10 Best Performing Dividend Kings Over The Last 10 Years

Image Source: Pixabay

The goal of rational investors is to maximize total return under a given set of constraints. High dividend stocks can contribute a significant portion of a stock’s total return.

In addition, stocks that raise their dividends each year, even during recessions, can provide high returns to shareholders over the long run.

The Dividend Kings are a group of just 56 stocks that have all increased their dividends for at least 50 consecutive years.

Regular dividend increases each year, even during recessions, are critical for dividend growth investors. This makes the Dividend Kings a great source of stocks that can provide long-term passive income.

While past performance is not a guarantee of future results, it can be useful to look back to see which Dividend Kings performed the best.

Therefore, this article will discuss the 10 best-performing Dividend Kings over the past 10 years.

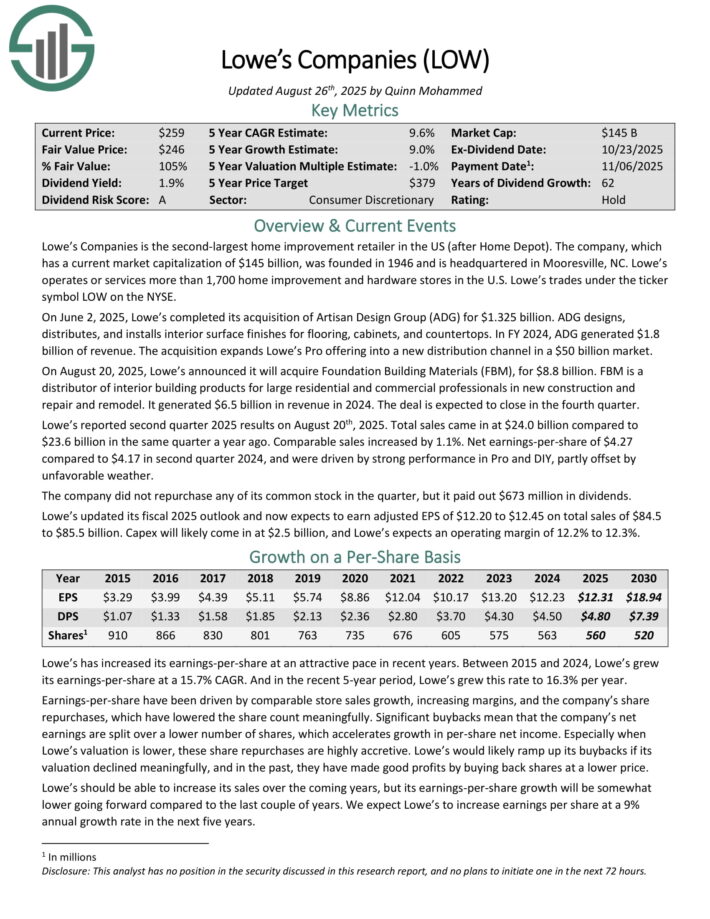

Best Performing Dividend King #10: Lowe’s Companies (LOW)

- 10-year annualized total returns: 13.9%

Lowe’s Companies is the second-largest home improvement retailer in the US (after Home Depot). The company was founded in 1946 and is headquartered in Mooresville, NC. Lowe’s operates or services more than 1,700 home improvement and hardware stores in the U.S.

On August 20, 2025, Lowe’s announced it will acquire Foundation Building Materials (FBM), for $8.8 billion. FBM is a distributor of interior building products for large residential and commercial professionals in new construction and repair and remodel. It generated $6.5 billion in revenue in 2024. The deal is expected to close in the fourth quarter.

Lowe’s reported second quarter 2025 results on August 20th, 2025. Total sales came in at $24.0 billion compared to $23.6 billion in the same quarter a year ago. Comparable sales increased by 1.1%. Net earnings-per-share of $4.27 compared to $4.17 in second quarter 2024, and were driven by strong performance in Pro and DIY, partly offset by

unfavorable weather.

The company did not repurchase any of its common stock in the quarter, but it paid out $673 million in dividends. Lowe’s updated its fiscal 2025 outlook and now expects to earn adjusted EPS of $12.20 to $12.45 on total sales of $84.5 to $85.5 billion.

