10 Safest Dividend Kings For 2023

Image Source: Unsplash

The Dividend Kings are the best of the best in dividend longevity.

What is a Dividend King? A stock with 50 or more consecutive years of dividend increases.

The downloadable Dividend Kings Spreadsheet List below contains the following for each stock in the index among other important investing metrics:

- Payout ratio

- Dividend yield

- Price-to-earnings ratio

The one requirement to be a Dividend King is 50+ years of rising dividends.

But not all Dividend Kings make equally good investments today. Some Dividend Kings are better than others, based on the sustainability of their dividends.

With this in mind, we have analyzed the 10 safest Dividend Kings from our Sure Analysis Research Database with the safest dividends based on our Dividend Risk Score rating system.

The following 10 Dividend Kings have Dividend Risk Scores of A (our top rating), and the lowest payout ratios. As a result, they are the safest Dividend Kings for 2023.

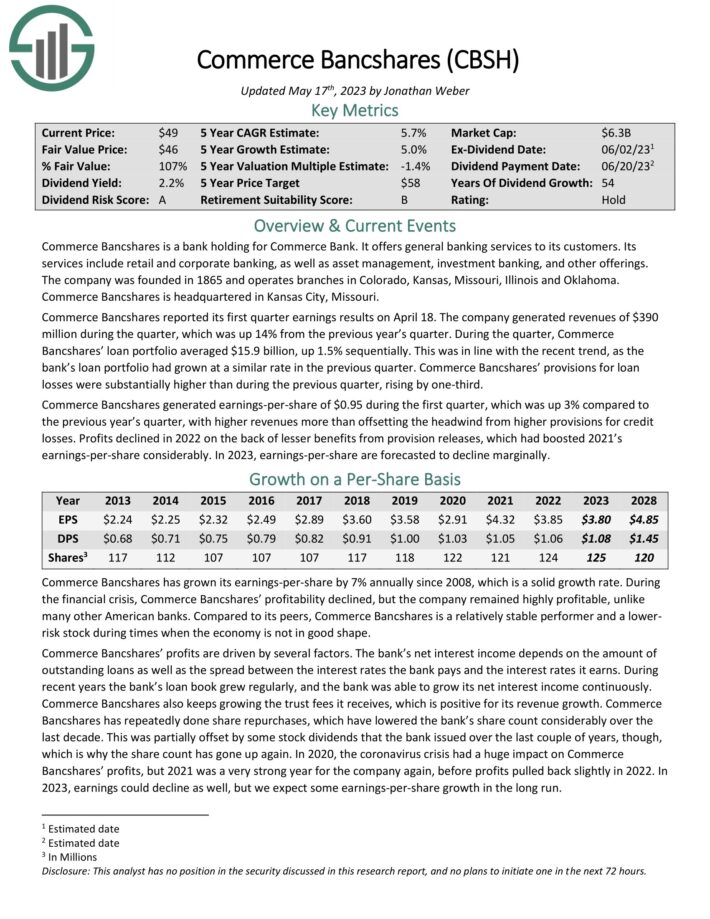

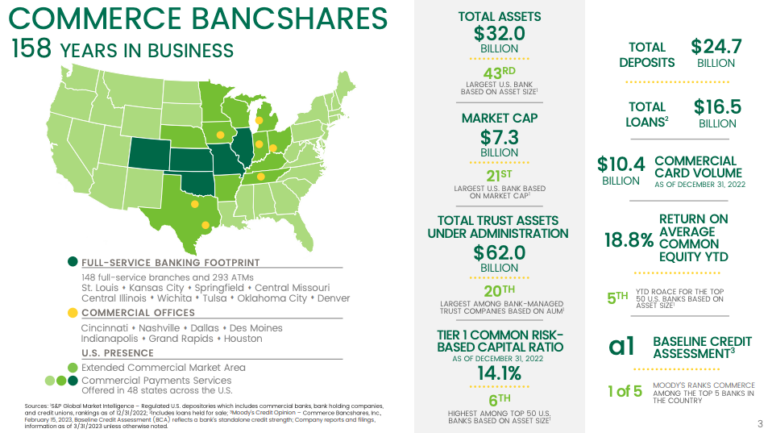

Safest Dividend Kings #10: Commerce Bancshares (CBSH)

- Payout Ratio: 28.3%

Commerce Bancshares is a bank holding for Commerce Bank. It offers general banking services to its customers. Its services include retail and corporate banking, as well as asset management, investment banking, and other offerings.

The company was founded in 1865 and operates branches in Colorado, Kansas, Missouri, Illinois, and Oklahoma.

Source: Investor Presentation

Commerce Bancshares reported its first-quarter earnings results on April 18. Revenues of $390 million rose 14% from the previous year’s quarter. During the quarter, Commerce Bancshares’ loan portfolio averaged $15.9 billion, up 1.5% sequentially. Provisions for loan losses were substantially higher than during the previous quarter, rising by one-third.

Commerce Bancshares generated earnings-per-share of $0.95 during the first quarter, which was up 3% compared to the previous year’s quarter, with higher revenues more than offsetting the headwind from higher provisions for credit losses.

