10 Dividend Kings That May Last Centuries

Income investors want to buy and hold quality dividend stocks that can maintain their dividend growth for years.

When it comes to dividend growth stocks, the Dividend Kings are the best-of-the-best in dividend longevity. The Dividend Kings have increased their dividends for 50+ consecutive years.

Of course, just because a company has grown its dividend for over five decades, does not necessarily mean these same companies will be growing their dividends in the decades ahead.

Rather than list these stocks based on expected returns, this article discusses 10 Dividend Kings that have a longevity advantage.

The following 10 Dividend Kings have increased their dividends for at least 50 consecutive years, and stand a good chance of increasing their dividends for another 50 years.

Dividend King For Decades: Procter & Gamble (PG)

Procter & Gamble is a consumer products giant that sells its products in over 180 countries. Notable brands include Pampers, Luvs, Tide, Gain, Bounty, Charmin, Puffs, Gillette, Head & Shoulders, Old Spice, Dawn, Febreze, Swiffer, Crest, Oral-B, Scope, Olay, and many more. The company generated $76 billion in sales in fiscal 2021.

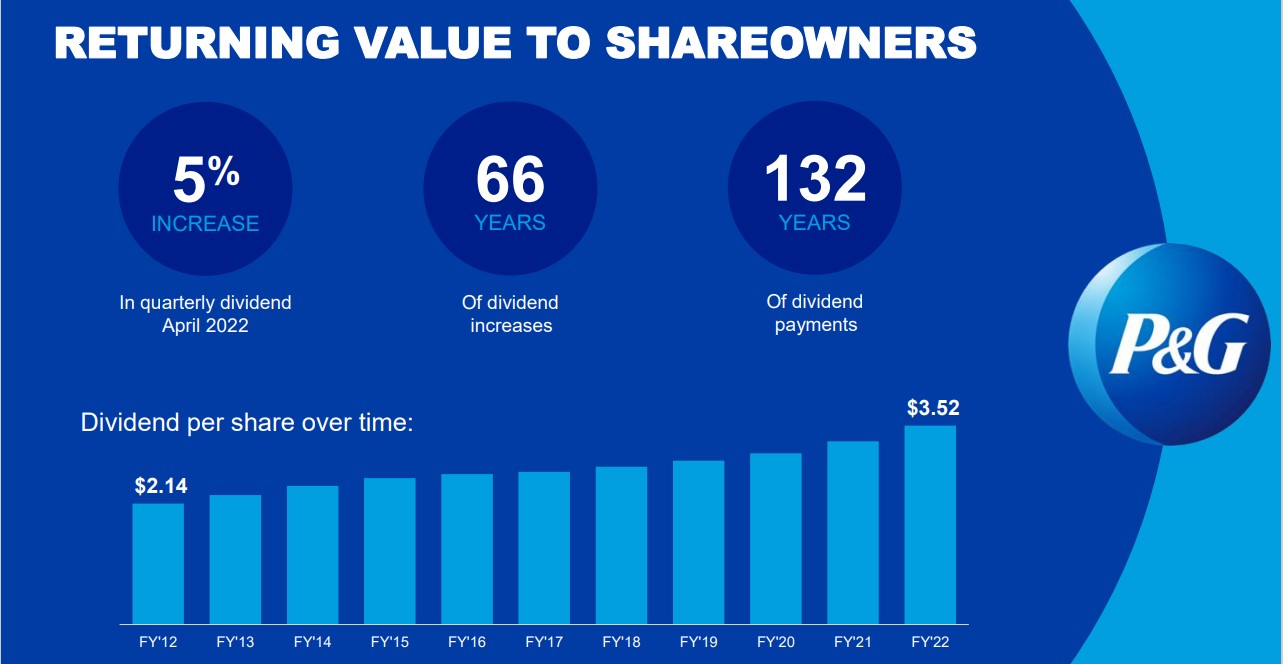

Procter & Gamble has paid a dividend for 131 years and has grown its dividend for 66 consecutive years – one of the longest active streaks of any company. On April 12th, 2022, Procter & Gamble raised its dividend by 5.0%, from $0.8698 per quarter to $0.9133.

Source: Investor Presentation

In late July, Procter & Gamble reported (7/29/22) financial results for the fourth quarter of fiscal 2022 (its fiscal year ends June 30th). The company grew its sales and its organic sales 3% and 7%, respectively, over the prior year’s quarter.

Organic sales growth resulted from 8% price hikes, which were partly offset by a -1% decrease in volumes. Despite the strong headwind from high cost inflation, which reduced gross margin by 370 basis points, adjusted earnings-per-share grew 7%. The firm sales amid strong price hikes are a testament to the strength of the brands of Procter & Gamble. The company expects 3%-5% growth of organic sales in fiscal 2023 and 0%-4% growth of earnings-per-share.

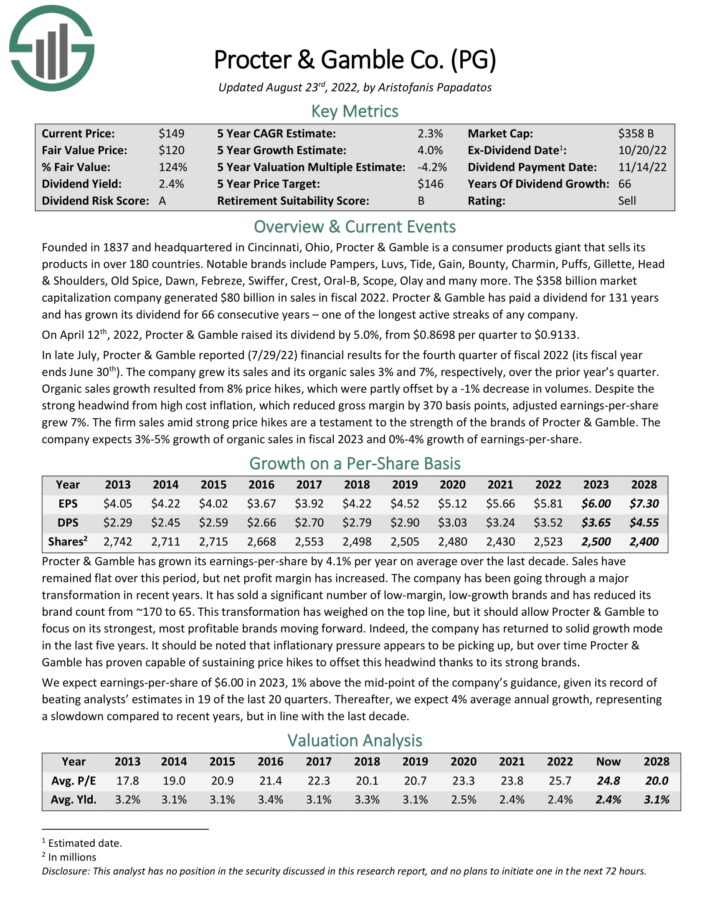

Click here to download our most recent Sure Analysis report on PG (preview of page 1 of 3 shown below):

Dividend King For Decades: Johnson & Johnson (JNJ)

Johnson & Johnson is a diversified healthcare company and a leader in the area of pharmaceuticals (~49% of sales), medical devices (~34% of sales) and consumer products (~17% of sales). The company has annual sales in excess of $93 billion.

