10 Best Robinhood Stocks To Buy In 2022

Robinhood Trading Platform is an online brokerage that upscaled the brokerage industry with its zero-commission investing. The key feature of this trading platform that is the reason behind its success is it is a simple and easy-to-use interface. Its founders, Vladimir Tenev and Baiju Bhatt are graduates of Stanford University creates this platform to attract the millennials who were not comfortable with the way the stock markets and its system worked.

According to the founder Vladmir Tenev, Robinhood focusses on:

- To attract first-time investors into the markets and provide them access to the market.

- Grow with client’s side by side by not only focusing on investing but also on other financial needs

- International expansion.

Image Source: Pexels

What are the Best Features/Advantages of Robinhood?

- Robinhood offers some of the lowest cost tradings in the industry

- Easy to use interface which is very convenient for the user

- Robinhood is amongst the few brokers that offer free crypto trading

What are the Shortcomings of Robinhood?

- It does not offer retirement accounts

- Robinhood does not offer mutual funds and bonds. Therefore, users find it difficult to build a diversified portfolio. Bonds vs Stocks is always debatable because they are two major sources of investment.

- In comparison to other brokerages, Robinhood’s customer service is not up to the mark

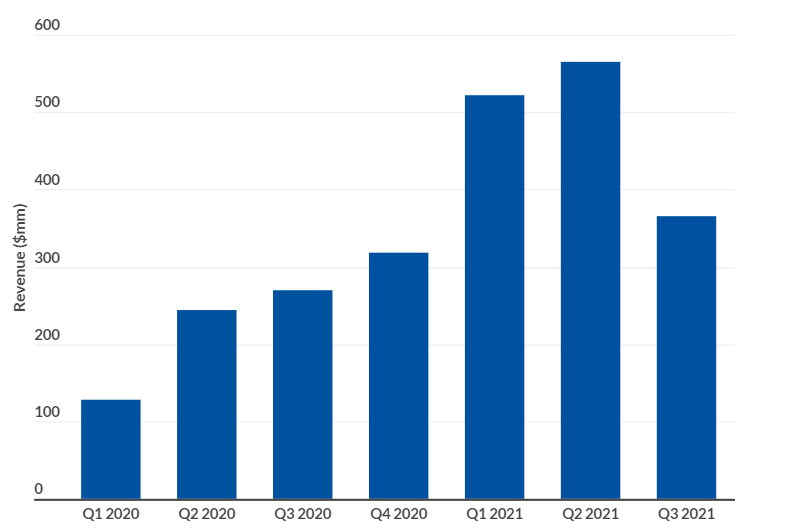

Robinhood is successfully climbing up the ladders. Its user base along with reported revenues is continuously increasing. In the past two years, there has been a tremendous improvement in revenue and user base.

The revenue detail of Robinhood is shown below:

| Year | Revenue |

| 2015 | $2.9 million |

| 2016 | $9.3 million |

| 2017 | $21 million |

| 2018 | $69 million |

| 2019 | $278 million |

| 2020 | $959 million |

The detail of the user base over the years is shown below:

| Year | Users |

| 2015 | 0.5 million |

| 2016 | 1 million |

| 2017 | 2 million |

| 2018 | 6 million |

| 2019 | 10 million |

| 2020 | 13 million |

| 2021 | 22.5 million |

Robinhood offers fractional share trading which has made it a huge hit amongst the millennials. Therefore, the majority of its user base is under the age of 31. With its approach, this platform is usually adopted by users for the short term.

Here we have compiled a list of 10 Robinhood Stocks to buy in 2022:

List of Best Robinhood Stocks to Buy Now:

NIO Inc. (NYSE: NIO)

NIO is a Chinese automobile manufacturing company. It specializes in designing and making electric vehicles and has created quite a reputation in its hometown and the global EV sector. Electric Vehicle stocks have a great future outlook and is a growing sector.

NIO has a market capitalization of $47.6 billion and its share is currently trading at $29.95. The share of NIO skyrocketed in the last quarter of 2020 and it peaked at $61.95 in January-2021. Since then it has pulled back and is now trading at a lesser price.

In its recent quarterly report, NIO reported:

- Total Revenue of $1,521.8 million. This represents an increase of 116.6% from the third quarter of 2020 and an increase of 16.1% from the second quarter of 2021.

