15 Highest Yielding Utility Stocks

Image Source: Pixabay

Utility stocks have great appeal for income investors. They typically generate steady earnings year after year, and many utility stocks have recession-proof dividend payouts.

After all, people will always need water, heat, and electricity, even during periods of steep economic downturns.

As a result, utility stocks tend to have high dividend yields, with consistent dividend growth over time.

So why do these businesses make for attractive investments?

Utilities usually conduct business in highly regulated markets, complying with rules set by federal, state, and municipal governments.

While this sounds highly unattractive on the surface, what it means in practice is that utilities are basically legal monopolies.

The strict regulatory environment that utility businesses operate in creates a strong and durable competitive advantage for existing industry participants.

For this reason, utilities are among the most popular stocks for long-term dividend growth investors — especially because they tend to offer above-average dividend yields.

Indeed, the regulatory-based competitive advantages available to utility stocks give them the consistency to raise their dividends regularly.

Simply put, utility stocks are some of the most dependable dividend stocks around.

This article will list the 15 highest-yielding utility stocks in the Sure Analysis Research Database.

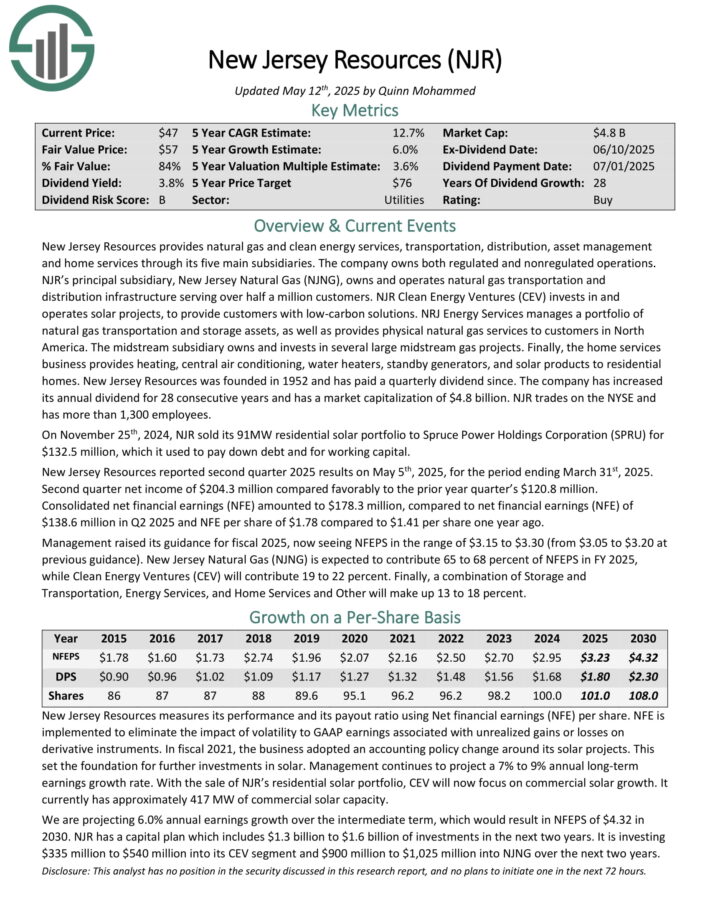

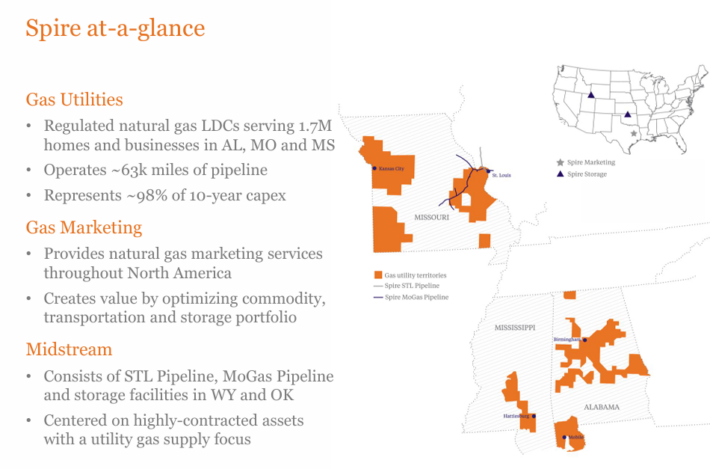

Highest-Yielding Utility Stock #15: New Jersey Resources (NJR)

- Dividend Yield: 4.0%

New Jersey Resources provides natural gas and clean energy services, transportation, distribution, asset management and home services through its five main subsidiaries. The company owns both regulated and non-regulated operations.

NJR’s principal subsidiary, New Jersey Natural Gas (NJNG), owns and operates natural gas transportation and distribution infrastructure serving over half a million customers. NJR Clean Energy Ventures (CEV) invests in and operates solar projects, to provide customers with low-carbon solutions.

NRJ Energy Services manages a portfolio of natural gas transportation and storage assets, as well as provides physical natural gas services to customers in North America.

The midstream subsidiary owns and invests in several large midstream gas projects. Finally, the home services business provides heating, central air conditioning, water heaters, standby generators, and solar products to residential homes.

New Jersey Resources reported second quarter 2025 results on May 5th, 2025, for the period ending March 31st, 2025.

Second quarter net income of $204.3 million compared favorably to the prior year quarter’s $120.8 million.

Consolidated net financial earnings (NFE) amounted to $178.3 million, compared to net financial earnings (NFE) of $138.6 million in Q2 2025 and NFE per share of $1.78 compared to $1.41 per share one year ago.

Management raised its guidance for fiscal 2025, now seeing NFEPS in the range of $3.15 to $3.30 (from $3.05 to $3.20 at previous guidance).

Click here to download our most recent Sure Analysis report on NJR (preview of page 1 of 3 shown below):

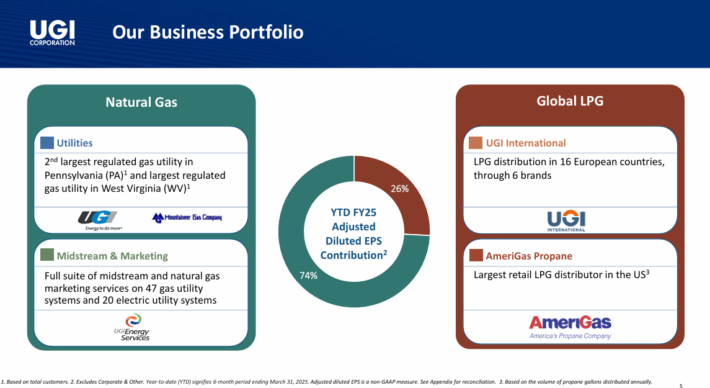

Highest-Yielding Utility Stock #14: UGI Corp. (UGI)

- Dividend Yield: 4.2%

UGI Corporation is a gas and electric utility that operates in Pennsylvania, in addition to a large energy distribution business that serves the entire US and other parts of the world. It was founded in 1882 and has paid consecutive dividends since 1885.

The company operates in four reporting segments: AmeriGas, UGI International, Midstream & Marketing, and UGI Utilities.

Source: Investor Presentation

UGI reported strong financial results for its fiscal second quarter ended March 31, 2025, delivering adjusted diluted earnings per share (EPS) of $2.21, surpassing the consensus estimate of $1.80 by 22.8%. This performance was driven by favorable weather conditions and operational improvements across its business segments.