Click here to download our most recent Sure Analysis report on Commerce Bancshares (preview of page 1 of 3 shown below):

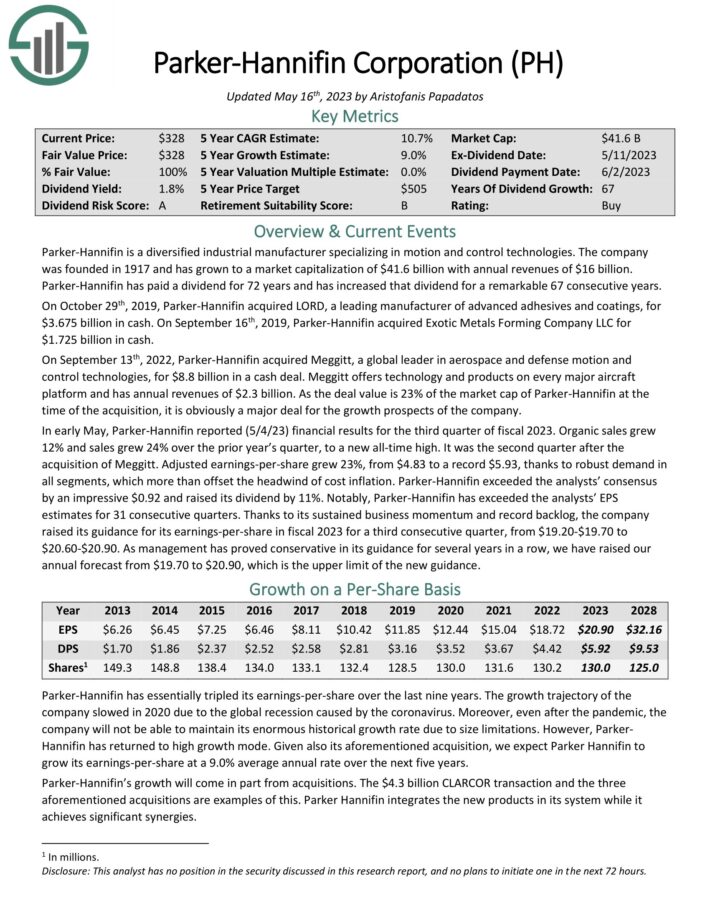

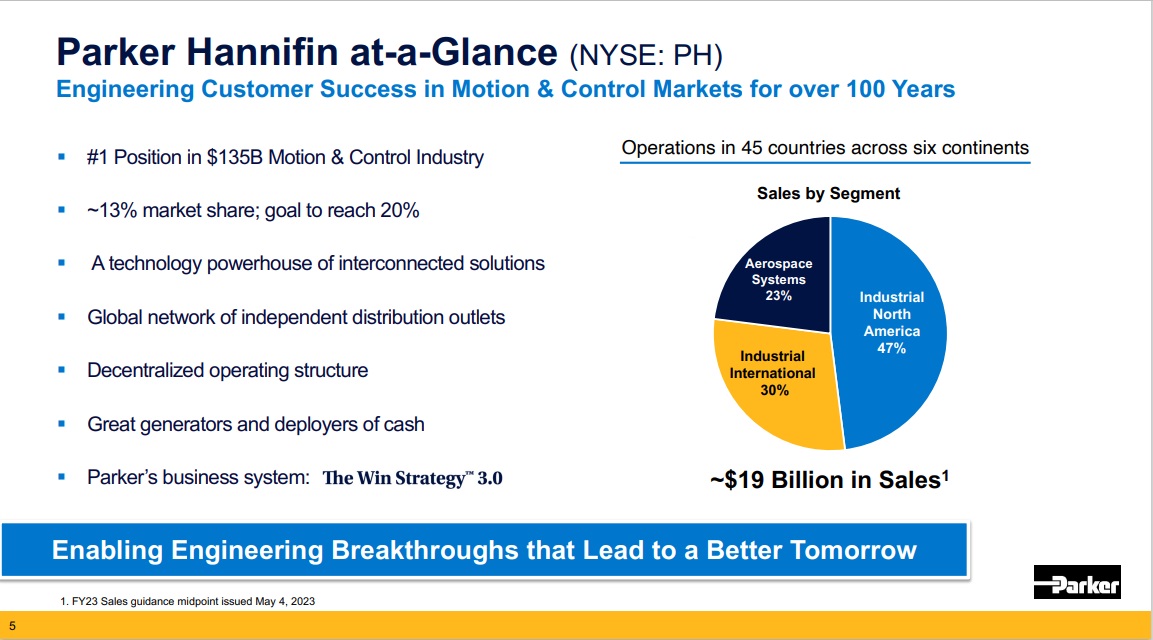

Safest Dividend Kings #9: Parker-Hannifin (PH)

- Payout Ratio: 28.4%

Parker-Hannifin is a diversified industrial manufacturer specializing in motion and control technologies. The company generates annual revenues of $16 billion. Parker-Hannifin has paid a dividend for 72 years and has increased the dividend for 67 consecutive years.

Source: Investor Presentation

In early May, Parker-Hannifin reported (5/4/23) financial results for the third quarter of fiscal 2023. Organic sales grew 12% and sales grew 24% over the prior year’s quarter, to a new all-time high. Adjusted earnings-per-share grew 23%, from $4.83 to a record $5.93, thanks to robust demand in all segments, which more than offset the headwind of cost inflation.