- Deliveries of vehicles were 24,439 in the third quarter of 2021. This represents an increase of 100.2% from the third quarter of 2020 and an increase of 11.6% from the second quarter of 2021.

NIO continues to broaden its user base and enter new markets. Moreover, the EV company is focused on expanding its sales and service network to increase reach and serve more customers worldwide.

Horizon Technology Finance (Nasdaq: HRZN)

Horizon is a leading venture lending platform that thoughtfully and creatively provides structured debt products to life science and technology companies. With the demand for AI technology increasing, investor interest in Artificial Intelligence stocks has also increased. Horizon offers growth-oriented loans to finance a variety of business activities. It majorly provides finance for:

- Cash runway extension

- Growth capital

- Acquisition

- Augment equity funding with less dilutive capital

Horizon has a market capitalization of $321 million. Its share is trading at $15.72. the share of Horizon has been performing well. Since the pandemic, it has been consistently rising and is now trading at a price higher than the pre-pandemic level.

In its recent quarterly report, Horizon reported:

- Quarterly record of $99 million of loans originated

- The total investment portfolio of $452.3 million as of September 30, 2021

- Net investment income of $8.0 million

Ford Motor Company (NYSE: F)

Ford is the second-largest family-owned company in the world and has been operating for more than 116 years. Founded in 1903, Ford is now a billion-dollar company with a huge portfolio of cars. The recent move within the automobile segment toward electric vehicles has also brought changes in the oldest automobile manufacturing company. Apart from regular cars and SUVs, Ford now offers hybrid and electric vehicle options to its customers.

Currently valued at $80 billion, the Ford Motors Company share is currently trading at $20.07. After the pandemic-driven market crash, the Ford share like many others plummeted. But it has risen from the lowest and is not trading at a higher price before the market crash.

In its recent quarterly report, the company achieved strong results. It reported:

- Quarterly revenue of $35.7 billion. Revenues were moderately down from the same period last year. Majorly due to semiconductor availability challenges

- Net income of $1.8 billion

- Resuming quarterly dividend

Exxon Mobil (NYSE: XOM)

ExxonMobil is one of the world’s largest publicly traded energy providers and chemical manufacturers. It develops and applies next-generation technologies to help safely and responsibly meet the world’s growing needs for energy and high-quality chemical products.

In its recent quarterly earnings report, the oil giant reported:

- Total earnings reported were $6.8 billion

- Exxon spent $3.9 billion on capital and exploration productions during the quarter

Exxon Mobil has a market valuation of around $260 billion. Its share is currently trading at $61.09. The pandemic-driven market crash gave a huge blow to the company’s stock and it plummeted. In line with the economic shutdown and travel ban, the whole industry suffered. The share price is en route to recovery but it’s still trading at a lower price when compared to the pre-pandemic levels.

GoPro (Nasdaq: GPRO)

GoPro is very popular for its compact action cameras. Along with the camera, it also develops its mobile apps and video-editing software. GoPro was ranked No. 2 amongst online photo and video equipment retailers in Newsweek’s recent report, “America’s Best Customer Service – 2022.”

Founded in 2002, GoPro has a market valuation of around $1.7 billion. Its share is currently trading at $10.7. The share of GoPro has been on an upward streak since last year. The stock peaked at $13.54 in March’21. Currently, it has pulled back and is trading at a price that is 25% less than the peak price. As an investor, you need to stay put and wait a while before you can benefit from your investment.

In its recent quarterly earnings report, the company reported:

- Revenue of $317 million representing a 13% year-over-year increase

- Total revenue of $94 million, representing a 16% year-over-year increase

- Subscriber count was reported at 1.34 million, representing a 168% year-over-year increase

- Net Income was reported at $312 million

Intuitive Surgical (Nasdaq: ISRG)

Intuitive Surgical is a global technology leader in robotic-assisted, minimally invasive surgery. It is most popular for its da Vinci system which is a robotic surgical system that is controlled by a surgeon from a console. This system is commonly used for prostatectomies and increasingly for cardiac valve repair and gynecologic surgical procedures.

The company has a market valuation of $128.5 billion and its share is trading at $359. Its share is on an upward streak since last year. In 2020 alone, this share has risen by 32%.