Click here to download our most recent Sure Analysis report on LOW (preview of page 1 of 3 shown below):

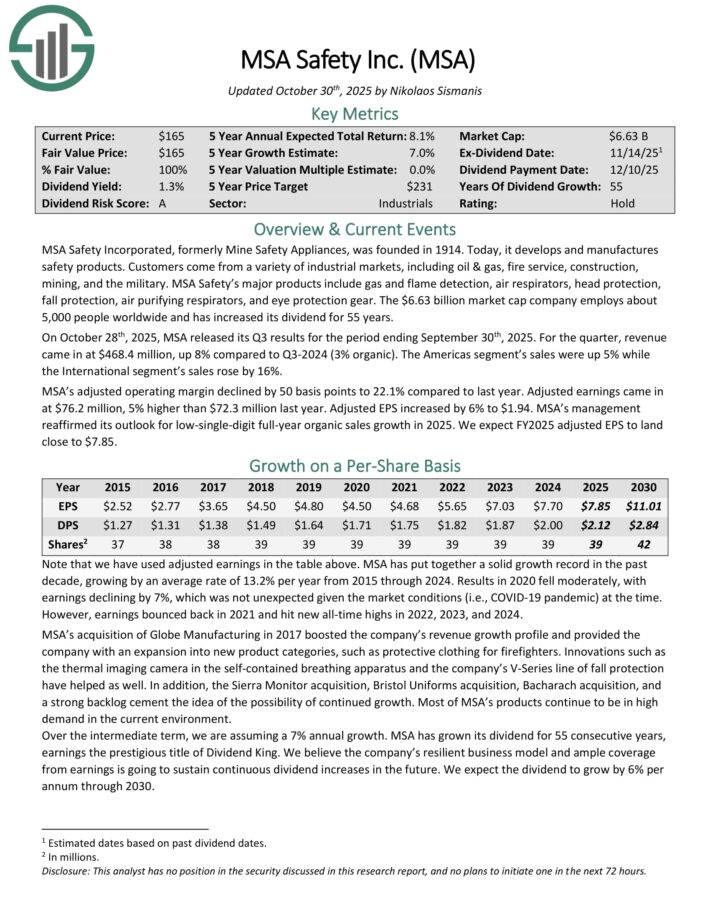

Best Performing Dividend King #9: MSA Safety (MSA)

- 10-year annualized total returns: 14.9%

MSA Safety Incorporated, formerly Mine Safety Appliances, was founded in 1914. Today, it develops and manufactures safety products. Customers come from a variety of industrial markets, including oil & gas, fire service, construction, mining, and the military.

MSA Safety’s major products include gas and flame detection, air respirators, head protection, fall protection, air purifying respirators, and eye protection gear. The company employs about 5,000 people worldwide and has increased its dividend for 55 years.

On October 28th, 2025, MSA released its Q3 results. For the quarter, revenue came in at $468.4 million, up 8% compared to Q3-2024 (3% organic). The Americas segment’s sales were up 5% while the International segment’s sales rose by 16%.

MSA’s adjusted operating margin declined by 50 basis points to 22.1% compared to last year. Adjusted earnings came in at $76.2 million, 5% higher than $72.3 million last year. Adjusted EPS increased by 6% to $1.94.

MSA’s management reaffirmed its outlook for low-single-digit full-year organic sales growth in 2025.

Click here to download our most recent Sure Analysis report on MSA (preview of page 1 of 3 shown below):

