12 Forever Stocks For Generational Rising Passive Income

Image Source: Pexels

Are you looking for long-term investment opportunities that can provide a reliable stream of passive income for you and your family? If so, “forever” stocks may be worth considering. These are stocks that have proven reliable and durable over long periods while retaining the potential to continue providing passive income for generations to come.

This article will highlight 12 “forever” stocks coming from various industries, including technology, healthcare, and consumer goods, with solid track records of growth and stability. Their unique qualities, market-leading positions, and commitment to growing their dividends are quite likely to keep serving you and your family with rising passive income for the long-term future.

What makes a stock a “forever” stock?

To more specifically define what makes a stock a “forever” stock in our book, here are a few attributes we considered when determining which stocks to include in our list:

Strong financials:

Our “forever” stock list includes companies with healthy balance sheets and the ability to post consistent profits during various economic environments. These companies are more likely to be able to continue paying and increasing their dividends in good times and bad.

Dividend history:

The stocks we have chosen have an established history of consistently paying dividends and increasing them over time. This is a good indicator that their management teams value their shareholders and are committed to returning value to them. Prolonged dividend growth track records also reinforce the previous point that these companies have already managed to grow their payouts in good and bad times. Our selected stocks feature at least 20 years of consecutive dividend hikes.

Dividend yield / Payout ratio:

While a company’s dividend yield is arbitrary when determining whether a stock is a generational holding, we have made sure that the stocks featured here pay out a meaningful yield that is also well-covered. While a high yield can be tempting, it’s important to consider the dividend’s sustainability. We have selected companies that yield at least 2.5% and whose payouts comprise less than 80% of their underlying earnings.

Growth potential:

An established track record of solid financials and dividend growth alone would be insufficient for a “forever” stock unless its future growth prospects also remain robust. We have selected stocks with several growth catalysts and a clear plan for future growth. This is essential to ensure these companies can continue to grow their dividends and help your wealth compound over time rather comfortably.

Competitive advantages/moat:

A strong competitive advantage can help a company maintain its profitability and growth over the long term, making it more likely to continue paying dividends and increasing them over time. This is one of the critical criteria that can make a stock a “forever” stock – a company that has a solid competitive advantage and can maintain its market position and profitability is more likely to be able to continue providing passive income for generations to come.

Forever Stock #12: Enbridge Inc. (ENB)

- Dividend yield: 6.6%

- Years of dividend growth: 27

Enbridge is an oil & gas company that operates the following segments: Liquids Pipelines, Gas Distributions, Energy Services, Gas Transmission & Midstream, and Green Power & Transmission. Enbridge bought Spectra Energy for $28 billion in 2016 and has become one of the largest midstream companies in North America.

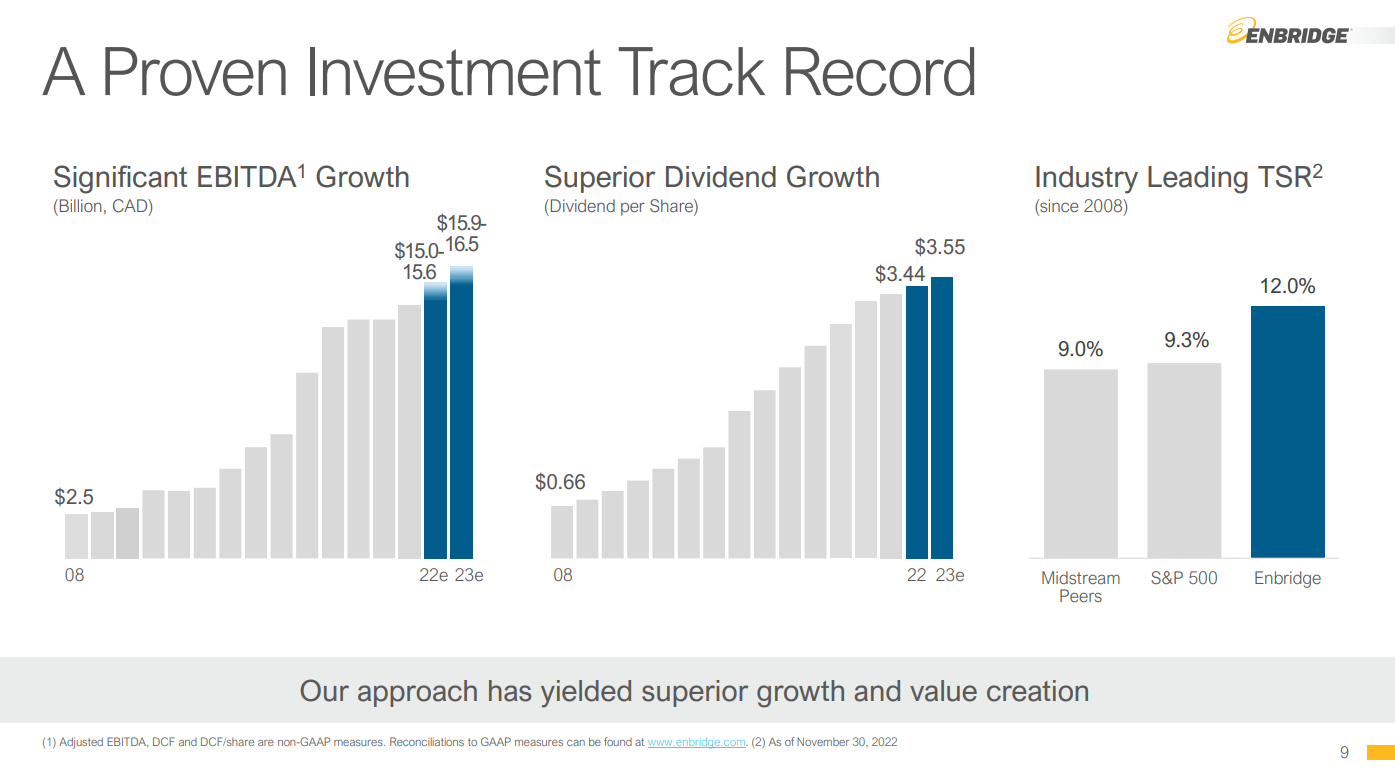

Enbridge reported its third-quarter earnings results on November 4th. The company generated higher revenues during the quarter, but since commodity prices are primarily a pass-through cost for the company, higher revenues do not necessarily translate into higher profits. During the quarter, Enbridge still managed to grow its adjusted EBITDA by 15% year over year, to CAD$3.8 billion, up from CAD$3.3 billion during the previous year’s quarter. This was possible thanks to stronger contributions from the liquids pipelines segment primarily.

Boasting 27 years of consecutive dividend increases, Enbridge has undoubtedly established its operational resilience capabilities. As critical energy infrastructure assets have become more essential than ever in today’s economy, Enbridge’s performance will likely remain robust in the coming years and in the long term.

Source: Investor Presentation

With its payout ratio standing at a healthy 68% and its vast asset footprint serving as a tremendous competitive advantage, we believe Enbridge should continue serving income-oriented investors adequately for decades.

Click here to download our most recent Sure Analysis report on Enbridge Inc. (preview of page 1 of 3 shown below):

Forever Stock #11: PepsiCo, Inc. (PEP)

- Dividend yield: 2.5%

- Years of dividend growth: 50

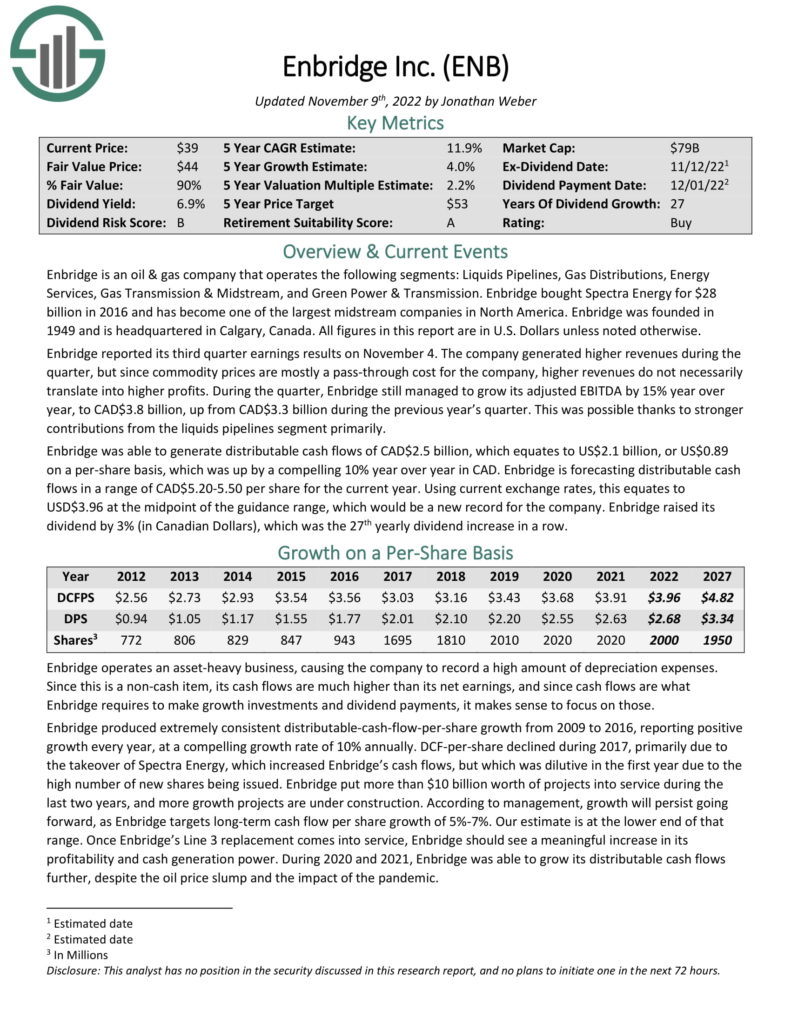

PepsiCo is a global food and beverage company that generates about $80 billion annual sales. The company has multiple competitive advantages, including its strong brands and a global scale. Specifically, PepsiCo has 23 individual brands that each generates at least $1 billion in annual sales. Besides its strong brands tending to yield consistent sales as they are widely trusted amongst consumers, they secure optimal shelf space at retailers and provide PepsiCo with exceptional pricing power.