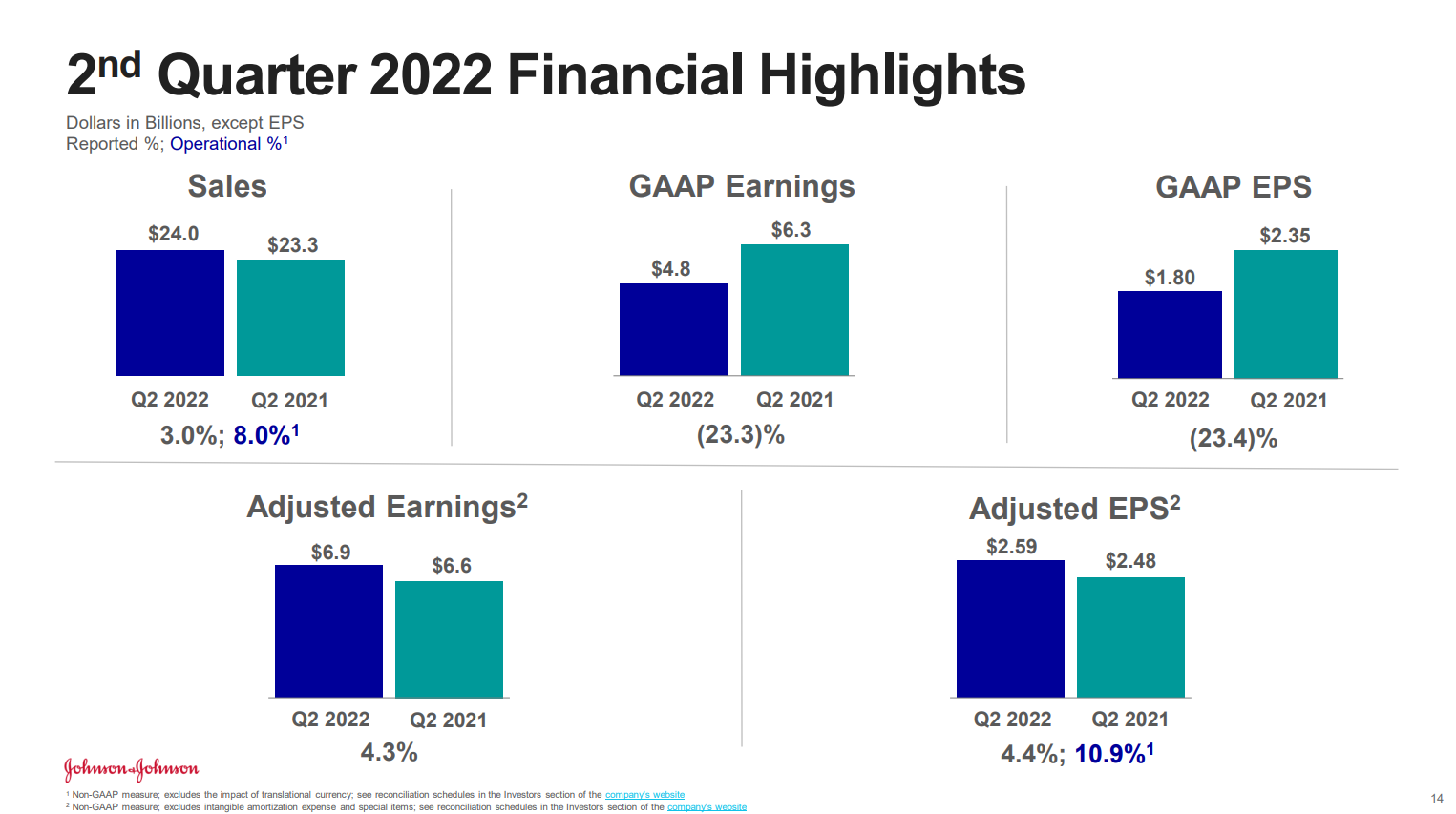

The company’s most recent earnings report was delivered on July 19th, 2022, for the second quarter. Results were better than expected on both revenue and profits, but the company lowered guidance for the full year, which it attributed to a much stronger US dollar.

Source: Investor presentation, page 14

For the second quarter, adjusted earnings-per-share came to $2.59, which was four cents ahead of expectations. Revenue was $24 billion, up 3% year-over-year and $180 million ahead of estimates.

Johnson & Johnson has averaged 7% growth in earnings-per-share for the past decade, which is impressive given its massive size. The company has been able to move the needle steadily through a combination of higher sales, better profit margins, and a slight reduction in the float through buybacks.

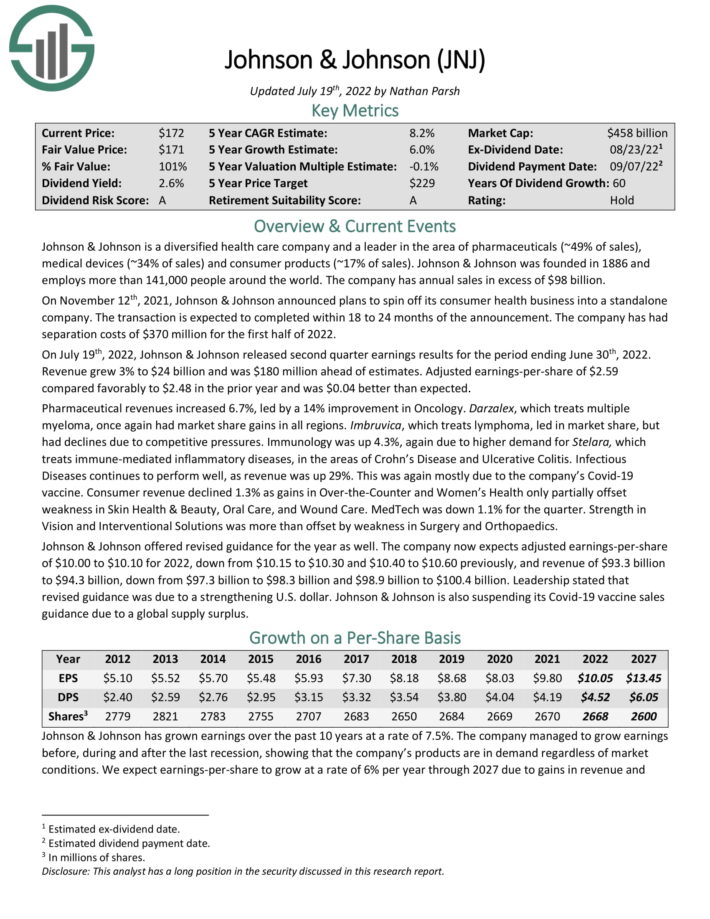

Click here to download our most recent Sure Analysis report on J&J (preview of page 1 of 3 shown below):