Despite the earnings beat, UGI’s revenue for the quarter was $2.67 billion, slightly below the consensus estimate of $2.70 billion, though it represented an 8.1% increase from the prior year’s $2.47 billion. Segment-wise, the Utilities segment reported EBIT of $241 million, up 6.6% year-over-year, benefiting from colder weather and increased customer additions.

The Midstream & Marketing segment’s EBIT remained steady at $154 million, while UGI International’s EBIT rose by 9.2% to $143 million, aided by operational efficiencies. AmeriGas Propane’s EBIT increased by 11.6% to $154 million, reflecting higher retail volumes and improved margins.

Click here to download our most recent Sure Analysis report on UGI (preview of page 1 of 3 shown below):

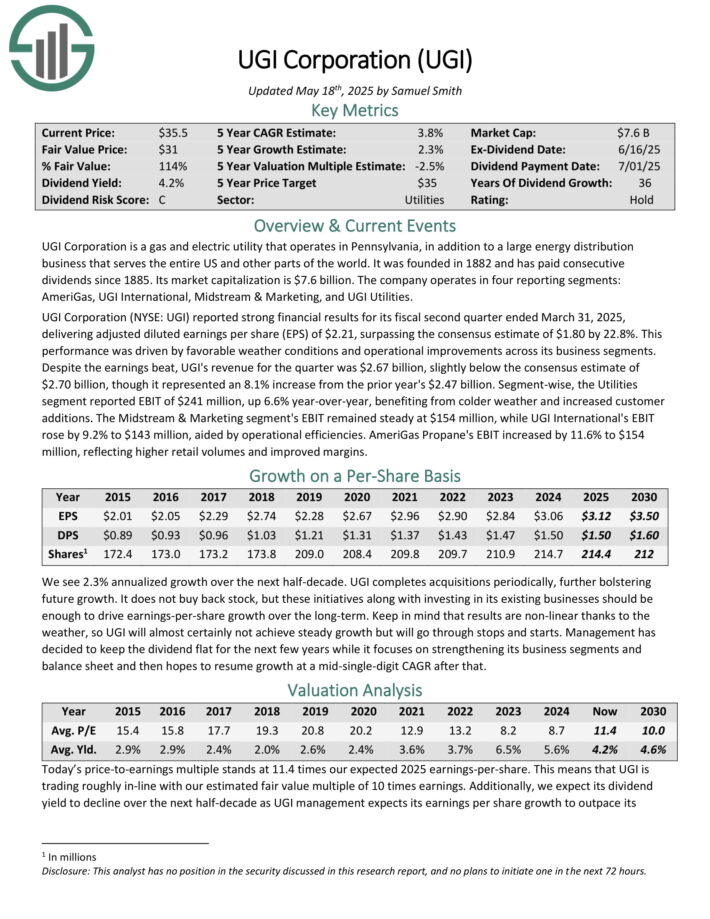

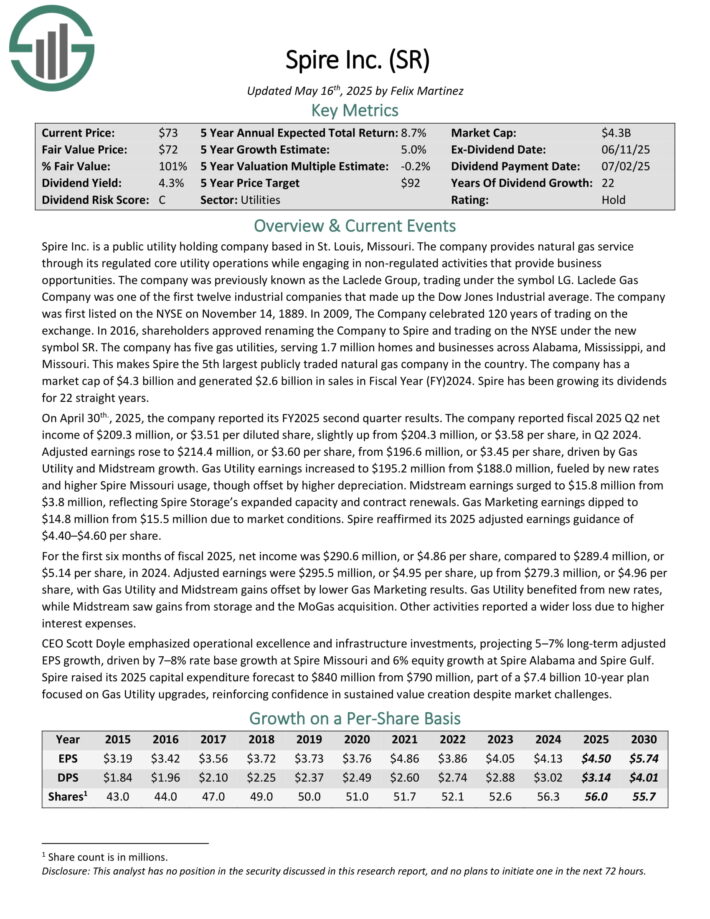

Highest-Yielding Utility Stock #13: Spire Inc. (SR)

- Dividend Yield: 4.2%

Spire Inc. is a public utility holding company based in St. Louis, Missouri. The company provides natural gas service through its regulated core utility operations while engaging in non-regulated activities that provide business opportunities.

The company has five gas utilities, serving 1.7 million homes and businesses across Alabama, Mississippi, and Missouri. This makes Spire the 5th largest publicly traded natural gas company in the country.

Source: Investor Presentation

It generated $2.6 billion in sales in Fiscal Year (FY) 2024. Spire has been growing its dividends for 22 straight years.

On April 30th 2025, the company reported its FY2025 second quarter results. It reported fiscal 2025 Q2 net income of $209.3 million, or $3.51 per diluted share, slightly up from $204.3 million, or $3.58 per share, in Q2 2024.

Adjusted earnings rose to $214.4 million, or $3.60 per share, from $196.6 million, or $3.45 per share, driven by Gas Utility and Midstream growth. Gas Utility earnings increased to $195.2 million from $188.0 million, fueled by new rates and higher Spire Missouri usage, though offset by higher depreciation.

Midstream earnings surged to $15.8 million from $3.8 million, reflecting Spire Storage’s expanded capacity and contract renewals. Gas Marketing earnings dipped to $14.8 million from $15.5 million due to market conditions.

Spire reaffirmed its 2025 adjusted earnings guidance of $4.40–$4.60 per share.