PepsiCo’s latest results once against demonstrated the company’s ability to achieve robust results during a rather challenging trading environment. In particular, Q3 revenues grew 8.8% to $21.97 billion, beating analysts’ estimates by $1.15 billion. The adjusted earnings-per-share of $1.97 compared to $1.79 in the prior year was $0.12 better than anticipated. Despite these impressive results, the stronger U.S. dollar imposed a 3% headwind to both revenue and earnings-per-share.

Earlier in 2022, PepsiCo increased its annualized dividend by 7% to $4.60, its 50th consecutive annual dividend increase. This officially tagged the company as a Dividend King. The company also announced a share repurchase authorization of up to $10 billion, solidifying its commitment to creating value for shareholders.

Source: Investor Presentation

Click here to download our most recent Sure Analysis report on PepsiCo, Inc. (preview of page 1 of 3 shown below):

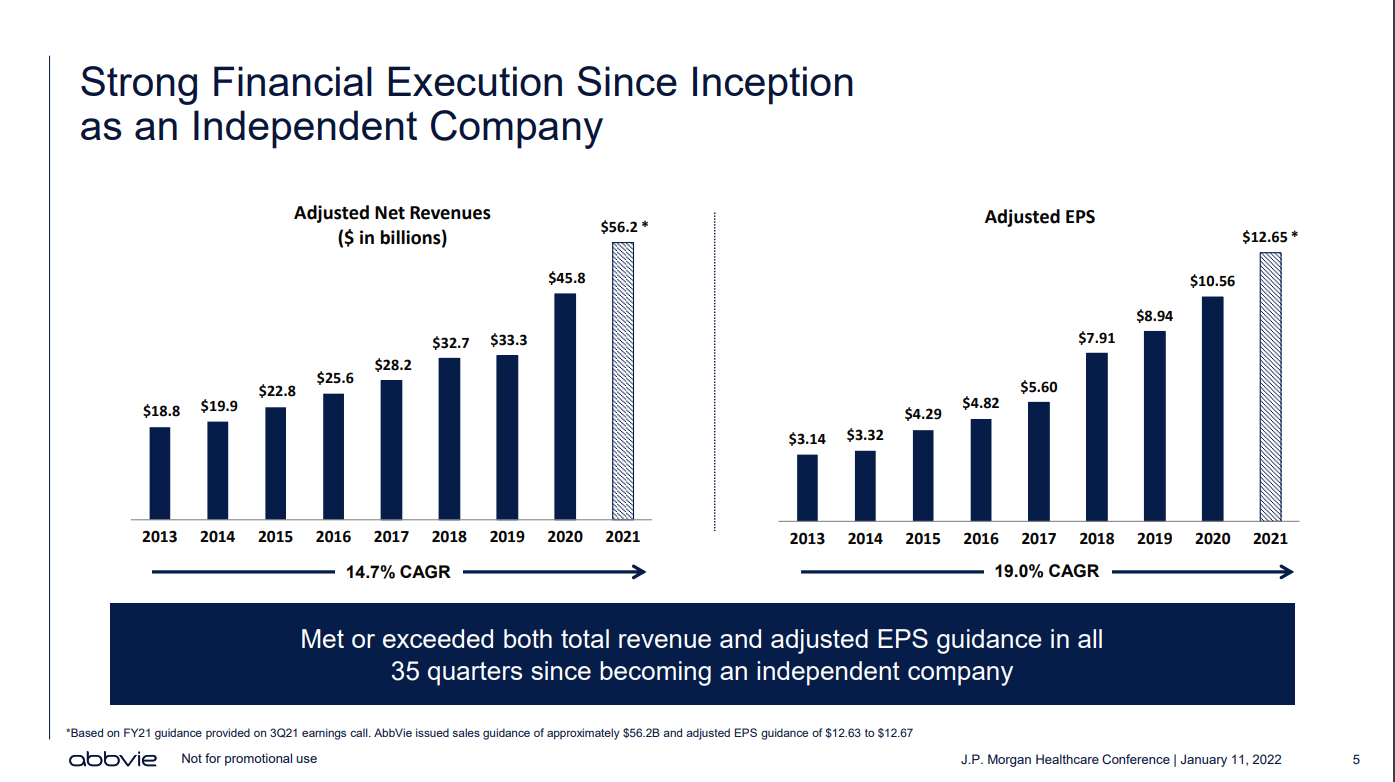

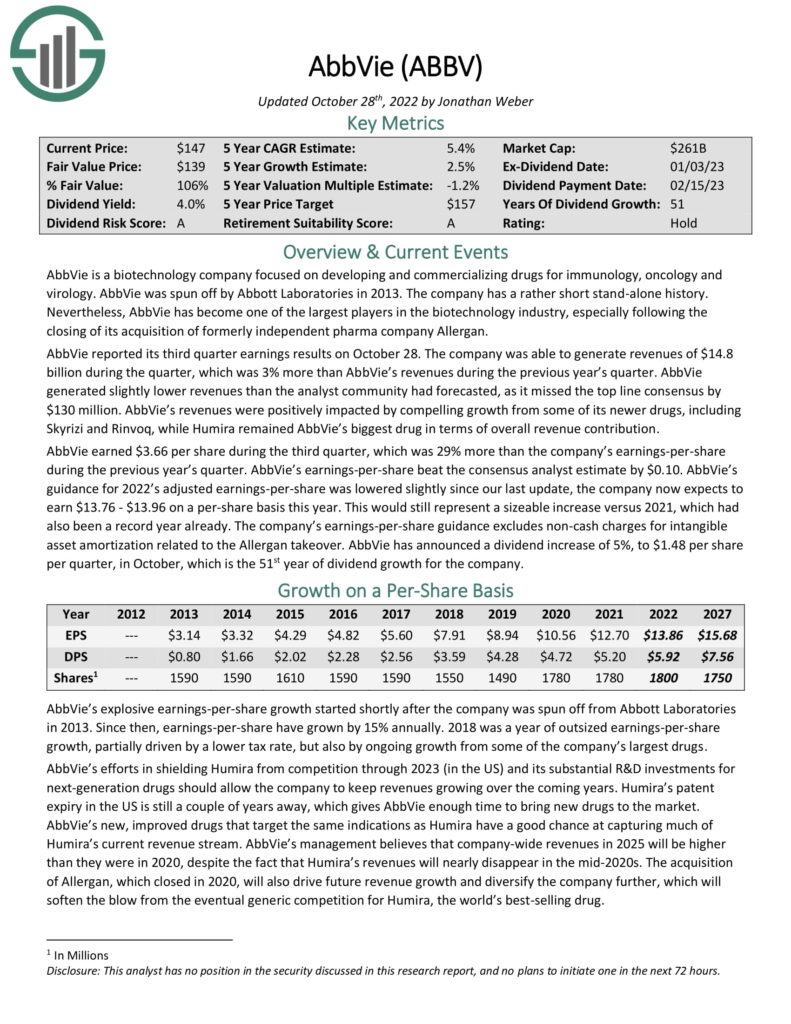

Forever Stock #10: AbbVie Inc. (ABBV)

- Dividend yield: 3.6%

- Years of dividend growth: 51

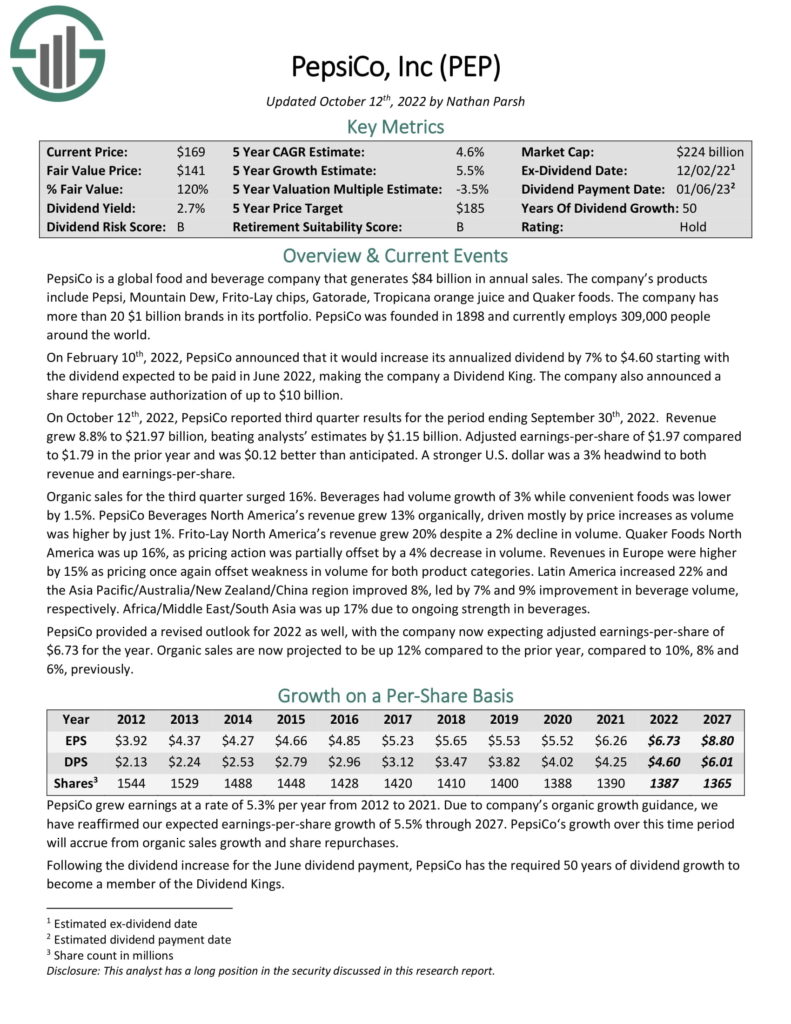

AbbVie is a biotechnology company focused on developing and commercializing drugs for immunology, oncology, and virology. AbbVie was spun off by Abbott Laboratories in 2013. The company has a rather short stand-alone history. Nevertheless, AbbVie has become one of the largest players in the biotechnology industry, especially following the closing of its acquisition of formerly independent pharma company Allergan.

