2 Airline Stocks That Could Fly Higher In June

Image: Bigstock

Now that we have entered the summer season, many travel-related companies should see increased business from higher demand and easing inflation. To that point, there are a few stocks sticking out among the Zacks Transportation-Airline Industry, which is currently in the top 16% of over 250 Zacks industries.

Let’s take a look at two standout stocks in the industry that appear to be poised for more upside as we move through the month of June.

Allegiant (ALGT - Free Report)

With a Zacks Rank #1 (Strong Buy), Allegiant Travel Company is well-positioned to benefit from this year’s peak travel season through its low-cost passenger airline, Allegiant Air. Although inflation has begun to ease, many consumers will still be looking to save on travel and may start seeking Allegiant’s services.

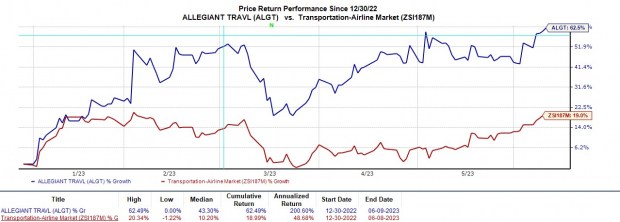

Based in Las Vegas, Allegiant is focused on linking leisure travelers in small- and medium-sized cities to world-class leisure destinations. Recently seen trading around $109 a share, Allegiant stock is up +62% year-to-date to easily top the S&P 500’s +13% and the Transportation-Airline Market's +19%.

Image Source: Zacks Investment Research

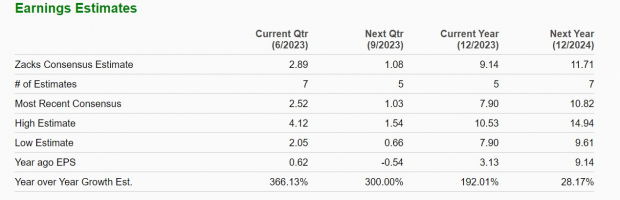

Allegiant’s stellar year-to-date performance could continue as earnings estimates have climbed throughout the quarter. Fiscal 2023 EPS estimates have now soared 46% over the last 90 days, with FY24 estimates up 18%.

Allegiant’s earnings are now expected to soar 192% this year to $9.14 per share compared to EPS of $3.13 in 2022. Plus, FY24 earnings are forecasted to rise another 28% at $11.71 per share. On the top line, sales are forecasted to rise 11% in FY23 and jump another 11% in FY24 to $2.85 billion.

Image Source: Zacks Investment Research

Copa Holdings (CPA - Free Report)

Also sporting a Zacks Rank #1 (Strong Buy), Copa Holdings is worthy of investors’ consideration and offers foreign exposure to Latin America's economy. Based in Panama, Copa’s two main subsidiaries, Copa Airlines and Copa Columbia, offer passenger and cargo services.

Notably, earnings estimates have gone up 25% for fiscal 2023 over the last three months, with FY24 EPS estimates rising 22%. Copa’s FY23 earnings are now projected to leap 75% to $14.49 per share compared to EPS of $8.26 in 2022. Fiscal 2024 earnings are expected to rise another 3%. Sales are forecasted to jump 15% this year and rise another 2% in FY24 to $3.50 billion.

Image Source: Zacks Investment Research

More intriguing, Copa stock is up 34% this year to outperform the benchmark and the Transportation-Airline Market, but it still trades at 7.6X forward earnings. This is a nice discount to the industry average of 10.5X and attractively beneath the S&P 500’s 19.9X.

Image Source: Zacks Investment Research

Bottom Line

There is a good chance Allegiant and Copa both continue moving higher, with earnings estimates flying over the last quarter. Now appears to be a good time to buy both stocks as we progress through the summer and into peak travel season.

More By This Author:

Lennar Expected To Beat Earnings Estimates: Can The Stock Move Higher?4 Technology Mutual Funds To Invest In As Interest Rates Stabilize

Bull Of The Day: Sinclair Inc

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more