Parker-Hannifin exceeded the analysts’ consensus by an impressive $0.92 and raised its dividend by 11%. Notably, Parker-Hannifin has exceeded the analysts’ EPS estimates for 31 consecutive quarters.

Click here to download our most recent Sure Analysis report on Parker-Hannifin (preview of page 1 of 3 shown below):

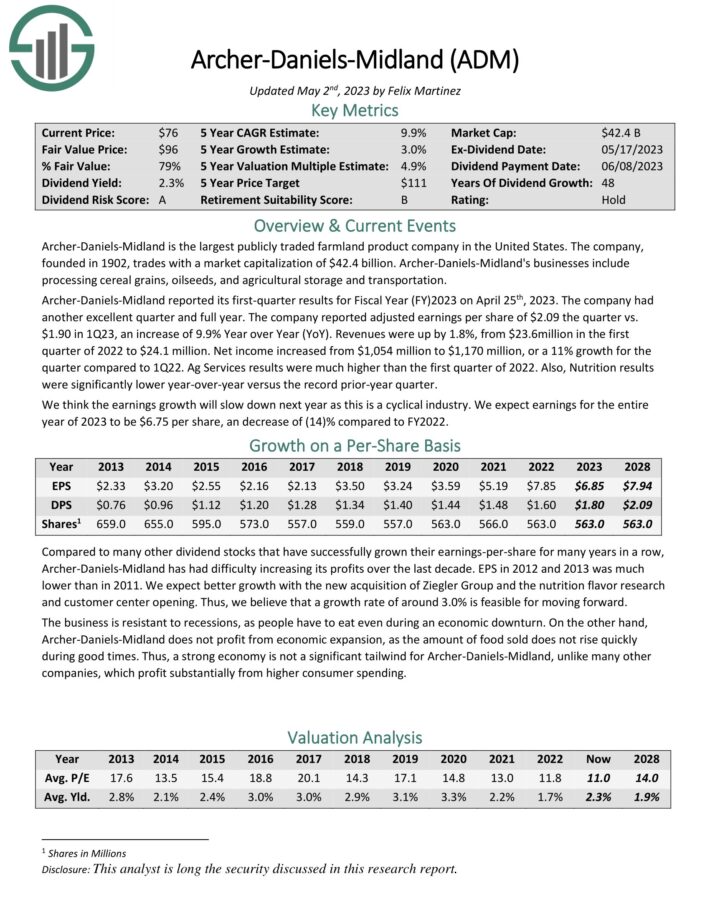

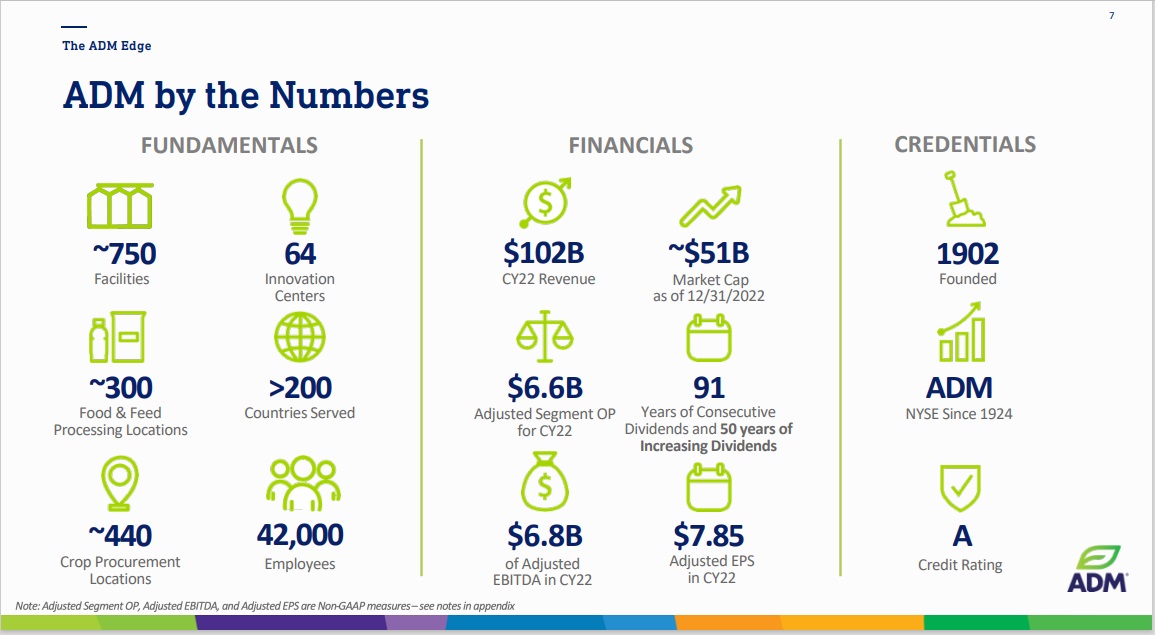

Safest Dividend Kings #8: Archer-Daniels-Midland (ADM)

- Payout Ratio: 22.6%

Archer-Daniels-Midland is one of the top agriculture stocks. ADM is the largest publicly traded farmland product company in the United States. Its businesses include processing cereal grains, oil seeds, and agricultural storage and transportation.