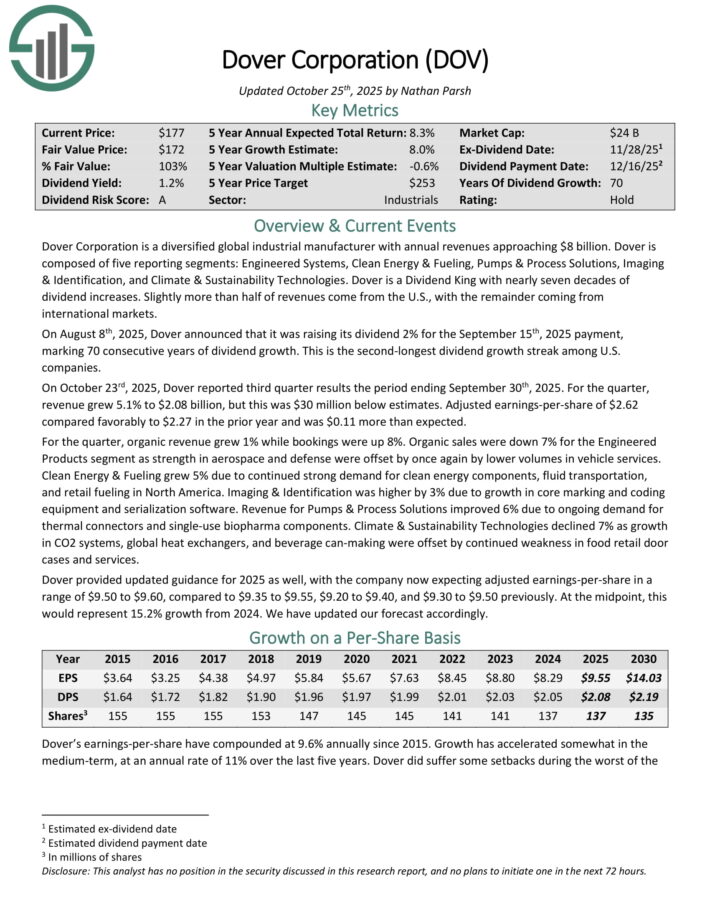

Best Performing Dividend King #8: Dover Corp. (DOV)

- 10-year annualized total returns: 15.4%

Dover Corporation is a diversified global industrial manufacturer with annual revenue approaching $8 billion. Dover is composed of five reporting segments: Engineered Systems, Clean Energy & Fueling, Pumps & Process Solutions, Imaging & Identification, and Climate & Sustainability Technologies.

On August 8th, 2025, Dover announced that it was raising its dividend 2% for the September 15th, 2025 payment, marking 70 consecutive years of dividend growth. This is the second-longest dividend growth streak among U.S. companies.

On October 23rd, 2025, Dover reported third quarter results the period ending September 30th, 2025. For the quarter, revenue grew 5.1% to $2.08 billion, but this was $30 million below estimates. Adjusted earnings-per-share of $2.62 compared favorably to $2.27 in the prior year and was $0.11 more than expected.

For the quarter, organic revenue grew 1% while bookings were up 8%. Organic sales were down 7% for the Engineered Products segment as strength in aerospace and defense were offset by once again by lower volumes in vehicle services.

Clean Energy & Fueling grew 5% due to continued strong demand for clean energy components, fluid transportation, and retail fueling in North America. Imaging & Identification was higher by 3% due to growth in core marking and coding equipment and serialization software.

Climate & Sustainability Technologies declined 7% as growth in CO2 systems, global heat exchangers, and beverage can-making were offset by continued weakness in food retail door cases and services.

Dover provided updated guidance for 2025 as well, with the company now expecting adjusted earnings-per-share in a range of $9.50 to $9.60. At the midpoint, this would represent 15.2% growth from 2024.

Click here to download our most recent Sure Analysis report on DOV (preview of page 1 of 3 shown below):

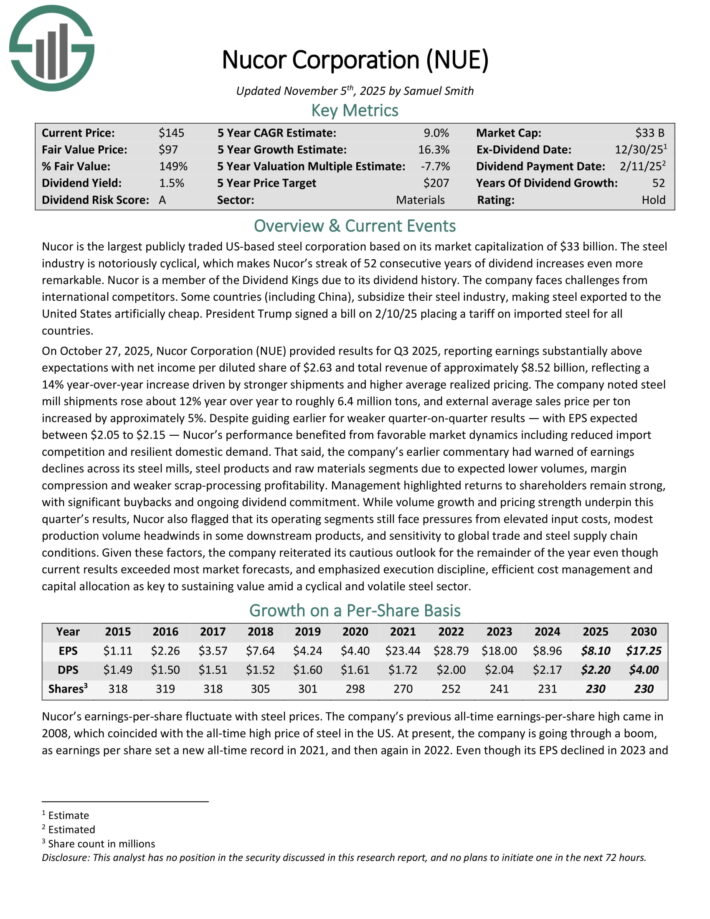

Best Performing Dividend King #7: Nucor Corp. (NUE)

- 10-year annualized total returns: 16.8%

Nucor is the largest publicly traded US-based steel corporation based on its market capitalization. The steel industry is notoriously cyclical, which makes Nucor’s streak of 52 consecutive years of dividend increases even more remarkable. Nucor is a member of the Dividend Kings due to its dividend history.