AbbVie reported its third-quarter earnings results on October 28. The company generated revenues of $14.8 billion during the quarter, which was 3% more than AbbVie’s revenues during the previous year’s quarter. AbbVie’s revenues were positively impacted by compelling growth from some of its newer drugs, including Skyrizi and Rinvoq, while Humira remained AbbVie’s most significant drug in terms of overall revenue contribution.

Following robust profitability, AbbVie’s guidance for 2022’s targets adjusted earnings-per-share between $13.76 and $13.96. This would represent a sizeable increase versus 2021, which was also a record year.

Source: Investor Presentation

While the upcoming expiry of AbbVie’s Humira patent has added some risks lately, the company’s diversified portfolio, including the recent acquisition of Allergan, should continue to generate tons of cash. With the payout ratio standing at just under 43% and AbbVie’s latest 51st consecutive dividend hike by 5% cementing management’s confidence in future performance, we believe the stock makes for a tremendous generational income holding.

Click here to download our most recent Sure Analysis report on AbbVie Inc. (preview of page 1 of 3 shown below):

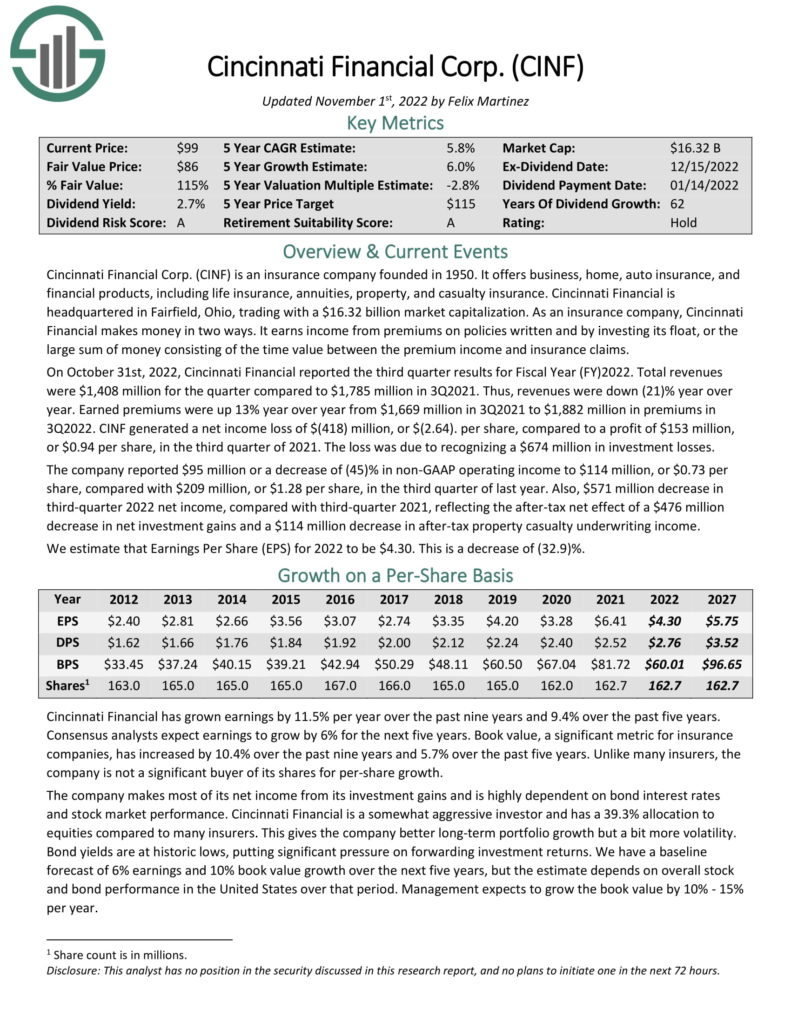

Forever Stock #9: Cincinnati Financial Corp. (CINF)

- Dividend yield: 2.6%

- Years of dividend growth: 62

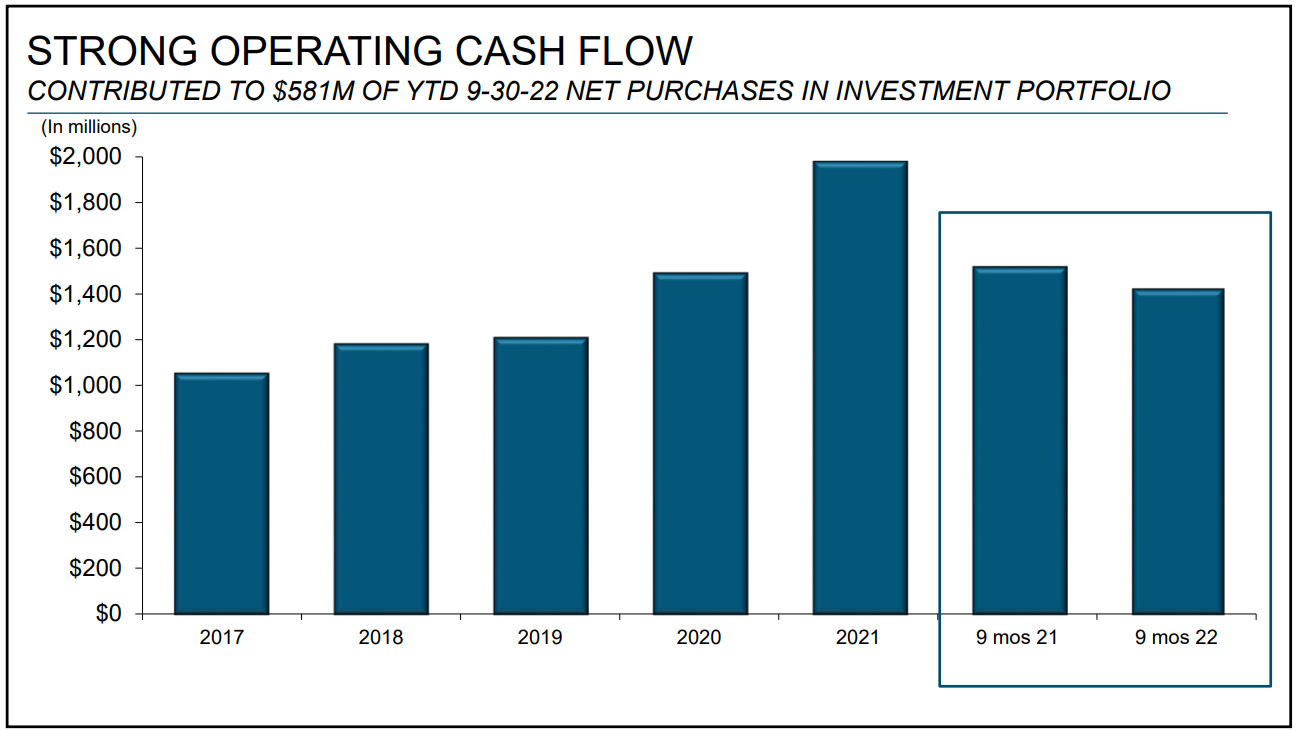

Cincinnati Financial Corp. is an insurance company founded in 1950. It offers business, home, auto insurance, and financial products, including life insurance, annuities, property, and casualty insurance. Cincinnati Financial is headquartered in Fairfield, Ohio, trading with a $16.4 billion market capitalization.

As an insurance company, Cincinnati Financial makes money in two ways. It earns income from premiums on policies written and by investing its float, or the large sum of money consisting of the time value between the premium income and insurance claims.

On October 31st, 2022, Cincinnati Financial reported its Q3 results for Fiscal Year (FY)2022. Total revenues were $1.4 billion, down 21% year-over-year. Still, earned premiums grew 13% to $1.88 billion compared to last year.

The company posted a net loss of $(418) million, or $(2.64) per share, compared to a profit of $153 million, or $0.94 per share, in Q3 of 2021. That said, the loss was due to realizing $674 million in investment losses during the quarter amid the rough market situation in the capital market during this period.

Source: Investor Handout

While the insurance industry is highly competitive, Cincinnati Financial’s brand, large-scale, and close relationship with its customers should continue to differentiate amongst its peers. These qualities have helped the company to increase its dividend for 62 years in a row.