Click here to download our most recent Sure Analysis report on SR (preview of page 1 of 3 shown below):

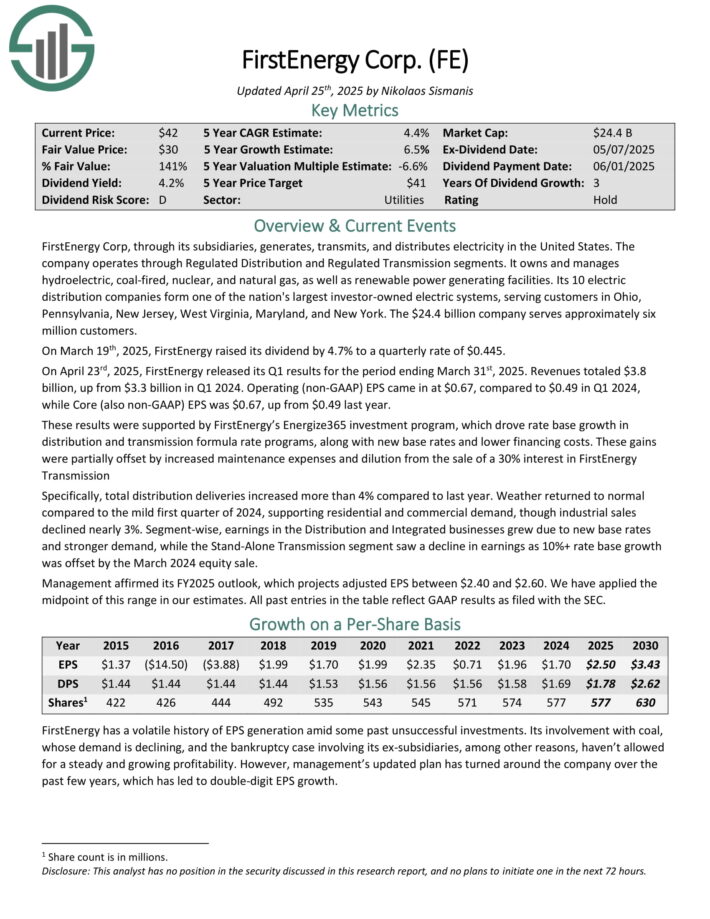

Highest-Yielding Utility Stock #12: Firstenergy Corp. (FE)

- Dividend Yield: 4.4%

FirstEnergy Corp, through its subsidiaries, generates, transmits, and distributes electricity in the United States. The company operates through Regulated Distribution and Regulated Transmission segments. It owns and manages hydroelectric, coal-fired, nuclear, and natural gas, as well as renewable power generating facilities.

Its 10 electric distribution companies form one of the nation’s largest investor-owned electric systems, serving customers in Ohio, Pennsylvania, New Jersey, West Virginia, Maryland, and New York. The company serves approximately six million customers.

On March 19th, 2025, FirstEnergy raised its dividend by 4.7% to a quarterly rate of $0.445.

On April 23rd, 2025, FirstEnergy released its Q1 results for the period ending March 31st, 2025. Revenues totaled $3.8 billion, up from $3.3 billion in Q1 2024. Operating (non-GAAP) EPS came in at $0.67, compared to $0.49 in Q1 2024, while Core (also non-GAAP) EPS was $0.67, up from $0.49 last year.

These results were supported by FirstEnergy’s Energize365 investment program, which drove rate base growth in distribution and transmission formula rate programs, along with new base rates and lower financing costs.

Management affirmed its FY2025 outlook, which projects adjusted EPS between $2.40 and $2.60.

Click here to download our most recent Sure Analysis report on FE (preview of page 1 of 3 shown below):

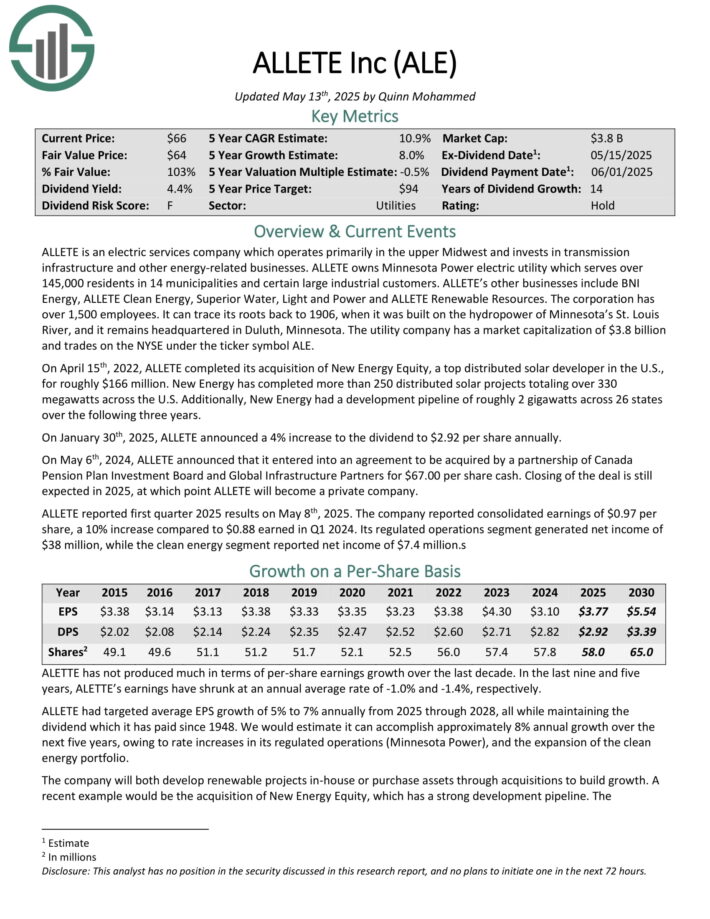

Highest-Yielding Utility Stock #11: Allete, Inc. (ALE)

- Dividend Yield: 4.5%

ALLETE is an electric services company which operates primarily in the upper Midwest and invests in transmission infrastructure and other energy-related businesses. ALLETE owns Minnesota Power electric utility which serves over 145,000 residents in 14 municipalities and certain large industrial customers.

ALLETE’s other businesses include BNI Energy, ALLETE Clean Energy, Superior Water, Light and Power and ALLETE Renewable Resources. The corporation has over 1,500 employees.

On January 30th, 2025, ALLETE announced a 4% increase to the dividend to $2.92 per share annually.

On May 6th, 2024, ALLETE announced that it entered into an agreement to be acquired by a partnership of Canada Pension Plan Investment Board and Global Infrastructure Partners for $67.00 per share cash. Closing of the deal is still expected in 2025, at which point ALLETE will become a private company.

ALLETE reported first quarter 2025 results on May 8th, 2025. The company reported consolidated earnings of $0.97 per share, a 10% increase compared to $0.88 earned in Q1 2024. Its regulated operations segment generated net income of $38 million, while the clean energy segment reported net income of $7.4 million.

Click here to download our most recent Sure Analysis report on ALE (preview of page 1 of 3 shown below):