In its recent quarterly report, Intuitive Surgical reported:

- Revenue of $1.2 billion, representing a 30% increase from last year same period

- Net Income was reported at $387, representing a 22% increase from last year same quarter

- Worldwide da Vinci procedures grew approximately 20% compared with the third quarter of 2020

- The Company grew its da Vinci Surgical System installed base to 6,525 systems as of September 30, 2021, an increase of 11% compared with 5,865 as of the end of the third quarter of 2020.

Amazon (Nasdaq: AMZN)

Amazon has become a household name today. The online retailer gained widespread fame due to the pandemic led lockdown. Moreover, the pandemic gave a huge boost to the sales of revenues, which escalated its share price and multiplies its revenues.

Amazon is a big giant and is amongst the top five biggest companies. It has a market capitalization of $1.74 trillion. Its share is currently trading at $3,420. During the pandemic, the stock of Amazon sky-rocketed and touched new peaks. In the last 2 years, the stock of Amazon has more than doubled.

In the recent quarterly report, Amazon reported:

- Net sales increased 15% to $110.8 billion, compared with $96.1 billion in the third quarter of 2020

- Net income decreased to $3.2 billion in the third quarter, or $6.12 per diluted share, compared with $6.3 billion

Amazon become the third-largest company by revenue in 2020 when it reported $386 billion in revenue. Amazon Web Service (AWS) is becoming very popular and almost half of the net income earned in 2020 came from AWS. In addition to it, Amazon Prime is rising in popularity and has reached more than 200 million users.

Shopify (NYSE: SHOP)

Shopify is a Canadian-based e-commerce company. This e-commerce platform underwent phenomenal growth since last year when physical stores sales went down due to pandemic lockdown. Due to the pandemic, online sales rose and so did Shopify’s sales. Despite the economy shifting back to normal life and physical stores being open, the e-commerce boost is here to stay. No doubt the accelerated growth will slow but it will continue to rise.

Shopify has a market capitalization of $172.65 billion. Its share is currently trading at $1,385. Since the market crash of March’20, the stock has picked up an upward streak and is continuously rising. It is trading at its highest and peaked at $1,600 in November.

Shopify platform makes it’s easier for its merchants to sell its products worldwide. Alongside, this platform enables the merchants to build good connections with their customers.

In its recent quarterly report, Shopify reported:

- Total revenue was reported to be $1,123.7 million, representing a 46% increase year over year.

- Net income was reported to be $1,148.4 million

Coinbase Global Inc. (Nasdaq: COIN)

Coinbase Global is an American company that operates a cryptocurrency exchange platform. It trades more than 90 types of cryptocurrencies. It is an easy way to enter cryptocurrency trading for beginners.

Coinbase is a remote company with no physical office. It has recently gone public in April 2021. After the IPO the stock dipped by 45% in the next few days but son recovered. The stock is still experiencing volatility because of the volatility of the cryptocurrency. Coinbase has a market valuation of $66.66 billion. Its share is currently trading at $254.55.

In its recent quarterly report, Coinbase reported:

- Revenue of $1.31 billion, representing a 316% increase year-on-year

- Net income was reported to be $406 million, representing an approx. 400% year-on-year increase

GameStop Corp. (NYSE: GME)

GameStop is an American high street shop that sells games, consoles, and other electronics. It went popular as the meme stock at the start of 2021. It became a trending stock when some Reddit users bought a huge amount of GameStop shares which led to the share price rising phenomenally. In 3 days in January 2021, the share of GameStop rose by more than 350% increasing from $96.8 to $347.5. It started the year 2021 at a price of $17.69 and in less than a month rose to $347.5.

GameStop has a market capitalization of $11.7 billion. Its share is currently trading at $154. No doubt the Reddit users’ deliberate attempt to create hype has pushed the share price up and it is still trading at a comparatively higher price than before.

In its recent quarterly report, GameStop reported:

- Total sales were reported to be around $1 billion

- The company reported a net loss of $18.8 million

CONCLUSION

Robinhood platform is targeted towards a younger age group and its prime focus is majorly on short-term investment approach. The above-short-listed companies are some of the most trending and profitable trading options on the platform.

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more