Click here to download our most recent Sure Analysis report on Cincinnati Financial Corp. (preview of page 1 of 3 shown below):

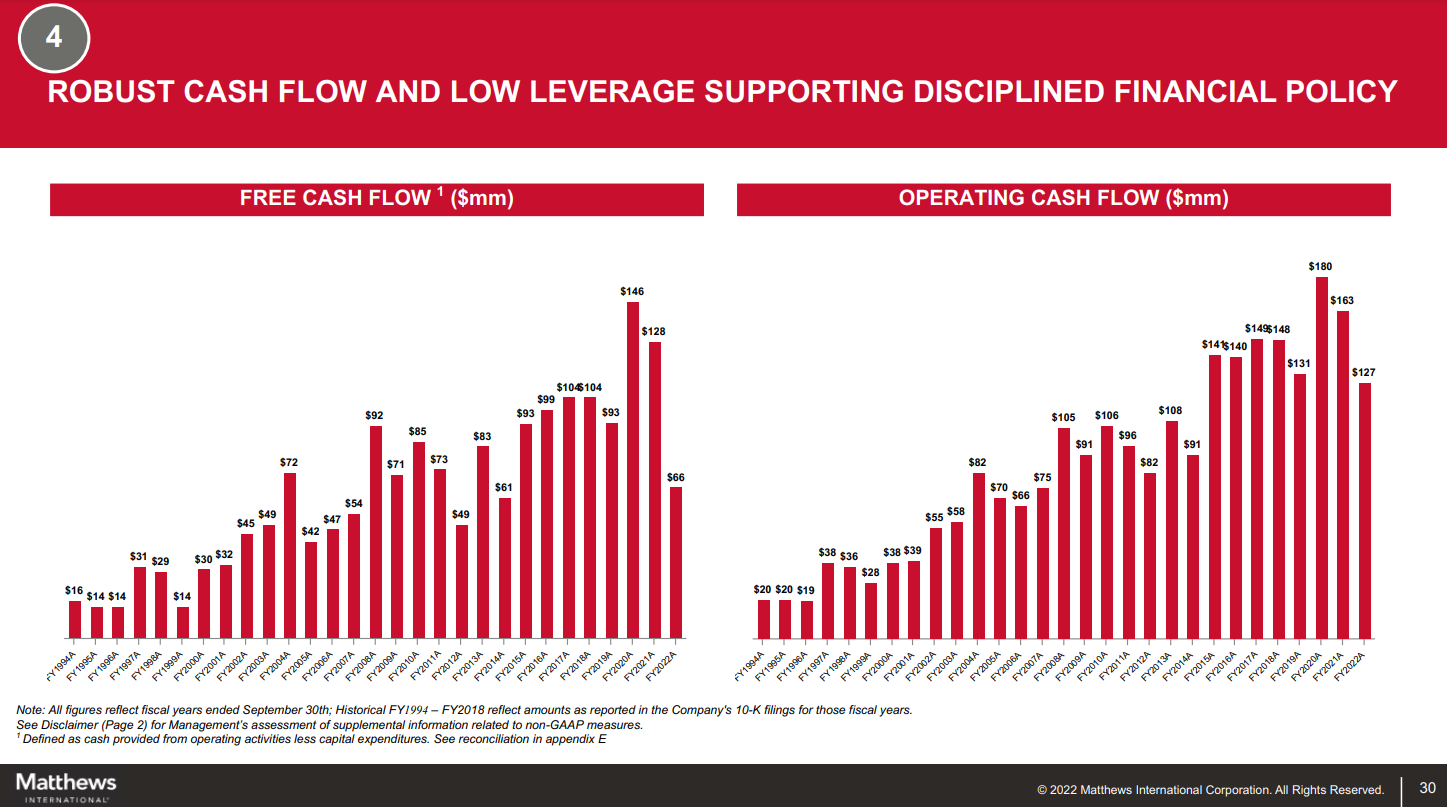

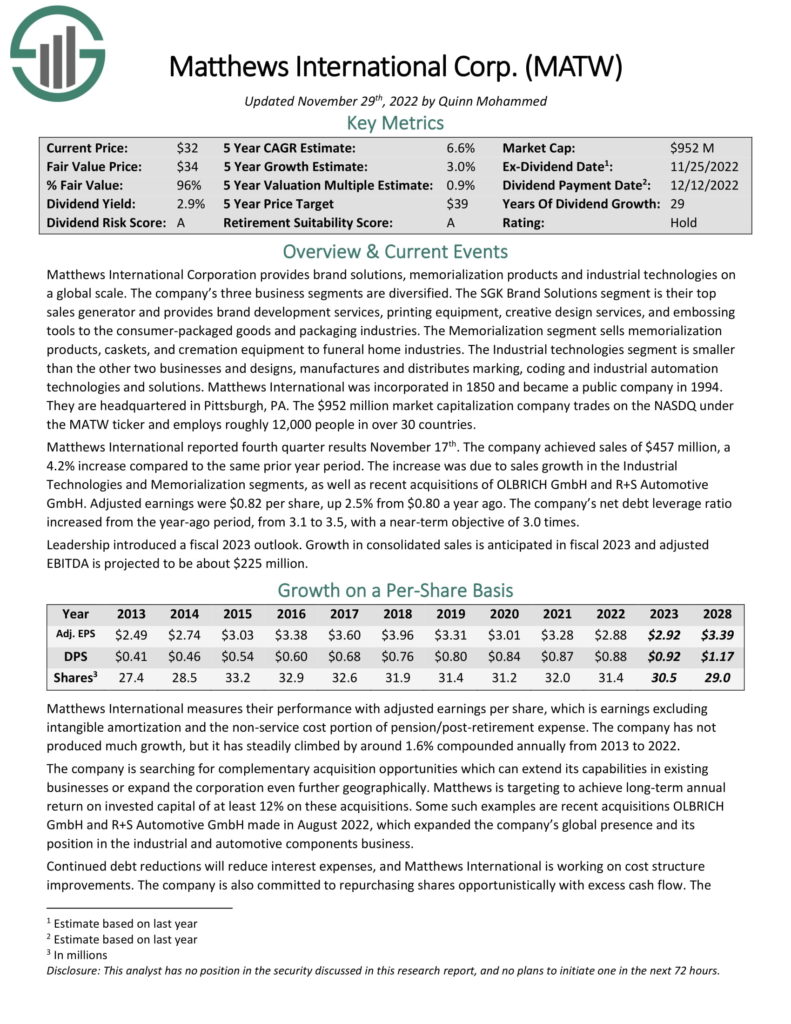

Forever Stock #8: Matthews International Corporation (MATW)

- Dividend yield: 3.0%

- Years of dividend growth: 29

Matthews International Corporation provides brand solutions, memorialization products, and industrial technologies on a global scale. The company’s three business segments provide diversifed cash flows that are sourced anywhere from brand development services and printing equipment, to memorialization products, caskets, and cremation equipment, to industrial automation technologies and solutions.

Matthews International reported fourth-quarter results on November 17th. The company achieved sales of $457 million, a 4.2% increase compared to the same prior year period. The increase was due to sales growth in the Industrial Technologies and Memorialization segments, as well as recent acquisitions of OLBRICH GmbH and R+S Automotive GmbH.

The company is searching for complementary acquisition opportunities which can extend its capabilities in existing businesses or expand the corporation even further geographically. Matthews is targeting to achieve a long-term annual return on invested capital of at least 12% on these acquisitions. Some such examples are recent acquisitions OLBRICH GmbH, and R+S Automotive GmbH made in August 2022, which expanded the company’s global presence and its position in the industrial and automotive components business.

Source: Investor Presentation

With Matthews International’s payout ratio standing below one-third of earnings and the company’s recent acquisition likely to ignite further growth, we believe its extended dividend growth track record is set to continue for decades to come.

Click here to download our most recent Sure Analysis report on Matthews International Corporation (preview of page 1 of 3 shown below):

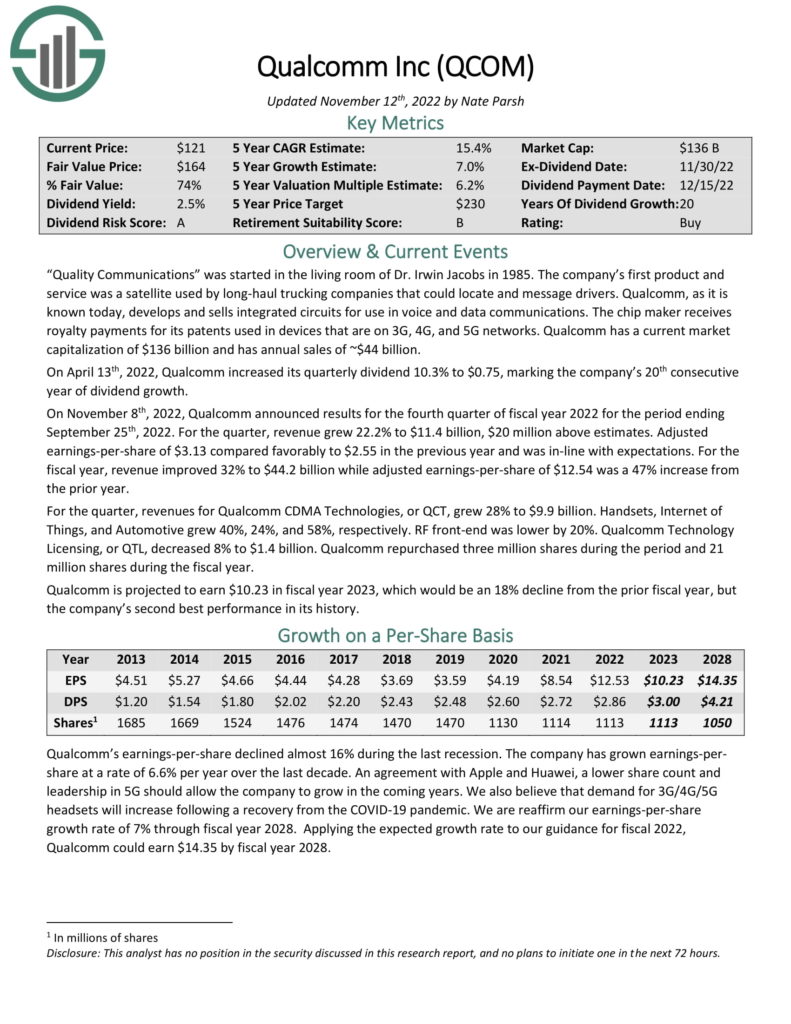

Forever Stock #7: QUALCOMM Incorporated (QCOM)

- Dividend yield: 2.7%

- Years of dividend growth: 20

Qualcomm, as it is known today, develops and sells integrated circuits for use in voice and data communications. The chip maker receives royalty payments for its patents used in devices that are on 3G, 4G, and 5G networks. Qualcomm has a current market capitalization of $123 billion and generates annual sales of ~$44 billion.