On October 27, 2025, Nucor Corporation (NUE) provided results for Q3 2025, reporting earnings substantially above expectations with net income per diluted share of $2.63 and total revenue of approximately $8.52 billion, reflecting a 14% year-over-year increase driven by stronger shipments and higher average realized pricing.

The company noted steel mill shipments rose about 12% year over year to roughly 6.4 million tons, and external average sales price per ton increased by approximately 5%.

Despite guiding earlier for weaker quarter-on-quarter results — with EPS expected between $2.05 to $2.15 — Nucor’s performance benefited from favorable market dynamics including reduced import competition and resilient domestic demand.

Click here to download our most recent Sure Analysis report on NUE (preview of page 1 of 3 shown below):

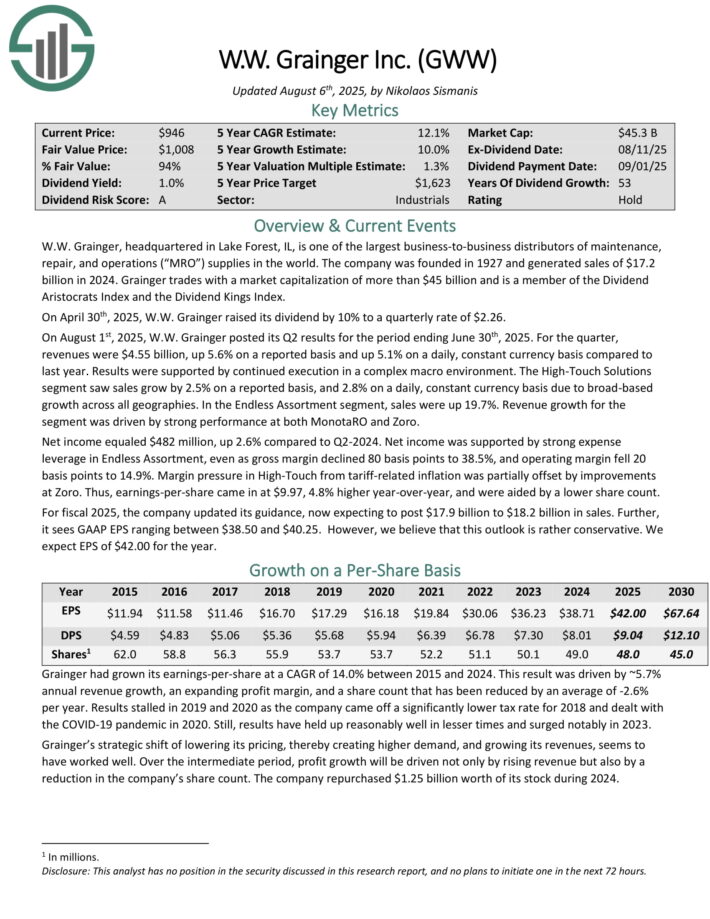

Best Performing Dividend King #6: W.W. Grainger (GWW)

- 10-year annualized total returns: 18.7%

W.W. Grainger, headquartered in Lake Forest, IL, is one of the largest business-to-business distributors of maintenance, repair, and operations (“MRO”) supplies in the world. The company was founded in 1927 and generated sales of $17.2 billion in 2024.

On August 1st, 2025, W.W. Grainger posted its Q2 results for the period ending June 30th, 2025. For the quarter, revenues were $4.55 billion, up 5.6% on a reported basis and up 5.1% on a daily, constant currency basis compared to last year.

The High-Touch Solutions segment saw sales grow by 2.5% on a reported basis, and 2.8% on a daily, constant currency basis due to broad-based growth across all geographies.

In the Endless Assortment segment, sales were up 19.7%. Revenue growth for the segment was driven by strong performance at both MonotaRO and Zoro.

Net income equaled $482 million, up 2.6% compared to Q2-2024. Net income was supported by strong expense leverage in Endless Assortment, even as gross margin declined 80 basis points to 38.5%, and operating margin fell 20 basis points to 14.9%.