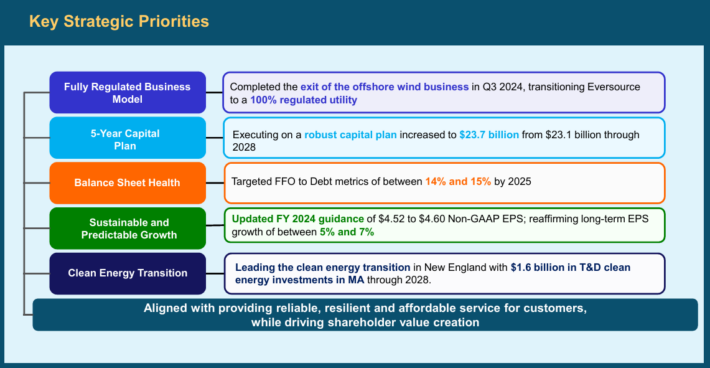

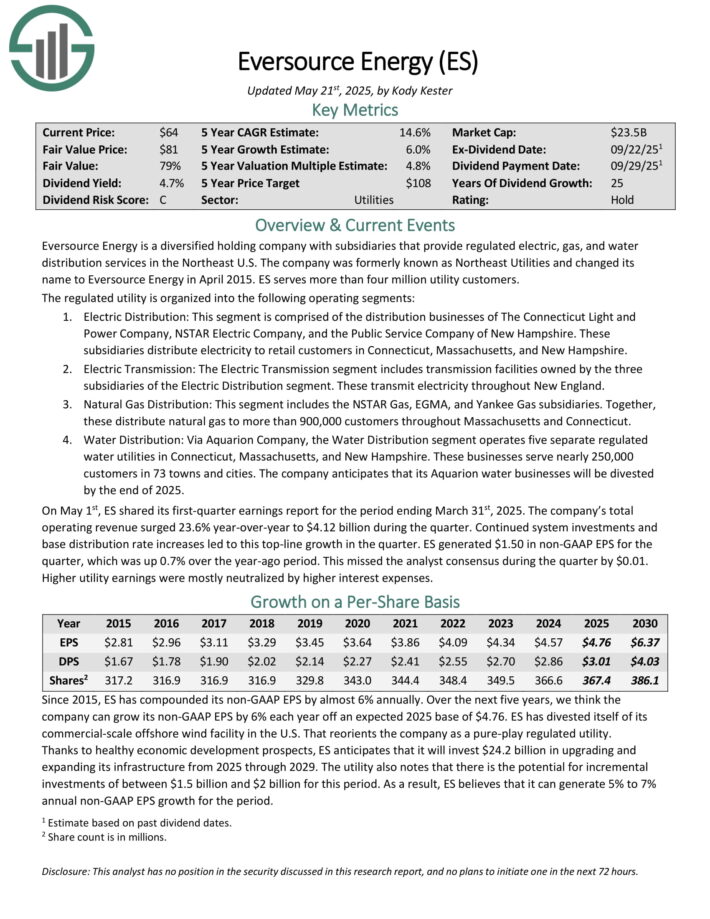

Highest-Yielding Utility Stock #10: Eversource Energy (ES)

- Dividend Yield: 4.6%

Eversource Energy is a diversified holding company with subsidiaries that provide regulated electric, gas, and water distribution service in the Northeast U.S.

FactSet, Erie Indemnity, and Eversource Energy are the three new Dividend Aristocrats for 2025.

The company’s utilities serve more than 4 million customers. Eversource has delivered steady growth to shareholders for many years.

Source: Investor Presentation

On February 11th, 2025, Eversource Energy released its fourth-quarter and full-year 2024 results. For the quarter, the company reported net earnings of $72.5 million, a significant improvement from a net loss of $(1,288.5) million in the same quarter of last year, which reflected the impact of the company’s exit from offshore wind investments.

On May 1st, ES shared its first-quarter earnings report for the period ending March 31st, 2025. The company’s total operating revenue surged 23.6% year-over-year to $4.12 billion during the quarter.

Continued system investments and base distribution rate increases led to this top-line growth in the quarter. ES generated $1.50 in non-GAAP EPS for the quarter, which was up 0.7% over the year-ago period.

Click here to download our most recent Sure Analysis report on ES (preview of page 1 of 3 shown below):

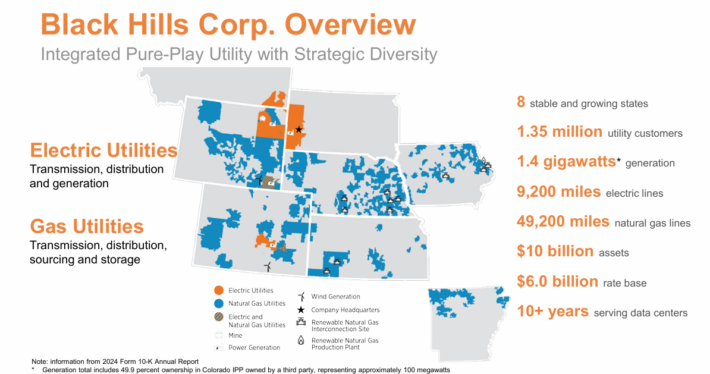

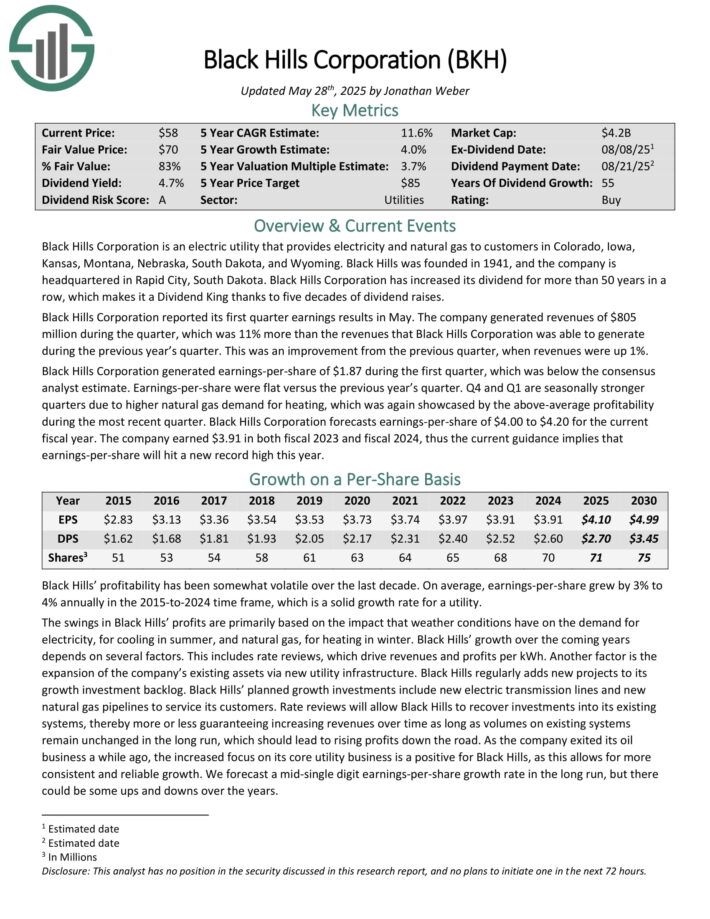

Highest-Yielding Utility Stock #9: Black Hills Corp. (BKH)

- Dividend Yield: 4.7%

Black Hills Corporation is an electric utility that provides electricity and natural gas to customers in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming.

The company has 1.35 million utility customers in eight states. Its natural gas assets include 49,200 miles of natural gas lines. Separately, it has ~9,200 miles of electric lines and 1.4 gigawatts of electric generation capacity.

Source: Investor Presentation

Black Hills Corporation reported its first quarter earnings results in May. The company generated revenues of $805 million during the quarter, which was 11% year-over-year growth.

Black Hills Corporation generated earnings-per-share of $1.87 during the first quarter, which was below the consensus analyst estimate. Earnings-per-share were flat versus the previous year’s quarter.

Q4 and Q1 are seasonally stronger quarters due to higher natural gas demand for heating, which was again showcased by the above-average profitability during the most recent quarter.

Black Hills Corporation forecasts earnings-per-share of $4.00 to $4.20 for the current fiscal year.