While the semiconductor industry is cyclical, Qualcomm’s chips are essential for phone manufacturers to power their devices. Qualcomm’s technologies are critical for powering the telecommunications industry in general, and the company has enjoyed great traction lately due to the ongoing expansion of the 5G network.

On November 8 th, 2022, Qualcomm announced results for the fourth quarter of fiscal year 2022 for the period ending September 25 th, 2022. For the quarter, revenue grew 22.2% to $11.4 billion, $20 million above estimates. Adjusted earnings-per-share of $3.13 compared favorably to $2.55 in the previous year and was in-line with expectations. For the fiscal year, revenue improved 32% to $44.2 billion, while adjusted earnings-per-share of $12.54 was a 47% increase from the prior year.

Source: Investor Presentation

Qualcomm has grown its dividend for 20% consecutive years and based on its projected earnings for the year, its dividend payout ratio stands close to 29%.

Click here to download our most recent Sure Analysis report on QUALCOMM Incorporated (preview of page 1 of 3 shown below):

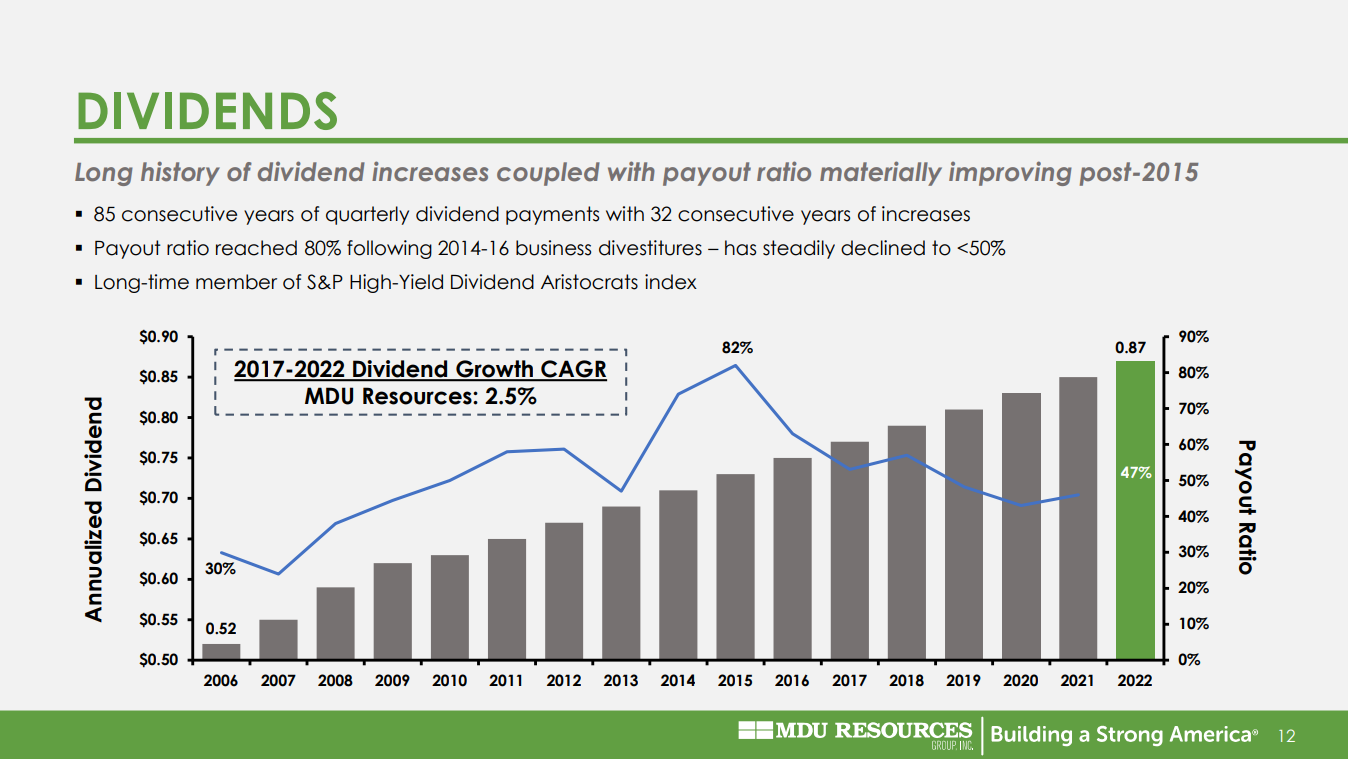

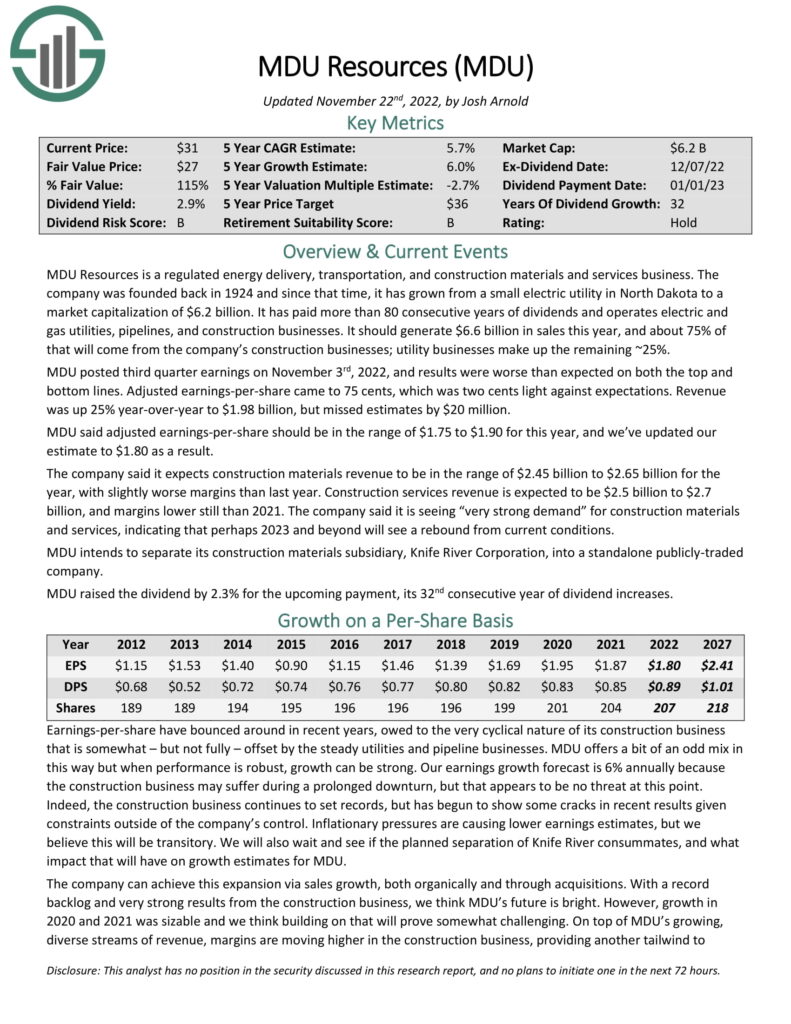

Forever Stock #6: MDU Resources (MDU)

- Dividend yield: 2.9%

- Years of dividend growth: 32

MDU Resources is a regulated energy delivery, transportation, and construction materials and services business. The company was founded in 1924, and since then, it has grown from a small electric utility in North Dakota to a market capitalization of $6.2 billion.

MDU has paid 85 consecutive years of dividends and operates electric and gas utilities, pipelines, and construction businesses. It should generate $6.6 billion in sales this year, and about 75% of that will come from the company’s construction businesses; utility businesses make up the remaining ~25%.

Source: Investor Presentation

MDU posted third-quarter earnings on November 3rd, 2022, and results were worse than expected on both the top and bottom lines. Adjusted earnings-per-share came to 75 cents, which was two cents light against expectations. Revenue was up 25% year-over-year to $1.98 billion but missed estimates by $20 million. Management said adjusted earnings-per-share should be in the range of $1.75 to $1.90 this year, implying a relatively stable performance compared to fiscal 2021.

The company can achieve this expansion via sales growth, both organically and through acquisitions. With a record backlog and robust results from the construction business, we think MDU’s future is bright. Its ability to perform well and grow shareholder returns over the years is reflected in its 32-year dividend growth track record.