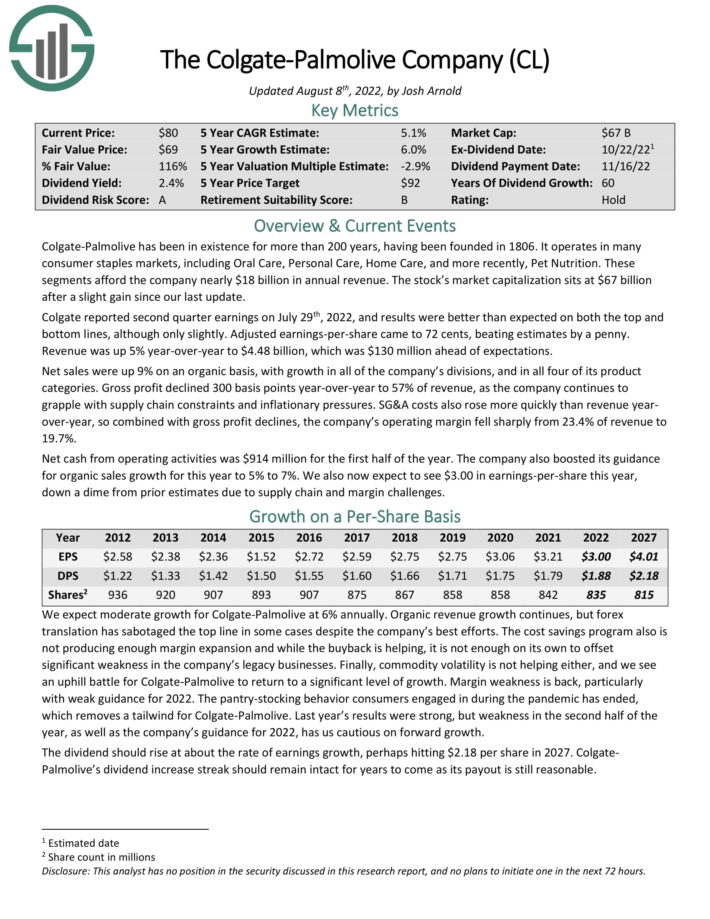

Dividend King For Decades: Colgate-Palmolive (CL)

Colgate-Palmolive is a consumer staples conglomerate that has increased its dividend for 60 consecutive years, one of the longest streaks in the entire stock market. Perhaps more impressively, Colgate-Palmolive has continuously paid dividends on its common stock since 1895.

Colgate-Palmolive was founded in 1806 and has built an impressive and extensive portfolio of consumer brands. The company generates around $18 billion in annual revenue. Its portfolio is focused on four core categories.

Source: Investor presentation

Colgate-Palmolive has structured itself into four units: Oral Care, Personal Care, Home Care, and Pet Nutrition.

Colgate-Palmolive has had fourteen straight quarters at or above the target organic sales growth rate of 3% to 5%. Growth has accelerated in recent years, with the coronavirus pandemic only being a temporary setback. We see this driving much of the company’s growth in the coming years.

Colgate-Palmolive reported second-quarter earnings on July 29th, 2022. Net sales increased 5.5%, while organic sales grew 9.0% year-over-year. Adjusted earnings-per-share decreased 10% to $0.72 for the quarter. The gross profit margin declined by 300 basis points to 57.0% as the company saw inflationary pressures causing various costs to rise.

The company maintained a 39.6% global market share in toothpaste and a 31.3% market share in toothbrushes year-to-date, which shows its competitive advantages.

Click here to download our most recent Sure Analysis report on Colgate-Palmolive (preview of page 1 of 3 shown below):