Click here to download our most recent Sure Analysis report on BKH (preview of page 1 of 3 shown below):

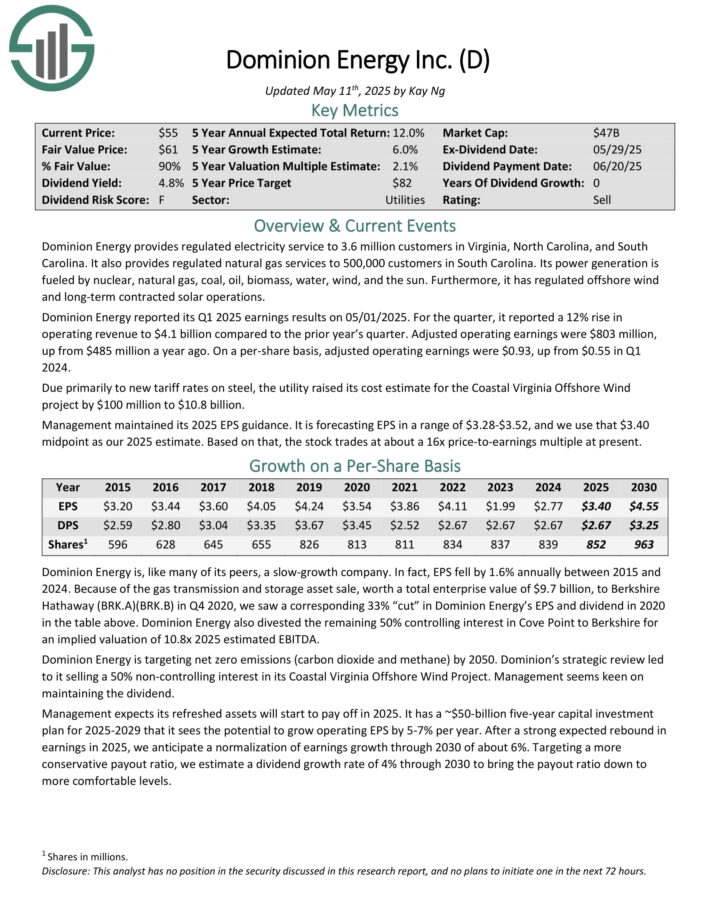

Highest-Yielding Utility Stock #8: Dominion Energy (D)

- Dividend Yield: 4.8%

Dominion Energy provides regulated electricity service to 3.6 million customers in Virginia, North Carolina, and South Carolina. It also provides regulated natural gas services to 500,000 customers in South Carolina.

Its power generation is fueled by nuclear, natural gas, coal, oil, biomass, water, wind, and the sun. Furthermore, it has regulated offshore wind and long-term contracted solar operations.

Dominion Energy reported its Q1 2025 earnings results on 05/01/2025. For the quarter, it reported a 12% rise in operating revenue to $4.1 billion compared to the prior year’s quarter.

Adjusted operating earnings were $803 million, up from $485 million a year ago. On a per-share basis, adjusted operating earnings were $0.93, up from $0.55 in Q1 2024.

Due primarily to new tariff rates on steel, the utility raised its cost estimate for the Coastal Virginia Offshore Wind project by $100 million to $10.8 billion.

Management maintained its 2025 EPS guidance. It is forecasting EPS in a range of $3.28-$3.52.

Management expects its refreshed assets will start to pay off in 2025. It has a ~$50-billion five-year capital investment plan for 2025-2029 that it sees the potential to grow operating EPS by 5-7% per year.

Click here to download our most recent Sure Analysis report on D (preview of page 1 of 3 shown below):

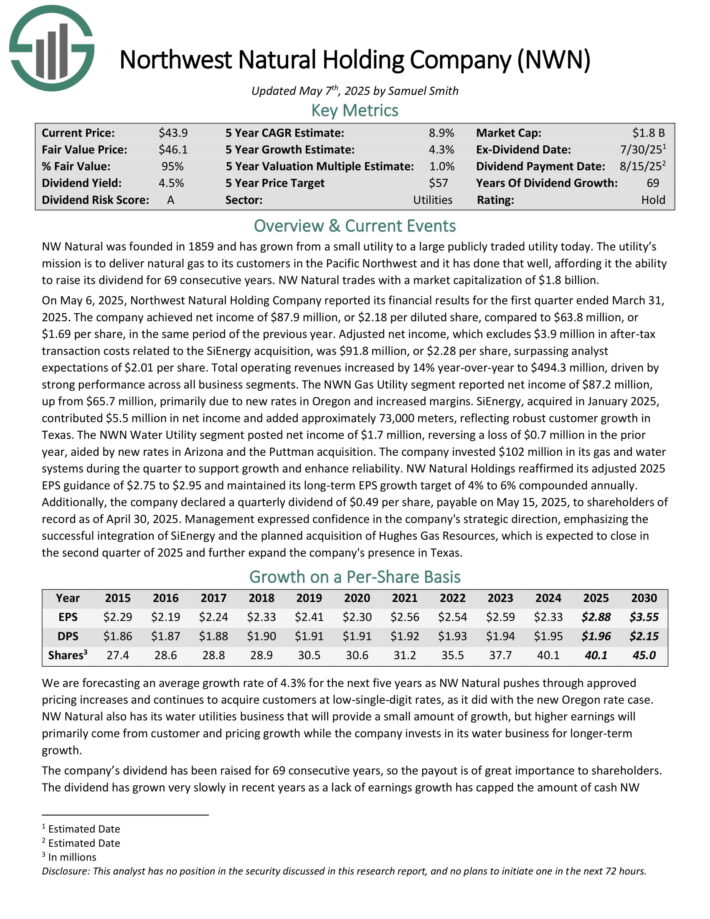

Highest-Yielding Utility Stock #7: Northwest Natural Holding (NWN)

- Dividend Yield: 4.9%

NW Natural was founded in 1859 and has grown from a small utility to a large publicly traded utility today. The utility’s mission is to deliver natural gas to its customers in the Pacific Northwest.

Source: Investor Presentation

On May 6, 2025, Northwest Natural Holding Company reported its financial results for the first quarter ended March 31, 2025. The company achieved net income of $87.9 million, or $2.18 per diluted share, compared to $63.8 million, or $1.69 per share, in the same period of the previous year.

Adjusted net income, which excludes $3.9 million in after-tax transaction costs related to the SiEnergy acquisition, was $91.8 million, or $2.28 per share, surpassing analyst expectations of $2.01 per share. Total operating revenues increased by 14% year-over-year to $494.3 million, driven by strong performance across all business segments.

The NWN Gas Utility segment reported net income of $87.2 million, up from $65.7 million, primarily due to new rates in Oregon and increased margins. SiEnergy, acquired in January 2025, contributed $5.5 million in net income and added approximately 73,000 meters, reflecting robust customer growth in Texas.

The NWN Water Utility segment posted net income of $1.7 million, reversing a loss of $0.7 million in the prior year, aided by new rates in Arizona and the Puttman acquisition.

NW Natural Holdings reaffirmed its adjusted 2025 EPS guidance of $2.75 to $2.95.