Margin pressure in High-Touch from tariff-related inflation was partially offset by improvements at Zoro. Earnings-per-share came in at $9.97, 4.8% higher year-over-year, and were aided by a lower share count.

Click here to download our most recent Sure Analysis report on GWW (preview of page 1 of 3 shown below):

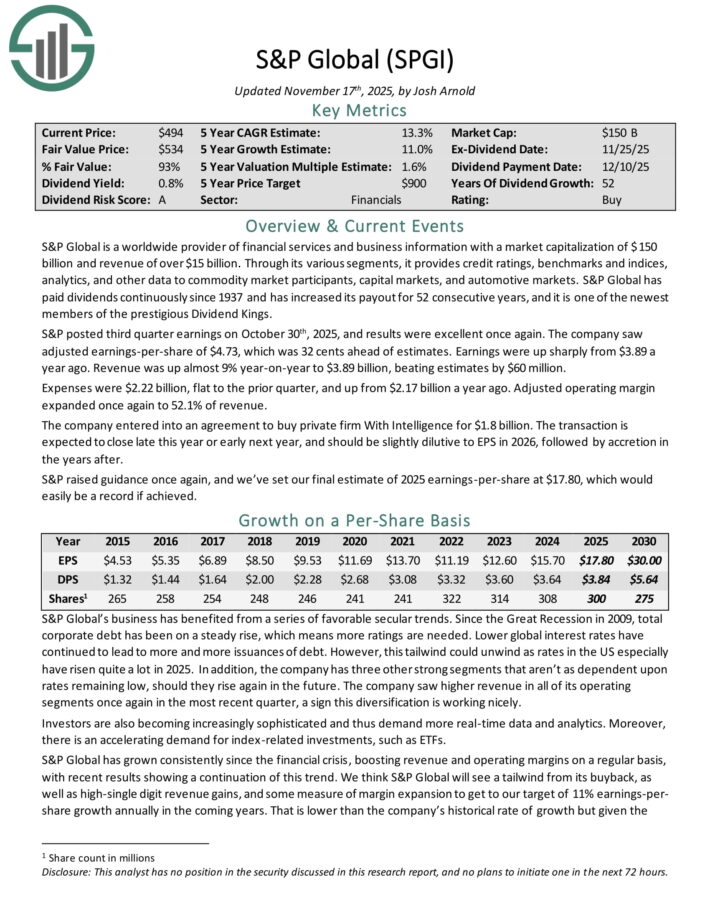

Best Performing Dividend King #5: S&P Global (SPGI)

- 10-year annualized total returns: 18.8%

S&P Global is a worldwide provider of financial services and business information with revenue of over $15 billion. Through its various segments, it provides credit ratings, benchmarks and indices, analytics, and other data to commodity market participants, capital markets, and automotive markets.

S&P Global has paid dividends continuously since 1937 and has increased its payout for 52 consecutive years, and it is one of the newest members of the prestigious Dividend Kings.

S&P posted third quarter earnings on October 30th, 2025. The company saw adjusted earnings-per-share of $4.73, which was 32 cents ahead of estimates.

Earnings were up sharply from $3.89 a year ago. Revenue was up almost 9% year-on-year to $3.89 billion, beating estimates by $60 million.

Expenses were $2.22 billion, flat to the prior quarter, and up from $2.17 billion a year ago. Adjusted operating margin expanded once again to 52.1% of revenue.

The company entered into an agreement to buy private firm With Intelligence for $1.8 billion. The transaction is expected to close late this year or early next year, and should be slightly dilutive to EPS in 2026, followed by accretion in the years after.

Click here to download our most recent Sure Analysis report on SPGI (preview of page 1 of 3 shown below):