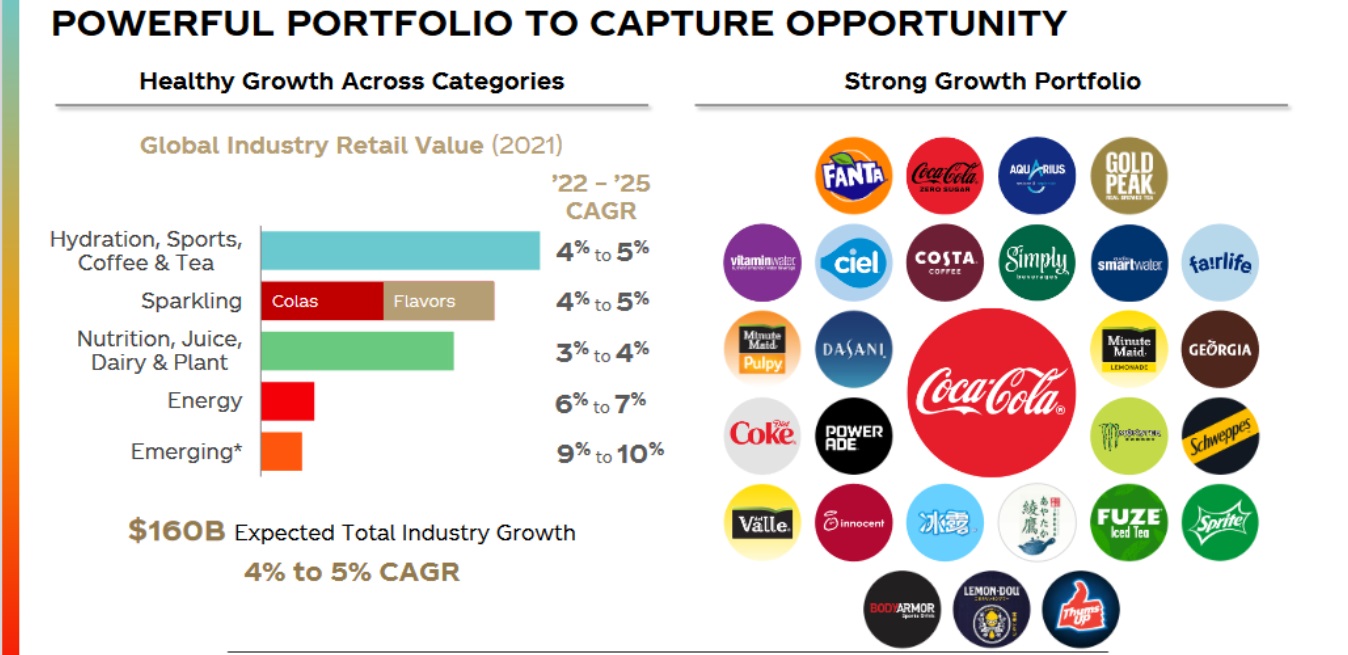

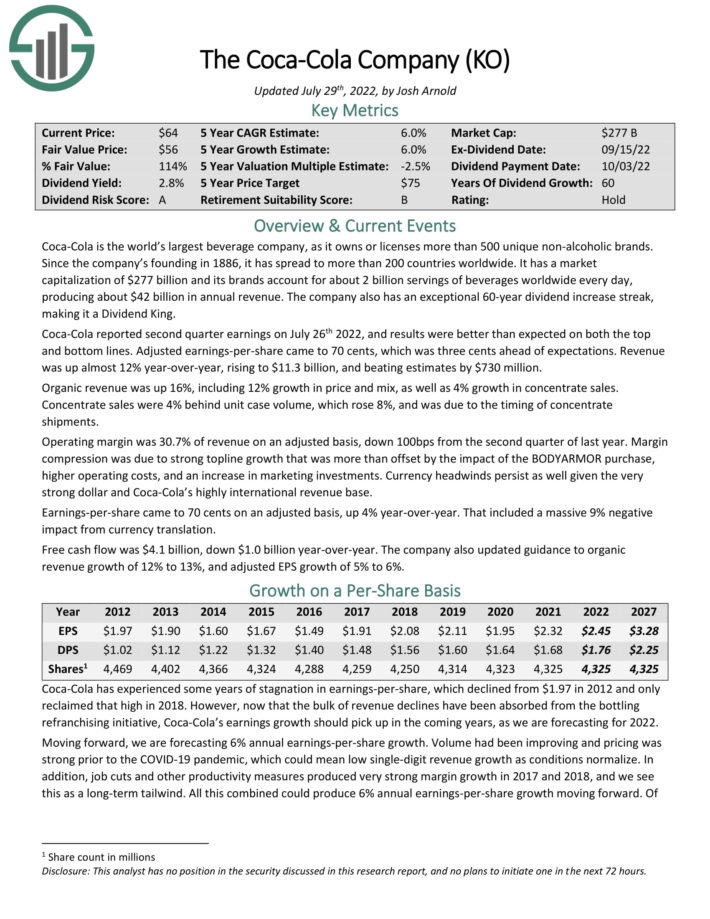

Dividend King For Decades: The Coca-Cola Company (KO)

Coca-Cola is the world’s largest beverage company, as it owns or licenses more than 500 unique non–alcoholic brands. Since the company’s founding in 1886, it has spread to more than 200 countries worldwide.

Source: Investor Presentation

The company also has an exceptional 59-year dividend increase streak.

Coca-Cola reported second-quarter earnings on July 26th, 2022, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to 70 cents, which was three cents ahead of expectations. Revenue was up almost 12% year-over-year, rising to $11.3 billion, and beating estimates by $730 million. Organic revenue was up 16%, including 12% growth in price and mix, as well as 4% growth in concentrate sales.

Operating margin was 30.7% of revenue on an adjusted basis, down 100bps from the second quarter of last year. Margin compression was due to strong topline growth that was more than offset by the impact of the BODYARMOR purchase, higher operating costs, and an increase in marketing investments.

Earnings-per-share came to 70 cents on an adjusted basis, up 4% year-over-year. Free cash flow was $4.1 billion, down $1.0 billion year-over-year. The company also updated guidance to organic revenue growth of 12% to 13%, and adjusted EPS growth of 5% to 6%.

Click here to download our most recent Sure Analysis report on KO (preview of page 1 of 3 shown below):

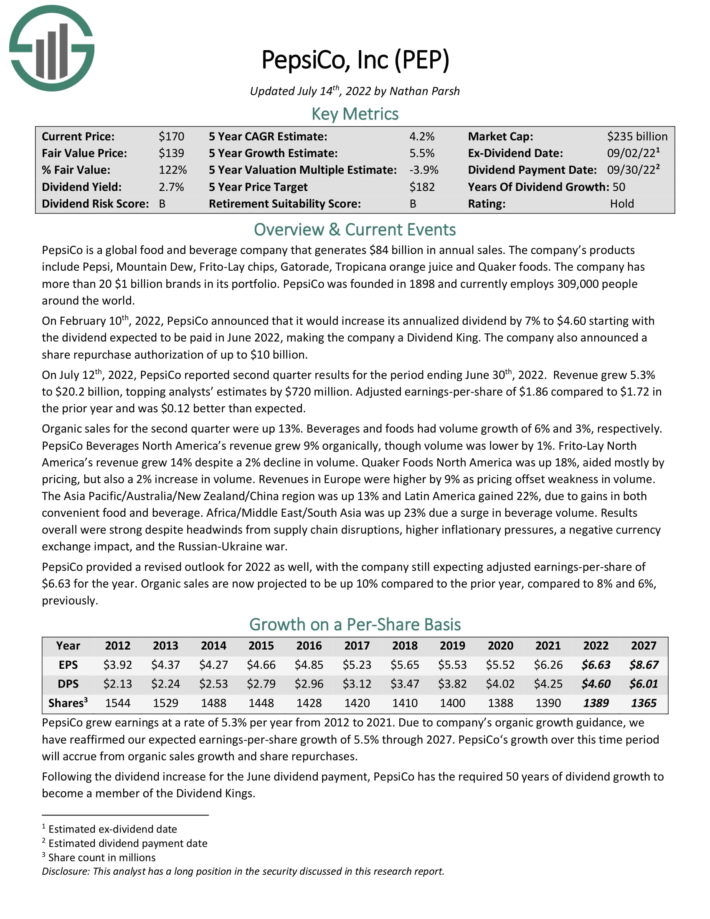

Dividend King For Decades: PepsiCo (PEP)

PepsiCo is a global food and beverage company that generates $82 billion in annual sales. The company’s brands include Pepsi, Mountain Dew, Frito–Lay chips, Gatorade, Tropicana orange juice and Quaker foods. The company has more than 20 $1 billion brands in its portfolio.

Source: Investor Presentation

On 2/10/2022, PepsiCo announced that it would increase its annualized dividend by 7% to $4.60 starting with the dividend expected to be paid in June 2022, making the company a Dividend King. The company also announced a share repurchase authorization of up to $10 billion.

On July 12th, 2022, PepsiCo reported second-quarter results for the period ending June 30th, 2022. Revenue grew 5.3% to $20.2 billion, topping analysts’ estimates by $720 million. Adjusted earnings-per-share of $1.86 compared to $1.72 in the prior year and was $0.12 better than expected. Organic sales for the second quarter were up 13%. Beverages and foods had volume growth of 6% and 3%, respectively.

PepsiCo Beverages North America’s revenue grew 9% organically, though volume was lower by 1%. Frito-Lay North America’s revenue grew 14% despite a 2% decline in volume. Quaker Foods North America was up 18%, aided mostly by pricing, but also a 2% increase in volume. Revenues in Europe were higher by 9% as pricing offset weakness in volume.

PepsiCo provided a revised outlook for 2022 as well, with the company still expecting adjusted earnings-per-share of $6.63 for the year. Organic sales are now projected to be up 10% compared to the prior year, compared to 8% and 6%, previously.