Click here to download our most recent Sure Analysis report on MDU Resources (preview of page 1 of 3 shown below):

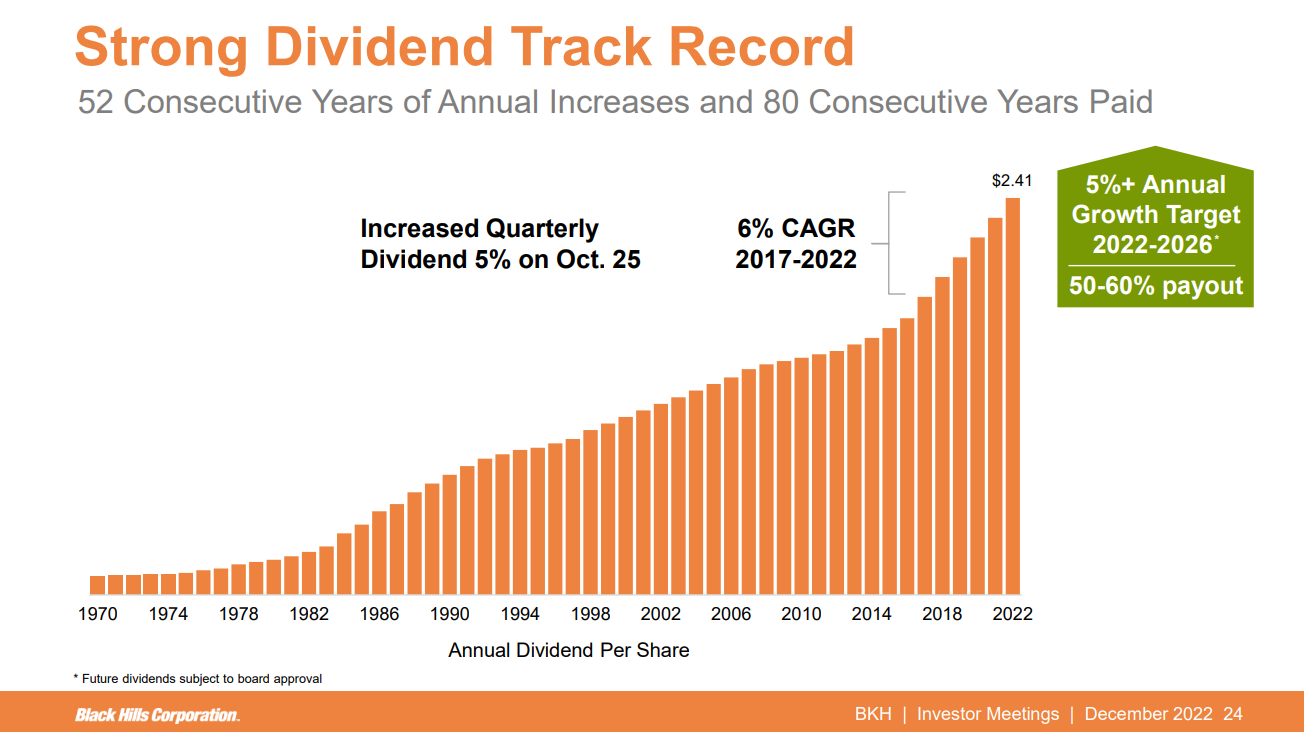

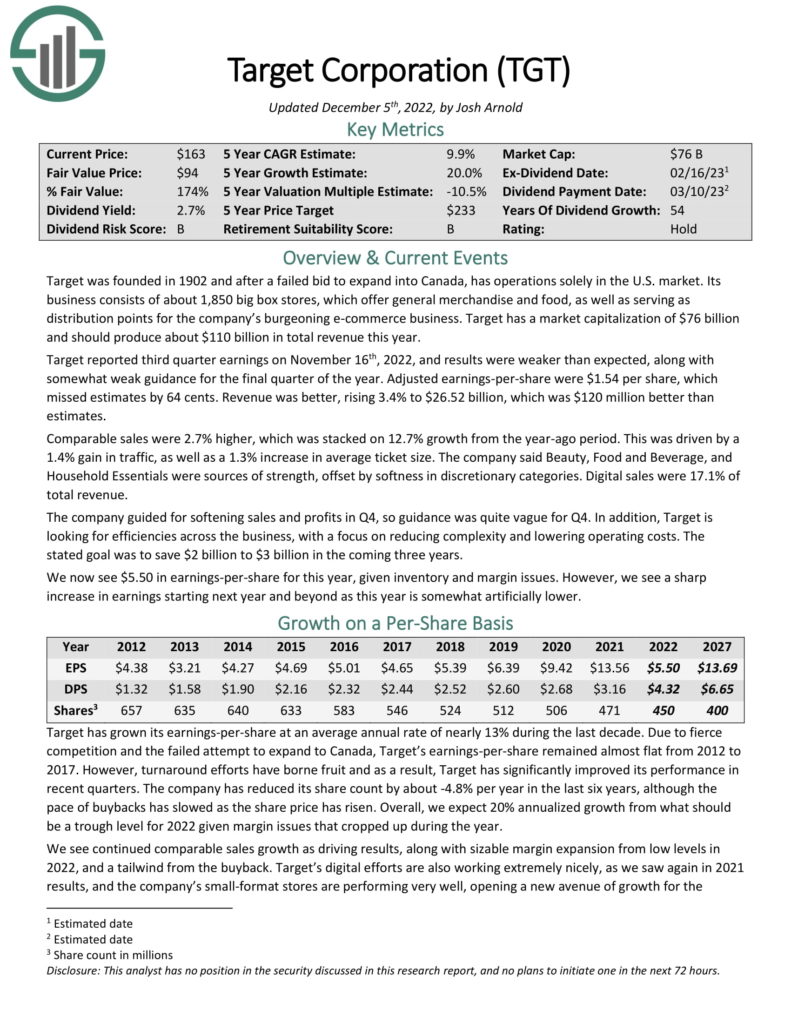

Forever Stock #5: Black Hills Corporation (BKH)

- Dividend yield: 3.6%

- Years of dividend growth: 52

Black Hills Corporation is an electric utility that provides electricity and natural gas to customers in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming. Black Hills was founded in 1941 and is headquartered in Rapid City, South Dakota. Black Hills Corporation has increased its dividend for over 50 years, making it a Dividend King thanks to five decades of dividend raises.

Black Hills Corporation reported its third-quarter earnings results on November 2nd. The company generated revenues of $460 million during the quarter, which was 22% more than the revenues that Black Hills Corporation was able to generate during the previous year’s quarter. Black Hills Corporation’s revenues were higher than the analyst community expected, beating the consensus estimate by a hefty $70 million.

Due to a modest dividend growth rate, Black Hills Corporation’s dividend payout ratio declined over the past decade. Today, the company pays out roughly 60% of its net profits through dividends.

Source: Investor Presentation

Demand for electricity and gas is not very cyclical, although it depends on weather conditions to some degree. Thus, Black Hills should remain profitable under most circumstances. Customers tend to stick with their provider because Black Hills operates a relatively stable business model. The company should also be able to weather future recessions well, which makes it an ideal generational stock for rising income.

Click here to download our most recent Sure Analysis report on Black Hills Corporation (preview of page 1 of 3 shown below):

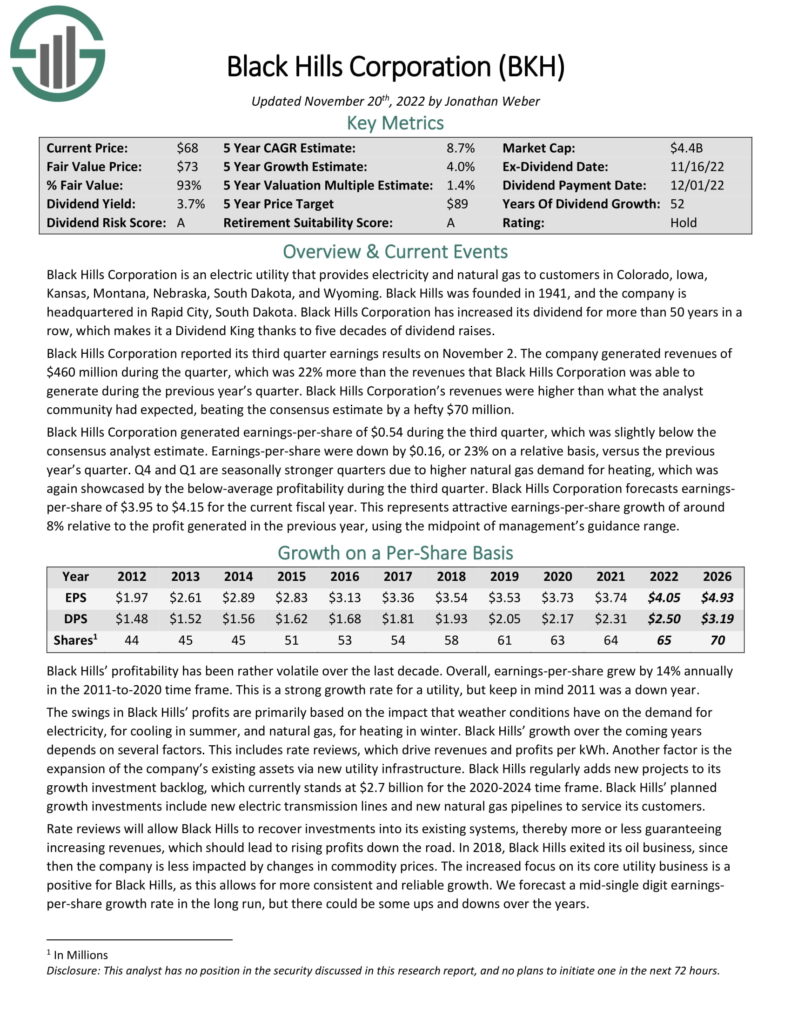

Forever Stock #4: Realty Income Corporation (O)

- Dividend yield: 4.6%

- Years of dividend growth: 27

Realty Income is a REIT that has become famous for its successful dividend growth history and monthly dividend payments. Today, the trust owns more than 4,000 properties that are not part of a wider retail development (such as a mall) but instead are stand-alone properties. This means that its locations are viable for many different tenants, including government services, healthcare services, and entertainment.

Realty Income announced its third-quarter earnings results on November 3. The trust reported that it generated revenues of $840 million during the quarter, up 71% compared to the prior-year period. Realty Income also managed to generate a robust adjusted AFFO-per-share of $0.98 during the quarter.