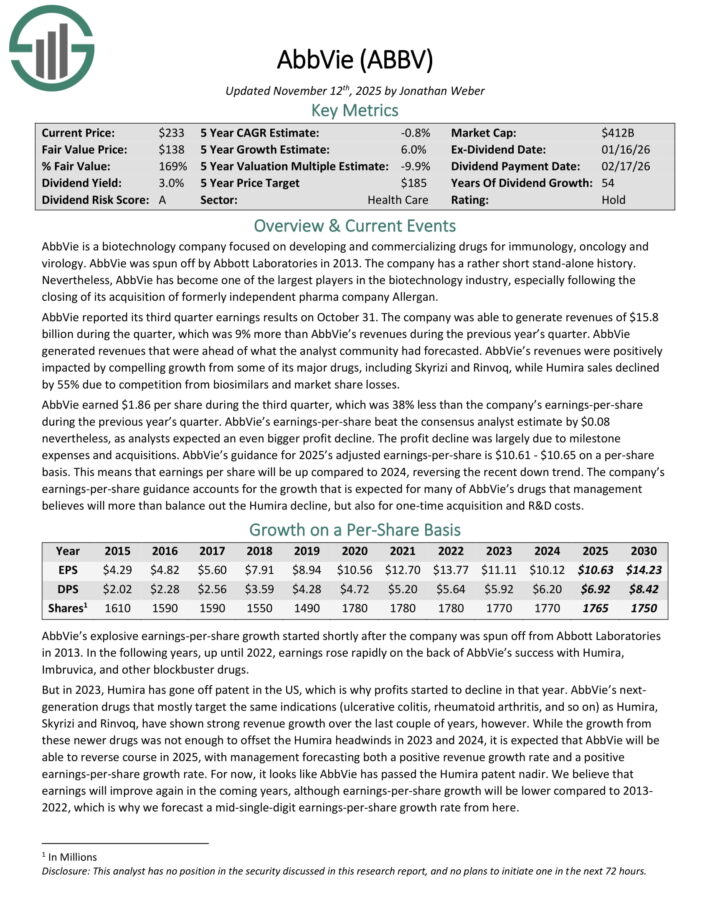

Best Performing Dividend King #4: AbbVie Inc. (ABBV)

- 10-year annualized total returns: 19.3%

AbbVie is a biotechnology company focused on developing and commercializing drugs for immunology, oncology and virology. It was spun off by Abbott Laboratories in 2013 and has become one of the largest players in the biotechnology industry.

AbbVie reported its third quarter earnings results on October 31. The company was able to generate revenues of $15.8 billion during the quarter, which was 9% year-over-year growth.

Revenue was positively impacted by compelling growth from some of its major drugs, including Skyrizi and Rinvoq, while Humira sales declined by 55% due to competition from biosimilars and market share losses.

AbbVie earned $1.86 per share during the third quarter, which was 38% less than the company’s earnings-per-share during the previous year’s quarter.

Earnings-per-share beat the consensus analyst estimate by $0.08. Guidance for 2025 adjusted earnings-per-share is $10.61 – $10.65.

Click here to download our most recent Sure Analysis report on ABBV (preview of page 1 of 3 shown below):

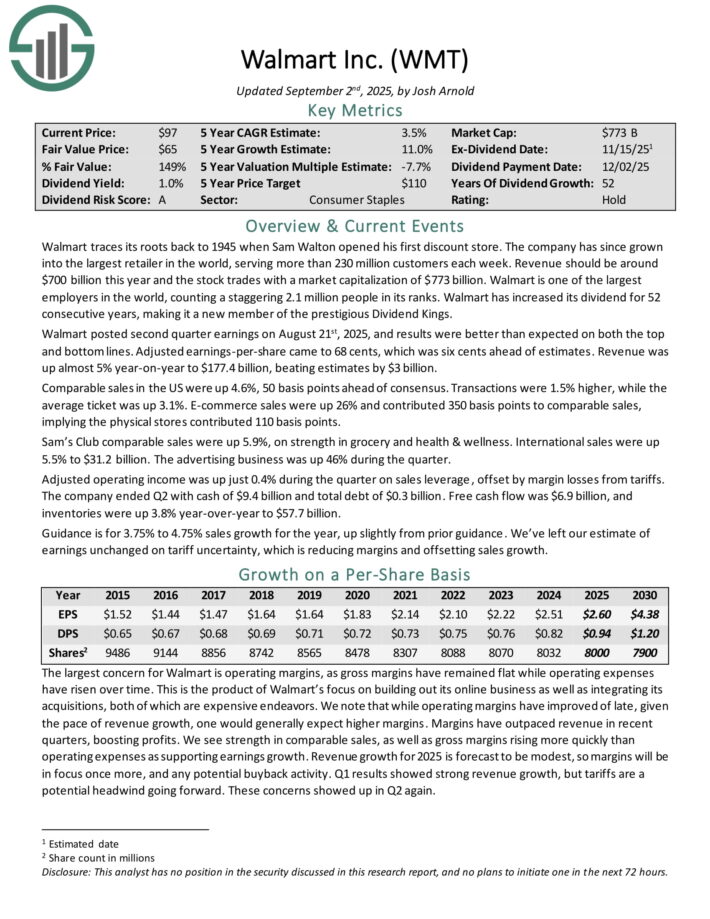

Best Performing Dividend King #3: Walmart Inc. (WMT)

- 10-year annualized total returns: 20.5%

Walmart traces its roots back to 1945 when Sam Walton opened his first discount store. The company has since grown into the largest retailer in the world, serving more than 230 million customers each week. Revenue should be around $700 billion this year.