Source: Investor Presentation

Archer-Daniels-Midland reported its first-quarter results on April 25th, 2023. The company had another excellent quarter. The company reported adjusted earnings per share of $2.09 the quarter versus $1.90 in 1Q23, an increase of 9.9% year-over-year.

Revenues were up by 1.8%, from $23.6 million in the first quarter of 2022 to $24.1 million. Net income increased from $1,054 million to $1,170 million, or an 11% growth for the quarter compared to the first quarter of 2022.

Click here to download our most recent Sure Analysis report on ADM (preview of page 1 of 3 shown below):

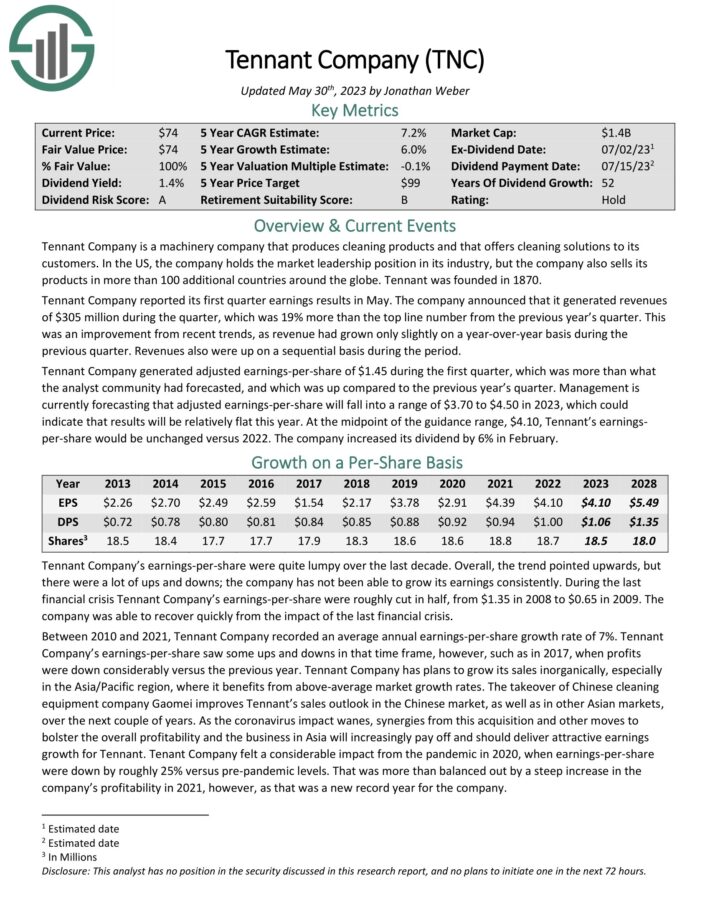

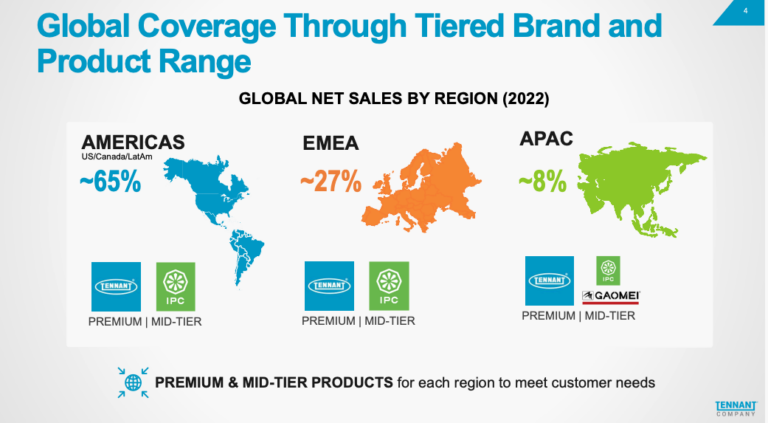

Safest Dividend Kings #7: Tennant Co. (TNC)

- Payout Ratio: 25.9%

Tennant Company is a machinery company that produces cleaning products and offers cleaning solutions to its customers. In the US, the company holds the market leadership position in its industry, but it also sells its products in more than 100 additional countries around the globe.

Source: Investor Presentation

Tennant Company reported its first-quarter earnings results in May. It generated revenues of $305 million during the quarter, which was 19% more than the previous year’s quarter. This was an improvement from recent trends, as revenue had grown only slightly on a year-over-year basis during the previous quarter.

Tennant Company generated adjusted earnings-per-share of $1.45 during the first quarter, which was more than what the analyst community had forecasted, and which was up compared to the previous year’s quarter.