Realty Income has trademarked itself as “The Monthly Dividend Company”, boasting 628 monthly dividends declared and 100 consecutive quarterly increases.

Source: Investor Presentation

Click here to download our most recent Sure Analysis report on Realty Income Corporation (preview of page 1 of 3 shown below):

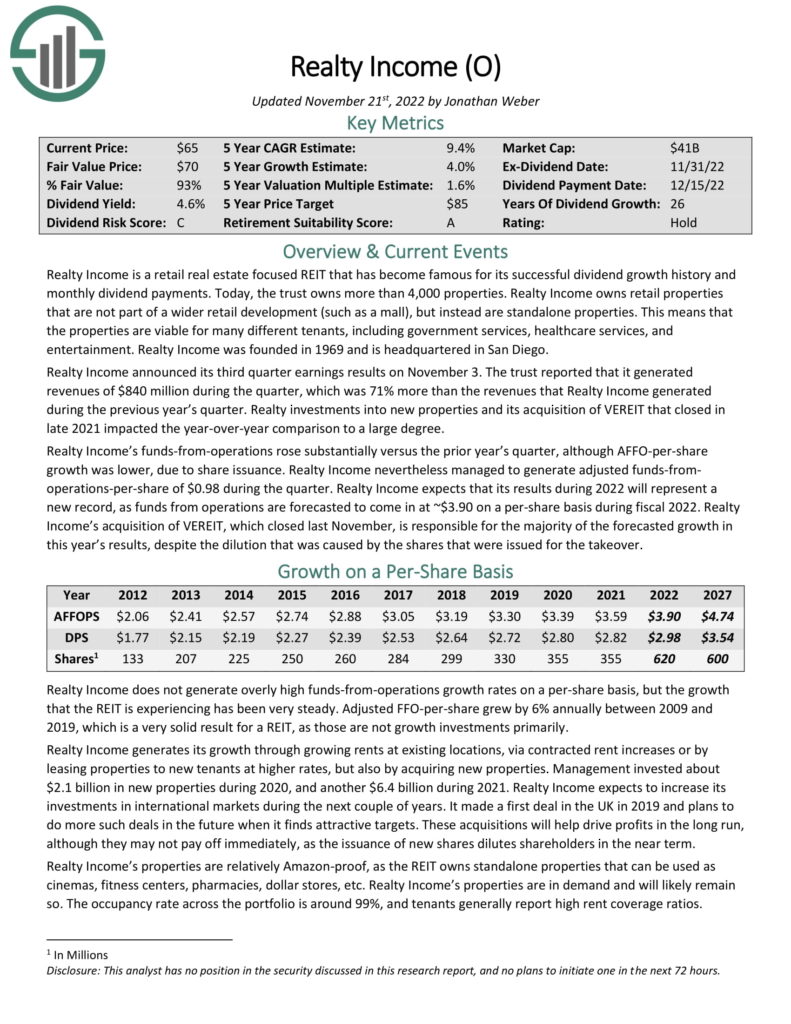

Forever Stock #3: Target Corporation (TGT)

- Dividend yield: 3.0%

- Years of dividend growth: 54

Target was founded in 1902 and, after a failed bid to expand into Canada, has operations solely in the U.S. market. Its business consists of about 2,000 big box stores that offer general merchandise and food and serve as distribution points for the company’s burgeoning e-commerce business. Target’s market capitalization of $67.6 billion should produce about $110 billion in total revenue this year.

Target reported third-quarter earnings on November 16th, 2022, and results were weaker than expected, along with somewhat weak guidance for the year’s final quarter. Adjusted earnings-per-share was $1.54 per share, which missed estimates by 64 cents. Revenue was better, rising 3.4% to $26.52 billion, which was $120 million better than estimates.

Source: Investor Infographic

We see continued comparable sales growth as driving results, along with sizable margin expansion from low levels in 2022 and a tailwind from buybacks. Target’s digital efforts are also working exceptionally nicely. The company’s small-format stores are performing very well, opening a new avenue of growth for the company in the coming years.

Click here to download our most recent Sure Analysis report on Target Corporation (preview of page 1 of 3 shown below):

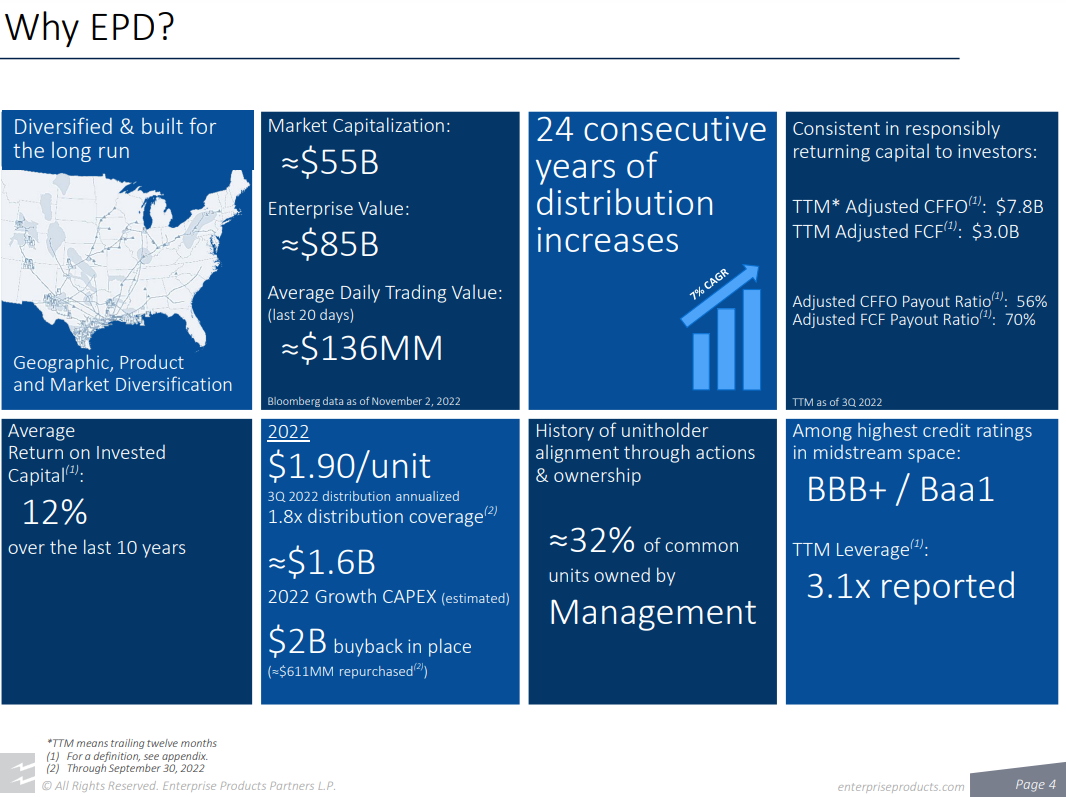

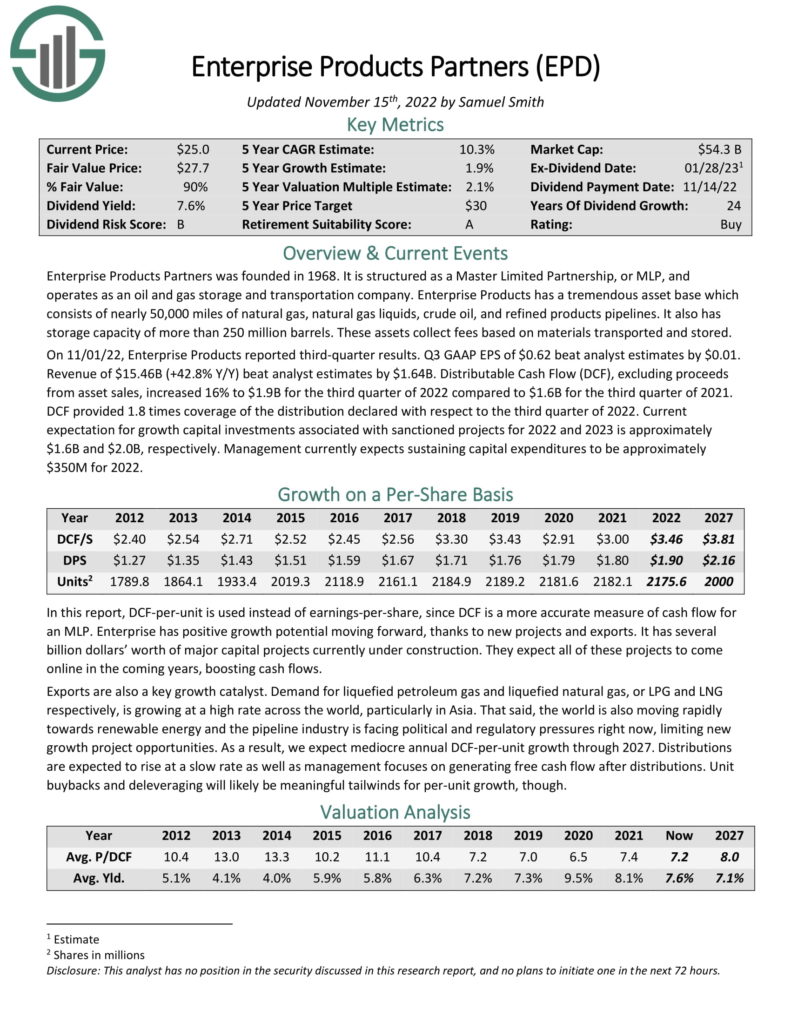

Forever Stock #2: Enterprise Products Partners L.P. (EPD)

- Dividend yield: 7.9%

- Years of dividend growth: 24

Enterprise Products Partners was founded in 1968. It is structured as a Master Limited Partnership, or MLP, and operates as an oil and gas storage and transportation company. Enterprise Products has a tremendous asset base which consists of nearly 50,000 miles of natural gas, natural gas liquids, crude oil, and refined products pipelines. It also has a storage capacity of more than 250 million barrels. These assets collect fees based on materials transported and stored.