Walmart posted second quarter earnings on August 21st, 2025, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to 68 cents, which was six cents ahead of estimates. Revenue was up almost 5% year-on-year to $177.4 billion, beating estimates by $3 billion.

Comparable sales in the US were up 4.6%, 50 basis points ahead of consensus. Transactions were 1.5% higher, while the average ticket was up 3.1%. E-commerce sales were up 26% and contributed 350 basis points to comparable sales, implying the physical stores contributed 110 basis points.

Sam’s Club comparable sales were up 5.9%, on strength in grocery and health & wellness. International sales were up 5.5% to $31.2 billion. The advertising business was up 46% during the quarter.

Adjusted operating income was up just 0.4% during the quarter on sales leverage, offset by margin losses from tariffs. The company ended Q2 with cash of $9.4 billion and total debt of $0.3 billion. Free cash flow was $6.9 billion, and inventories were up 3.8% year-over-year to $57.7 billion.

Guidance is for 3.75% to 4.75% sales growth for the year, up slightly from prior guidance.

Click here to download our most recent Sure Analysis report on WMT (preview of page 1 of 3 shown below):

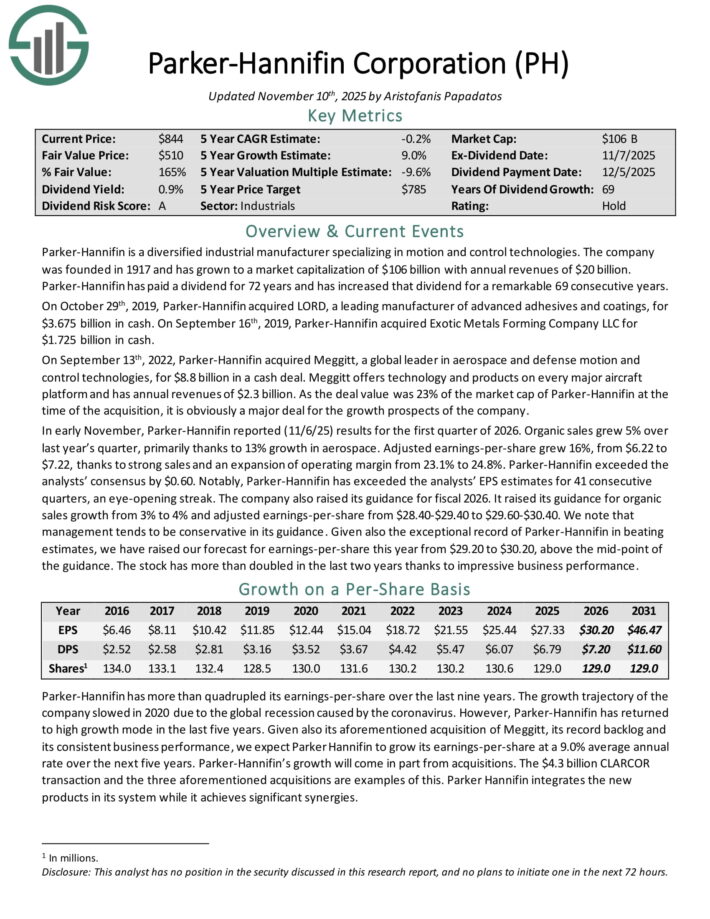

Best Performing Dividend King #2: Parker-Hannifin (PH)

- 10-year annualized total returns: 25.4%

Parker-Hannifin is a diversified industrial manufacturer specializing in motion and control technologies. The company generates annual revenues of $20 billion. Parker-Hannifin has increased the dividend for 69 consecutive years.

In early November, Parker-Hannifin reported (11/6/25) results for the first quarter of 2026. Organic sales grew 5% over last year’s quarter, primarily thanks to 13% growth in aerospace.

Adjusted earnings-per-share grew 16%, from $6.22 to $7.22, thanks to strong sales and an expansion of operating margin from 23.1% to 24.8%.

Parker-Hannifin exceeded the analysts’ consensus by $0.60. Notably, Parker-Hannifin has exceeded the analysts’ EPS estimates for 41 consecutive quarters.

