2 AI Energy Stocks To Buy Now That Might Be The Next Oklo

Image: Bigstock

Key Takeaways

- Oklo and other nuclear and next-gen energy stocks have soared as part of the AI trade.

- Nano Nuclear Energy is a soaring home-run nuclear energy stock to potentially buy for big upside.

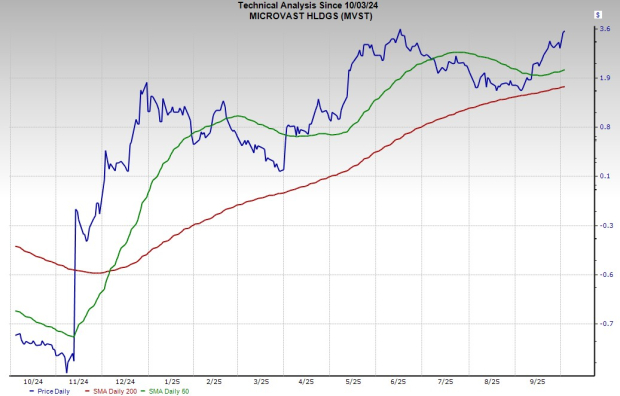

- Microvast is a cheap (~$5 a share), Zacks Rank #1 (Strong Buy) rated energy storage stock poised to breakout.

Wall Street is treating next-generation nuclear energy companies such as Oklo as direct bets on artificial intelligence. The reason is simple: large AI data centers consume as much electricity as a mid-sized city, which is a huge reason why U.S. electricity demand is set to grow ~75% by 2050.

The desperate need for more power to fuel AI expansion helped Sam Altman-backed nuclear energy upstart Oklo (OKLO - Free Report) stock soar 500% so far in 2025, despite being pre-revenue. Investors have also sent established energy giants such as GE Vernova, Constellation Energy, and Vistra skyrocketing over the past few years.

AI hyperscalers are taking an all-of-the-above approach to energy from nuclear and natural gas to solar, which is great for energy storage companies.

Oklo has appeared to be a bit overheated after climbing 140% since early July. It’s likely time to buy other stocks that could be the next home-run AI energy investments with huge near-term and long-term upside.

Investors looking for the next Oklo might want to consider Zacks Rank #1 (Strong Buy) energy storage company Microvast, which has been trading for under $5 a share, and speculative microreactor stock Nano Nuclear Energy.

Buy Nano Nuclear Stock Before It Soars Again

Nano Nuclear Energy Inc. (NNE - Free Report) is developing advanced portable micro nuclear reactors. The speculative pre-revenue nuclear company envisions a future where its microreactors provide energy to AI data centers, cargo ships, moon bases, and beyond.

Nano’s bull case is deepened by its strong balance sheet ($210 million in cash and cash equivalents vs. $5 million in total liabilities).

Image Source: Zacks Investment Research

Nano Nuclear Energy said last quarter that it’s experiencing “growing support and interest from long-term oriented institutional investors.” AI hyperscalers are partnering with nuclear energy companies like Oklo and Constellation (CEG - Free Report) to make sure they’re prepared to power their data centers.

Big tech companies might even buy a few small nuclear energy companies like Nano because securing power is the most difficult part of the AI supply chain.

Nuclear energy, as Nano pointed out in its Q3 earnings report in August, is also backed by “unprecedented bipartisan legislative and policy support in the U.S. for nuclear energy.” Nano Nuclear Energy is gaining interest from Wall Street. Zacks has five brokerage recommendations for the stock, up from two in the spring (3 out of 5 are “Strong Buys”).

Nano Nuclear Energy announced in late September that it was included in the S&P Global Broad Market Index (BMI), “the world's first float-adjusted global benchmark.” The company was also added to the S&P Total Market Index (TMI), which “encompasses the entire U.S. equity market.” These inclusions expanded the stock's visibility to a large swath of investors.

Image Source: Zacks Investment Research

Nano Nuclear stock lagged some of its home-run nuclear energy peers in 2025, yet it still has been up 80% year-to-date and 760% since its early May 2024 IPO. However, Nano has not broken out above its early 2025 highs.

The stock appears heavily short (~28% of the float), setting up the potential for quick and substantial upside if Wall Street takes some of its Oklo winnings and dives into Nano.

The chart above shows the stock held its ground at its post-IPO highs and its 21-day moving average. It has also been far from overheated on the RSI front, proving Nano Nuclear may have breakout potential in Q4 and beyond once it can climb above its January peaks.

Time to Buy Cheap AI Energy Stock Microvast in October

Microvast (MVST - Free Report) designs, develops, and manufactures lithium-ion battery solutions. The Texas-based company boasts that its cutting-edge cell technology and its vertical integration capabilities extend from core battery chemistry to modules and packs.

Microvast is capitalizing on the long-term momentum of solar energy expansion, which necessitates the massive deployment of energy storage solutions. It also benefits from the broader electrification of vehicles, big and small.

U.S. utility-scale battery storage grew ~66% last year, with it set to add another 20 GW of battery storage to the grid in 2025, to reach nearly 50 GW, up from essentially zero before 2020.

Image Source: Zacks Investment Research

The battery technology company's huge beat-and-raise second quarter report in early August sent its FY25 consensus estimate 46% higher, with its FY26 estimate up 21%. Microvast's positive bottom-line revisions have helped it earn a Zacks Rank #1 (Strong Buy) rating.

Microvast is projected to swing from an adjusted loss of -$0.27 a share last year to +$0.19 a share in FY25, and then grow its earnings per share (EPS) by 53% in 2026. It is also projected to grow its revenue by 22% in 2025 and 2026 to reach $563.5 million vs. $108 million in 2020.

Image Source: Zacks Investment Research

Microvast stock soared 120% year-to-date and over 2,220% off its November 2024 lows. Yet it still has been trading roughly 23% below its average Zacks price target and 80% beneath its 2021 highs.

Microvast stock may be on the verge of breaking out to new 2025 highs and overtaking a potentially key level highlighted above that could help it start marching back up to its all-time highs. Investors might also be attracted to Microvast's status as a cheap stock trading for roughly $4.56 a share.

More By This Author:

The Best Top-Ranked Stocks To Buy In OctoberThe Best AI Nuclear Energy Stock To Buy Not Named Oklo

3 Top Artificial Intelligence (AI) Stocks To Buy Not Named Nvidia

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more