Click here to download our most recent Sure Analysis report on PepsiCo (preview of page 1 of 3 shown below):

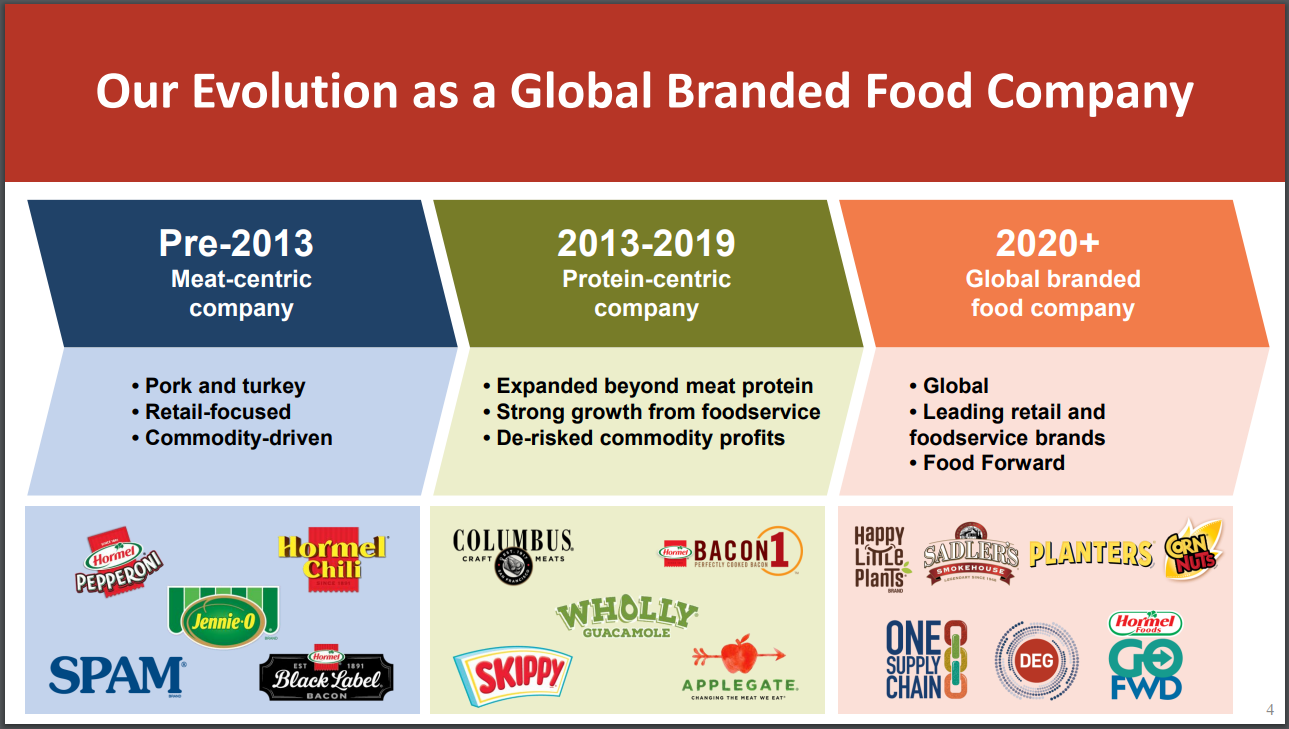

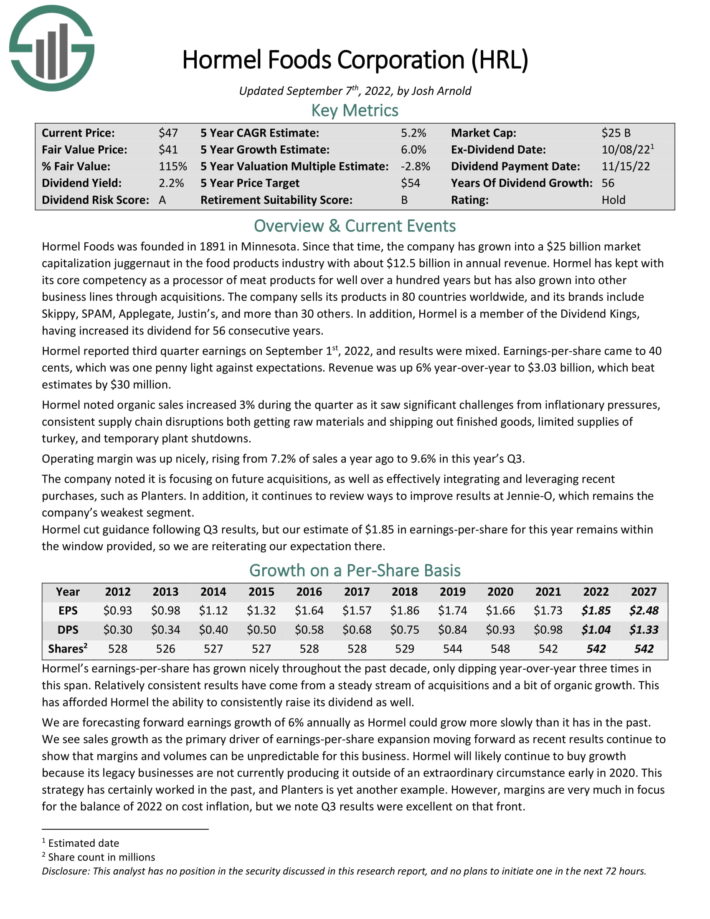

Dividend King For Decades: Hormel Foods (HRL)

Hormel Foods is a processed food manufacturer that competes in several grocery categories. The company was founded 131 years ago and has managed to increase its dividend for the past 56 years.

the company produces about $12.5 billion in annual revenue, with its core products remaining true to its history as a meat processor.

Hormel’s reach is expansive, with distribution in more than 80 countries across the globe.

Source: Investor Presentation

Hormel has a staggering 40 product categories where its brands are first or second in terms of market share.

The company has focused on building scale and brand recognition in all of its categories, which has paid off over time. This kind of dominance is difficult to find in any industry, but Hormel has managed to do it.

Hormel’s products are arranged in four categories: Refrigerated Foods, Center Store Foods, Jennie-O Turkey, and International. Hormel has been busy remaking its portfolio through acquisitions and divestitures in recent years.

For example, in 2021, Hormel announced the acquisition of the Planters snack nuts business from Kraft-Heinz (KHC) for $3.35 billion. The acquisition has boosted Hormel’s growth.

Hormel reported third-quarter earnings on September 1st, 2022. Revenue hit a record of $3.0 billion and was slightly ahead of expectations. Adjusted diluted earnings-per-share were 40 cents, up 25% year-over-year. We are forecasting $1.85 in earnings per share for this year.

