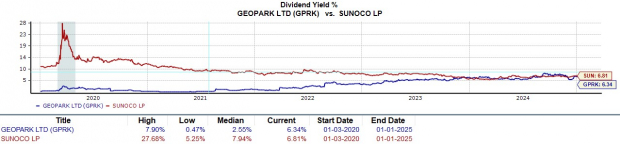

Generous Dividends

Of course, the generous dividends many oils and energy sector stocks are known to pay often attract investors with Geopark and Sunoco standing out in this regard. At the moment, Geopark and Sunoco have annual dividend yields over 6% which blows away the S&P 500’s 1.22% average and the broader Zacks Oils and Energy sectors' 4.17%.

Image Source: Zacks Investment Research

Bottom Line

Attributing to their strong buy ratings is that FY25 EPS estimates have spiked for Geopark and Sunoco over the last 60 days which magnifies their attractive P/E valuations and enticing dividends. As we begin the new year, GPRK and SUN are two energy stocks that could have plenty of upside.

More By This Author:

3 Financial Mutual Funds To Buy As Rate Cuts Slow Down In 20255 Top-Performing Dividend ETFs Of 2H Yielding At Least 20%

3 Top-Ranked Goldman Sachs Mutual Funds For Amazing Returns

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more