Click here to download our most recent Sure Analysis report on Tennant Company (preview of page 1 of 3 shown below):

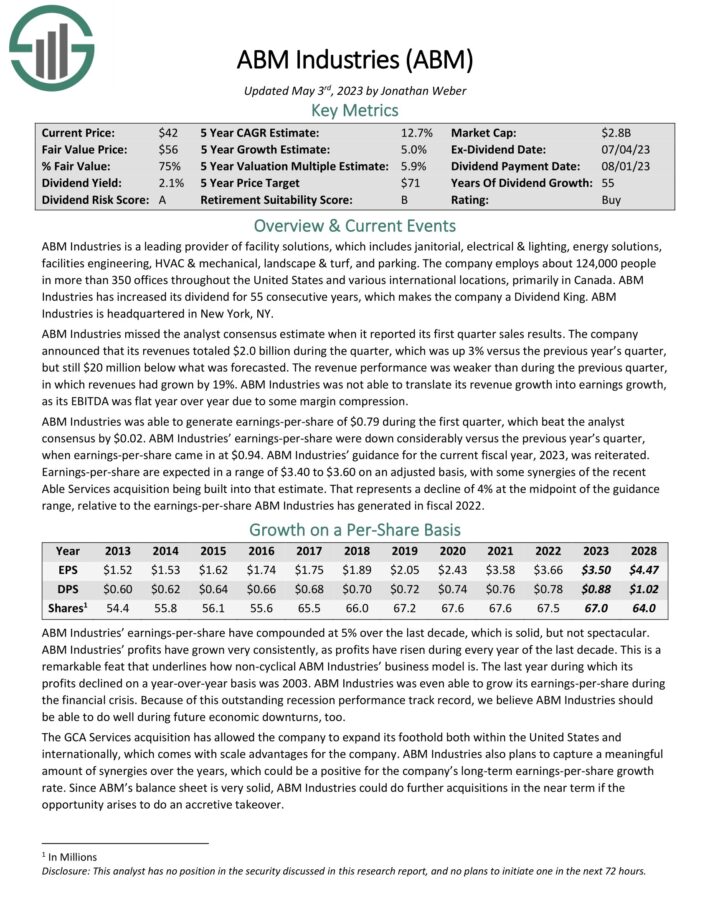

Safest Dividend Kings #6: ABM Industries (ABM)

- Payout Ratio: 25.1%

ABM Industries is a leading provider of facility solutions, which includes janitorial, electrical & lighting, energy solutions, facilities engineering, HVAC & mechanical, landscape & turf, and parking. ABM Industries has increased its dividend for 55 consecutive years.

First-quarter revenues totaled $2.0 billion, which was up 3% versus the previous year’s quarter, but still $20 million below forecasts. EBITDA was flat year over year due to some margin compression. ABM Industries was able to generate earnings-per-share of $0.79 during the first quarter, which beat the analyst consensus by $0.02.

ABM Industries’ earnings-per-share were down considerably versus the previous year’s quarter when earnings-per-share came in at $0.94. ABM Industries’ guidance for the current fiscal year, 2023, was reiterated. Earnings-per-share are expected in a range of $3.40 to $3.60 on an adjusted basis.

Click here to download our most recent Sure Analysis report on ABM (preview of page 1 of 3 shown below):

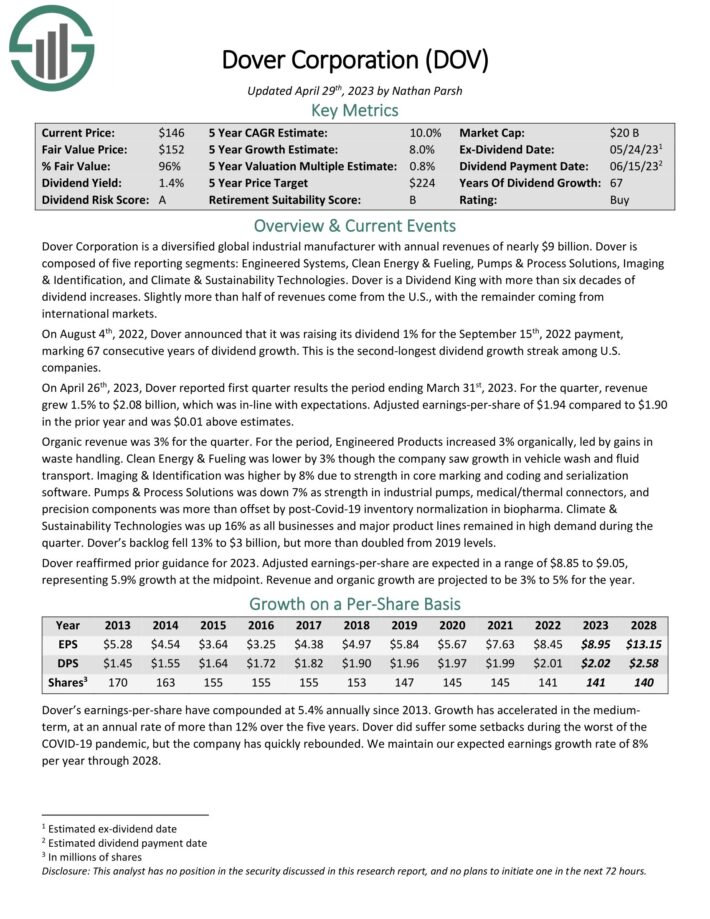

Safest Dividend Kings #5: Dover Corporation (DOV)

- Payout Ratio: 22.6%

Dover Corporation is a diversified global industrial manufacturer with annual revenues of nearly $9 billion. Dover is composed of five reporting segments: Engineered Systems, Clean Energy & Fueling, Pumps & Process Solutions, Imaging & Identification, and Climate & Sustainability Technologies. Slightly more than half of revenues come from the U.S., with the remainder coming from international markets.