Click here to download our most recent Sure Analysis report on Hormel (preview of page 1 of 3 shown below):

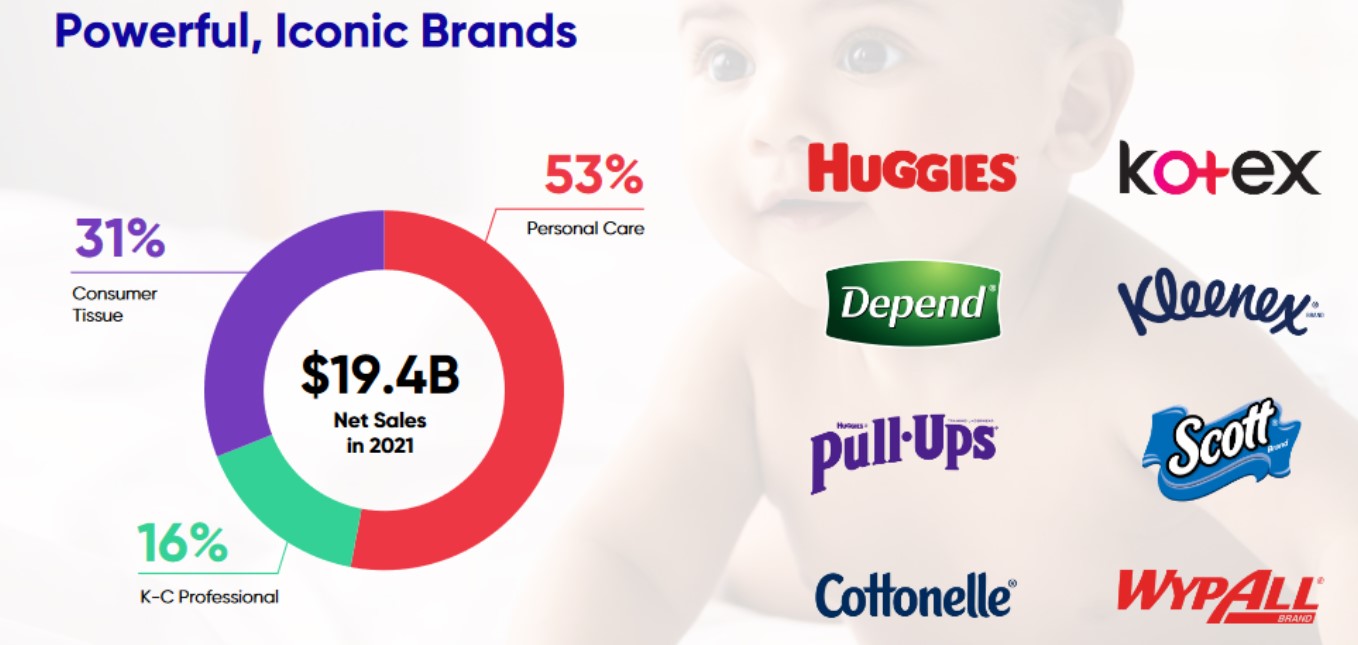

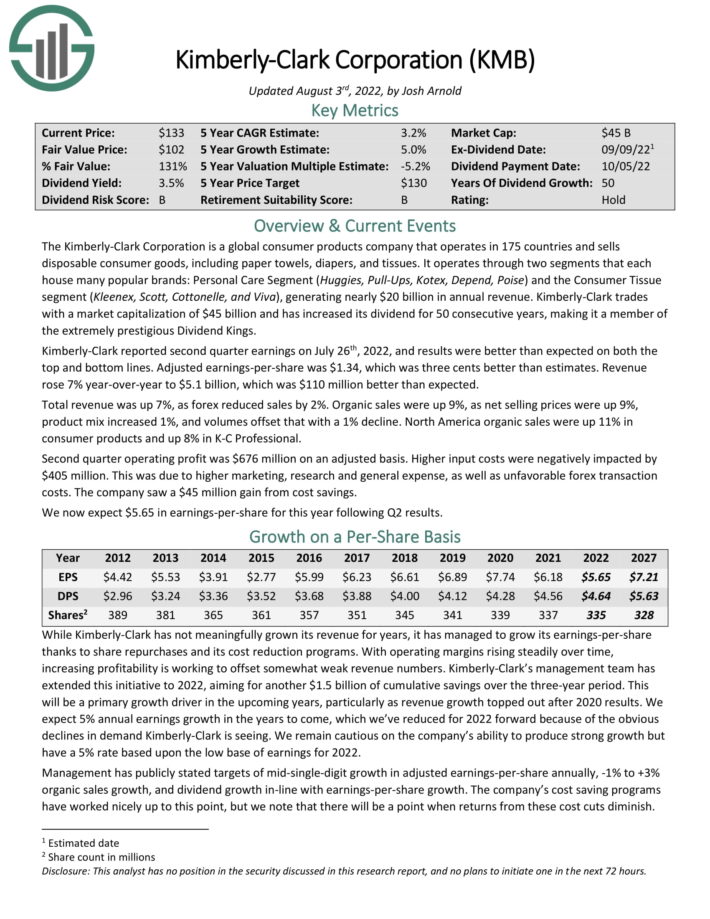

Dividend King For Decades: Kimberly-Clark (KMB)

Kimberly-Clark is a global consumer products company that operates in 175 countries and sells disposable consumer goods, including paper towels, diapers, and tissues.

It operates through two segments that each house many popular brands: Personal Care Segment (Huggies, Pull-Ups, Kotex, Depend, Poise) and the Consumer Tissue segment (Kleenex, Scott, Cottonelle, and Viva), generating nearly $20 billion in annual revenue.

Source: Investor Presentation

Kimberly-Clark reported second-quarter earnings on July 26th, 2022, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share was $1.34, which was three cents better than estimates. Revenue rose 7% year-over-year to $5.1 billion, which was $110 million better than expected.

Total revenue was up 7%, as forex reduced sales by 2%. Organic sales were up 9%, as net selling prices were up 9%, product mix increased 1%, and volumes offset that with a 1% decline. North America organic sales were up 11% in consumer products and up 8% in K-C Professional.

Click here to download our most recent Sure Analysis report on Kimberly-Clark (preview of page 1 of 3 shown below):