On 11/01/22, Enterprise Products reported third-quarter results. Q3 GAAP EPS of $0.62 beat analyst estimates by $0.01. Revenue of $15.46B (+42.8% Y/Y) beat analyst estimates by $1.64B. Distributable Cash Flow (DCF), excluding proceeds from asset sales, increased 16% to $1.9B for the third quarter of 2022 compared to $1.6B for the third quarter of 2021. DCF provided 1.8 times coverage of the distribution declared with respect to the third quarter of 2022.

In terms of safety, Enterprise Products Partners is one of the strongest midstream MLPs. It has credit ratings of BBB+ from Standard & Poor’s and Baa1 from Moody’s, which are higher ratings than most MLPs. It also has a distribution coverage ratio of over 1.6x, leaving room for distribution increases and unit repurchases. Enterprise Products’ high-quality assets generate strong cash flow, even in recessions.

Source: Investor Presentation

Click here to download our most recent Sure Analysis report on Enterprise Products Partners L.P. (preview of page 1 of 3 shown below):

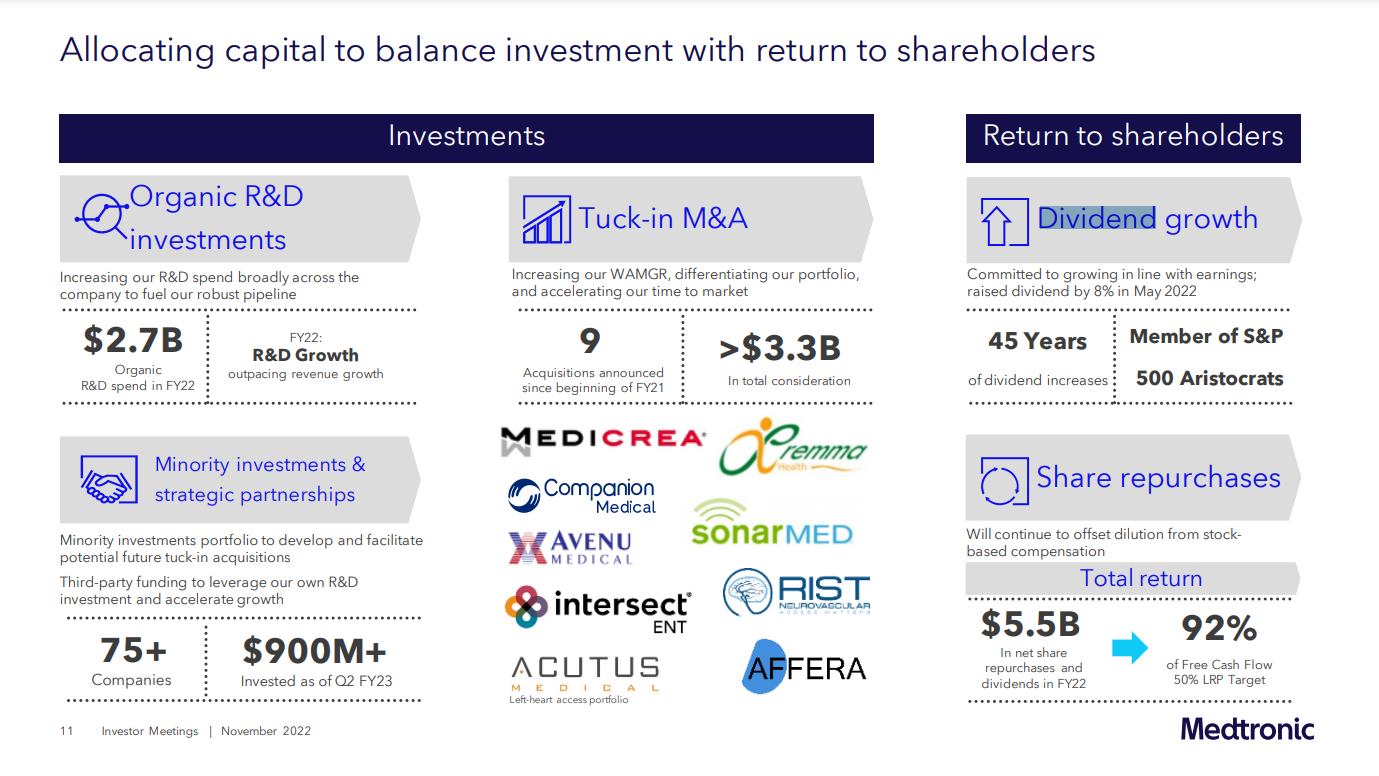

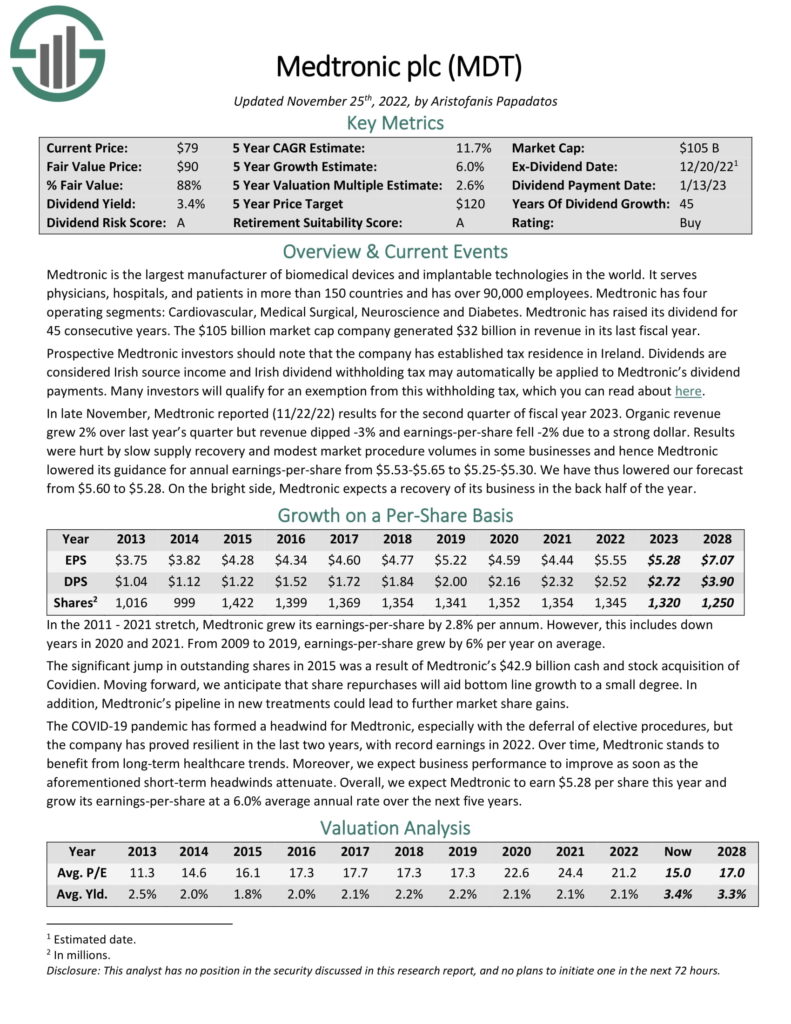

Forever Stock #1: Medtronic plc (MDT)

- Dividend yield: 3.5%

- Years of dividend growth: 45

Medtronic is the largest manufacturer of biomedical devices and implantable technologies in the world. It serves physicians, hospitals, and patients in more than 150 countries and has over 90,000 employees. Medtronic has four operating segments: Cardiovascular, Medical Surgical, Neuroscience, and Diabetes.The $104 billion market cap company generated $32 billion in revenue in its last fiscal year.

In late November, Medtronic reported (11/22/22) results for the second quarter of fiscal year 2023. Organic revenue grew 2% over last year’s quarter, but revenue dipped -3%, and earnings-per-share fell -2% due to a strong dollar.

Results were hurt by slow supply recovery and modest market procedure volumes in some businesses, and hence Medtronic lowered its guidance for annual earnings-per-share from $5.53-$5.65 to $5.25-$5.30. Nevertheless, we believe that these modest impacts are mostly transitory amid the ongoing macroeconomic landscape.

Medtronic’s most compelling competitive advantage is its intellectual leadership in a complicated industry within the healthcare sector. Medtronic also has a strong product pipeline that should drive its growth for the foreseeable future.

Source: Investor Presentation

Its growing financials, moat, and consistent focus on invocation have allowed the company to grow its dividend for 45 consecutive years. The dividend has grown by 16% per year on average over the last 45 years and by 8% per year on average over the last five years.

Click here to download our most recent Sure Analysis report on Medtronic plc (preview of page 1 of 3 shown below):

Final Thoughts

In conclusion, “forever” stocks, such as the 12 names we featured in this article, can be a great way to generate passive income and gradually grow your wealth over time. Forever stocks have proven to be dependable and enduring over long periods, and their growth catalysts should continue providing rising income for generations to come.

When selecting “forever” stocks for your portfolio, it’s essential to consider a variety of factors, including solid financials, a history of consistently paying and increasing dividends, growth potential, and a solid competitive advantage or “moat.” We hope that our list has provided some worthwhile ideas for long-term investment opportunities.

More By This Author:

Dividend Kings In Focus: Nucor Corporation

3 Healthcare Stocks To Buy For 2023

Monthly Dividend Stock In Focus: Hugoton Royalty Trust