On April 26th, 2023, Dover reported first-quarter results for the period ending March 31st, 2023. For the quarter, revenue grew 1.5% to $2.08 billion, which was in line with expectations. Adjusted earnings-per-share of $1.94 compared to $1.90 in the prior year and was $0.01 above estimates.

Click here to download our most recent Sure Analysis report on DOV (preview of page 1 of 3 shown below):

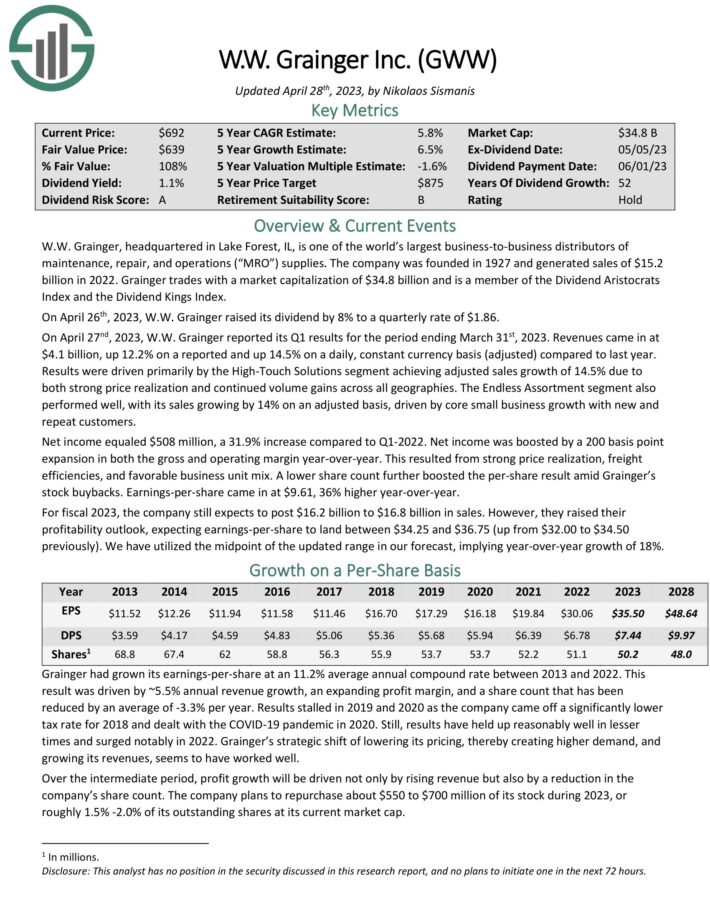

Safest Dividend Kings #4: W.W. Grainger (GWW)

- Payout Ratio: 21.0%

W.W. Grainger, headquartered in Lake Forest, IL, is one of the world’s largest business-to-business distributors of maintenance, repair, and operations (“MRO”) supplies.

On April 27th, 2023, W.W. Grainger reported its Q1 results for the period ending March 31st, 2023. Revenues came in at $4.1 billion, up 12.2% on a reported and up 14.5% on a daily, constant currency basis (adjusted) compared to last year. Results were driven primarily by the High-Touch Solutions segment achieving adjusted sales growth of 14.5% due to both strong price realization and continued volume gains across all geographies.

Click here to download our most recent Sure Analysis report on GWW (preview of page 1 of 3 shown below):

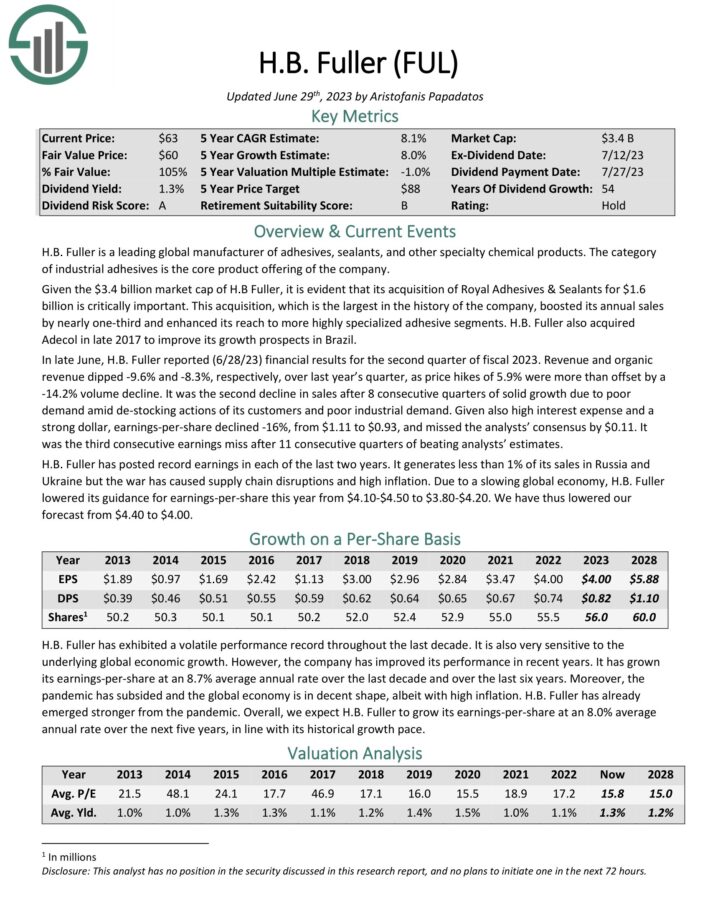

Safest Dividend Kings #3: H.B. Fuller (FUL)