Click here to download our most recent Sure Analysis report on NWN (preview of page 1 of 3 shown below):

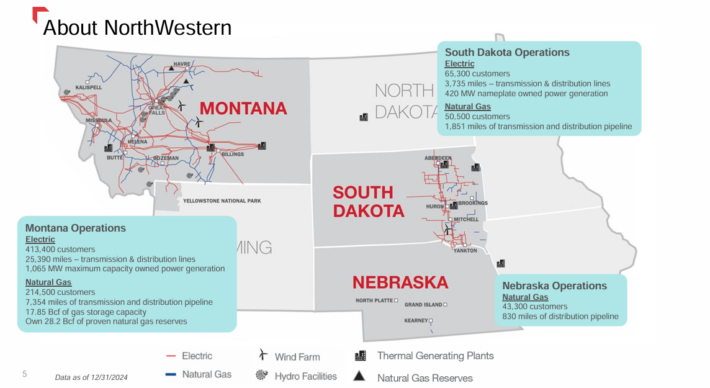

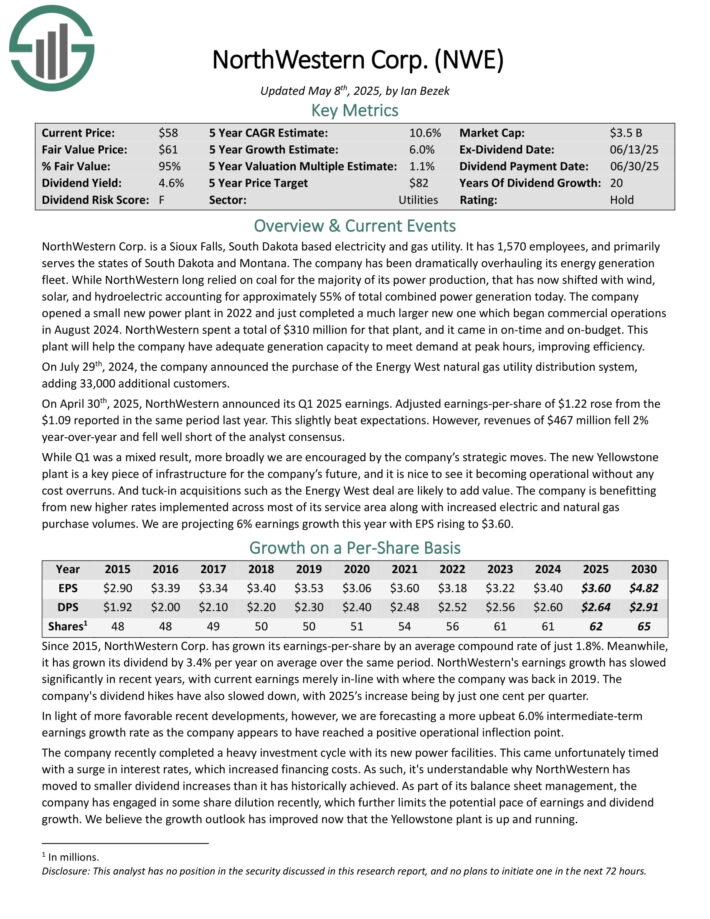

Highest-Yielding Utility Stock #6: NorthWestern Energy Group (NWE)

- Dividend Yield: 5.0%

NorthWestern Corp. is a Sioux Falls, South Dakota based electricity and gas utility. It has ~1,570 employees, and primarily serves the states of South Dakota and Montana.

The company has been dramatically overhauling its energy generation fleet. While NorthWestern long relied on coal for the majority of its power production, that has now shifted with wind, solar, and hydroelectric accounting for approximately 55% of total combined power generation today.

Source: Investor Presentation

On April 30th, 2025, NorthWestern announced its Q1 2025 earnings. Adjusted earnings-per-share of $1.22 rose from the $1.09 reported in the same period last year. This slightly beat expectations. However, revenues of $467 million fell 2% year-over-year and fell well short of the analyst consensus.

While Q1 was a mixed result, more broadly we are encouraged by the company’s strategic moves. The new Yellowstone plant is a key piece of infrastructure for the company’s future, and it is nice to see it becoming operational without any cost overruns. And tuck-in acquisitions such as the Energy West deal are likely to add value.

NWE is benefiting from new higher rates implemented across most of its service area along with increased electric and natural gas purchase volumes.

Click here to download our most recent Sure Analysis report on NWE (preview of page 1 of 3 shown below):

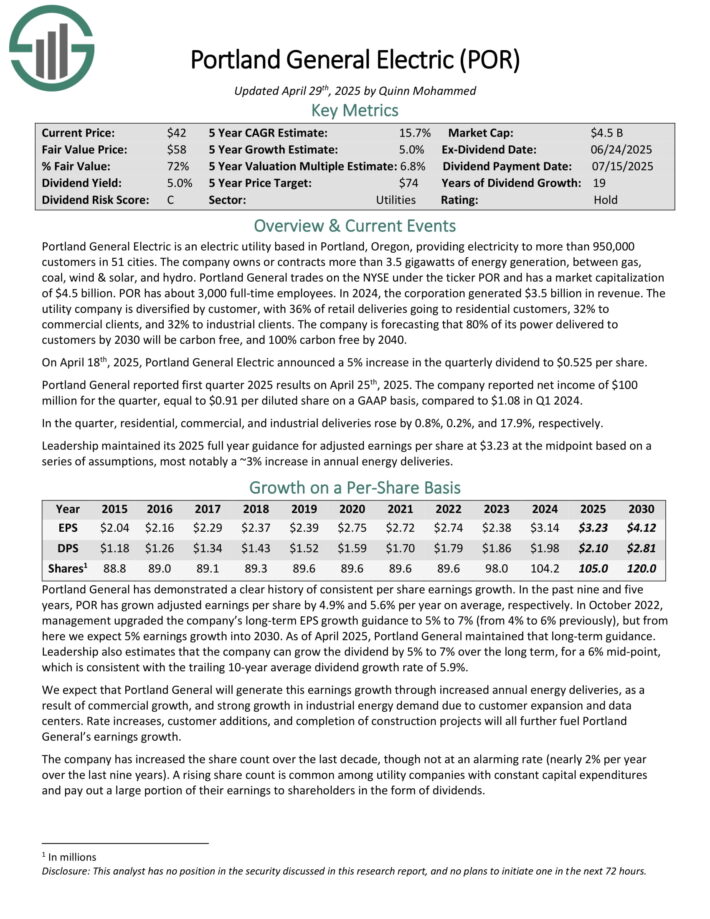

Highest-Yielding Utility Stock #5: Portland General Electric (POR)

- Dividend Yield: 5.1%

Portland General Electric is an electric utility based in Portland, Oregon, providing electricity to more than 950,000 customers in 51 cities. The company owns or contracts more than 3.5 gigawatts of energy generation, between gas, coal, wind & solar, and hydro.

In 2024, the corporation generated $3.5 billion in revenue. The utility company is diversified by customer, with 36% of retail deliveries going to residential customers, 32% to commercial clients, and 32% to industrial clients. The company is forecasting that 80% of its power delivered to customers by 2030 will be carbon free, and 100% carbon free by 2040.

On April 18th, 2025, Portland General Electric announced a 5% increase in the quarterly dividend to $0.525 per share.

Portland General reported first quarter 2025 results on April 25th, 2025. The company reported net income of $100 million for the quarter, equal to $0.91 per diluted share on a GAAP basis, compared to $1.08 in Q1 2024.

In the quarter, residential, commercial, and industrial deliveries rose by 0.8%, 0.2%, and 17.9%, respectively. Leadership maintained its 2025 full year guidance for adjusted earnings per share at $3.23 at the midpoint.