The company also raised its guidance for fiscal 2026. It raised its guidance for organic sales growth from 3% to 4% and adjusted earnings-per-share from $28.40-$29.40 to $29.60-$30.40.

Parker-Hannifin has a number of competitive advantages, including its scale, global distribution network, and technical experience.

It manufactures components that are relatively obscure yet critical to the operations of heavy machinery, factory equipment, aircrafts, and other large industrial devices. This is appealing because the company operates in a profitable niche that helps discourage large would-be competitors.

Click here to download our most recent Sure Analysis report on Parker-Hannifin (preview of page 1 of 3 shown below):

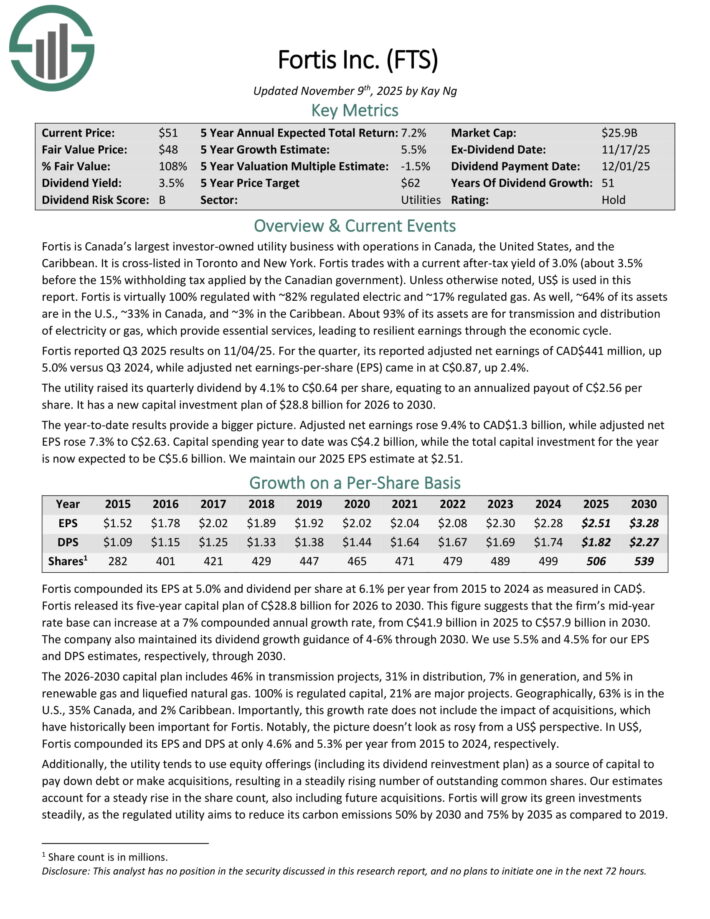

Best Performing Dividend King #1: Fortis Inc. (FTS)

- 10-year annualized total returns: 47.6%

Fortis is Canada’s largest investor-owned utility business with operations in Canada, the United States, and the Caribbean. It is cross-listed in Toronto and New York.

Fortis trades with a current after-tax yield of 3.0% (about 3.5% before the 15% withholding tax applied by the Canadian government).

Fortis is virtually 100% regulated with ~82% regulated electric and ~17% regulated gas. As well, ~64% of its assets are in the U.S., ~33% in Canada, and ~3% in the Caribbean.

About 93% of its assets are for transmission and distribution of electricity or gas, which provide essential services, leading to resilient earnings through the economic cycle.

Fortis reported Q3 2025 results on 11/04/25. For the quarter, its reported adjusted net earnings of CAD$441 million, up 5.0% versus Q3 2024, while adjusted net earnings-per-share (EPS) came in at C$0.87, up 2.4%.

The utility raised its quarterly dividend by 4.1% to C$0.64 per share, equating to an annualized payout of C$2.56 per share. It has a new capital investment plan of $28.8 billion for 2026 to 2030.

The year-to-date results provide a bigger picture. Adjusted net earnings rose 9.4% to CAD$1.3 billion, while adjusted net EPS rose 7.3% to C$2.63. Capital spending year to date was C$4.2 billion, while the total capital investment for the year is now expected to be C$5.6 billion.

Click here to download our most recent Sure Analysis report on FTS (preview of page 1 of 3 shown below):

More By This Author:

3 High Yield Stocks With Safe Dividends

10 Low Volatility High Dividend Stocks For Stability And Income

3 High Dividend Stocks For Low Volatility

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more