- Payout Ratio: 20.5%

H.B. Fuller is a leading global manufacturer of adhesives, sealants, and other specialty chemical products. The category of industrial adhesives is the core product offering of the company.

In late June, H.B. Fuller reported (6/28/23) financial results for the second quarter of fiscal 2023. Revenue and organic revenue declined by 9.6% and 8.3%, respectively, over last year’s quarter, as price hikes of 5.9% were more than offset by a 14.2% volume decline.

Given also high-interest expense and a strong dollar, earnings-per-share declined -16%, from $1.11 to $0.93, and missed the analysts’ consensus by $0.11. It was the third consecutive earnings miss after 11 consecutive quarters of beating analysts’ estimates.

Due to a slowing global economy, H.B. Fuller lowered its guidance for earnings-per-share this year from $4.10-$4.50 to $3.80-$4.20.

Click here to download our most recent Sure Analysis report on H.B. Fuller (preview of page 1 of 3 shown below):

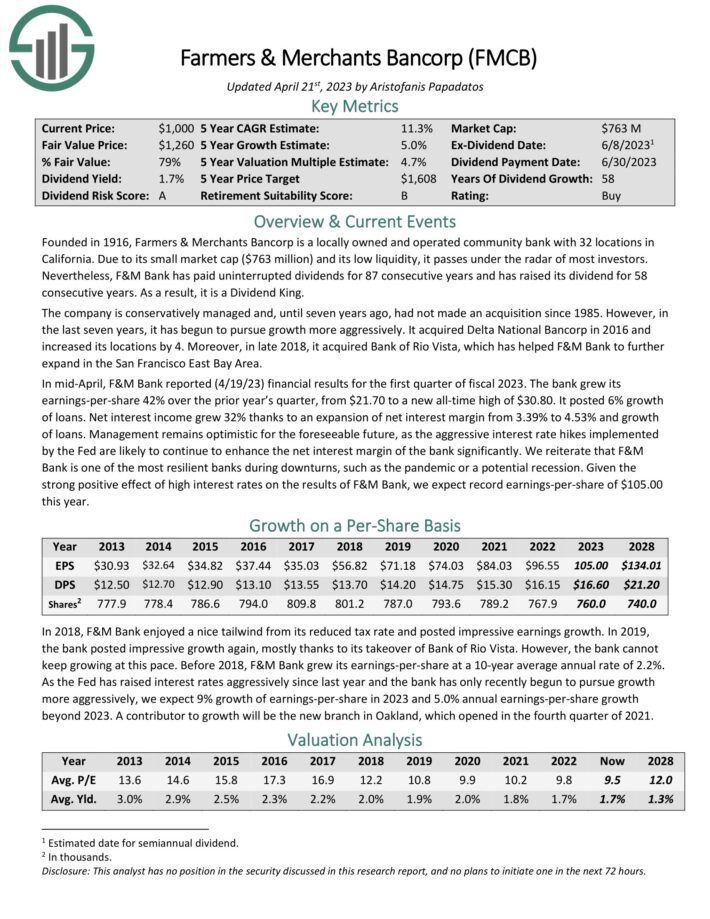

Safest Dividend Kings #2: Farmers & Merchants Bancorp (FMCB)

- Payout Ratio: 15.8%

Farmers & Merchants Bancorp is a locally owned and operated community bank with 32 locations in California. F&M Bank has paid uninterrupted dividends for 87 consecutive years and has raised its dividend for 58 consecutive years.

In mid-April, F&M Bank reported (4/19/23) financial results for the first quarter of fiscal 2023. The bank grew its earnings-per-share 42% over the prior year’s quarter, from $21.70 to a new all-time high of $30.80. It posted a 6% growth in loans. Net interest income grew 32% thanks to an expansion of the net interest margin from 3.39% to 4.53% and the growth of loans.