Click here to download our most recent Sure Analysis report on POR (preview of page 1 of 3 shown below):

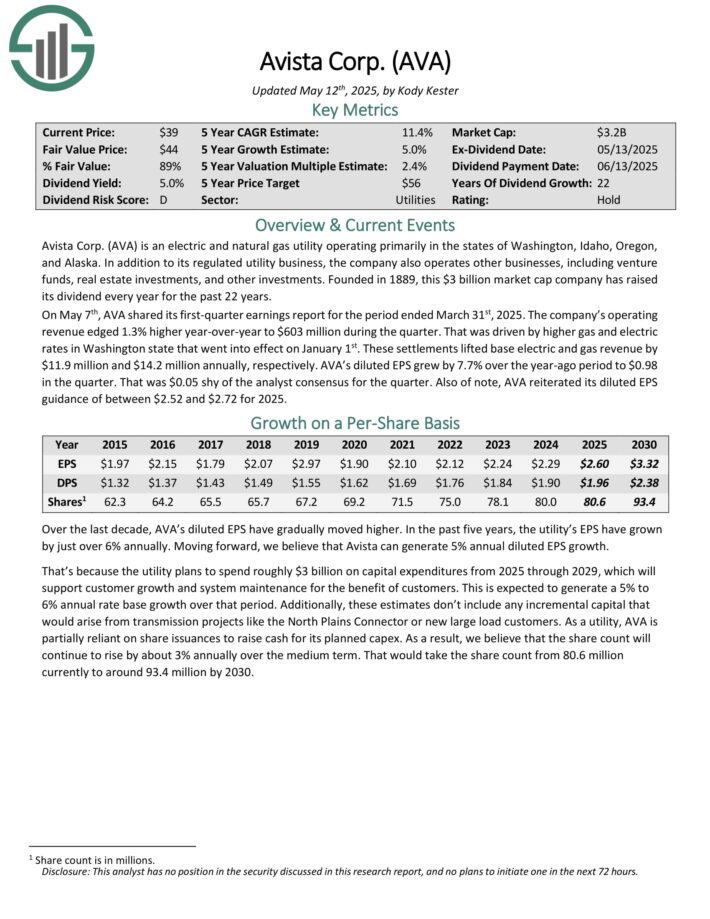

Highest-Yielding Utility Stock #4: Avista Corp. (AVA)

- Dividend Yield: 5.2%

Avista is an electric and natural gas utility operating primarily in the states of Washington, Idaho, Oregon, and Alaska. In addition to its regulated utility business, the company also operates other businesses, including venture funds, real estate investments, and other investments.

Founded in 1889, the company has raised its dividend every year for the past 22 years.

On May 7th, AVA shared its first-quarter earnings report for the period ended March 31st, 2025. The company’s operating revenue edged 1.3% higher year-over-year to $603 million during the quarter.

That was driven by higher gas and electric rates in Washington state that went into effect on January 1st. These settlements lifted base electric and gas revenue by $11.9 million and $14.2 million annually, respectively.

AVA’s diluted EPS grew by 7.7% over the year-ago period to $0.98 in the quarter. That was $0.05 shy of the analyst consensus for the quarter. Also of note, AVA reiterated its diluted EPS guidance of between $2.52 and $2.72 for 2025.

It plans to spend roughly $3 billion on capital expenditures from 2025 through 2029, which will support customer growth and system maintenance for the benefit of customers. This is expected to generate a 5% to 6% annual rate base growth over that period.

Click here to download our most recent Sure Analysis report on AVA (preview of page 1 of 3 shown below):

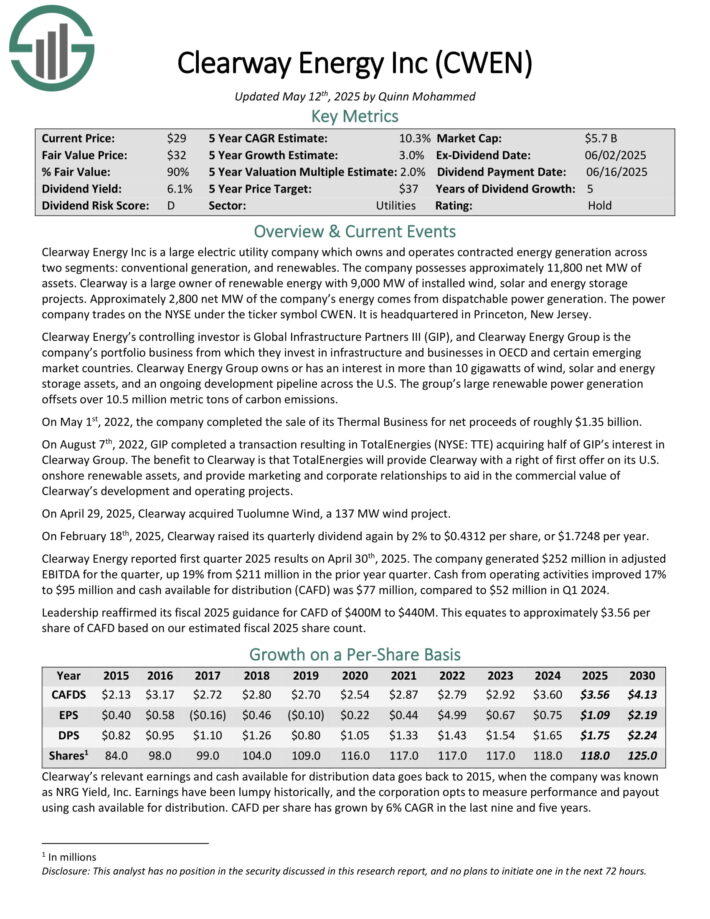

Highest-Yielding Utility Stock #3: Clearway Energy Inc. (CWEN)

- Dividend Yield: 5.7%

Clearway Energy Inc is a large electric utility company which owns and operates contracted energy generation across two segments: conventional generation, and renewables. The company possesses approximately 11,800 net MW of assets.

Clearway is a large owner of renewable energy with 9,000 MW of installed wind, solar and energy storage projects. Approximately 2,800 net MW of the company’s energy comes from dispatchable power generation.

Clearway Energy Group owns or has an interest in more than 10 gigawatts of wind, solar and energy storage assets, and an ongoing development pipeline across the U.S. The group’s large renewable power generation offsets over 10.5 million metric tons of carbon emissions.

On February 18th, 2025, Clearway raised its quarterly dividend again by 2% to $0.4312 per share, or $1.7248 per year. Clearway Energy reported first quarter 2025 results on April 30th, 2025. The company generated $252 million in adjusted EBITDA for the quarter, up 19% from $211 million in the prior year quarter.

Cash from operating activities improved 17% to $95 million and cash available for distribution (CAFD) was $77 million, compared to $52 million in Q1 2024.

Leadership reaffirmed its fiscal 2025 guidance for CAFD of $400M to $440M. This equates to approximately $3.56 per share of CAFD based on our estimated fiscal 2025 share count.