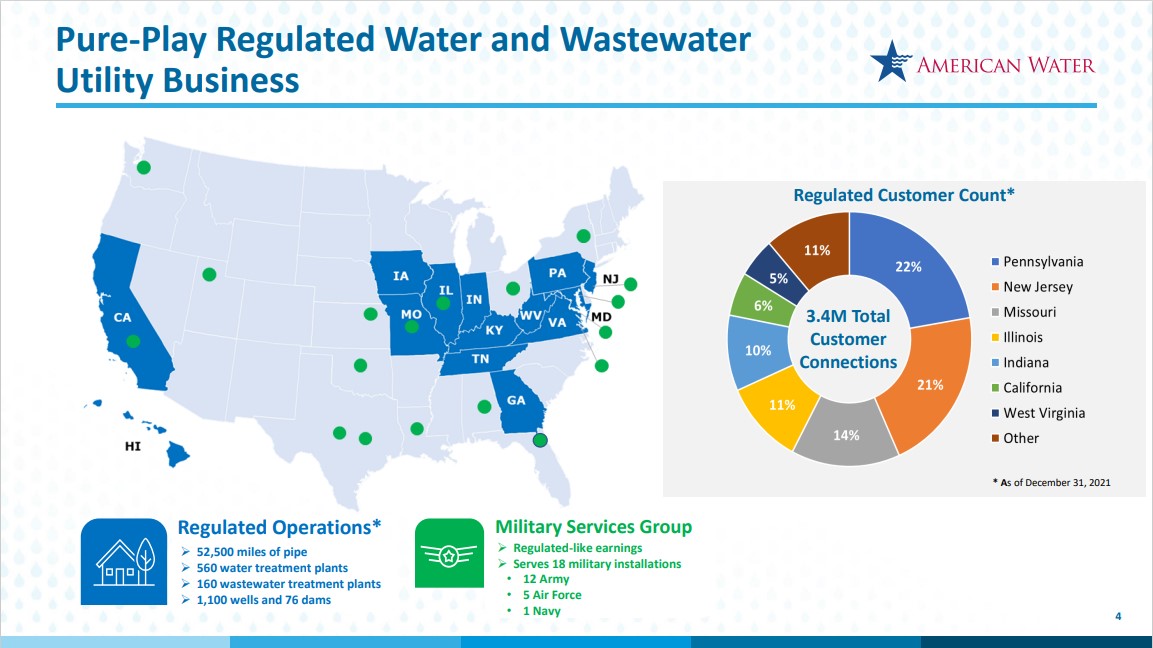

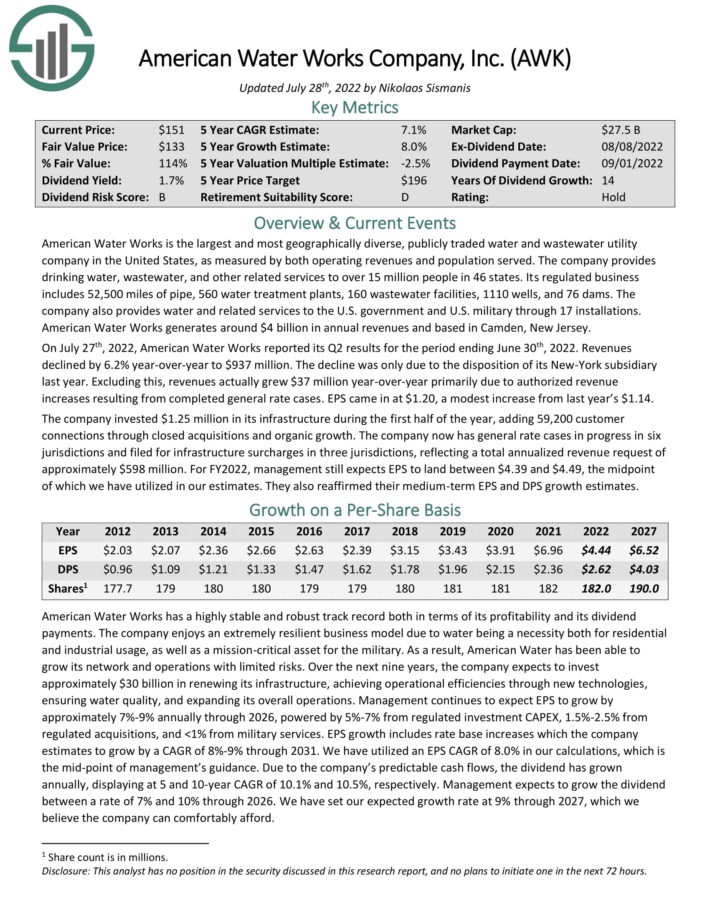

Dividend King For Decades: American Water Works (AWK)

American Water Works is the largest and most geographically diverse, publicly traded water stock, as measured by both operating revenues and population served. The company provides drinking water, wastewater, and other related services to over 15 million people in 46 states.

Its regulated business includes 52,500 miles of pipe, 560 water treatment plants, 160 wastewater facilities, 1110 wells, and 76 dams. The company also provides water and related services to the U.S. government and U.S. military through 17 installations. American Water Works generates around $4 billion in annual revenues and based in Camden, New Jersey.

Source: Investor Presentation

On July 27th, 2022, American Water Works reported its Q2 results for the period ending June 30th, 2022. Revenue declined by 6.2% year-over-year to $937 million. The decline was only due to the disposition of its New-York subsidiary last year. Excluding this, revenues actually grew $37 million year-over-year primarily due to authorized revenue increases resulting from completed general rate cases. EPS came in at $1.20, a modest increase from last year’s $1.14.

The company invested $1.25 million in its infrastructure during the first half of the year, adding 59,200 customer connections through closed acquisitions and organic growth. The company now has general rate cases in progress in six jurisdictions and filed for infrastructure surcharges in three jurisdictions, reflecting a total annualized revenue request of approximately $598 million. For FY2022, management still expects EPS to land between $4.39 and $4.49.

Click here to download our most recent Sure Analysis report on AWK (preview of page 1 of 3 shown below):

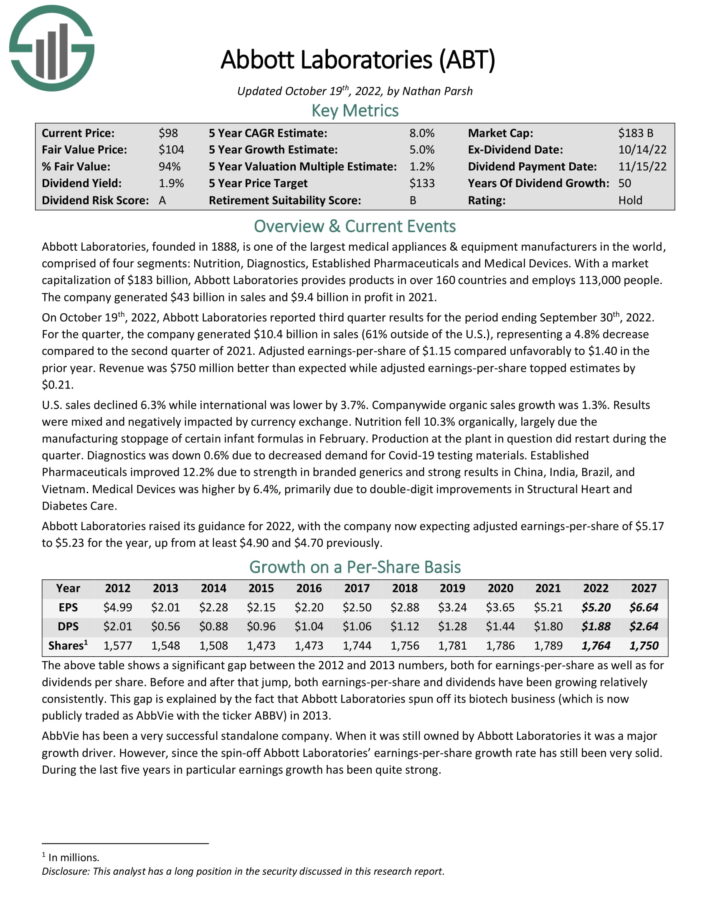

Dividend King For Decades: Abbott Laboratories (ABT)

Abbott Laboratories, founded in 1888, is one of the largest medical appliances & equipment manufacturers in the world, comprised of four segments: Nutrition, Diagnostics, Established Pharmaceuticals and Medical Devices. The company generated $43 billion in sales and $9.4 billion in profit in 2021.