Click here to download our most recent Sure Analysis report on FMCB (preview of page 1 of 3 shown below):

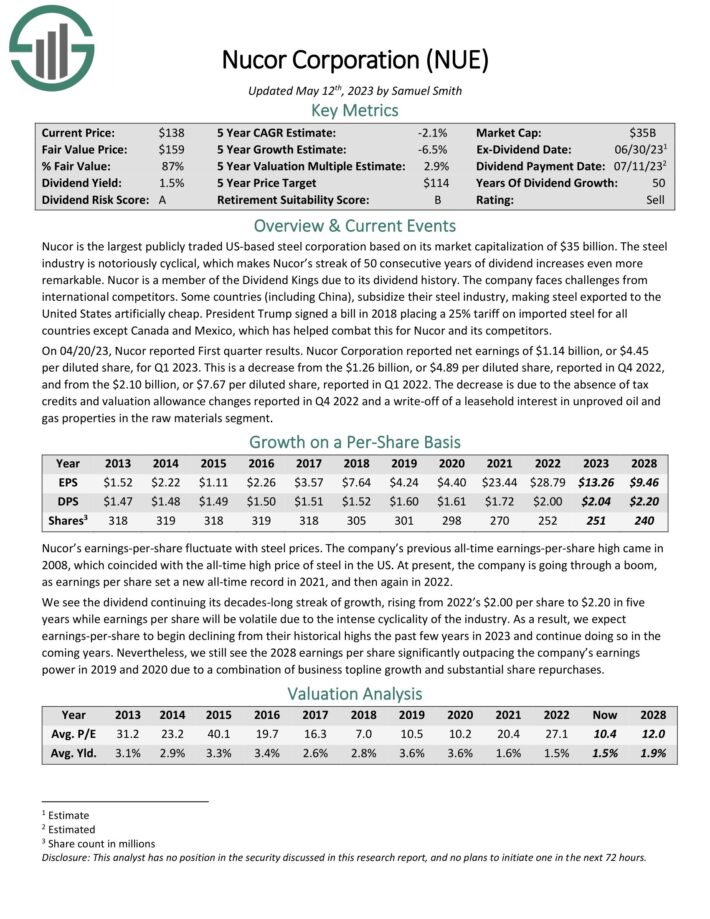

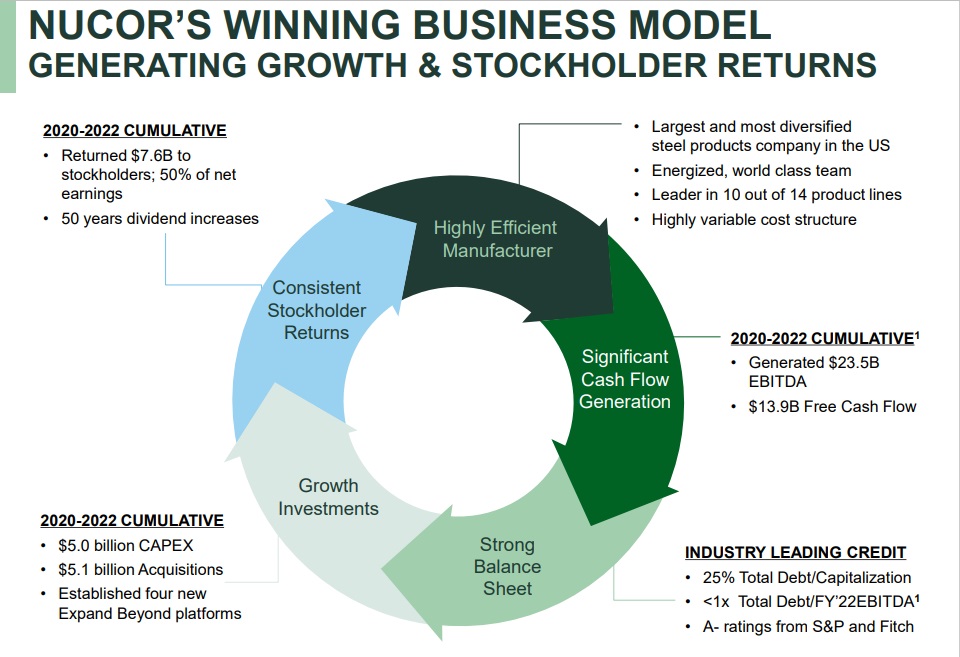

Safest Dividend Kings #1: Nucor Corp. (NUE)

- Payout Ratio: 15.4%

Nucor is the largest publicly traded US-based steel corporation. The steel industry is notoriously cyclical, which makes Nucor’s streak of 50 consecutive years of dividend increases even more remarkable.

Source: Investor Presentation

On 04/20/23, Nucor reported First quarter results. Nucor Corporation reported net earnings of $1.14 billion, or $4.45 per diluted share, for Q1 2023. This is a decrease from the $1.26 billion, or $4.89 per diluted share, reported in Q4 2022, and from the $2.10 billion, or $7.67 per diluted share, reported in Q1 2022.

The decrease is due to the absence of tax credits and valuation allowance changes reported in Q4 2022 and a write-off of a leasehold interest in unproved oil and gas properties in the raw materials segment.

Click here to download our most recent Sure Analysis report on NUE (preview of page 1 of 3 shown below):

Final Thoughts

The Dividend Kings are a group of high-quality businesses with shareholder-friendly management teams that have strong competitive advantages.

Purchasing businesses with these characteristics at fair or better prices and holding them for long periods of time will likely result in strong long-term investment performance.

The 10 stocks presented in this article have the highest Dividend Risk scores in our database, as well as the lowest dividend payout ratios. As a result, they are the safest Dividend Kings.

More By This Author:

3 Royalty Trusts With Extremely High Yields

3 Safe Dividend Aristocrats With Recession-Proof Payouts

10 Safest Dividend Aristocrats For 2023

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more