Click here to download our most recent Sure Analysis report on CWEN (preview of page 1 of 3 shown below):

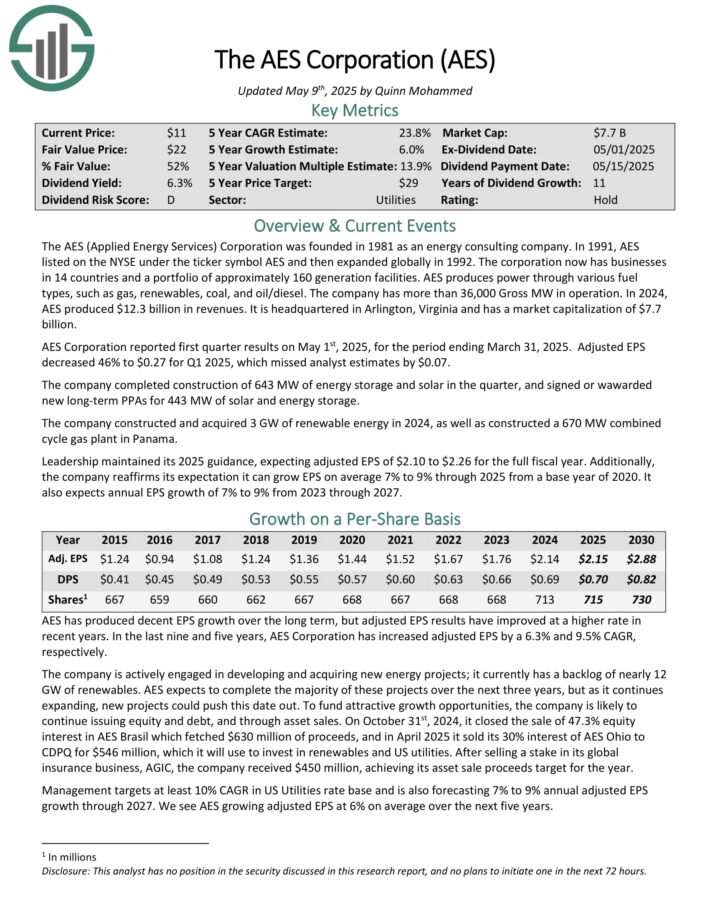

Highest-Yielding Utility Stock #2: AES Corp. (AES)

- Dividend Yield: 6.2%

The AES (Applied Energy Services) Corporation has businesses in 14 countries and a portfolio of approximately 160 generation facilities. AES produces power through various fuel types, such as gas, renewables, coal, and oil/diesel.

The company has more than 36,000 Gross MW in operation. In 2024, AES produced $12.3 billion in revenues.

AES Corporation reported first quarter results on May 1st, 2025, for the period ending March 31, 2025. Adjusted EPS decreased 46% to $0.27 for Q1 2025, which missed analyst estimates by $0.07.

The company completed construction of 643 MW of energy storage and solar in the quarter, and signed or wawarded new long-term PPAs for 443 MW of solar and energy storage.

The company constructed and acquired 3 GW of renewable energy in 2024, as well as constructed a 670 MW combined cycle gas plant in Panama. Leadership maintained its 2025 guidance, expecting adjusted EPS of $2.10 to $2.26 for the full fiscal year.

Click here to download our most recent Sure Analysis report on AES (preview of page 1 of 3 shown below):

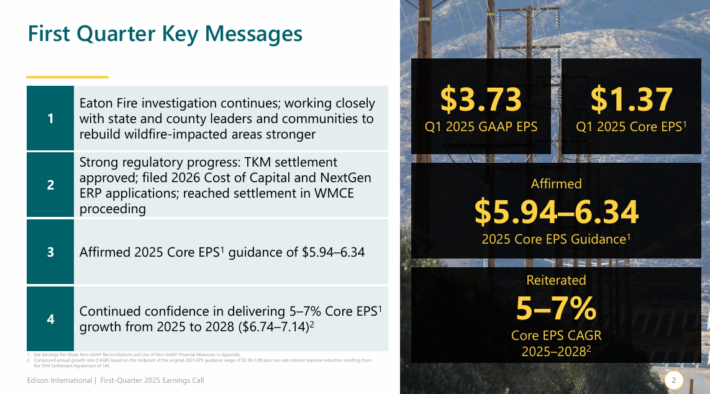

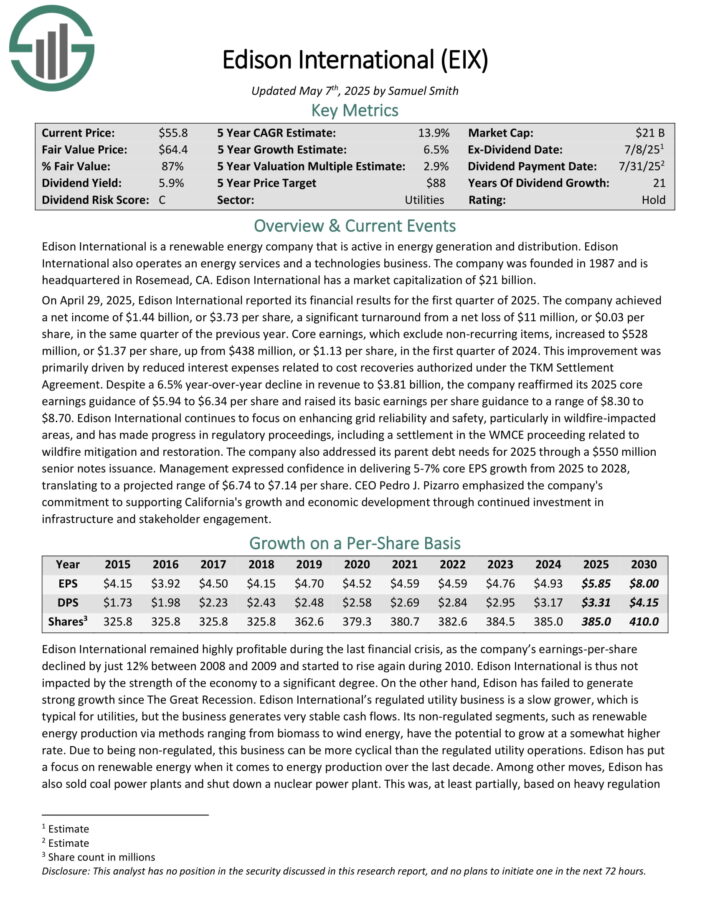

Highest-Yielding Utility Stock #1: Edison International (EIX)

- Dividend Yield: 6.6%

Edison International is a renewable energy company that is active in energy generation and distribution. Edison International also operates an energy services and a technologies business. The company was founded in 1987 and is headquartered in Rosemead, CA.

On April 29, 2025, Edison International reported its financial results for the first quarter of 2025. The company achieved a net income of $1.44 billion, or $3.73 per share, a significant turnaround from a net loss of $11 million, or $0.03 per share, in the same quarter of the previous year.

Source: Investor Presentation

Core earnings, which exclude non-recurring items, increased to $528 million, or $1.37 per share, up from $438 million, or $1.13 per share, in the first quarter of 2024.

This improvement was primarily driven by reduced interest expenses related to cost recoveries authorized under the TKM Settlement Agreement. Despite a 6.5% year-over-year decline in revenue to $3.81 billion, the company reaffirmed its 2025 core earnings guidance of $5.94 to $6.34 per share.

Click here to download our most recent Sure Analysis report on EIX (preview of page 1 of 3 shown below):

More By This Author:

15 Highest Yielding Food Stocks Now

3 Food Stocks To Satisfy Your Hunger For Income

12 Industrials Sector Dividend Kings For Long-Term Growth

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more