On October 19th, 2022, Abbott Laboratories reported third-quarter results for the period ending September 30th, 2022. For the quarter, the company generated $10.4 billion in sales (61% outside of the U.S.), representing a 4.8% decrease compared to the second quarter of 2021. Adjusted earnings-per-share of $1.15 compared unfavorably to $1.40 in the prior year. Revenue was $750 million better than expected while adjusted earnings-per-share topped estimates by $0.21.

Abbott Laboratories raised its guidance for 2022, with the company now expecting adjusted earnings-per-share of $5.17 to $5.23 for the year.

Abbott Laboratories’ dividend payout ratio has never been above 50% throughout the last decade. Coupled with the fact that the company’s earnings-per-share did not decline during the last financial crisis (it actually continued to grow), and Abbott Laboratories’ dividend looks very safe.

After the spin-off of AbbVie, Abbott Laboratories has proven to be a very stable performer with a solid outlook. The markets that Abbott Laboratories addresses are not cyclical as medical devices and diagnostics are needed whether the economy is doing well or not. This explains why Abbott Laboratories performed so well during the last financial crisis.

Moreover, for future recessions, we believe Abbott Laboratories will most likely not be vulnerable. The company is a leader in the markets it addresses, such as in point-of-care diagnostics, which provides competitive advantages due to Abbott Laboratories’ scale and global reach.

Click here to download our most recent Sure Analysis report on Abbott Laboratories (preview of page 1 of 3 shown below):

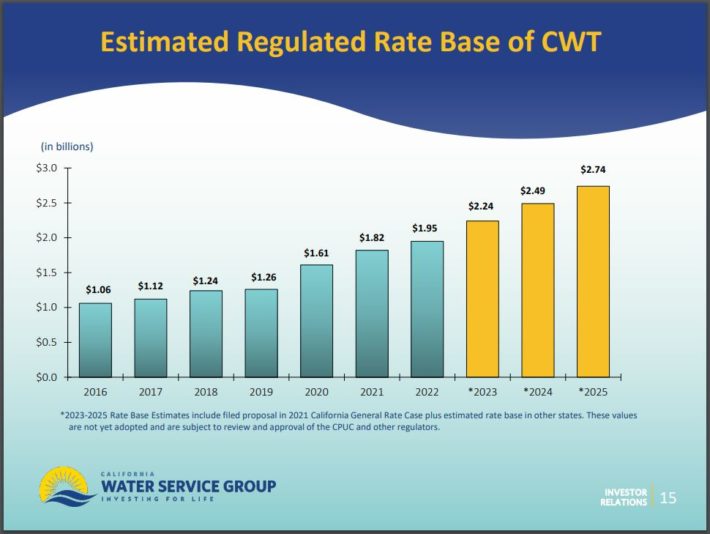

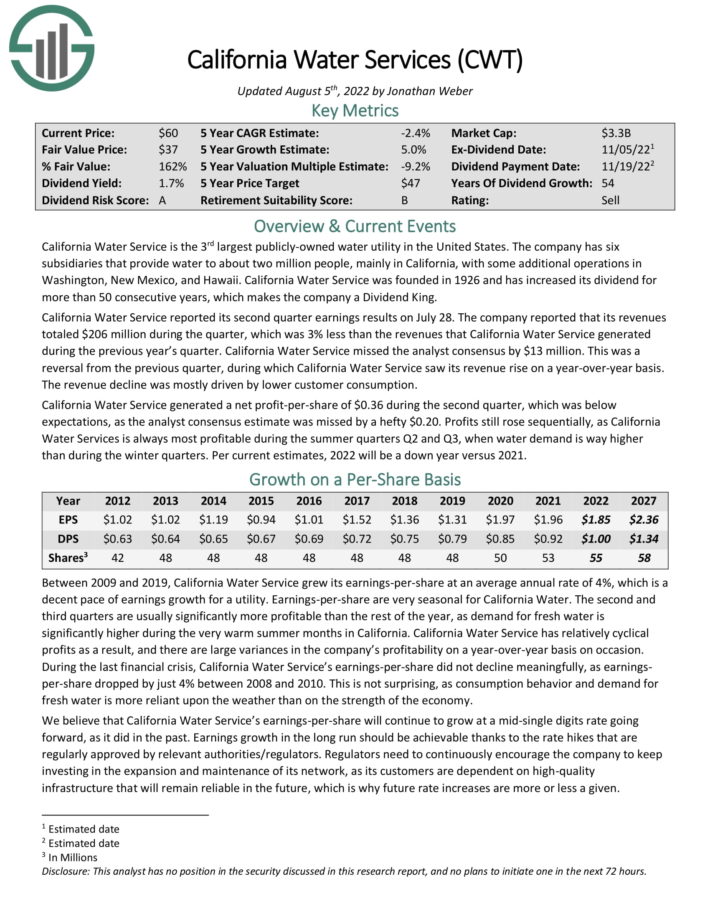

Dividend King For Decades: California Water Service (CWT)

California Water Service is the third-largest publicly-owned water utility in the United States. CWT was founded in 1926 and has six subsidiaries that provide water to approximately 2 million people in 100 communities, primarily in California but also in Washington, New Mexico and Hawaii.

The reliable rate hikes that utilities enjoy result in a resilient business model, which is characterized by fairly predictable cash flows and earnings growth. This is clearly reflected in the fact that CWT has raised its dividend for 54 consecutive years.

California Water Service reported its second-quarter earnings results on July 28th, 2022. Revenue totaled $206 million during the quarter, which was a 3% year-over-year decline. Management explained the second-quarter revenue decline was primarily due to lower customer consumption.

California Water Service generated a net profit–per–share of $0.36 during the second quarter, which was below analyst expectations by $0.20 per share. One major driver of earnings growth will be continued rate hikes.

The chart below show that the regulated rate base of CWT is expected to grow by 9.3% per year from 2022-2025.

Source: Investor Presentation

Earnings growth, in the long run, should be achievable thanks to the rate hikes that are regularly approved by relevant authorities/regulators.

Utilities have extremely high barriers to entry to potential competitors. It is essentially impossible for new competitors to enter the markets in which CWT operates. Overall, utilities have among the widest business moats in the economy.

In addition, while the vast majority of companies suffer during recessions, water utilities are among the most resilient to recessions, as economic downturns do not affect the amount of water consumed by customers.

Click here to download our most recent Sure Analysis report on CWT (preview of page 1 of 3 shown below):

Final Thoughts

Screening to find the best Dividend Kings is not the only way to find high-quality dividend growth stock ideas.

More By This Author:

7 High Dividend Stocks To Buy And Hold For Decades

Don’t Overlook These 10 High Yield Dividend Champions

3 MLPs That Are Attractive For High Yields And Safety